Long stories shortest in Aotearoa’s political economy this morning:

Within months and before Parliamentary approval is obtained, the Government plans to strip non-Maori landowners of the right to use the Environment Court to stop compulsory acquisition for fast-track projects and big new motorways.

The Government also wants to buy off landowners who volunteer to sell early by paying them up to $150,000, with all non-volunteers getting up to $92,000 extra.

Iwi land owners will also get paid off, but can still appeal to the Environment Court under changes to the Public Works Act to be legislated next year.

A survey taken in late February found 55% of New Zealanders have struggled to pay for or gone without essentials such as food and doctors’ visits.

The Government will host a conference for foreign infrastructure investors this week, but Shamubeel Eaqub asks why they would invest when the Government itself is cutting investment. (See quote of the day and chart of the day below)

A new Horizon poll has found 36% of NZ First voters are disappointed with the coalition Government’s performance, endangering its ability to get over the 5% threshold at next year’s election.1

(There is more detail, analysis and links to documents below the paywall fold and in the video and podcast above for paying subscribers. If we get over 100 likes from paying subscribers we’ll open it up for public reading, listening and sharing, although we’d love it if you subscribed to support our ability to make this journalism public. Remember all students and teachers who sign up for the free version with their .ac.nz and .school.nz email accounts are automatically upgraded to the paid version for free. Also, here’s a couple of special offers: $3/month or $30/year for under 30s & $6.50/month or $65/year for over 65s who rent.)

The six things to know this morning

Long stories short, my top six news items in Aotearoa’s political economy around housing, climate and poverty on Monday, March 10 are:

Infrastructure Minister Chris Bishop and Land Information Minister Chris Penk yesterday announced plans to amend the Public Works Act “within months to accelerate the acquisition of land needed for the public projects that are listed in Schedule 2 of the Fast-track Approvals Act, and the Roads of National Significance listed in the Government Policy Statement on land transport 2024.”

They said the changes would apply six months before amendments from a wider review of the Act goes through Parliament, which was not expected until next year. They said objectors to land acquisition would not be able to appeal to the Environment Court, although iwi would.

Meanwhile, the Government would offer voluntary sellers a premium of up to 15% of their land’s value, while non-volunteers would all get up to 5% extra to a maximum of $92,000 each.

A ResearchNZ survey of 1,006 adults taken from February 20-24 was published yesterday, showing 55% said they had struggled to pay for or gone without essentials such as food, doctors’ visits and power bills.

The survey found 71% of those aged 18-34, 62% of those living with children and 60% of women said they had struggled or gone without. It showed no overall improvement in two years. A third of those surveyed said they had been unwell and gone without medical care in the last three months.

Simplicity Economist Shamubeel Eaqub says the Government is asking foreign investors to have confidence to invest, when the majority of the Government’s own spending cuts in the last year were cuts in investment.

My pick’ n’ mix six of scoops & deep-dives this morning

Housing scoop: Auckland homelessness spike prompts 'please help' letter RNZ’s Katie Todd

Politics scoop: Andrew Bayly takes a break to climb Everest Stuff’s Andrea Vance

Housing deep-dive: Why a $62m Auckland plot has sat empty for 20 years. The chunk of land once home to a popular bowling club has sat empty for two decades, despite a Chinese developer’s grand plans for a $453m apartment project. Stuff’s Caroline Williams

Housing deep-dive: Leaking sewage, no hot water, and stabbed walls: The ‘unsanitary’ flats two women felt they couldn’t refuse. The women were placed in the dilapidated units by a prisoner reintegration charity after being released from jail. Now they’ve been awarded more than $25,000 in damages. Stuff’s Edward Gay

Climate analysis: A case of when, not if, Government dumps NZ’s 2030 Paris ‘pledge’ Prime Minister Christopher Luxon’s unwillingness to restate commitment to key carbon-reduction pledge has unnerved Labour and the Greens. The Post-$$$’s Tom Pullar-Strecker

Housing deep-dive (and good news): Improving NZ’s woeful housing situation, one panel at a time.Your home should not send you to hospital, and this joint venture has devised simple tech to build passive-style airtight homes anywhere in the country. Gill South in Stuff

Quote of the day

‘You should invest, but I won’t’

“Cutting investment spend and asking others to invest instead seems fraught,” Simplicity Economist Shamubeel Eaqub via a LinkedIn post yesterday.

Chart of the day

‘Government is cutting capex, not opex’

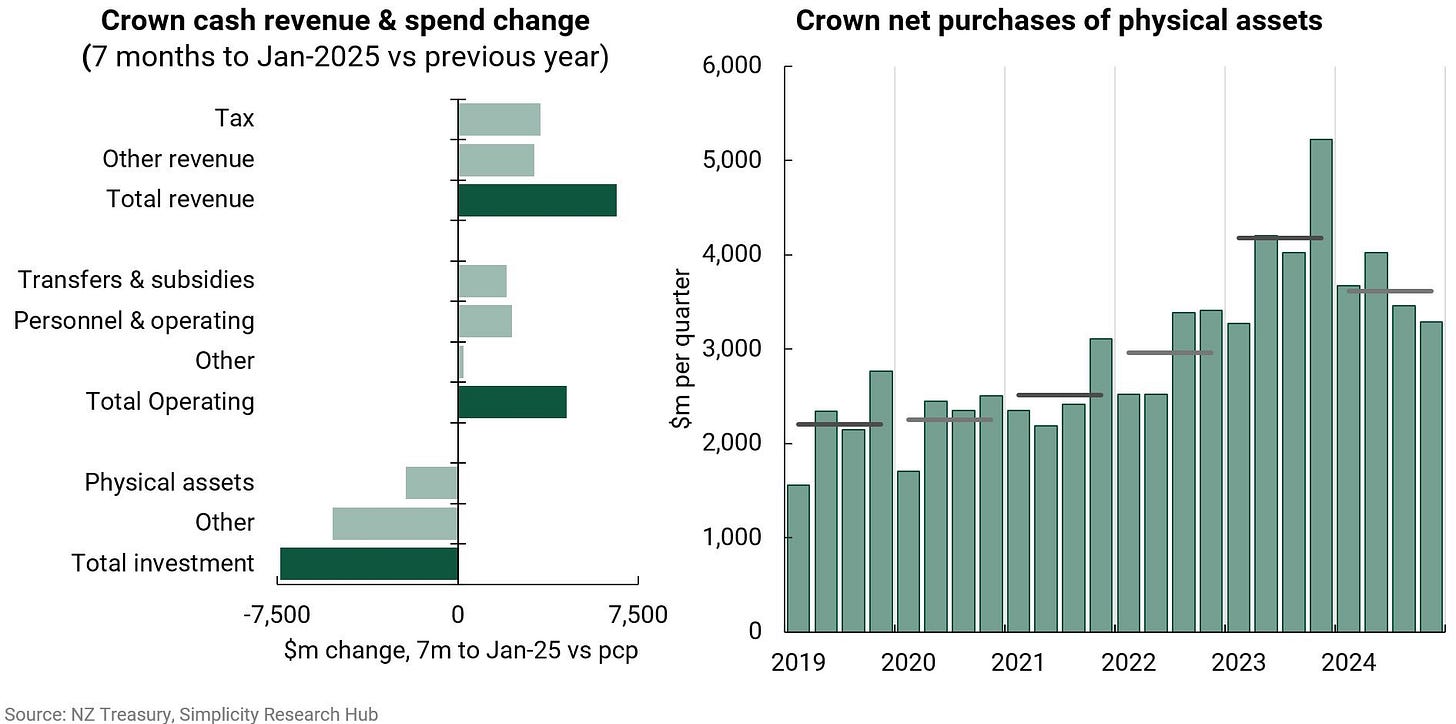

Simplicity Economist Shamubeel Eaqub yesterday put the correct framing around the Government’s conference on Thursday and Friday for foreign infrastructure investors. Why would foreigners invest when the Government isn’t? And why has the fiscal austerity so far been all about quickly turning off investment? Here’s Shamubeel in his LinkedIn post with the chart above (bolding mine):

“Fiscal austerity so far has been reduced investment and not much else, because red projects were turned off by the blue team.

“In the 7 months to Jan-25, government net cash spend (opex+capex-revenue) into the economy was down 41% from the previous year. [See left chart.]

“Rising tax revenue may surprise; they would have increased more without income tax cuts. Operating spending is still growing (1/4 from NZ Super!), despite announced cuts. So, tax cuts have not been offset by spending cuts and efficiencies. NZ is borrowing money to fund operations not investment, as a prudent country does.

“The biggest slashing has been in investment spending, which slowed sharply in the 2024 calendar year, down $2.3b or 14% from 2023. [See right chart.]” Simplicity Economist Shamubeel Eaqub via LinkedIn post.

Substack essential of the day

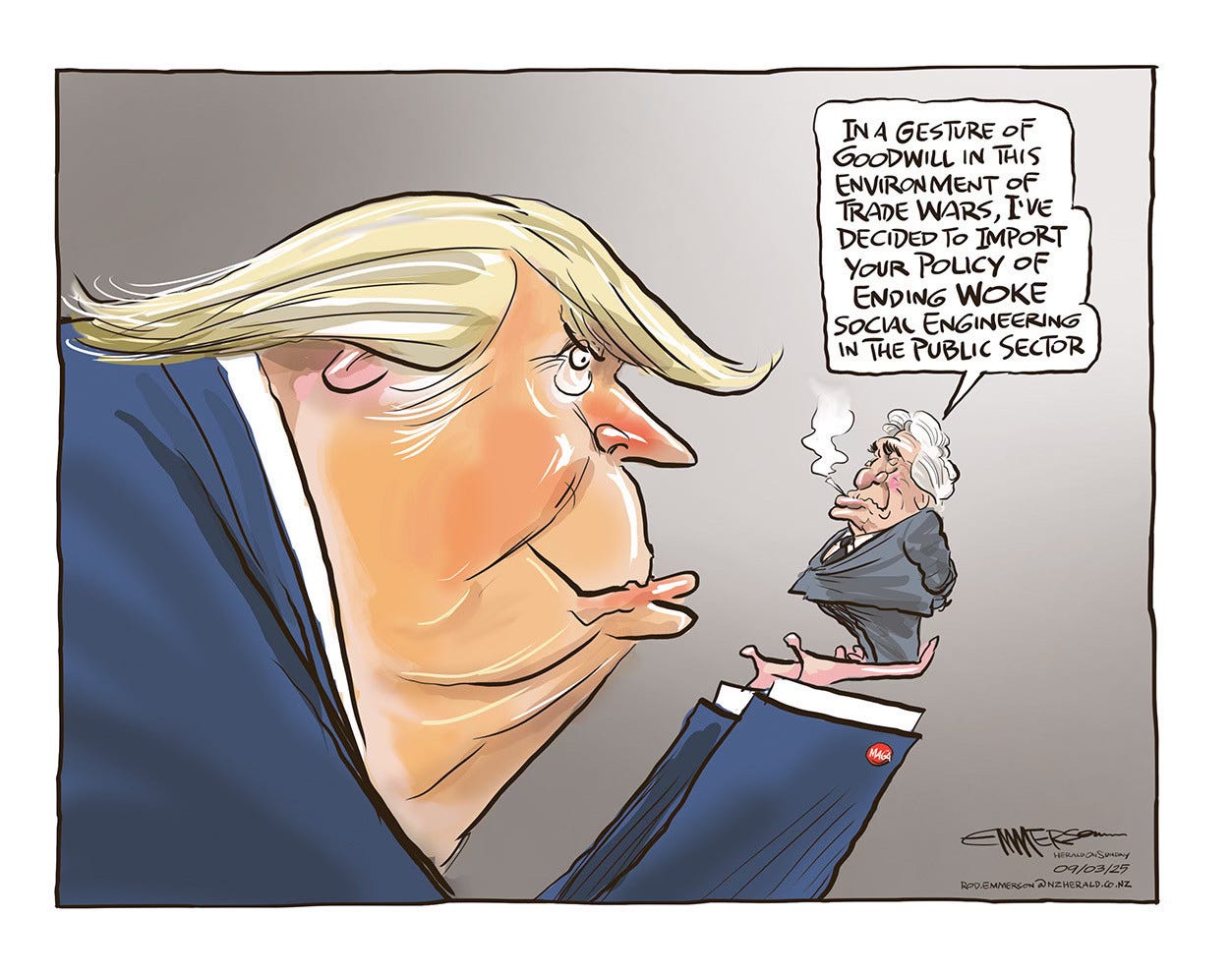

Cartoon of the day

Timeline-cleansing nature pic of the day

Ka kite ano

Bernard

Share this post