TLDR & TLDL: Now the financial year of Covid has ended, it’s worth totting up who has done well and badly out of the various Government and Reserve Bank actions taken to rescue the economy and support the economic welfare of Aotearoa-New Zealand’s residents.

We now know that asset owners are $307b or an average of $92,000 richer because of the Government’s decisions to pump up housing values and share market values by cutting interest rates and printing nearly $60b to support the economy through the ‘wealth effect’. That includes the effects of $14b of cash in wage subsidies that has overwhelmingly been saved in business and household term deposit and savings accounts, which rose $20b to $310b over the last year.

Meanwhile, renters, the unemployed, young workers, families in poverty, the disabled and most Maori and Pasifika citizens went backwards because of lost income from precarious and low-paid work and because the $2,560 in cash support from the Government per household was gobbled up by higher rents.

Here’s the calculus

Now we’re past June 30, we can calculate what has happened to house values here over the last year and we know that global stock markets are up more than 80% since the onset of Covid-19 after central banks around the world printed over US$10t to lower interest rates and boost asset values. At some point there has to be a reckoning for the Covid (k-shaped) ‘rekovery’ around the developed world that has made the rich much, much richer and has largely left the poor poorer.

CoreLogic figures for June show New Zealand’s housing market’s total value rose by $278b in the last year to be worth $1.5 trillion. Given an extra $33b of mortgage borrowing over that time to $314b, that means households owning property ‘made’ $245b in tax-free capital gains on paper over our worst economic crisis in living memory and now have housing equity of $1.186 trillion.

Reserve Bank figures show rental property investors made total paper gains of $60b over the year and now own $360b worth of rental properties. After increasing their mortgages by $6b to $86b, they made tax-free gains on their equity of $54b and have a collective Loan to Value Ratio of 23.8%.

Reserve Bank figures show that household financial assets (term deposits, loans to others, shares, bonds and insurance reserves) have also risen a further $62b to $1.193t in the year to the end of March.

Measuring the ‘K’ shaped ‘rekovery’ from Covid

Combined therefore, the year of Covid saw those households owning assets receive equity capital gains from house values and shares of $307b over the year of Covid and now have net financial and housing equity of $2.379 trillion. That means their wealth rose 15% or $62,060 per New Zealander over the last year to an average of $475,800 per New Zealander. However, given around 1.6 million New Zealanders rent and have little in the form of shares and savings, they have not seen that benefits.

Owners of property and shares have gained by around $92,000 each in the last year to be worth an average $714,400, while renters have seen their rents rise by $50 a week on average to $500/week.

Meanwhile, beneficiaries received a $25 a week increase over that year, which adds up to $1,300 for the year. Also, couples on benefits with children received $1,260 in winter energy payments between May and October last year in a one-off doubling of the annual payment. That’s a total of $2,560 extra in revenue per renting beneficiary household from the Government over the Covid year when rents rose $2,600, which means they were net worse off for the year, before any of the effects of job and revenue losses for renters not on benefits who were out of work or lost jobs and other revenue.

So, in summary: Asset owners gained around $92,000 in asset value appreciation over the year of Covid, while renters, the young, the disabled, most Maori and most Pasifika went backwards. This is how the ‘K’ shaped Rekovery’ has played out in New Zealand.

But the gains are starting to slow

CoreLogic reported value growth of 1.8% overall in house values across New Zealand in the month of June, down from 2.2% in May “providing early evidence of a gentle deceleration in market momentum.”

The rate of growth slowed in 12 of the 18 largest markets and values actually dropped in three markets in the month (Gisborne fell 0.9%, New Plymouth fell 0.3% and Napier fell 0.1%). However, some others saw accelerations. Both Nelson and Invercargill saw increases in their monthly rate of growth of 2.1% and 1.6% respectively. Palmerston North’s growth of 3% in June took its annual growth rate to 38.6%.

I spoke to Nick Goodall from CoreLogic about these figures and the effects of Reserve Bank and Government moves in the last six months to slow the inflation. Our conversation is in the dawn chorus podcast above.

“The exceptional growth displayed during the past year was not sustainable, particularly with increased deposit requirements, market uncertainty driven by Government regulation and the prospect of higher interest rates.” CoreLogic’s Head of Research Nick Goodall

Nanaia Mahuta’s troubled Three Waters

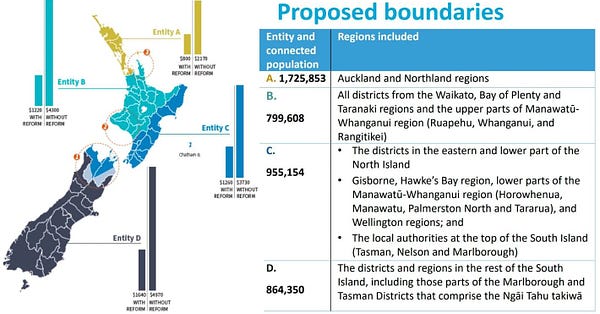

Local Government Minister Nanaia Mahuta yesterday released the biggest lump of details yet on the Government’s proposal to combine the water authorities from 67 councils into four regional water authorities.

Here’s her argument:

“The data shows the case for change is compelling. Without these changes DIA modelling shows that even at the more conservative end of estimates, the average household bill for water services could be as high as $1900 to $9000 by 2051, which would be unaffordable for many communities

“Under our proposal for four providers those figures range from $800 to $1,640, saving households thousands of dollars.

“It’s estimated New Zealand will need to invest between $120 billion and $185 billion to maintain safe, sustainable and environmentally appropriate drinking water, wastewater and stormwater infrastructure over the next 30 years, costs that most local councils simply can’t shoulder on their own.” Nanaia Mahuta

But the latest details were not well received by those who need to agree to it, including Auckland Mayor Phil Goff and Whangarei’s council, who would see their water assets combined in an entity built on Watercare at the top of the South Island.

Here’s some useful news links on the detail and reaction.

Scoops and news breaking this morning

Signs of the times news

Charts of the day

Useful longer reads

Share this post