Kia ora. Long stories short, here’s my top six things to note in Aotearoa’s political economy around housing, climate and poverty on Tuesday, November 12:

The Government will apologise today for decades of abuse in state care, but has put off any decisions on how much compensation it will pay until next year’s Budget as it focuses on its main aim: reducing public debt and the size of Government below 30% of GDP.

Scoop du jour: Tens of thousands of people are set to lose access to Dunedin Urgent Doctors and After-hours care from next week, the ODT-$$$’s Matthew Littlewood reports this morning.

Deep-dive du jour: Joel MacManus’ analysis of homelessness via The Spinoff is well worth reading.

Solutions news: The construction, infrastructure, manufacturing, engineering and logistics sectors’ Workforce Development Councils have published a report on how to employ more disabled workers. RNZ

Editorial opinion: Newsroom’s Laura Walters calls out the Government’s apology “from a Solicitor-General who refuses to step aside, a national apology without redress for those tortured as children, and law changes without wholesale reform.”

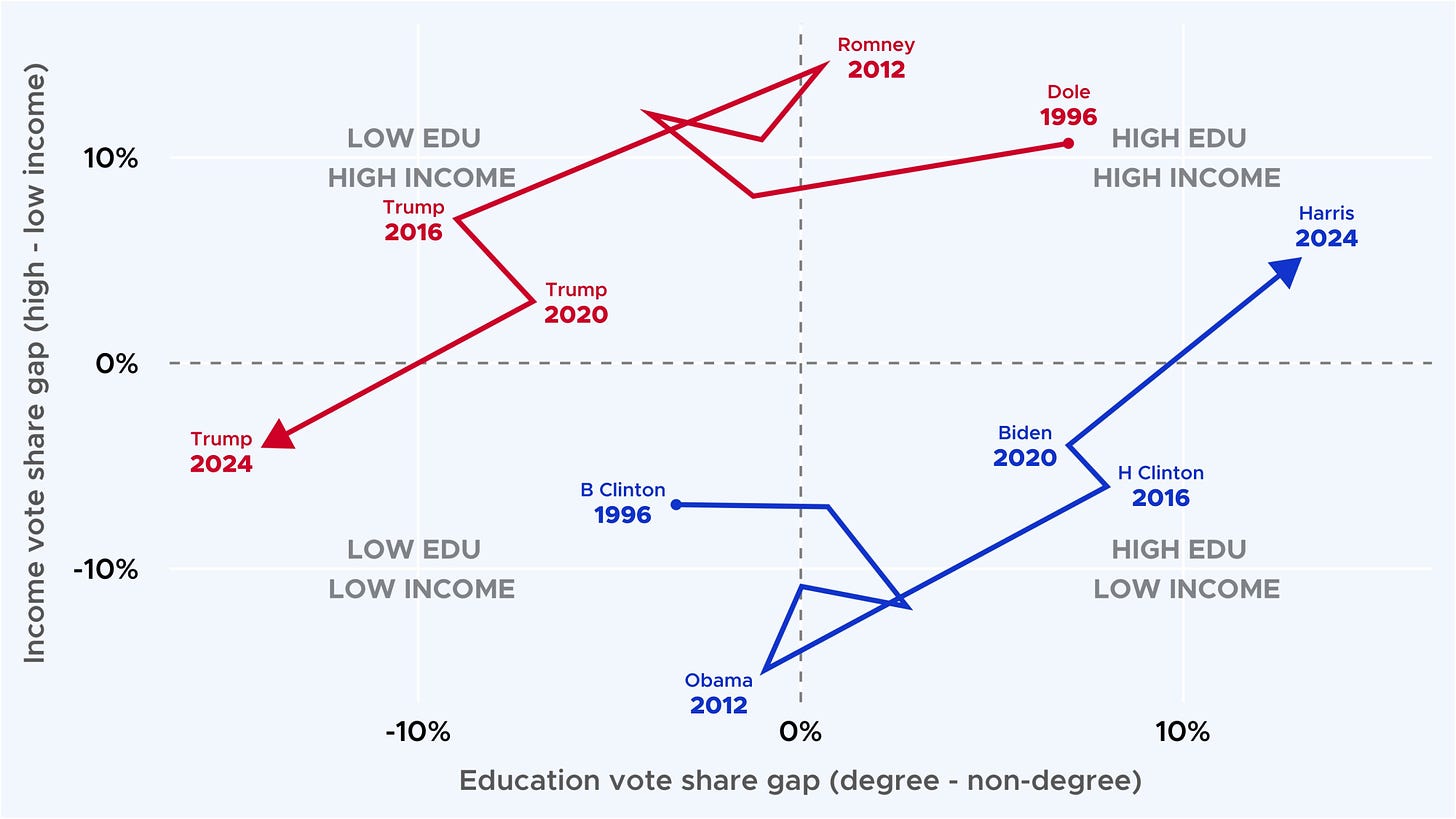

Chart of the day: The economics explained behind the Democrats’ demise.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers. If we get over 100 likes we’ll open it up for public reading, listening and sharing.)

1. The 30/30 fiscal rule that rules everything

Abuse in care redress delayed, more health cuts & Fonterra’s pullback

Here’s my podcast above in readable form:

Today I wanted to talk about three news items today, which on the face of it don't seem connected, but which are deeply intertwined with an overall approach to running government and also running the economy.

Firstly, today's apology for abuse in state care. We now know after the press conference last night from the Prime Minister Christopher Luxon that there will not be an announcement of compensation for those abused in state care. The Prime Minister said that it was a very complex issue to decide on compensation for thousands of people abused in state care.

He denied it was because the government didn't want to spend what could be billions of dollars on compensation, if it was done properly. However he did say after initial plans to have something ready for this apology today, that there will not be anything through until next year, and it will be in the budget for 2025.

The 30/30 rule is always in the background

The background to all of this is that the government's finances are by choice under enormous pressure and this is all about the 30-30 rule. This is not just the current government. This is both sides of Parliament for 30 years. It's a rule that not many people really know about or understand, but it really is the one rule to rule us all.

For much of the last 20 or 30 years, whoever is in government will try to get the size of government under 30% of GDP in the long run. That is a doctrinal and ideological view that the government should be relatively small. And it's something that's developed through both the National Party and the Labour Party through the last 20 to 30 years.

The view is that we're better off when the size of government is repressed or restricted under 30% of GDP. It has blipped up over that 30% threshold at various periods, often around, for example, the Global Financial Crisis or the COVID crisis, but the overall aim is always to get it down.

We saw after the initial GFC in 2008-10, and then the Christchurch earthquakes. The then-National government borrowed to buffer the shock to the economy from the GFC and the earthquakes, but from 2012 onwards right through to 2017, it continued to push down on government spending with a series of zero spending allowance budgets, and to try to reduce the government's gross debt to under 20% of GDP. Depending on how you measure it it might have been 30 percent if it was a net number, however the guts of it is the government wants to get the size of the government government spending under 30 percent of GDP and to keep a debt public debt under 30 percent of GDP.

Why? Because there is this view that somehow we need the flexibility to have low debt so that when there's a shock we can borrow from international investors and they'll be happy to lend us the money. This combination of saying we must keep debt under 30% of GDP and keep the size of government under 30% of GDP is what's driving not just this government, but the previous government, to try to cut back on spending, certainly in real per capita terms, after these shocks.

We now know after the election of this new government that it has the same aim to get the size of government down from where it is currently around about 34% of GDP, to under 30% of GDP within the next three to four years, and also to reduce the size of net debt from where it is currently is, 43% of GDP, towards 30%, or at least on a track towards 30% of GDP. That’s the 30-30 rule.

So what does that actually mean? We know from Treasury in a speech a couple of months ago that this drive to cut the size of government will mean that any discretionary spending — i.e apart from things that are sort of set in stone, for example, the New Zealand superannuation spending, the idea that primary and secondary schools are free, and that in theory our publicly-funded health care system remains publicl- funded — has to be cut in real per capita terms.

So you might hear the government and others say Government spending is always increasing. In nominal terms, it will be. But the real question is what's happening in real per capita terms. Treasury has said the size of the cuts needed in real per capita terms over the next two to three years will have to be more aggressive than at any stage in the history of the government. That includes the comparison with the 1991-93 period of ‘Ruthanasia,’ the ‘Mother of all Budgets’ and the various budget cuts back then.

Constant and big cuts in real per-capita spending required

So that's the background here. The government is very, very keen not to spend any of its own money, and that means essentially scaling back capital expenditure on things like railways, schools, hospitals, and also scaling back on any discretionary spending, and that means doing whatever's possible to not spend money on something that's just come up.

It also means that there is a structural nature to the government's approach to not having a capital gains tax, to not tax wealth particularly on residential land. That's because once you bring in a wealth tax, you are essentially increasing the size of the government. Unless there's some sort of big tax switch, you are more than likely to increase it above 30% of GDP. So when you stick to the 30-30 rule, you can't really have a capital gains tax unless there's some sort of massive tax switch.

That means that the structure of our economy is based on using any spare savings to invest in residential land and to capture the capital gains tax-free, particularly in a leveraged way, and that is by a long shot the best investment return for household savers in a risk-adjusted leveraged way. That means that anyone who owns land, anyone who has spare money, will do whatever they can to invest in residential land and to not invest in businesses or anything that actually produces much that can be exported, and to least to try to avoid highly capital intensive businesses. That means that we don't invest much in training, in new technology, in increasing the capital intensity of our businesses, particularly exports.

It means we refocus as much of our savings and our capital in domestic businesses, ones that are not subject to competition, where you can essentially increase returns by increasing your share of the market and using your power to increase prices. Or you focus your activities on extraction of value from resources in the most simple way — digging things up and selling them off without without doing much extra processing or transformation or essentially going up and down the value chain to make them more valuable.

Item 1: No redress

We know that the government has just decided not to bring forward or to pay out big compensation this year for those abused in state care. And this has led to the government essentially delaying, pushing away the hard decision and the hard announcement into the future, and preparing the ground for a very small set of payments. We can hear that in the comments from the Prime Minister last night and this morning, where he argued that there had already been quite a bit of compensation paid, there were already people in process and that the government was ‘working as hard as it could’, when it's clearly not. We know that because we've had recommendations on compensation for three years and the government has soft-peddled continually.

We also know from looking at the details in the Abuse in State Care report that much of the motivation for the very aggressive approach taken by Crown Law and various government agencies over the last two decades in contesting court cases brought forward by those abused in state care, was to avoid any admission of responsibility or liability and to reduce the size of the payouts that the government would have to make. I’ve linked in the email newsletter to a bunch of commentaries pointing out the inadequacy of the redress in compensation and the inadequacy of an apology without redress.

Item: 2: Local Government & Health cuts

The second thing is a bunch of stories we're getting day after day now from local government, essentially frustrated that the Crown is not stepping forward and helping things like local transport investment. And so they're having to make their own cutbacks and to essentially avoid their own spending because the government is reducing its spending to achieve the 30-30 rule, and often pushing that spending back down to councils.

A good example of that is the intense financial pressure that the Wellington Council is under and it has just had a Crown Observer appointed. The irony here is that the Crown Observer will charge $1,000 a day to observe and report back to the Minister, and that has to be paid for by the Council.

There have been many other examples in the last six to 12 months of the government pushing down costs to councils to absorb, and all in the aim of getting that 30-30 rule achieved.

Item 3: Fonterra’s refocusing on commodities

Then finally today we hear that Fonterra has confirmed plans to sell off its consumer businesses. You may ask what are Fonterra's consumer businesses and why should we care? These are all of the international brands that Fonterra has built up over the years including the likes of Anchor and Fresh and Fruity. These are brands made up of decades of R&D and marketing spend to increase the added value, the final value of the milk, that Fonterra’s farmers produce.

This has been one of the great aims of the last 20 to 30 years. You can recall the views of Sir Paul Callaghan about volume and value, the idea of adding value to the fruit of our land and that we should always be trying to increase the added value in the exports that we make, rather than just producing commodities. Because when you produce commodities, you're not really increasing the wealth, you're simply exporting more volume, often using intensive land use as opposed to increasing the value of the existing commodity. One of the great hopes 20 or so years ago was that Fonterra, with its strong position in the global milk and dairy products business, would be able to build up some consumer brands and add value, not just inside New Zealand, but inside other countries with factories, with marketing, with brands, by building up its ability to add value right along the supply chain.

However, a couple of years ago, Fonterra essentially made a strategic decision to get out of those consumer brands and to sell them off, essentially to hand back the cash to farmers who would then use that to repay the debt they have on their farmland.

They're under intense pressure from the banks, who of course are focusing most of their business growth now on mortgage lending. Why? Because that's where the savings are being directed by households. And to do that, you have to reduce the share of the lending that you do into farming. So you constantly demand that farmers repay their debt.

Farmers realise that they're better off as well using any spare capital they've got to invest in residential land, or at least land that could be turned into residential land. That's the driver behind Fonterra getting out of the value added business. Essentially because our banking system and our economy has reoriented in the last 20 to 30 years around focusing spare capital and savings into leveraged residential land.

Where does the growth come from then?

It does raise the question of how you get real economic growth when the focus of your banking system and of savers and the government is on creating the conditions purely for leveraged tax-free capital gains on residential land. It also begs the question: how are we actually going to improve the wellbeing of our people when this focus on reducing the size of government and reducing government debt to 30-30 is so strong from both sides of Parliament.

The irony is the government has said it's focused purely on increasing economic growth and also on doubling exports, but to do that the only way in the short term without significant investment in infrastructure and business is to encourage more extraction of basic value in commodity exports. So that means lots of exports of plain paper bags of milk powder, plain logs, plain meat to the rest of the world. And that is not going to drive real economic growth. It's essentially going to extract value from the future, because in doing that you wreck your environment.

2. Scoop du jour:

Thousands in Dunedin lose after-hours care ODT-$$$1’s Matthew Littlewood

Honorable mentions

'Cloak of secrecy': Aviation leaders accuse CAA of covert restructure NZ Herald-$$$’s Michael Morrah

Collaboration not competition: Concern raised at after-hours healthcare tender process NZ Herald-$$$’s James Pocock

Rising seas will affect city schools ODT-$$$

Notable news elsewhere

Sistema proposes more than 100 job cuts, workers devastated 1News

Counselling service fumes after funding cut RNZ

Council faces hefty maintenance bill if major road is tolled RNZ

Some Gisborne roads may revert to unsealed, amid budget cuts RNZ

3. Deep-dive du jour: Housing unaffordability

Joel MacManus’ analysis of homelessness via The Spinoff is well worth reading.

Honorable mentions:

The slash and burn of the public sector: where are the numbers at now? An in-depth, up-to-date picture of one of the biggest cuts the public service has faced in decades. The Press’ Harriette Boucher and Anna Whyte

Foodbank demand symptomatic of other issues. The high cost of accommodation is spilling out into other areas of people’s lives, says Motueka Community House manager Jane Henderson. “They’re just not affording food.” The Press’ Catherine Hubbard

Explainer: Four things to look out for at COP29 climate summit Newsroom’s Marc Daalder

Cancelled bus routes leave parents scrambling, and angry Newsroom/RNZ’s Amanda Gillies

Pacific foundation fights on after Govt funding cuts Newsroom’s Sam Sachdeva

4. Solutions news: Higher wage jobs

Industry works on plan to hire more disabled workers RNZ

Honorable mention

6. Editorial, Op-Ed or column du jour:

Column by Laura Walters: The big apology is here, including one from the Solicitor-General Newsroom

Op-Ed by Aaron Smale: Sorry means you don’t do it again Newsroom

Column by Tina Morrison: The case for feeding our 5 million first, before first tonne is exported Newsroom

NZ Herald-$$$ Editorial: Abuse in Care - Govt apology to victims has got to be more than just lip service

Op-Ed by Shaun Robinson: It’s time for actions, not words, to put an end to this practice. Most of the factors that led to or contributed to the abuse the inquiry found still occur today. The Press

Op-Ed by Dr Stephen Winter: Apology will be hollow without meaningful legal and system changes Newsroom

Chart du jour: ‘They go low, we go high’

The Kākā’s Journal of Record for Tuesday, November 12

Migration: Realestate.co.nz reported US-based searches for NZ property increased 123% the day after Donald Trump won, with the biggest increase in California. U.S. visits to realestate.co.nz also increased in the two weeks before the election result, and are 159.4% higher than last year.

Politics & Wellington: Local Government Minister Simeon Brown appointed former Tasman District Council CEO Lindsay McKenzie as Crown Observer to Wellington City Council, which the Department of Internal Affairs said is at risk of being unable to plan, fund, or deliver services and infrastructure.

Poverty: The Responding to Abuse in Care Legislation Amendment Bill will have its first reading after the National Apology to survivors of abuse in state care. Lead Coordination Minister Erica Stanford said the Bill will end strip searches of children in care, strengthen restrictions for people working with young children, enforce better agency record-keeping, and amend the definition of a 'vulnerable adult' to include disability. RNZ

Climate: Climate Change Minister Simon Watts announced he'd attend the 29th UN Climate Summit (COP29) in Baku, Azerbaijan this week, which gathers climate delegates to discuss implementing the Paris Agreement. Watts said one of the major focuses of COP29 will be developing a new global climate finance goal. RNZ, Newsroom-$$$

Poverty & media: Parliament Speaker Gerry Brownlee reversed his decision to decline investigative journalist Aaron Smale permission to attend the national apology for abuse in care, following backlash from survivors, advocates, and the Green Party. Newsroom co-editor Tim Murphy said the Beehive believed Smale was "too forceful" in his interview of children's minister Karen Chhour.

Climate: Pacific Studies Professor Steven Ratuva will bring the results of the largest yet study of climate adaptation in the Pacific region at the COP29 meeting. The study maps the impacts of climate change on economies, infrastructure, and culture, and found Pacific communities are already adapting to climate change, including by relocating villages.

Cartoon du jour: ‘Like sand through the hour glass…’

Timeline-cleansing nature pic of the day

Red and shiny

Ka kite ano

Bernard

Just a reminder that links with -$ on them are paywalled. Those without−$, including NZ Herald, Newsroom and Post/Press articles that are occasionally not paywalled, will specifically not have the -$$$ on them.

I’m just as concerned about what happens if or when we get under 30%. Then what 25 then 20, privatisation of everything. There doesn’t seem to be any other substantive plan

You already know the answer to that question....Privatisation is the end goal and the easiest way to do that is portraying the SOE or government department as not functioning properly (due to underfunding) so the unsuspecting public is duped into them selling it off.

The expectation is something like we can pay American level taxes but enjoy Scandinavian level services. I still think when it comes to the health system, the voting public won’t go for privatisation. But maybe with enough spin, they might!

It is privatisation by stealth. By underfunding the public health system, you destroy confidence in it. People then go and buy private health insurance and once you have enough people with it, the demand to publicly fund health goes away. Look at the increase in Southern Cross membership in last three years, and the $$ being spent building new private health facilities.

Of course, as soon as you have a pre-existing condition you're no longer covered, and once you hit 60, premiums go through the roof.

It gets done by stealth. Bit by bit.

What the government and the neoclassical economists don't understand is that "paying back" the "debt" by reducing deficits or running a surplus takes money out of the economy. That's unemployment and stalling productivity. If people do not have jobs to pay for the private goods and services, those businesses fold too resulting in more unemployment etc etc.

That lack of new spend into the system from government must result in increasing private debt, and that's exactly what we see.

It's the private debt we need to be concerned about, not the "public debt"

I am a fan of modern monetary theory. Having recently read the deficit myth. I agree with your assessment of the situation

This government is unreformable. But will Labour learn anything from Kamala Harris's defeat? Will Labour acknowledge that woke is dead? Forget ethnicity and gender. What people care about is the cost of housing, the cost of eating, the cost of schooling, the cost of health care, the cost of living.

I'm not sure Kamala Harris lost because she didn't offer good policies to combat the cost of housing etc. I think she lost because angry people wanted to have someone to blame and punish.

So many all of a sudden realizing they have no idea what tariffs are and how they work & now having buyer's regret when they find out things are going to be even more expensive.

The Americans have fucked around and are about to find out. Just like the British with Brexit.

I'm trying to remember what Labour offered last election besides GST off fresh fruit and veges.

Bernie Sanders:

https://x.com/BernieSanders/status/1854271157135941698

and Bernie again:

https://youtu.be/QVlum0tUsTs

Crazy bridges and unnecessarily underground trains for Auckland

Note for Mr Luxon, if you have nothing to say you might as well sing it:

https://www.youtube.com/watch?v=lLbvyRYGcLc

RIP Sharon Jones

Release please Bernard an excellent summary of NZ idiocy. Needs urgent release. Next week the fast track will complete the destruction of NZ and the money will all go to rich pricks as usual.

Depressing. The Tumbrils may eventually come but far too late. Congratulations!

Patrick Medlicott

Important information so please release. Labour should listen to Bernie Sanders’ comments on why blue collar workers abandoned the Democrats…

Yes - and today's graph from Philipp Heimberger reinforces this.

That graph is excellent, Remarkable that within one generation, the whole political landscape in the US has flipped 180 degrees

Keep up the excellent work, Bernard!

Have to note, though, that the actual story in the ODT about the Emergency Doctor clinic here in Ōtepoti

is rather more nuanced than the headline suggests. A small number of medical centres are not part of the Urgent Doctots group. They have their own after hours services, and they don't provide staff for after hours shifts at the Urgent Doctors clinic. I would have expected these medical centres to make sure their patients knew about these arrangements (it appears many patients are unaware).

This is not to say that health care services, in general, are anywhere near adequate - here in Ōtepoti or in the rest of Aotearoa! However a little background can go a long way!

Is Luxon for real? We are talking about people who's entire lives been brutally destroyed, what is the $ value he thinks they already received that will be a fair compensation for that, I'm sure whatever the tight b$%#@d thinks of will not be anything even close to what it should be because that will mean billions of dollars in compensation.

When you are geographically isolated with a small population, is the only game in town not the government? Why do we seem so obsessed with shrinking it to nothing?

Thank you Bernard I think reiterating the 30% government target is crucial even if your paid subscribers know this. It must change if we are to achieve equality & at the very least a health service which results in healthy folk who are productive & therefore improve economy.

1. Health

2. Education

3. Reduce child poverty (1 & 2)

4. Housing for all, not luxury homes for the wealthy & middle class.

Please release to all.

3 more likes & we reach the ton!

The 2025 budget is writing itself - increased spending on defence to suck up to Trump, freeze on health and public education spending and cuts to most other government departments and agencies and more user pays for public services all to fund miserly levels of redress for those abused in state care. Oh, and international instability (Trump again) means rising cost of living again and decreased tax take. Just like any household.

Personally I am disappointed that responsible ministers from across the house and past chief executives weren't standing up apologising for their roles in the travesty and the endless flaming hoops the survivors of abuse in care are still forced to jump through to obtain justice

Luxon is mistaken if he thinks rolling out a few sorries is enough or as easy as doling out dispensations to his ministers. By now the PM should be demanding to see plans and allocating budget both for ongoing work and reparations for survivors. It's pretty clear that substantive reparations and a sustainably funded cross-party programme is needed to progress the 'apology 'to a safer and saner environment for children in care.

Hi Bernard, as you basically point out our nation is stuffed without some major policy frame work changes. National who pride themselves as business oriented are hypocritical in that they wont agree on a CGT which will assist to take monies from the over inflated housing market over time and direct it to business and change attitudes of Banks and investors.

Our Govt Super is costing us 20billion a year and yet no party is addressing the on going cost escalation. There are opportunities to address these major financial anomalies for the future of the nation. Labour has got to find courage and vision for a (at least) 20 yr strategy on how and where it wants the country to be and explaining succinctly the reasons and benefits! In the current environment why wouldn’t youth head overseas!

Thank you Bernard for reiterating Rod Oram’s simple message to Fonterra and the timber industry- add value to the product in New Zealand before exporting.

FYI I’ve decided to open this one up a tad early after requests from paying subscribers.

Thanks Bernard, sorry I just read this.

Crikey, that Solicitor General is just pure evilness.

I wish these messages were not each so vital.

The loss of real economic strength from the Fontera sell off is idiocy and selling off NZ.

I am delighted today's post is going public, and hope it's messages are restated loudly.

Also excellent RNZ coverage today in Morning Report of iceshelf changes and relevance: https://www.rnz.co.nz/national/programmes/morningreport/audio/2018963755/science-team-investigates-state-of-ross-ice-shelf from RNZ.

Bernard writes: "That's because once you bring in a wealth tax, you are essentially increasing the size of the government." I am not sure I understand this relationship - size of government increasing because tax take has grown? an issue to do with tax on government properties? Any clarification of this would be very welcome. Thanks.