TLDL & TLDL: There was some good news yesterday for first home buyers, investors and developers of apartment buildings and other medium density homes that are needed to address housing unaffordability and climate change.

ANZ, the country’s biggest bank, announced it would lend on apartments bigger than 38 square metres with a 20% deposit. Previously it required a 50% deposit on anything less than 45 square metres. ASB is also now lending with a 20% deposit on homes over 40 square metres and recently dropped its requirement for a car park. BNZ still requires a 35% deposit for apartments under 50 square metres. (Interest)

Money flooding in

There’s also more good news for the Government’s finances, emphasising again that it can’t cry poor when under pressure to fund social and infrastructure spending. Treasury figures yesterday for the 11 months to the end of May showed a budget deficit before gains and losses of $3.644b, which less than half the forecast in the May budget for a deficit of $9.446b.

Revenues were $4.161b better than expected because of stronger GST and PAYE receipts linked to better-than-forecast economic and jobs growth, while Government spending was $881m less than expected. The Government also has over $40b of cash in its settlement account with the Reserve Bank.

The next two Budgets before the 2023 election will have plenty of room for spending.

Global tax deal done

There’s also a more positive longer term outlook for receiving tax from global tech firms. Overnight, 130 of the OECD’s 139 countries agreed to a global deal to set a 15% minimum corporate tax rate in exchange for giving up digital services taxes.

The deal will mean Big Tech firms with revenues of over €20b of turnover will have to pay 20-30% of their profits over a 10% margin to countries in which they operate. However, there were nine holdouts, including Ireland, Hungary, Estonia, Barbabos, Kenya, Nigeria and St Vincent and Grenadines. It’s estimated the changes due to kick in from 2023 will increase the tax being paid by Big Tech by US$100b a year. (Politco)

Scoops and news breaking this morning

Signs o’ the times news

Useful longer reads

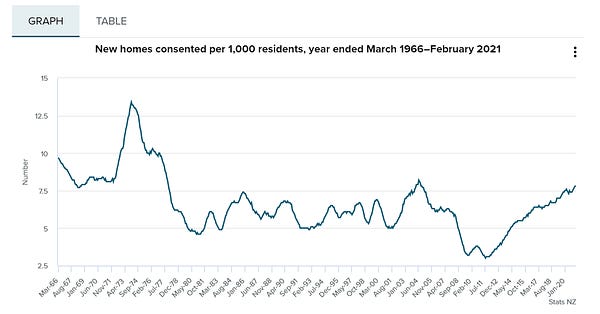

Chart of the day

Share this post