TL;DR: These are the six things that stood out to me in news and commentary on Aotearoa-NZ’s political economy at 8:06am on Monday, April 29:

The Lead: The Government's constant talk of inheriting a financial mess, its freezes on transport, housing and water project grants and decisions, and a cavalcade of state sector job cuts has unnerved businesses and consumers into snapping shut their own wallets. It’s a reversal from late last year, when spenders and investors had expected better things from a change in Government. (Paying subscribers can see more detail, analysis and charts below the paywall fold and hear more in my podcast above.)

A coalition that prides itself on being a better economic manager than Labour is talking the economy into ever-deeper recession, as shown in collapses in business and consumer confidence in March and April, along with slumps in factory, services and construction activity reported in the last fortnight.

Climate: The Government’s failure to assess whether the Fast-track Approvals Bill was consistent with the climate clauses in our recent free trade deals with the EU and UK and the Trans-Pacific Partnership should worry farmers, the Environmental Defence Society has warned.

Health: Te Whatu Ora has confirmed it has ordered hospitals to urgently cut $105 million in costs in the next eight weeks to get former DHB budgets back into surplus, and ensure there are enough savings to pay for tax cuts in the May 30 Budget. Consultants from PwC are charging the Ministry for advice on the cuts. RNZ Phil Pennington

Health: Ministry of Health officials advised the Government in February its initial plans to cut waiting lists for specialist appointments and surgeries could cost $723 million over two years. NZ Herald Sophie Trigger

Politics: Former Green co-leader and retiring list MP James Shaw will give his valedictory speech on Wednesday. He admitted in an interview with Jack Tame aired yesterday on Q+A that he had come close to resigning as Climate Change Minister in the previous Labour-led Government because he didn’t think Labour was doing enough on climate and indigenous biodiversity.

(Paying subscribers can see more detail, analysis and links to documents and articles below the paywall fold and in the podcast above. We’ll open it up for public reading, listening and sharing if we get over 100 likes. Update: Achievement unlocked!.)

1: A dirge of austerity & uncertainty infects the economy

John Maynard Keynes, the godfather of modern macroeconomics, invented the term ‘animal spirits’ in his 1936 book, The General Theory of Employment, Interest and Money, to show how an economy had ‘moods’ that could be shifted by mere ideas or talk.

Right now, in Aotearoa-NZ, our ‘animal spirits’ are darkening towards a winter of discontent, thanks at least partly to a chorus of comments and actions from the Government this year about:

inheriting a ‘financial mess/hole/click/train-wreck’ from Labour that meant it had to cut the size of Government (and pay for promised tax cuts);

its immediate freezing of capital funding and decisions on state-backed water, transport and housing investments that had stopped construction sector planning, hiring and investing in its tracks; and,

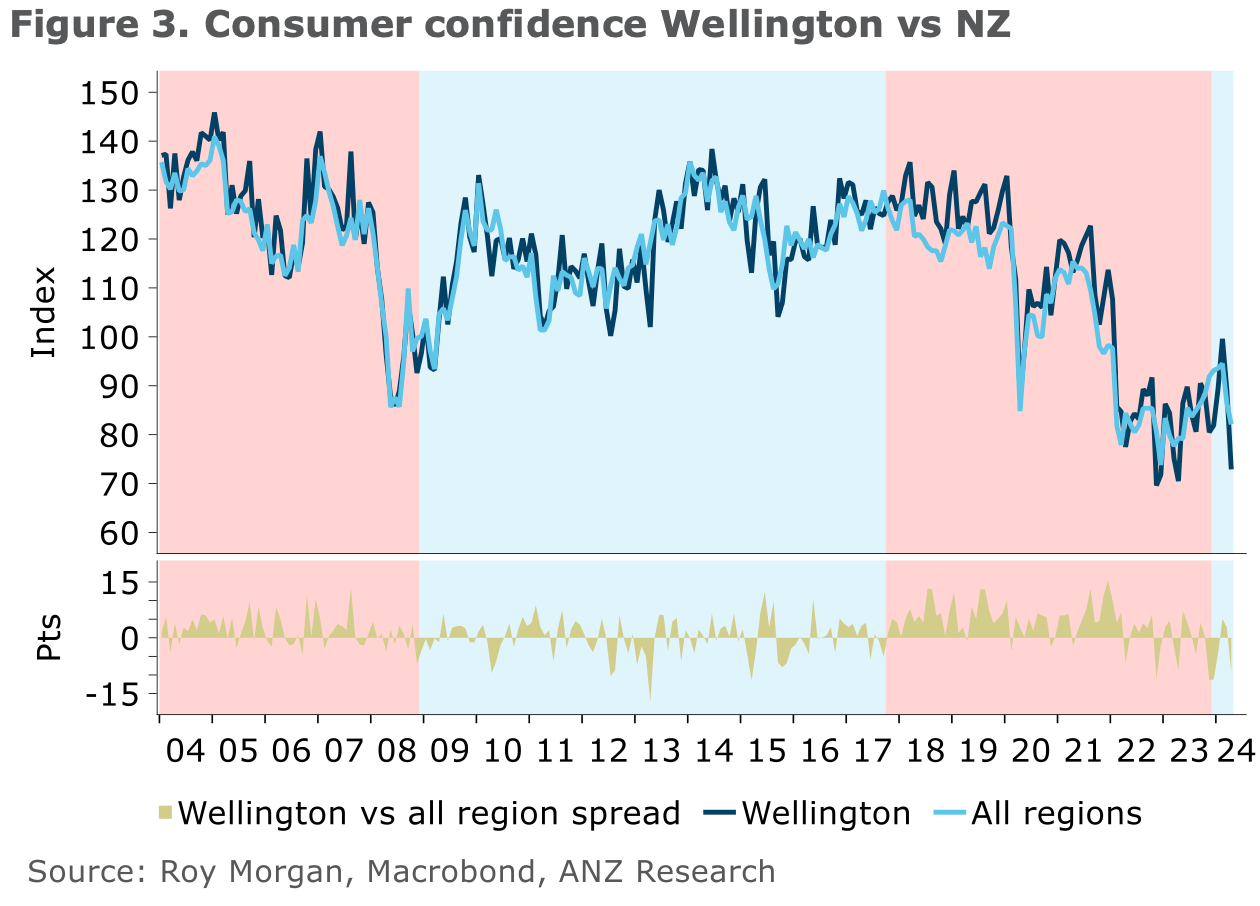

then an ongoing chorus of news about state-sector job cuts that has wrecked confidence in our capital city.

It’s almost been a lesson from an macroeconomics 101 class in how a Government can talk what had been a technical recession in the second half of 2023 into an extended and deeper one that could last through much of 2024. The Government’s own actions to push cost increases along to ministries and councils has forced them to ‘pass it on’ as inflationary increases in fees and rates. That has deepened the malaise as it dawns on homeowners that this is one of the factors holding mortgage rates high for longer.

It didn’t start out like this.

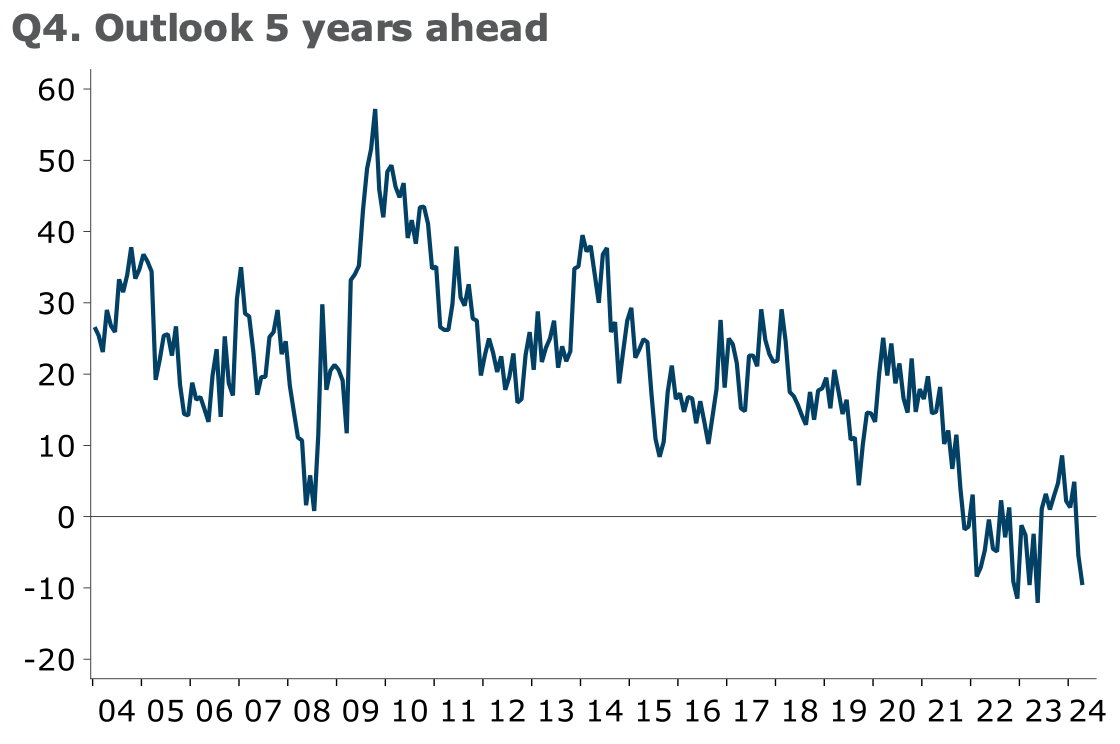

There was an initial burst of enthusiasm in November and December from business decision makers and consumers, who saw a change of Government as a circuit-breaker that would kick-start investing, the housing market and retail spending. But that surge ebbed away through January and February, before collapsing in March and April through a variety of leading indicators measuring confidence, new orders, building consents and retail spending.

Here’s those key measures in chart form:

Consumers less confident than during first lockdown and GFC

Consumer confidence collapsed after initial spike with new Government

Confidence in Wellington is even closer to late-2021 lockdown lows

Services, construction and retail business confidence slumped too

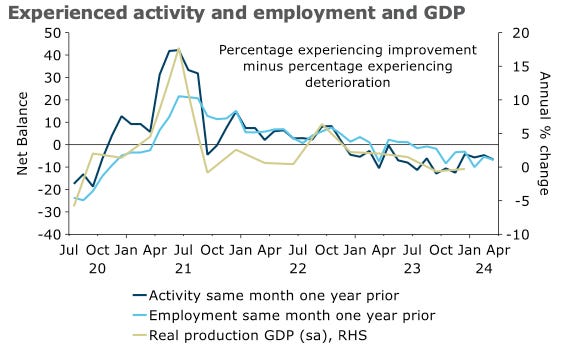

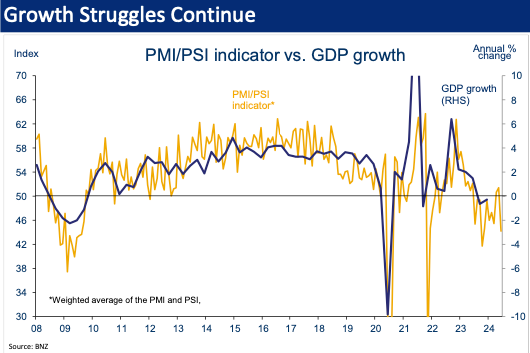

Leading indicators suggests deeper recession extending through 2024

Manufacturing outlook in recession too in April survey

Services sector contracting again in April survey

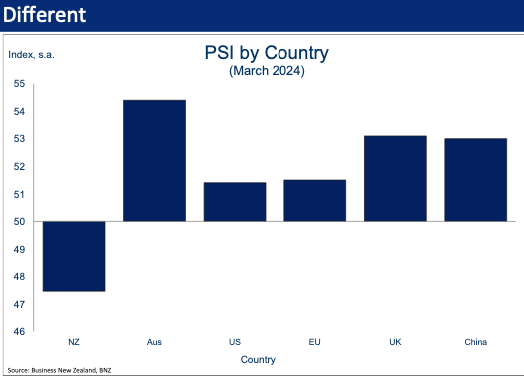

And we are special. It is just us going backwards

Quote of the day

‘The economy just came to a screaming halt’

“The fledgling improvement in the Performance of Services Index (PSI) earlier this year has come to a screaming halt. It is a pattern we have seen in a few indicators of late including last week’s PMI and QSBO. It raises the question that the economy may well be even weaker than is widely appreciated as well as questioning the timing of any recovery.” BNZ Senior Economist Doug Steel in his PSI note last week.

Cartoon of the day

Fast-track firestarters

Timeline-cleansing nature pic of the day

Autumn is coming

Ka kite ano

Bernard

Share this post