TLDR & TLDL: The Government unveiled a much healthier financial outlook this week, but chose to use almost all of a $54.5b jump in expected tax revenues and most of an unspent pile of $50b in cash to lower debt over the next four years.

It chose to lower public debt and have slightly lower interest rates than would otherwise be the case, instead of investing much more heavily in infrastructure and social spending to improve housing affordability, reduce child poverty and address climate change. Again, it chose lower interest rates and holding up inflated asset prices now, over paying it forward to deal with housing and climate emergencies.

I asked Grant Robertson why the Government didn’t use the extra fiscal headroom to increase capital and social spending to improve wellbeing in areas such as housing affordability and child poverty by much more.

He said the Government needed to ‘strike a balance’ between extra investment and reducing the debt expanded during Covid. This section from his Budget Policy Statement summarises his reasoning:

“Our fiscal strategy continues to take a balanced approach to supporting current and future generations by managing debt prudently and reducing the deficit caused by COVID-19, while growing the economy sustainably and investing in important public services like health and education.” Robertson’s Budget Policy Statement.

Essentially, the Government is choosing lower debt now over higher wellbeing for future generations, let alone filling the infrastructure deficit estimated at up to $75b created over the last 30 years. Cutting debt instead of investing would make sense if our debt was precariously high and we risked being bankrupted by it, or being cut off by international markets, but that is nowhere near the case, as Robertson himself pointed out this week with this chart comparing our debt with our peers with similar credit ratings.

Lower interest rates bolster asset prices now

So why would any Government with a longer term view than winning the next election and one that professed to run ‘Wellbeing Budgets’ choose debt reduction over improving future wellbeing? Especially when the need is so great, both to fix the most expensive housing market in the world relative to income and rents, but also to take actions to address our housing and climate emergencies.

The first answer is that Labour has no choice under the law. The Public Finance Act (1989) effectively forces any Government to run surpluses and repay debt as soon as it gets the chance after any increase caused by a crisis. (I explain in more detail below the paywall fold why the PFA was written that way and followed ever since, and why it has become the key tool for intergenerational wealth transfer for 30 years.)

The second answer is that this is exactly what the Labour Government wants to do, and what the bulk of median home-owning voters who put it in power want it to do. In their heart of hearts, they both know that higher Government debt means slightly higher interest rates, which in turn puts downward pressure on inflated asset prices. Public debt reduction is so ingrained as an axiom of our political and economic life that it’s never questioned. Not investing in the future to keep interest rates low, effectively pulls forward wealth from future generations to inflate asset values now.

Somewhat strangely, given it’s 30-35 years since public debt was a national threat, the ‘Overton window’ of mainstream political debate has excluded using the Crown’s balance sheet to reverse this intergenerational wealth transfer, or even to stop it.

The debate is quickly framed and shut down with this paraphrased argument:

‘Big spending Labour (or National) can’t be trusted to run up higher debt because future taxpayers will just have to pay it back through higher taxes, and it will just overheat the economy and generate inflation, We’re doing our grandkids a favour by keeping debt low, and it gives us protection if we have another earthquake or pandemic.’ My paraphrased summary of the low debt mantra.

But don’t take my word for it, here’s what new self-professed-centrist Opposition Leader Christopher Luxon and his new finance spokesperson Simon Bridges said on the issue of spending and debt and inflation shortly after the Government released the Half Yearly Economic and Fiscal Update (HYEFU ) and BPS:

“Why is she (PM Jacinda Ardern) continuing to spend at record levels, despite inflation running at a 30-year high with prices growing faster than wages, making everyday hard-working Kiwis poorer?” Christopher Luxon asking PM Jacinda Ardern a question in Parliament.

“Does he accept taking core Crown expenses to $128 billion next year—68 percent more than when he first became finance Minister—in an already hot economy will raise inflation and really hurt Kiwis?” Simon Bridges asking Grant Robertson a question in Parliament.

‘Don’t borrow to invest. The kids won’t thank us’

Even Robertson argued in the BPS future generations would be better off if he kept the debt low.

“Net core Crown debt is forecast to be 30.2 per cent of GDP in 2025/26. This is significantly lower than forecast for most advanced economies and will reduce the intergenerational inequity of high public debt.” Robertson.

(See below for more of my analysis of how a couple of generations of voters, their politicians and their bureaucrats created budget processes and tools to engineer this ongoing transfer of wealth and wellbeing from future generations to today’s asset owners.)

(And remember, here’s this special last-time-ever offer from me to you and other existing ‘free’ subscribers who’ve been putting it off, subscribe fully now for 50% off for a year to join the The Kākā discussion community, to get full access to all my daily emails and articles, and to get all my daily podcasts (like the one above paid subscribers can listen to).

(This ‘Gravy Day’ offer is open until the end of Dec 21, 2021, to celebrate the first three months since we launched The Kākā on Sept 21. It’s the last special offer I’ll make for the foreseeable future. Subscribe to support my type of accountability and explanatory journalism about housing affordability, child poverty and climate change. You’ll also be able to see what’s in the full daily email, along with listen to my podcast above)

Intergenerational inequity and how it was created

Wealth transfers can happen two ways: between different groups of people in the same time period, or between groups of people now and groups of people in the near or distant future.

We all understand intuitively how we can make our incomes and wealth feel better now by not investing to fix wear and tear in the past and by not investing for future benefits that we won’t be able to experience. It’s why businesses run three different measures of their success so they know when today’s managers are essentially stealing from the future, or investing for the future. Those accounts are:

profit and loss accounts to understand performance in any one period;

cash accounts to understand what cash flowed in and out during the period; and,

balance sheets to compare snapshots of stocks of assets and liabilities at the beginning and end of the period.

For example, a manager could make the cash accounts look good and make shareholders feel better in the short term by not using surplus cash to invest in repairing wear and tear on the businesses assets, or to not invest to improve future production, and instead paying out a higher cash dividend. But this can’t (or shouldn’t) be hidden because this action to consume capital for the short term gain of shareholders would be reflected in a reduction in the stock of assets there to produce income in the longer run, and therefore generate a reduction in shareholder equity.

That decision to take a bigger dividend instead of investing would show up in the two other accounts because the now-tattier and more tired assets would be revalued lower in the balance sheet. To reflect that, there would be a revaluation loss in the P&L.

There should be nowhere to hide in these accounts and it’s one of the reasons why the Government moved to a similar way of reporting its finances after the passing of the Public Finance Act (1989). There are clear measures of a type of P&L that shows a budget deficit or surplus in place of a profit. Then there are cash accounts and a balance sheet, which should show the value of the Crown’s assets and liabilities.

It should make it difficult to structurally under-invest and ‘steal’ from the future, but the way assets and liabilities are measured across Government independently of the rest of rest of society makes that hard to spot. And this is where taking a business-like approach to measuring performance breaks down.

Treasury doesn’t measure the collective value of Aotearoa-NZ’s air or water, nor the collective future pain and grief from mental health issues, a diabetes crisis, deaths from air pollution and the lost productivity from kids living in poverty, bouncing from one mouldy and cold rental home to the next and never settling in at school. It can measure the value of the Government’s assets, such as Kāinga Ora’s land and houses, as well as plant and equipment, but it doesn’t measure the future liabilities from all those kids growing up in poverty, such as higher benefit costs, higher justice and corrections costs, higher health costs and lower taxes because of lower productivity and PAYE paid.

So it made sense for Governments since 1989 to not to borrow to invest in new public housing, and to let these houses run down. Kāinga Ora, then called Housing NZ, even had to pay a dividend to the crown. That meant ‘profits’ were recorded in the accounts, but not the increased long-term liabilities because of higher child poverty.

Government’s land revalued up by $12b

For example, the value of Government land rose $12b to $71b between the May Budget and the HYEFU (page 121) this week, largely due to Kāinga Ora’s land being revalued up, even though housing quality often remains dire and there’s clearly a massive shortage. But there’s no measure in the accounts of the despair and the stress suffered by renters and frustrated first home buyers now locked out of the market, or the number of quality-adjusted-life-years lost because the homes were mouldy and many kids living in poverty are growing up with diabetes and mental health issues.

Treasury, the Labour Government and some other parts of Government have started to talk more in recent years about trying to measure wellbeing and manage the Crown’s finances to improve it. The PFA was even amended to sprinkle the word ‘wellbeing’ throughout. Read this week’s BPS and it would seem Treasury and the Government are deadly serious about it. For example, here’s the first three paragraphs of the BPS (bolding mine):

The Labour Government is committed to achieving its policy goals using a wellbeing approach. This aims to improve New Zealanders’ living standards by taking an intergenerational view to tackling long-term challenges. It also means looking beyond traditional measures of success, such as gross domestic product (GDP), and towards broader indicators of wellbeing.

The Treasury’s Living Standards Framework recognises that human, environmental, social, and physical and financial capital needs to be developed and sustained in order to achieve wellbeing. A complementary framework is being developed to sit alongside, He Ara Waiora, which draws on a te ao Māori perspective. Each framework provides a distinct contribution to understanding New Zealand’s wellbeing outlook.

These frameworks invite us to consider the distributional impacts of policies on different groups and the environment. This is achieved by working in the spirit of kotahitanga (unity) with those most affected by policy changes, and by considering the intergenerational impacts of the choices we make to support our tiakitanga (stewardship) and mana whanake (intergenerational prosperity).

Yeah…nah…

It’s just performative

This ‘wellbeing’ approach has been honoured more in the breach than in the observance, although the lack of clarity or real information has made accountability impossible in many areas, especially on the environment and housing.

As the Parliamentary Commissioner for the Environment, Simon Upton, reported this week, few signs could be found in either the Crown’s accounts or the actions of Government that they had changed their decisions because of that ‘wellbeing’ approach or the ‘Livings Standards Framework’ that is talked about so much, and which the PM has talked up so much overseas to great acclaim. Here’s Upton in the report (bolding mine):

“The Treasury’s reasons for recommending against the environmental proposals scrutinised as part of this review in the context of the first three wellbeing budgets were almost invariably drawn from a traditional menu of arguments honed to rein in budgetary creep. There are no signs to date that spending proposals are being knocked back on the basis of their potentially negative impacts on current or future wellbeing.” Simon Upton

This failure to analyse funding decisions or to justify different investment, borrowing and spending choices is writ large in just about every variable in this week’s Half Yearly Economic and Fiscal Update (HYEFU) and BPS.

Inflation’s dividends captured by asset owners

Here’s a quick summary of the key details in this week’s reports:

faster than expected economic growth and higher inflation means forecast GST, PAYE and corporate tax revenues for the next four years are $48.6b higher than the May forecasts;

that’s partly because of fiscal drag (higher incomes drags taxpayers up into higher tax brackets) and partly because of higher interest rate forecasts, which lift term deposit withholding taxes;

higher carbon credit prices mean Emissions Trading Scheme revenues are $5.4b higher than expected in March and total revenue increases from the May budget are $54.5b;

new operational spending worth $12.8b over four years was added, largely from a one-off $6b sum to create the new Health NZ and the Māori Health Authority; and,

a new Climate Emergency Response Fund (CERF) worth $4.5b, of which only $3.6b is allocated over the four years;

the Budget is forecast to be in surplus at least two years earlier than expected and the combined deficits or losses are $18.5b better than expected over the next four year; and,

all that led to a decision to borrow $41b less over the next four years than was signalled in May; and,

that meant net crown debt will peak eight percentage points lower than expected at 40.1% of GDP, and fall back to 30.2% within four years.

So normal service is resumed. The net debt track is back into the 20-30% of debt band that Treasury has preferred for 20 years or so and the Govt will be back in surplus next financial year 2022/23. The Govt is complying fully with the PFA’s direction to always post surpluses and get debt down once a crisis is over.

In essence, an economic rebound and an inflation ‘dividend’ landed in the government’s lap and it had a choice about what to do with it. It could choose to keep borrowing as much as it had previously planned and use that ‘bonus’ to invest more in housing, climate and welfare measures, or it could use the spare money to borrow less.

Govt chose to borrow less and hand back spare cash

Here’s the chart that shows firstly the improvement in the ‘profit’ line, described here as the Operating Balance before extraordinary gains and losses (OBEGAL):

And here’s the chart showing what that means for net debt, and how much the curve has been allowed to drop by not investing in future generations. The grey line was the May forecast and the red line is this week’s forecast. (Ignore the light pink line that includes low interest rate loans to banks by the Reserve Bank of freshly printed money. That will be repaid).

Just to ensure you understand why Robertson and the Treasury is so focused on debt reduction, here’s the key part of their ‘Fiscal Strategy’ section of the BPS (bolding mine):

“Our fiscal strategy continues to take a balanced approach to supporting current and future generations by managing debt prudently and reducing the deficit caused by COVID-19, while growing the economy sustainably and investing in important public services like health and education. Given the nature of the COVID-19 global economic shock and the need to support the economy, debt remains at prudent levels throughout the forecast period, and there remains space in the Government’s fiscal strategy to respond to future shocks.” Robertson in the BPS.

There’s the reasoning in bold: we want low debt so we can borrow again if there’s another shock. Essentially, we’ve got a rainy day fund for the next rainy day. But what about all the kids living out in the rain now? Or that the rain is crashing down now because of climate change? Why reduce debt just in case there is a future emergency, when there are two emergencies right in everyone’s faces right now?

But wait, there’s more

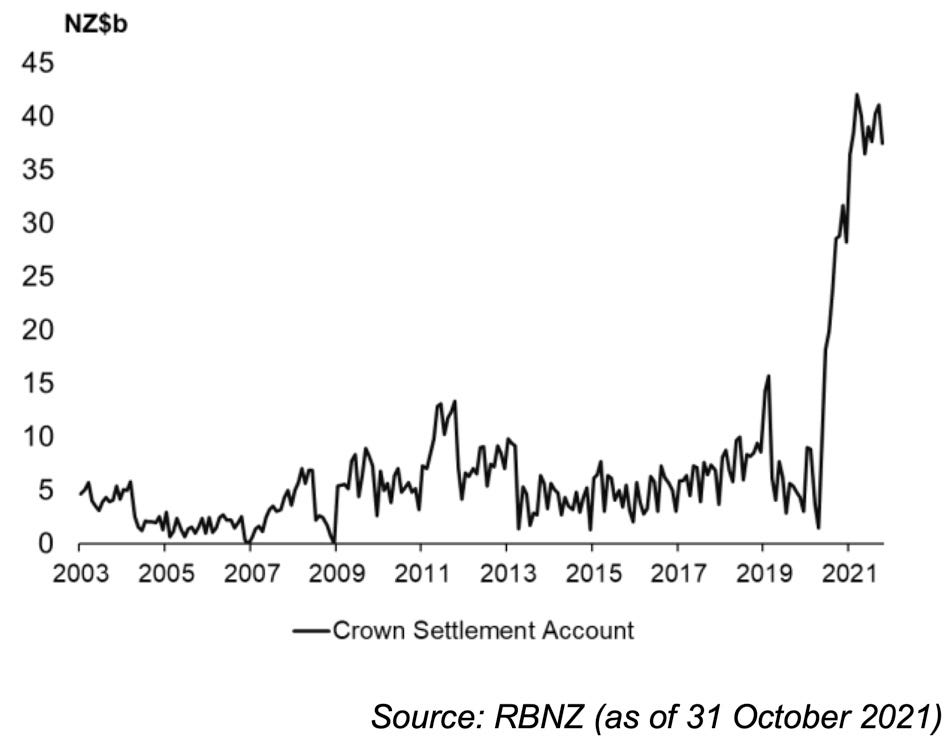

One of the most extraordinary decisions revealed this week was the Govt’s quiet move to run down a massive cash pile it built up by over-borrowing during Covid. Yes, you read that right. Treasury issued mountains of new bonds during Covid, in part because the Reserve Bank was hoovering them up in the secondary markets with freshly printed money. In effect, the Government was receiving cash indirectly from the Reserve Bank and then putting it in a cheque account with the Reserve Bank, known as a Crown Settlement Account (CSA).

Treasury wanted to ensure it had plenty of cash on hand, just in case Covid got really, really bad and the financial markets shut down. Think of it like when you withdrew loads of cash from an ATM the day before the lockdown and never needed to use it because all the EFTPOS machines kept working throughout. That’s what happened and here’s the account balance chart:

Treasury’s Debt Management Office announced this week it had decided to run down that cash surplus to a longer term level of around $15b, which is just under 5% of GDP, and about in line with where other countries have their Govt cash reserves.

DMO will do that by issuing less debt than it normally would over the next couple of years. In effect, the Goverment already had as much as $50b in cash and other liquid assets in its account. It could have invested in infrastructure and allowed the account to have gone back to normal levels of about $5b and not even had to borrow more. Instead, it’s using the extra tax revenue from inflation and economic growth to reduce the borrowing programme by about $41b.

That’s the scale of the opportunity missed. New spending on houses, public transport and hospitals that could start reversing the intergenerational wealth transfer worth at least $1t over the last 20 years.

There was $40b in cash just sitting there and Cabinet chose not to spend it.

Just think now about Treasury’s advice last Christmas (which Cabinet accepted) not to spend an extra $1b or so a year through an immediate $50 increase for beneficiaries, as Social Development Minister Carmel Sepuloni had wanted to do. See more on that from my Dec 8 article.

So I asked Robertson why the government had chosen not to invest more than the extra $4b in capital spending allocated over four years as signalled this week, of which only $2.2b is actually scheduled to be spent inside the forecast period.

Here’s his answer:

“It's a balance. We have continued to increase our investment over time in infrastructure but as I've tried to do throughout my time as Minister of Finance, it is a balance around what we also leave in terms of net crown debt. I'm confident that the balance is right, but we always keep looking at it. And as I say there are some large infrastructure projects coming down the line, which we will pay attention to in due course.” Grant Robertson.

Balancing asset owning-voters vs non-voting renters

Robertson also talked up the wellbeing approach’s move to create Child Poverty Reduction targets, which are included in the list of amendments to the PFA (1989).

This is where the rubber hits the road for the wellbeing approach: writing hard targets into law to give some steel and accountability to the words.

So if wellbeing mattered, why hasn’t the Govt set housing affordability targets?

His answer was no:

“We haven't given specific consideration to do that. There are a number of objectives in the government's housing program that we can be assessed against. And they are on dashboards that are made available on a regular basis, but we haven't given consideration to a legislative change.” Grant Robertson.

For the record, there are no housing affordability measures anywhere on the MBIE, HUD or MSD websites that the govt has committed to. See more on that in my article this week on the PM refusing to set affordability targets.

Also for the record, the Govt’s surprisingly good forecasts and decision to reduce borrowing by $41b was welcomed by bond investors, who pushed the five year Government bond yield down by 15 basis points to 2.17% this week to celebrate.

That means there’s a minor chance mortgage rates might fall a bit, or not rise by a bit. That will help keep asset prices up. Yet again, value is pulled forward to asset values now, and costs are pushed off into the future, where someone else can deal with them.

So how could things be done differently?

The essence of the problem is the PFA’s obsession borne of Robert Muldoon’s borrowing spree in the 1970s and early 1980s in foreign currencies with variable interest rates. Given our fixed exchange rate, those debts were bombs that could go off at any moment.

That is not the case any more. Our Government borrows in NZ dollar with fixed interest rate securities that transfer the interest rate and exchange rate risk to foreign investors, or are simply held by local investors. The PFA is a relic of an age when bond vigilantes were kings. Now bond investors are desperate for more bonds. From any one. They are happy to lend money to the German Government for minus 0.35% when German inflation is over 6%.

The other tool that needs to change is the Treasury’s use of punishingly high discount rates for cost benefit analysis. The current 5% discount rate used for most projects discounts away the costs and benefits to nothing within a few years, meaning the interests of future generations are ignored.

The Stern report into climate change used a 1.4% discount rate, as Simon Upton pointed out this week in recommending the Government look to use lower discount rates. Watch out tomorrow for more from me on that in my Spinoff podcast.

Here’s our use of discount rates compared with others, courtesy of the PCE.

Chart of the day

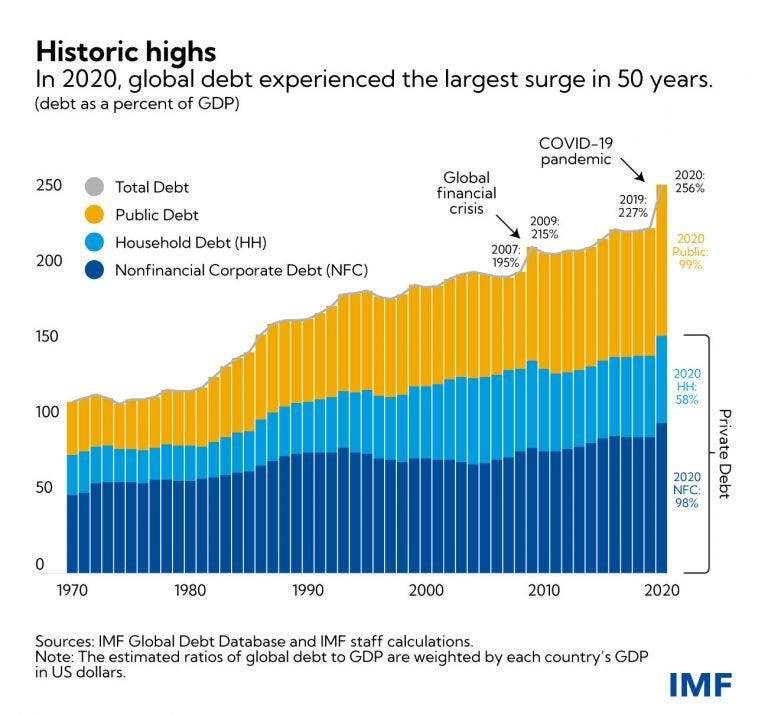

Just to show how low our debt is. Global public debt is nearly 100% of GDP. Ours is 40% and falling. If bond investors did get grumpy, we’d be the last in the queue to get shot.

A fun thing

Frank PSA on Twitter: Year in review 2021 edition

Ka kite ano

Bernard

Share this post