TLDR & TLDL: This week I take a hoon around the political economy with independent wealth, inequality and welfare researcher Max Rashbrooke. We talk about how the Covid ‘Rekovery’ is shaping up for the poor, the rich, the young and the old, and how the Public Finance Act is shaping the Government’s response.

The anatomy of the ‘Rekovery’

This week CoreLogic came out with its figures for the housing market in June. I thought it was worth totting up after over a year with Covid who had done well and badly out of the various Government and Reserve Bank actions taken to rescue the economy and support the economic welfare of Aotearoa-New Zealand’s residents.

I worked out that asset owners are $307b or an average of $92,000 richer because of the Government’s decisions to pump up housing values and share market values by cutting interest rates and printing nearly $60b to support the economy through the ‘wealth effect’. That includes the effects of $14b of cash in wage subsidies that has overwhelmingly been saved in business and household term deposit and savings accounts, which rose $20b to $310b over the last year.

Meanwhile, renters, the unemployed, young workers, families in poverty, the disabled and most Maori and Pasifika citizens went backwards because of lost income from precarious and low-paid work and because the $2,560 in cash support from the Government per household was gobbled up by higher rents. See more here in Thursday’s Dawn Chorus.

The problems with the RMA and Three Waters reforms

Environment Minister David Parker formally launched his RMA reforms and Local Government Minister Nanaia Mahuta released the first real details of how her Three Waters reforms would turn 67 water authorities into four.

I wrote in Wednesday’s Dawn Chorus about how it would be difficult to successfully get these reforms through until the following four elephants in the room were dealt with:

The Government hasn’t sought and received permission of the property-owning ratepayers who control councils to grow the population quickly, and hasn’t addressed the issue of population growth in its overall planning and funding systems in its RMA reform map;

It hasn’t resolved with those ratepayers, councils and taxpayers more broadly who will pay to build and run the infrastructure to cope with that population growth and how it will be paid for;

It hasn’t got agreement with either iwi or taxpayers and ratepayers in general about how the principles of the Te Tiriti o Waitangi will be included in these reforms in a meaningful way (ie how iwi will participate in plans and decisions)

In particular, it hasn’t reached a settlement between farmers, power generators and iwi about how to allocate and manage water rights.

Chart of the week

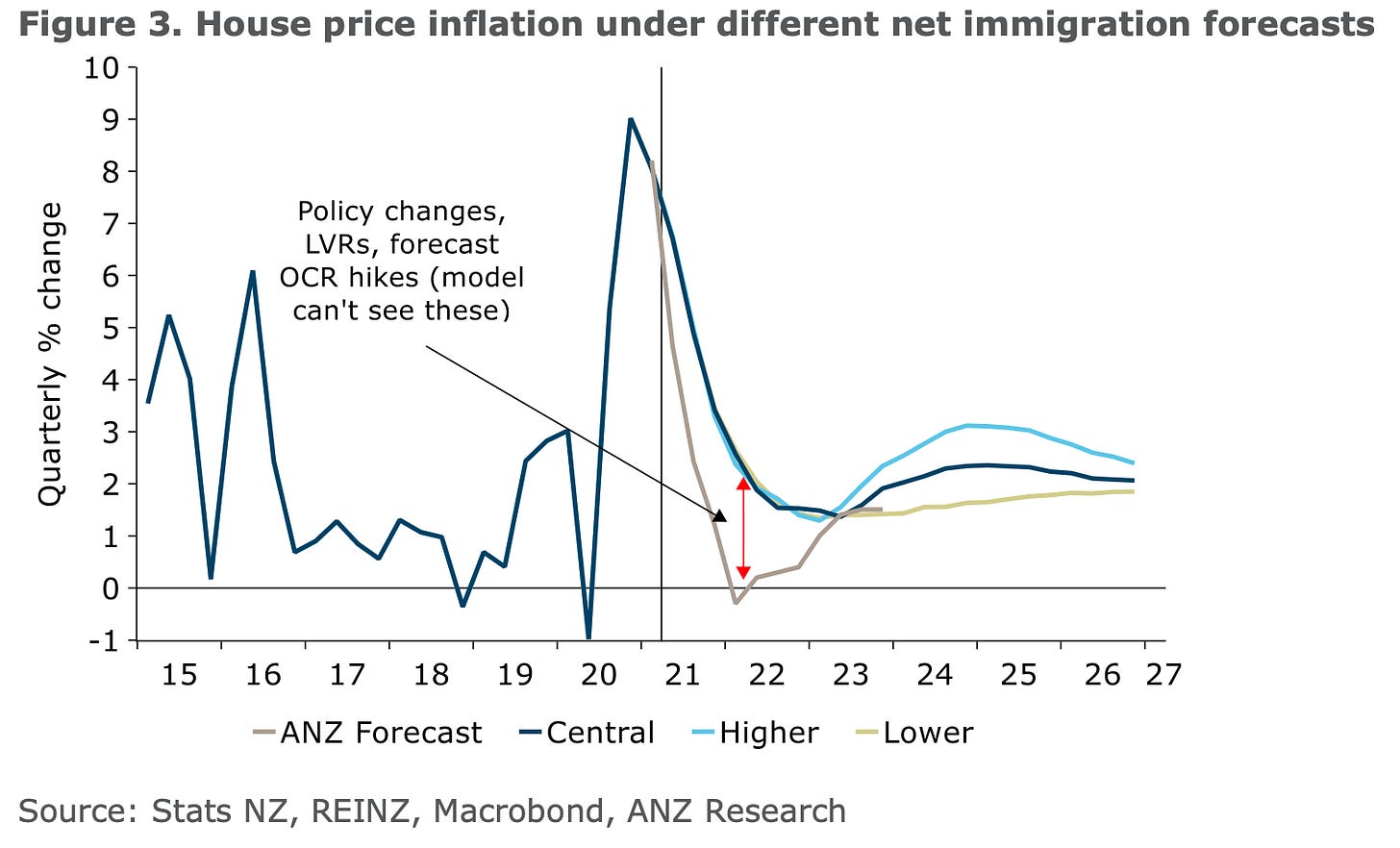

The most startling chart came out on Tuesday in a research note from ANZ’s economists showing from their modelling that higher immigration is associated with surges in house price inflation and nominal GDP, but not per-capita GDP.

Its modelling suggested a return to pre-Covid levels of net migration (14,000 per quarter) would double house prices again in the next five years, while lower levels of migration (6,000 per quarter) would increase house prices by almost three quarters, with all other factors being held constant.

“Those cumulative numbers sound massive, but they’re well-within historical experiences. For example, house prices increased 57% in the five years to May 2021, and 98% in the five years to June 2007.” ANZ’s economists.

Busway cut in a climate emergency

In Tuesday’s Dawn Chorus I highlighted how the Government’s focus on debt reduction was affecting its climate change efforts.

Pledges by the Government and Auckland Council of climate emergencies are looking increasingly like purely performative statements, rather than a signals of actual action. They remain more focused on keeping public debt and interest rates low for homeowners than addressing the crisis with public transport spending.

For example, Auckland Council has just signed off on a 10-year transport plan that reduces climate emissions by just one percent, in part because of funding cuts by the central Government’s Waka Kotahi-NZTA just 10 days ago.

That’s despite both the Government and the Council declaring climate emergencies in the last two years, the Council having a AA+ credit rating and the Government sitting on $40b in cash.

Banks getting with the programme

I highlighted in Friday’s Dawn Chorus how ANZ and ASB had recently changed their lending policies to make it easier to buy a small apartment, while in Monday’s Dawn Chorus I referred to ANZ’s 1.68% floating mortgage rate for new builds to trump ASB’s 1.79% ‘Back my build’ rate. ASB’s is funded from the Reserve Bank’s Funding for Lending programme of loans to banks at 0.25%.

My big idea for those needing a glimmer of hope

Quote of the week

Former National Government Attorney General Chris Finlayson unleashed this week in a way only he could, in this Stuff article.

“Now I know sometimes, you know, brands go off, but I've never seen brand destruction like I've seen in the National Party in the last year or two. You're talking to the wrong person if you expect me to express any sympathy for the current plight of the National Party, they deserve everything that's come to them. Put that in your article: they deserve everything they've got. Political parties have to feel the cold blast of opposition before they acquire the humility to be in government again. But if you're asking me to express sympathy for them, forget it.” Chris Finlayson

Ka kite ano

Bernard

Share this post