TLDR & TLDL: Here’s five things I think mattered in Aotearoa-NZ this year, as of December 21, 2021, which is known to Paul Kelly fans such as myself and The Kaka’s sub editor and photographer Lynn Grieveson as ‘Gravy Day’ (see the video below). Let’s hope the next nine days are incident free…

This is my selection of the events, trends, numbers and charts that I think summarise and clarify the year that was. This is for all the ‘free’ and paid subscribers to The Kaka to mark the end of the first three months since I turned the paywall on and invited subscribers to support my explanatory and accountability journalism about housing unaffordability, child poverty and climate change inaction.

This end-of-year wrap includes a podcast above of a final hoon of the year I recorded last Friday afternoon with two fellow Press Gallery ‘wonks’ on the political economy, Jenee Tibshraeny from Interest.co.nz and Stuff Political Editor Luke Malpass. NZ Herald reporter and columnist Thomas Coughlan is also on the roster for this Gallery ‘Hoon’ of wonks and I recorded this hoon with him the previous week. We’ll be doing this regularly during Parliamentary sitting weeks next year.

(I’d love those on the ‘free’ list to join our community at The Kaka. This ‘Gravy Day’ special of 50% for a year to become a paid subscriber with access to all the articles, full emails, webinar access and the ability to comment is open until 11:59 pm December 21 GMT (1pm Weds Dec 22, NZ Time. That will be it for the foreseeable future. Going, going…gone. I hope you all find my gratuitous use of GMT to give you a free more hours on Gravy Day useful)

1. Fortress NZ was virtually closed for another year…

…and it may just have worked to help us dodge another bullet.

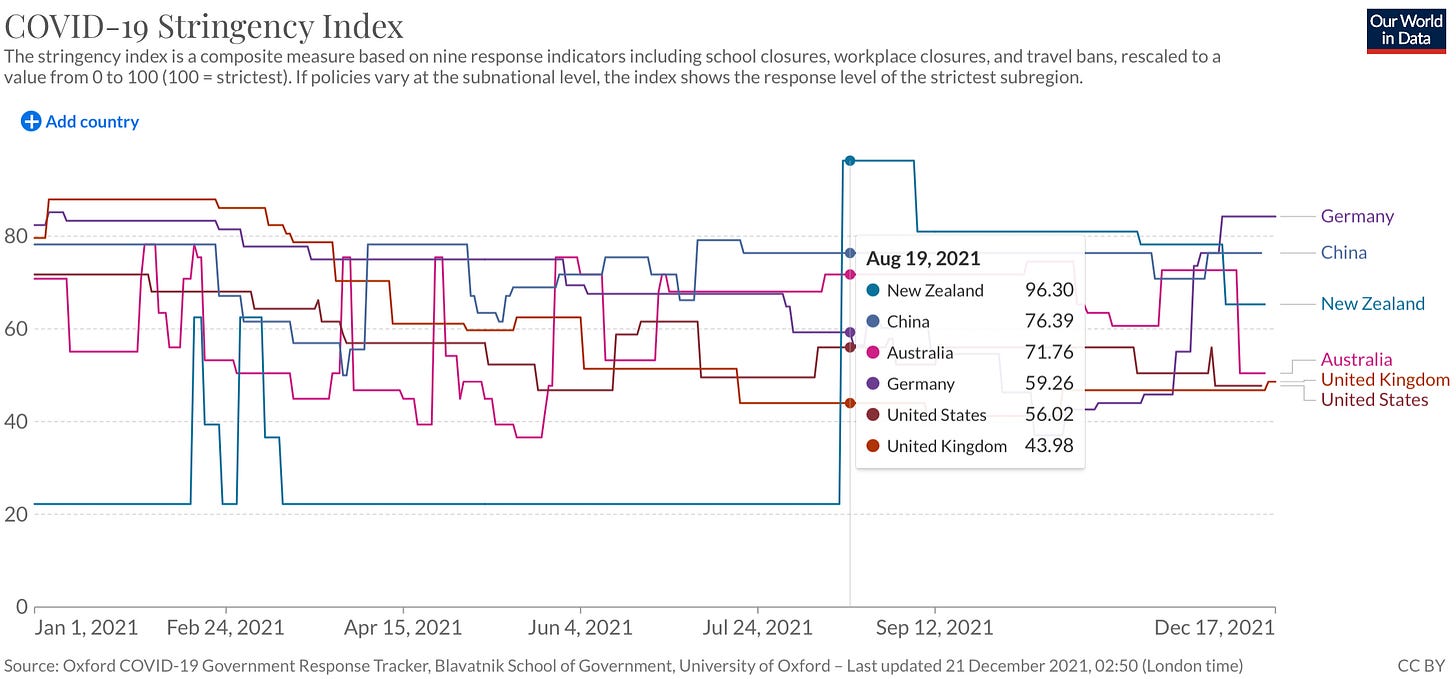

Aotearoa-NZ had both the loosest covid restrictions in the world for the longest period in 2021, and the tightest restrictions for the longest period in 2021. Aside from a short scare around Valentine’s Day, we went blithely through 2021 until August 17 with the view we could be eliminate covid again with short, sharp lockdowns and there was no frantic hurry to vaccinate. We even begun to think we could open up more before we had vaccinated over 90% and stay covid-free, mask-free and meet in our thousands. For almost all of those first seven and a half months we had the least stringent covid restrictions in the world.

Then delta broke out, so we tried to eliminate again with a “short, sharp lockdown” we assumed would last just a couple of weeks. It turned out we underestimated both delta and our ability to track and trace the virus in a part of the population mired in the poverty of expensive and over-crowded housing.

Independent economist Rodney Jones, who had been helping model the outbreak for the Government, identified Sept 7 as the day our elimination strategy died, citing a decision not to do widespread surveillance testing in South Auckland in case it appeared racist. Essentially, stressed communities with low trust in Government and few connections to the health system could not be reached by the contact tracers and couldn’t strictly abide by the lockdown rules, allowing the virus to spread undetected and unquashed. Tragically, many remain unvaccinated because

Our housing poverty problem and the lack of social cohesion that created effectively eliminated our elimination strategy in the face of delta. And it turned out we didn’t really have a ‘Plan B’ to cope without a hard and long lockdown for Auckland. So that’s what we had to do.

I wrote this on the morning of August 17, hours before news of the lockdown broke, pointing out we had bet the farm on elimination, which risked long hard lockdowns and a virtually closed border well into 2022. I then wrote this on the morning of August 23, asking whether it was ‘Time to eliminate elimination?’. I got enormous blow-back, so wrote this in response on August 24: ‘Why elimination will have to end before most voters want it to’

Elimination was formally abandoned on Oct 4, as I reported from the news conference here. Auckland ended up spending 104 days in lockdown. It’s borders only opened seven days ago, four months after they were shut.

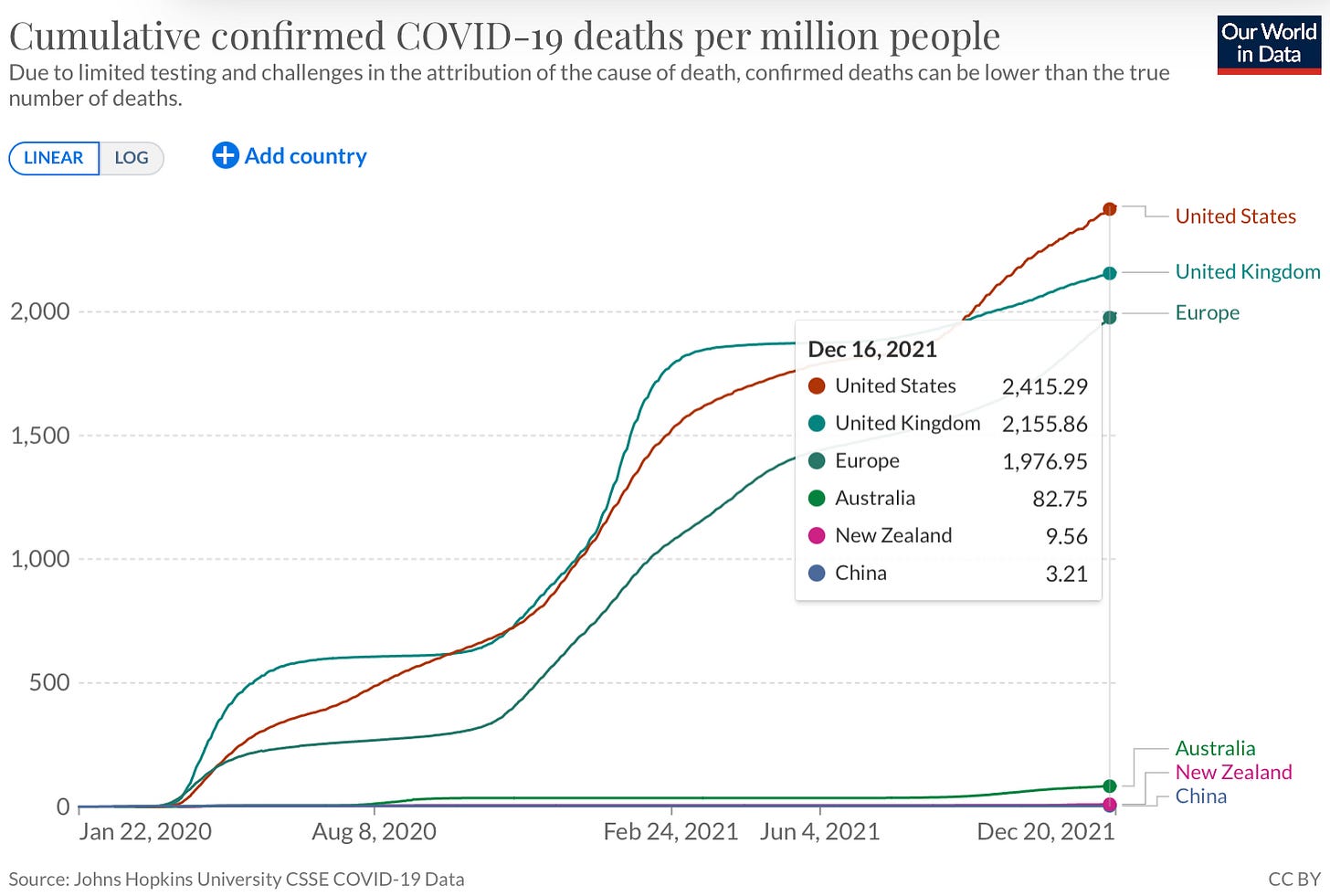

As it turned out, the shock of our failure to eliminate and the fear that delta would rage through the motu, helped unleash the most enormous and broadly successful vaccination programme that is now giving us a chance at ending the year with the lowest covid death rate in the developed world.

Ironically, the failure of elimination and the extended border closure served us well. That fear of a breakout, and the imposition of mask use and vaccination mandates that the Government would not have proposed in the elimination era, has given us a fighting chance to keep that death rate low. All was not lost.*1

Here’s the two charts that tell our covid story for 2021. Loose restrictions, then very tight restrictions, and the lowest death rate in the developed world.*2

2. Our economy grew strongly and unemployment fell…

…but inflation rose too, triggering early Reserve Bank rate hikes

In tune with what we saw in the second half of 2020, the economy kept growing strongly through the first half of 2021, thanks to faster-than-expected growth in consumer spending through the summer and a very resilient construction sector. The still raging housing market helped fire up the economy’s animal spirits too.

Happily and somewhat surprisingly, the collapse of the international tourism and overseas student industries was more than offset by astonishingly strong exports of commodities. Our commodity export prices rose 23% in NZ dollar terms to fresh record highs and they were shipped successfully to overseas markets in record volumes, despite all the global logistics grief.

This is was all great news for GDP, which grew on average by 4.9% annually in the year to the end of September, even after a 3.7% fall in the September quarter.

But all that growth also came with an inflation rate that rose to an annual rate of 5.9%, which was the highest annual rate in 35 years*3. Although two thirds of the inflation was generated by overseas prices and asset prices (fuel, rents and house building costs), all of which the Reserve Bank can’t and shouldn’t be trying to control with interest rate increases.

3. The Reserve Bank tightened earlier than the rest…

…and is likely to have to stop hiking rates next year

The Reserve Bank reacted to the higher inflation by hiking the Official Cash Rate in two 25 basis point chunks in October and November respectively, increasing it from 0.25% to 0.75%. It also forecast the OCR would need to rise to almost 2.6% by the end of 2023 to get inflation back to around 2% and keep it there.

Our central bank was either more prescient than the rest of the world’s developed world central banks*4 or was too trigger happy. The US Federal Reserve, the Reserve Bank of Australia and the European Central Bank all kept their powder dry and held their rates at zero or close to zero throughout this year. They’re all still printing money too, although the Fed signalled last week it would stop doing that by March and probably start hiking midway through next year. The RBNZ stopped printing in July.

In my view, it may have jumped too early. It hiked a day after our elimination strategy ended and while our biggest city was still in a hard lockdown. It also hiked before it was clear the inflation spike had transmogrified into a wage inflation spike and before it was clear the global pandemic was over*5 The RBA has said it wants to see the whites of the eyes of a wage inflation spike over 3% before it hikes interest rates. Currently, it expects to leave them on hold all of next year, before hikes in 2023 probably.

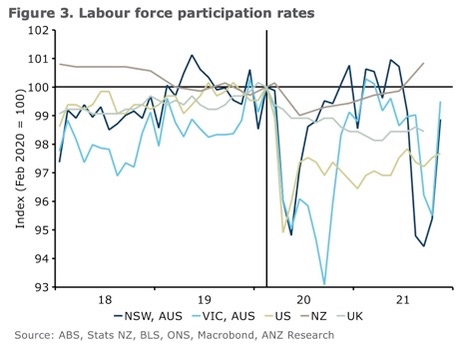

Meanwhile, our wage inflation is barely 2.4% and we have continued to grow labour force participation through covid, unlike in Australia or the even more dire situation in the United States. This means our labour market has a bit more flex than some might think, even though migration has stopped. This chart shows our grey line well above the yellow line of US participation.

One major reason for that is our superannuitants, who don’t have to give up their pensions when hit retirement age and keep working, keep continuing to work more than we (and maybe they) expected. That’s good news, but also means wage inflation is not so likely to take off, in my view. (Thanks to ANZ’s economists for the chart from this great note)

My view, not shared by bank or other economists, is that omicron and fiscal tightenings in the Northern Hemisphere will slow the global economic rebound, adding to the transitory nature of a lot of the inflation. In particular, the assumption that wage inflation will inevitably come is yet to be proven. Real wage deflation and sharply higher market interest rates are doing their job of slowing things down too.

4. The housing market stayed hotter for longer…

…but may finally be cooling because bankers have new boxes to tick

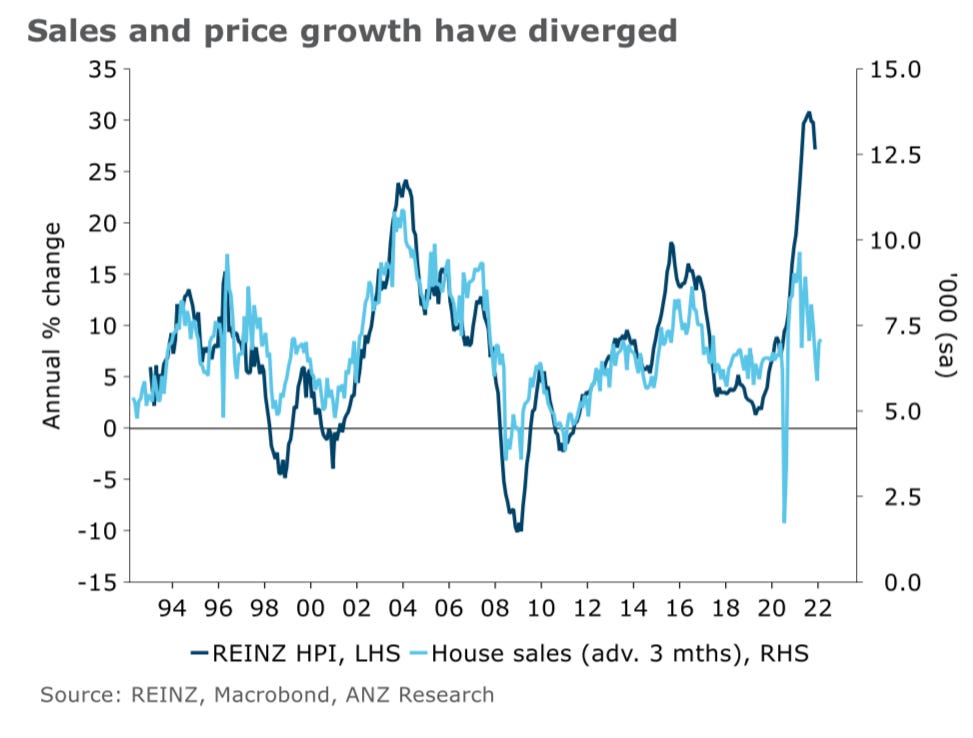

Most economists thought 2021 would be the year the housing market cooled down after a 25% rise in 2020. Instead, they rose another 28.3%, despite a raft of Government and Reserve Bank moves to take out some steam, including:

banning landlords from claiming interest as a taxable expense on already-existing homes (but not for new homes);

doubling the ‘bright-line’ test for calculating income tax on trading gains from house sales to 10 years from five years;

forcing councils and neighbours to accept the building of up to three homes up to three storeys each on a regular section without the need for a resource consent;

the Reserve Bank cutting its allowance or ‘speed limit’ for high loan to value ratio loans (of over 80% of a home’s value);

the Reserve Bank talking about introducing a limit on debt to income multiples next year, after formalising an interest rate affordability threshold (possibly around 7%) that banks already use internally; and,

the Reserve Bank forecasting a rise in short term interest rates of over 200 basis points to 2.6% by late 2023, which increased wholesale interest rates, and in turn lifted the cheapest fixed mortgage rates from 2.2% to 3.5%.

Just imagine what would have happened without those measures.

However, it may be something else entirely that has finally put a stop to the rampant inflation, in the short term at least. The new Credit Contracts and Consumer Credit Act that came into force on Dec 1 has forced the banks to do a lot more checking about the affordability of loans, including asking for details of spending plans and assuming that any substitutable spending on eating out, drinking in, travelling away and shoes can’t be substituted for interest payments.

The banks may well have used the CCCFA as the excuse for saying no to loans they have to reject to comply with the RBNZ’s new tighter LVR rules and the coming DTI rules, but it has certainly stopped a lot of the ‘easy’ money dead.

Brokers, agents and a few bank economists are saying this will finally cool things down, pointing to a growing disconnect between sales volumes and prices. We’ll see. Lots of people thought similar things a year ago.

5. The poor struggled while home owners got much richer…

…which will further erode social cohesion and worsen inequality

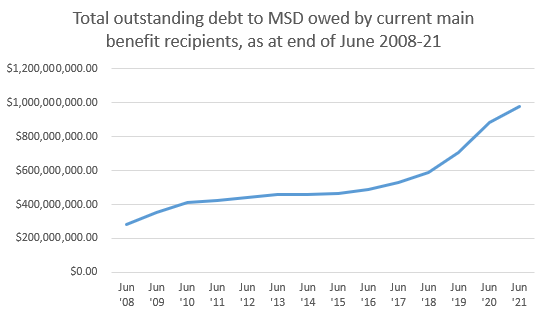

Last year was bad enough, but the Covid ‘Rekovery’ extended into dangerous new territory this year as home owners extended their post-covid wealth gains to nearly $900b, while poorer families were forced to apply for special needs grants and got an extra $200m in debt to MSD.

The Government refused to increase incomes for beneficiaries enough to deal with past underpayments and didn’t invest enough in new housing to deal with punishing housing costs. See more on this issue here, here and here.

Have a great summer. I’ll be back from Jan 17.

Ka Kite ano

Bernard

PS: As a treat, here are the five most popular emails on The Kākā for 2021, which have all been opened up for everyone to read in full and share to their heart’s content.

I was of course touching wood when I wrote this and cannot be blamed if omicron wreaks havoc in the next couple of months.

Aside from China, which is the only country still pursuing elimination and has leaders who don’t have to worry about elections.

Aside from the GST increase years of 1989 (10% to 12.5%) and 2010 (12.5% to 15%).

Aside from Norway, but the Norwegians are special because they’re the richest people in the world thanks to having an awful lot of oil and gas, which its sovereign wealth fund doesn’t like to invest in…

That meant it was tightening before we knew about omicron and before we had hit our 90% double-vaccinated threshold, before we knew we needed to get to 90% triple-vaccinated, and before we knew when our borders will open properly.

The year that was for the year’s end