Long stories short, my top six news items in Aotearoa’s political economy around housing, climate and poverty on Tuesday, March 4 are:

The Government is widening its drive to turn public capital and investment costs into consumer price inflation that the Reserve Bank has to control with high interest rates.

In recent days a rash of Government-controlled and driven price setters have signalled double-digit rises in prices, rates and fees in the next couple of years, due to the Government’s drive to reduce public borrowing and force their capital costs and investments off into private sector and council debt serviced through new or higher user charges, and higher council rates.

They include: Metlink (43% increase for off-peak bus and train fares from July 1), 51%-Government-owned gentailer Mercury (9.7% increase in average residential electricity bills from April 1), Environment Canterbury (9.9% rates increase from July 1) Dunedin City Council (10.5% from July 1, followed by 10.2% and 10.1% increases in the following two years), Tauranga City Council (12.5% from July 1), Hutt City Council (13.4% from July 1, then 12.9% in 2026/2027), Invercargill City Council (9.5% from July 1) and Ashburton District Council (9.8% from July 1).

This comes on top of plans announced over the last year to increase Government insurance levies by as much as 72%, to nearly treble the international tourist levy, to hike work visa fees 53%; to increase motor vehicle registration fees by 45%; to lift MPI fees by 18%; to reimpose the $5 prescription charge, and to remove subsidies for electric vehicles.

The Government has argued it needs to return the Budget to surplus and reduce borrowing to take inflation pressure off the economy, which would allow the Reserve Bank to lower interest rates faster than would otherwise have been the case, which would in turn stimulate the economy.

However, the administered price shock is forcing the Reserve Bank to hold interest rates higher for longer than expected and higher than seen after previous recessions, which means the cost-shifting and debt-shifting is proving counter-productive.

(There is more detail, analysis and links to documents below the paywall fold and in the video and podcast above for paying subscribers. If we get over 100 likes from paying subscribers we’ll open it up for public reading, listening and sharing, although we’d love it if you subscribed to support our ability to make this journalism public. Remember all students and teachers who sign up for the free version with their .ac.nz and .school.nz email accounts are automatically upgraded to the paid version for free. Also, here’s a couple of special offers: $3/month or $30/year for under 30s & $6.50/month or $65/year for over 65s who rent.)

Substack essentials today

Chart of the day

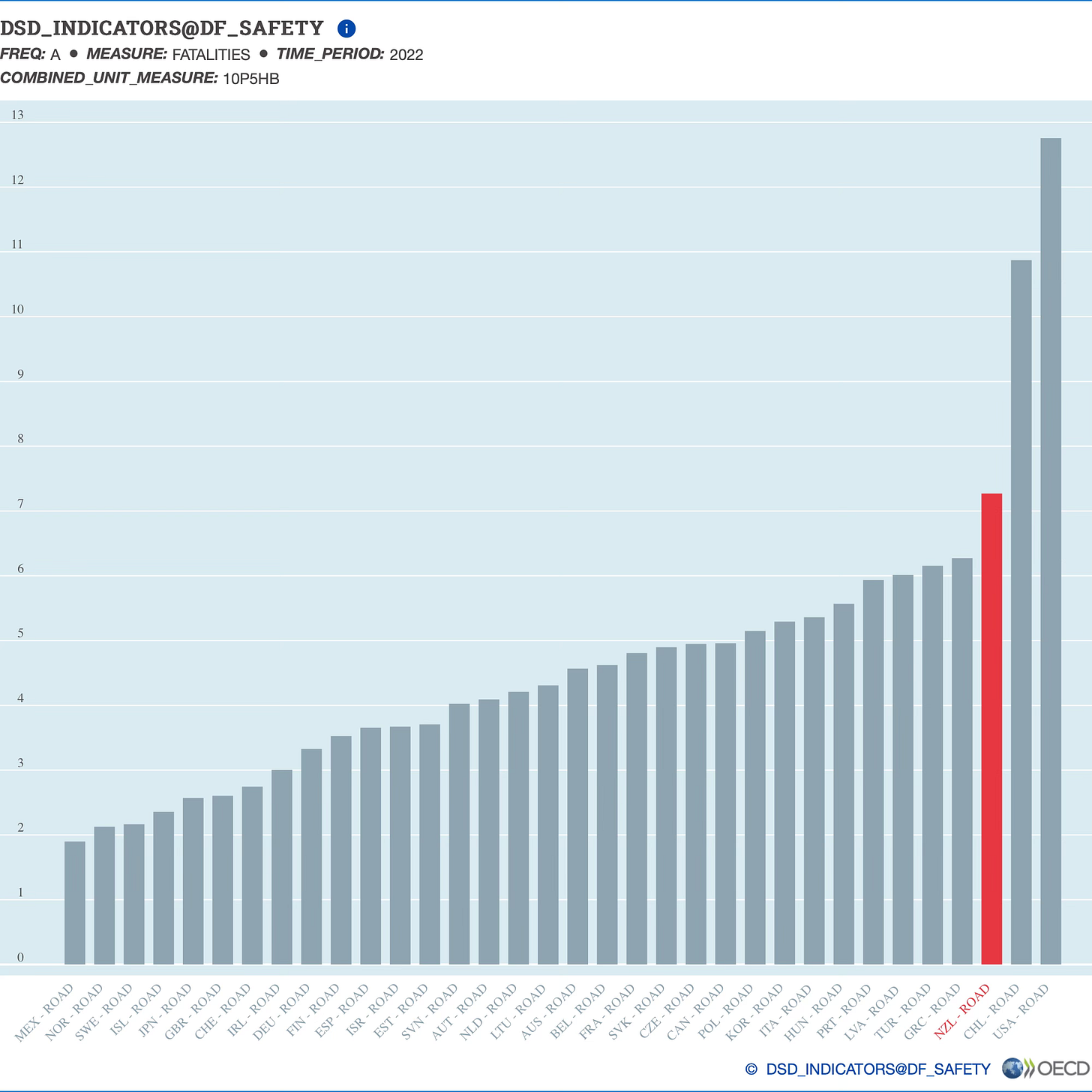

Third worst road traffic death rate in OECD, and getting worse

Quotes of the day

Auckland councillors on enforced speed increases

“$8.8 million to change signs to make our roads less safe. Have sourced figures and can confirm this equates to nearly 7 YEARS worth of Henderson-Massey LB's transport capex budget. I won't be supporting any cuts to transport investment in the West to meet this unfunded mandate.” Auckland City Councillor Shane Henderson via X

“Make no mistake. Govt’s forcing us to make streets, schools & neighbourhoods less safe will KILL KIDS. Some people don’t like me saying that but it will mean that. We have 2nd highest DSI (death and serious injury rate) in the OECD next to USA. We have almost 3x the deaths on our roads compared to the UK.” Auckland City Councillor Richard Hills via X

Cartoon of the day

Virtual navy

Timeline-cleansing nature pic of the day

Ka kite ano

Bernard