TLDR & TLDL: Pledges by the Government and Auckland Council of climate emergencies are looking increasingly like purely performative statements, rather than a signals of actual action. They remain more focused on keeping public debt and interest rates low for homeowners than addressing the crisis with public transport spending.

For example, Auckland Council has just signed off on a 10-year transport plan that reduces climate emissions by just one percent, in part because of funding cuts by the central Government’s Waka Kotahi-NZTA just 10 days ago.

That’s despite both the Government and the Council declaring climate emergencies in the last two years, the Council having a AA+ credit rating and the Government sitting on $40b in cash.

Auckland Transport CEO Shane Ellison told the Council yesterday, as it signed off on its 10-year Regional Land Transport Plan (RLTP), that the Eastern Busway – a key part of plans to link Botany and Panmure to get commuters out of cars and into buses – had been delayed for two years because of NZTA’s edict to councils across the country 10 days ago that it had to cut funding for public transport. (NZ Herald)

The Government has $40b in cash sitting its its accounts with the Reserve Bank and has no restrictions on its ability to borrow at less than 2% (Corrected from 10% as previously written/emailed). Yet the Government continues to insist it has to ‘keep a lid on debt,’ which is mandated under the Public Finance Act and actively enforced by the Labour Government.

The Government has committed to reach net zero emissions by 2050 and the Climate Commission has set a target of reducing emissions by 36% by 2035, including an assumption of a trebling of public transport use in Auckland by 2035. Auckland Council has committed to reducing transport emissions by 64% by 2030.

Neither is remotely credible while adhering to the Public Finance Act’s insistence on debt reduction in normal times while also not pricing in the liabilities of having to buy carbon credits on international markets in future years.

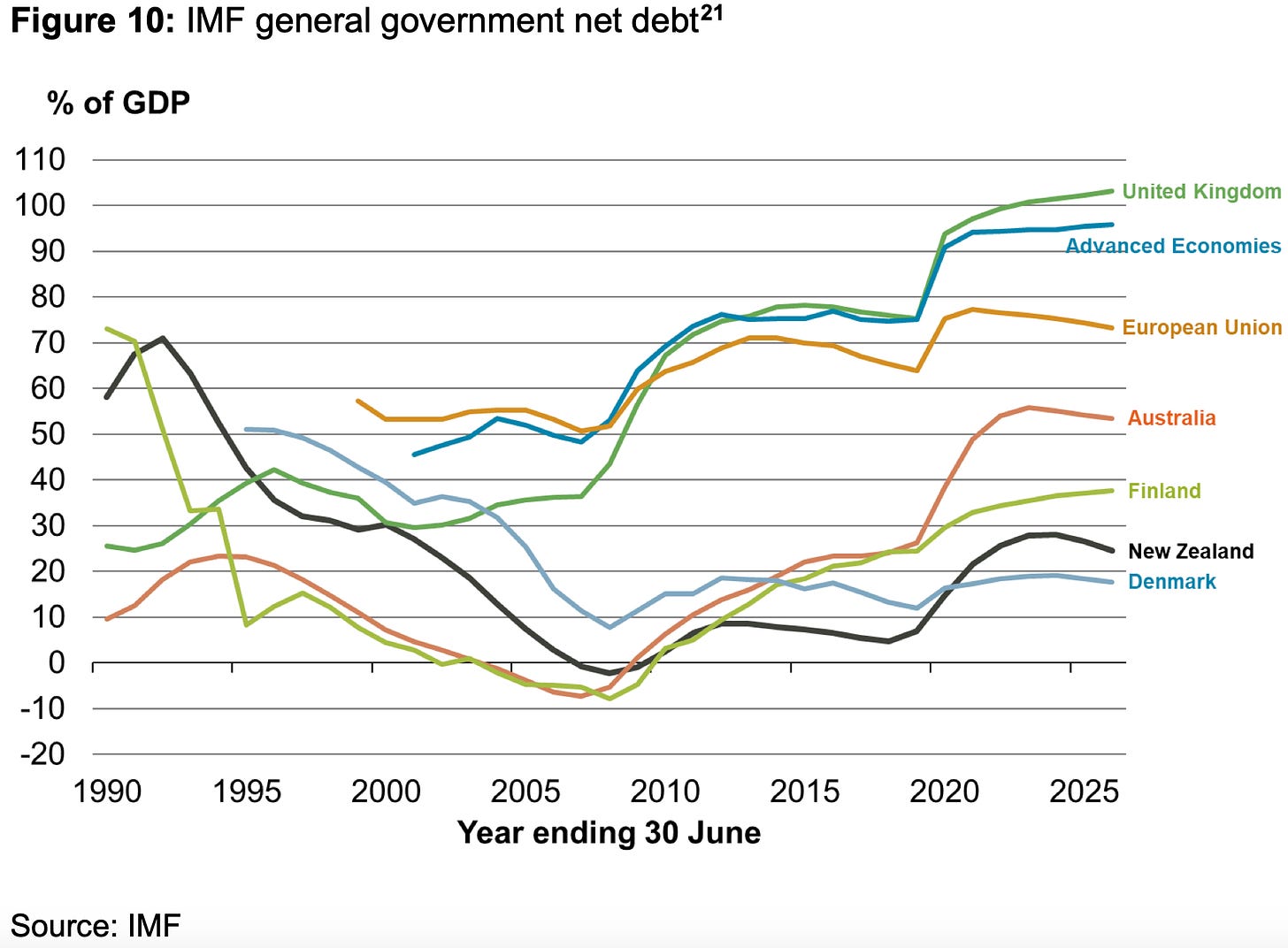

This chart shows how much lower NZ’s debt is than similarly rated sovereigns. Keeping our debt low is largely about reducing interest rates slightly to hold up property prices for median voters. Keeping infrastructure spending also reduces potential housing supply, which also supports house prices and rents for those dependent on tax-free capital gains and high rents to support their wealth.

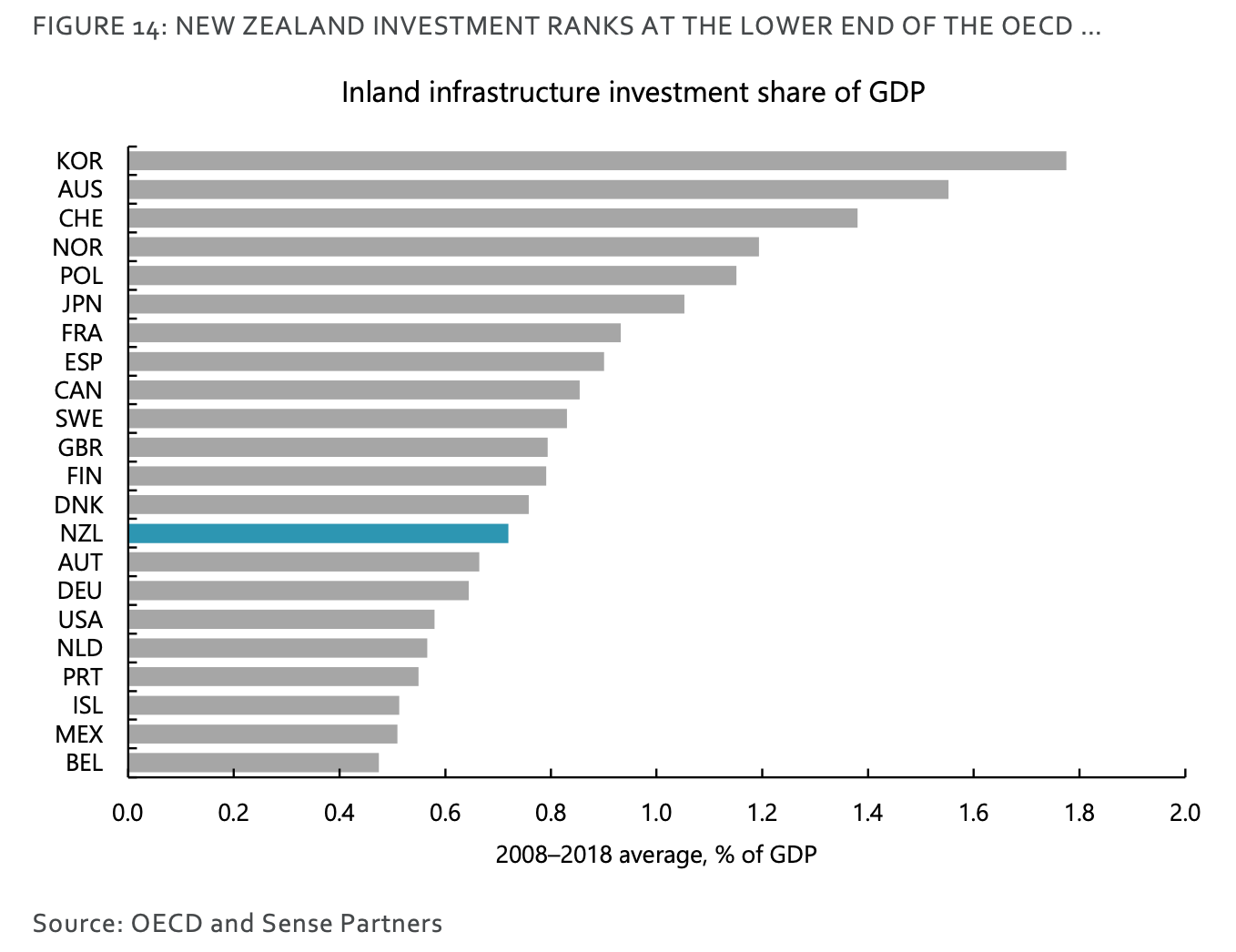

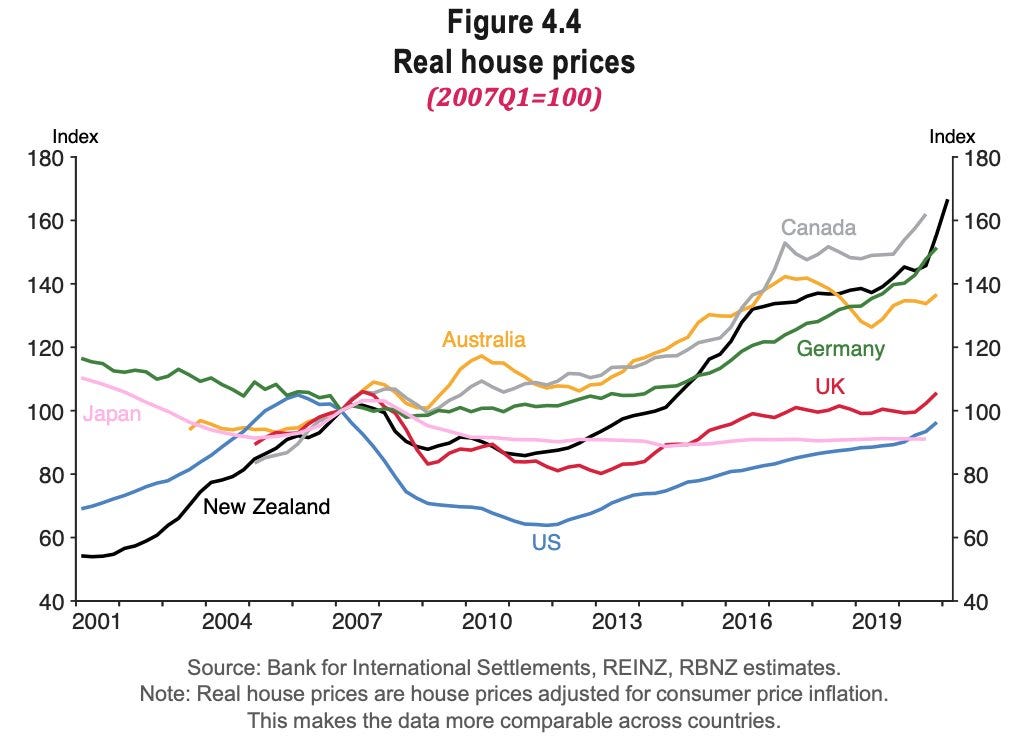

The low infrastructure spending over the last 30 years under the Public Finance Act and the lack of a capital gains tax has happened at the same time as NZ’s house price inflation has outperformed those other countries with capital gains taxes and higher public infrastructure spending, as these two charts show.

Briefly elsewhere in the local political economy

PM Jacinda Ardern said yesterday Cabinet would decide next week whether to make scanning into high risk premises with the CovidTracer app mandatory. Cabinet would also look at more mandatory mask wearing rules in high risk areas. It has yet to decide who would police the rules and whether proprietors or customers would be fined.

The Covid-19 situation in Australia continued to deteriorate overnight. Perth has gone into a snap four-day lockdown after three cases there linked to the New South Wales outbreak. Overall, there were 23 new community cases recorded in Australia yesterday, including 18 in New South Wales. Queensland, which made mask wearing mandatory yesterday, is expected to put Brisbane into lockdown later today after finding two new cases.

Also, Australian Prime Minister Scott Morrison announced after another emergency national cabinet meeting that under 40s would have unrestricted access to the AstraZeneca vaccine. (ABC Australia)

But there was some good Covid-19 news elsewhere overnight. A new study found those who ‘mix and match’ the Pfizer-BioNTech and AstraZeneca vaccines created a more robust immune response than just giving the doses on their own. Also, the Pfizer vaccine is seen to be effective for longer than previously thought. (CNBC)

Scoops and news breaking this morning

Other places I’ve appeared

Signs o’ the times news

Chart of the day and a useful longer read

Some fun things

Share this post