TL;DR: These are the six things that stood out to me in news and commentary on Aotearoa-NZ’s political economy at 9:06am on Monday, April 29:

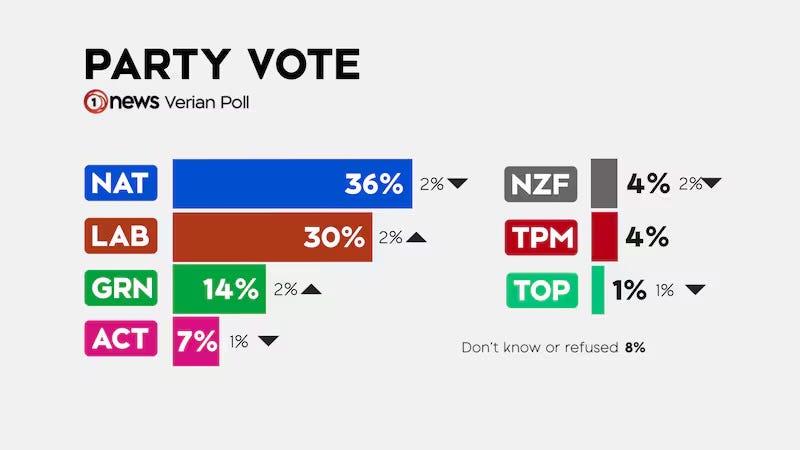

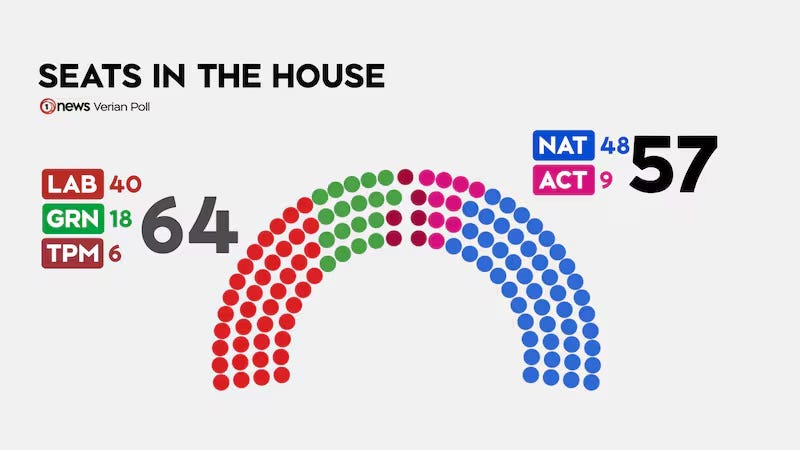

The Lead: A 1News-Verian poll published last night showed the collapse in business, consumer and voter confidence about the country’s direction in March and April has translated into the worst polling performance for any first-term Government since the introduction of MMP in 1996. The previous worst was the National Government in 1991 in the lead-up to Ruth Richardson’s Mother of All Budgets. (Paying subscribers can see more detail and analysis below the paywall fold and in the podcast above.)

Civil contractors report skilled construction staff are leaving for Australia because of the Government’s big freeze in capital spending decisions on state-backed or funded water, roading and housing projects. 1News Katie Bradford (See Quote of the day below the paywall fold)

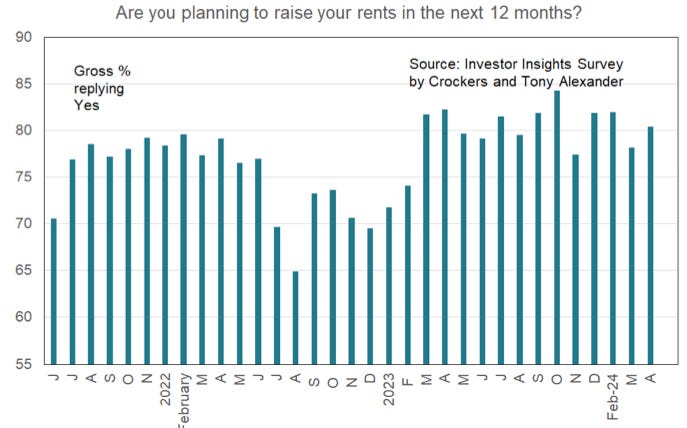

The Government’s hopes landlords would fund the building of new homes for rent and reduce rents from better after-tax returns from their existing properties are falling on deaf ears, this month’s survey of rental property owners by Tony Alexander has found. Investor intentions to build or develop new homes hit a record low in April, while more than 80% plan to increase rents in the next 12 months, back at pre-election levels. (See Charts of the day below the paywall fold)

Te Pūtea Matua - The Reserve Bank of New Zealand yesterday warned in a pre-published special section of its half-yearly Financial Stability Report due tomorrow that banks needed to check the insurance arrangements for home buyers more closely because insurers had started raising prices or removing coverage from some homes categorised as high risk for earthquakes and flood damage. (See Map of the day below the paywall fold)

The ministerial performance double-standard forced on PM Christopher Luxon by NZ First and ACT was underlined yesterday when David Seymour said any unilateral sacking by Luxon of an ACT minister would breach their coalition agreement. NZ Herald Adam Pearse

Pharmac’s funding increase announced yesterday illustrated1 the intense structural pressures driving up the Government’s share of economic activity, which both parties are refusing to acknowledge or adjust for with their approach of forcing a sinking lid on the size of Government and net debt to keep it permanently below 30% of GDP. (See more detail in the footnote below the paywall fold)

(Paying subscribers can see more detail, analysis and links to documents and articles below the paywall fold and in the podcast above. We’ll open it up for public reading, listening and sharing if we get over 100 likes.)

The worst start for any Government in the MMP era

Now the collapse in consumer and business confidence has gone political.

I’ve documented in recent months a collapse in confidence about the Government’s direction in ‘right track-wrong track’ polls and in business and consumer confidence polls. These, at least initially, weren’t reflected in support levels for individual parties.

That lag ended last night when 1News-Verian published its latest poll2 showing the gap between the governing coalition parties (National/ACT/NZ First) and the opposition parties had not only closed up, but had gone negative.

The coalition’s collective support able to be represented in Parliament dropped from 50% in mid-February to 43% this week, due to three percentage points lost by National and ACT and NZ First’s drop below the 5% threshold. If these results were replicated in an election, Labour/Green/Te Pāti Māori would be on 48% to National/ACT’s 43%.

The poll also found support for new Green co-leader Chloe Swarbrick rose two points to 6%, putting her ahead of David Seymour on 5% and Winston Peters on 4%.

Charts of the day

Landlords pull back from building and eye rent increases

Independent economist Tony Alexander published the results of his monthly survey of over 300 rental property investors for Crockers yesterday, including detail on landlords’ intentions to build new homes and put up rents.

The Government has argued that reversing Labour’s interest deductibility changes would encourage more landlords to increase the housing supply and would suppress rental growth. The survey showed landlords’ intentions to build and develop new homes fell to a record low in April and that the share of landlords planning to increase rents had risen back to pre-election levels, despite confirmation from the new Government of the reversal of the tax changes, along with an acceleration.

Map of the day

Where risk-based pricing is hitting hardest

Quote of the day

‘Show us the money’

"What we're seeing is the immediate uncertainty is causing clients to defer or cancel contracts, awaiting some kind of certainty from the Government is really frustrating because we know there's a mountain of work to be done." Civil Contractors NZ CEO Alan Pollard via 1News

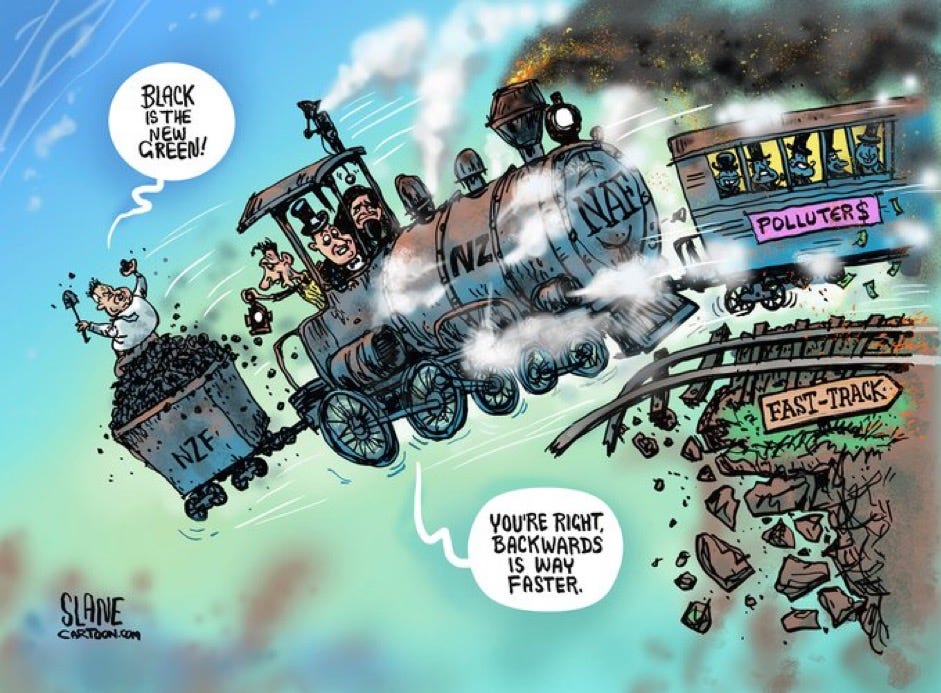

Cartoon of the day

Fast-track to where?

Timeline-cleansing nature pic of the day

Ooh shiny…but tasty?

Ka kite ano

Bernard

PS: I didn’t eat it.

Pharmac’s budget is being increased by around $400 million per year over the next four years to $6.294 billion by 2027/28, which Pharmac’s CEO said would just keep funding the existing drugs, rather than add new drugs. RNZ

Full poll attached in PDF form here.