Mōrena. Long stories short, the six things that mattered in Aotearoa’s political economy around housing, climate and poverty in this week were:

PM Christopher Luxon said his Goverment was ‘re-learning’ the austerity-infused economic lessons taught by former National Finance Minister Ruth Richardson in 1991, when she slashed spending to reduce public debt and the size of Government (and was then sacked in 1993);

The National-ACT-NZ First Coalition Government signalled it would renege on our nation’s Paris Commitments to reduce climate emissions by saying the Government would not buy emissions credits offshore;

The Government further reinforced the low wage, low investment, high immigration, high emigration, small-state and evidence-light nature of our economy by halving funding for research in humanities and social sciences without warning;

The OECD recommended the structural separation of our mostly-state owned ‘gentailers’ to boost competition, lower power costs and revive productivity, which is a move that has been called for by anti-poverty campaigners and competitors for years, but rejected by dividend-hungry Governments;

Infrastructure & Housing Minister Chris Bishop detailed the Government’s infrastructure funding strategy of using private finance and user charges to both pay for and limit the amount built, rather than using Crown borrowing, which means in practice that little will be built quickly; and,

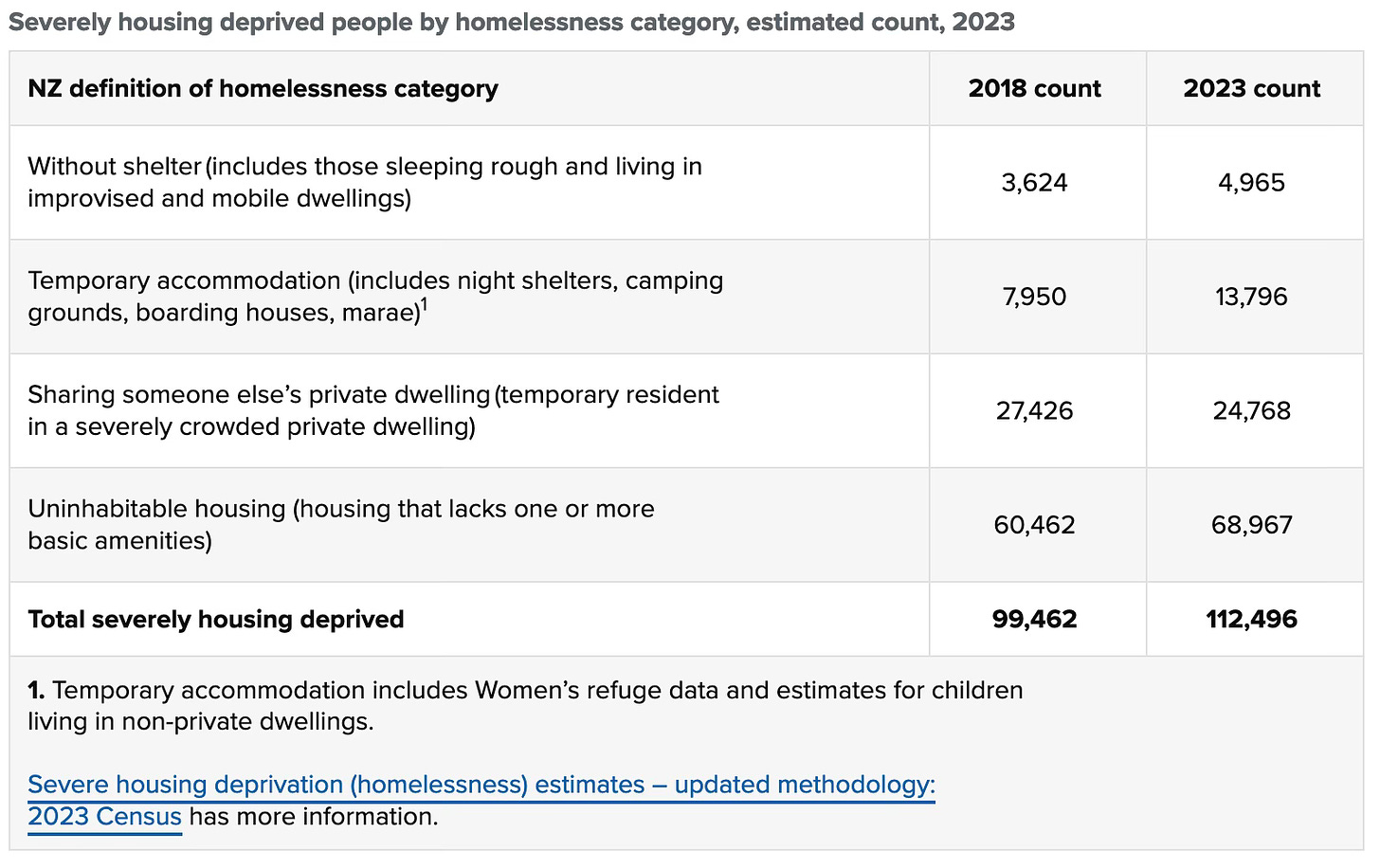

Stats NZ reported the 2023 Census found there were 112,496 people (2.3% of the population) living in severe housing deprivation, up from 99,462 in 2018, with 18,761 either sleeping rough or in tents, boarding houses or marae, up 62%.

(Normally at this point we would have a paywall for free subscribers and only paying subscribers could both listen to the podcast/video above and read the analysis and detail below. But during our ‘Gravy Day Fortnight’ until December 21, we have opened everything up for all immediately to give everyone a full taste of the public interest journalism your subscription supports. And here’s our ‘Gravy Day Fortnight’ deals, including the 50%-off introductory offer, the $30 for under 30s deal and the $65 for renting pensioners deal, respectively.)

The six things that mattered this week

1. The problem is it didn’t work then and is proven not to work now

Jack Tame’s interview with PM Christopher Luxon last Sunday on TVNZ’s Q+A was revealing for all sorts of reasons, but it was Luxon’s comments on the economy and the ‘economic lessons’ he had learned that struck me the most.

Here’s his comments in full:

“What I’d just to say to you is: we've kind of forgotten the laws of economics I'd say that we learned 35 years ago and we've taken good economic management for granted. When you increase spending by 84%, when you drive up inflation domestically, you have to then take interest rates up. When you take interest rates up, you've put the economy into recession, and when the economy is in recession it leads to unemployment.

“That's why we've always said if you actually care about working New Zealanders you actually are fiscal conservatives you actually run the economy well because the pain is ultimately unemployment and that's what we've actually been seeing.

“The last 3 to 6 months is the lagged effect of that. If you're a business that's hung in there with high inflation, high interest rates, suppressed demand, the last thing you're left with is is actually laying workers off and we've seen some of that this year so that's why we're working our way through those five components (Government spending, inflation, interest rates, unemployment, growth) but you've got to work through them sequentially so you get the show going.”

“You have to take your medicine. You actually have to work through the economy and that's what we're doing. You get spending under control as we have been doing. We haven't thrown the economy into austerity. We've got a very balanced approach to that.” Luxon to Jack Tame in the interview below.

In my view, Luxon is pointing to the Ruth Richardson ‘lessons’ from 1990-93 when she slashed spending dramatically and worsened unemployment to 11% at the same time as Don Brash was running high interest rates to get rid of inflation. Then National PM Jim Bolger sacked Richardson in 1993 when it became clear the medicine was making the patient sicker.

The ‘austerity medicine’ economic lesson has been proven repeatedly over the last 35 years to have failed to restart economic growth. The actual evidence in the last couple of years via the OECD, IMF and World Bank shows budget cutting doesn’t work to grow economies, instead reducing GDP, especially when the tightening is done during a recession when monetary policy is tight

Luxon is also plain wrong when he says his Government is not pursuing an austerity approach. Treasury advised the Government months ago that its fiscal track would generate the biggest real per-capita cuts in New Zealand’s economic history, bigger even than under Richardson.

2. NZ signals to EU & UK we’ll break our trade deal climate promises

It was a big week for climate news from the Government and other players in the debate, including:

Trade Minister Todd McClay telling RNZ the Government wouldn’t buy emissions credits overseas to meet our Paris Agreement commitments for emissions reductions, even though the latest forecasts are that Aotearoa will be short of at least 90 million tonnes by 2030 and our EU and UK trade agreements include these committments;

The Climate Change Commission telling the Government it needs to dramatically increase its emissions reductions efforts in order to be ‘net negative’ by 2050 by sucking 20 million tonnes out of the atmosphere (RNZ’s Eloise Gibson);

The Government releasing advice from a science panel it appointed that said cutting methane 14-15% by 2050 could be enough to stabilise global warming from our sheep and cows at today’s levels, which contrasted with the Commission’s advice methane should be cut by 35-47% by 2050 (RNZ’s Eloise Gibson);

McClay announcing the Government would partner with private foresters to plant pine and native trees on low value Crown land, including low value Conservation land, but excluding National Parks; and,

McClay and Climate Change Minister Simon Watts announcing pine forest planting would be limited on high-value farmland.

In my view, the Government is playing for time with vague, handwavey and gaslighty comments about both meeting the targets and not doing anything that is either financially or politically difficult. It appears to be hoping the Paris Accords fall over or are blown apart by others before the bill comes due.

I’m surprised those serious about addressing climate change, including big corporates, sustainable bond fund managers, banks and independent agencies beyond the Climate Commission, such as the Reserve Bank, the Financial Markets Authority and the Natural Hazards Commission, have not called bullshit on the Government’s approach as disingenuous, reckless and irresponsible, if only to ensure New Zealand can continue to obtain reinsurance and foreign capital that is mandated for investment in countries doing something about climate.

Almost every policy announced since the formation of the Government a year ago has increased New Zealand’s likely emissions, as often advised by officials, including:

focusing all new public transport investment on motorway building and maintenance;

ending any new cycling and walking investment, forcing councils to cut back or suspend new cycling lanes and other active mode transport spending;

planning to increase the cost of buses and trains for commuters so more public money can be spent on roads;

restarting drilling offshore for oil and gas;

increasing speed limits in ways that will increase emissions;

ending subsidies for electric cars and imposing new registration and road user charges on existing electric car owners, triggering a collapse in sales; and,

focusing all public investment activity in new electricity generation on importing gas.

The figleafs used by the Government so far are to suggest these increases can be offset by more tree planting, new definitions for farm emissions and vague ideas of carbon capture and storage. I shouldn’t be the only one calling bullshit on this.

Quote of the week

“Those who continue to promote the combustion of fossil fuels in the open air without permanent carbon capture & storage are, in my view, committing a crime against humanity.” Outgoing Climate Commission Chair Rod Carr in his final Environment Select Committee Appearance on Thursday. Vimeo

3. Doubling down on our low investment, evidence-lite political economy

The Government further reinforced the low wage, low investment, high immigration, high emigration, small-state and evidence-light nature of our economy by halving funding for pure research in humanities and social sciences through the Marsden fund without warning.

“By their nature, these mission-led projects produce evidence that is convenient to government. It asked for it, after all. What cutting social sciences and humanities from the Marsden Fund dramatically reduces is the ability of researchers to produce inconvenient evidence.” Tom Baker, an associate professor in Human Geography at the University of Auckland and a Marsden Fund grant awardee via this Newsroom Op-Ed.

4. ‘Break up the gentailers to improve productivity’

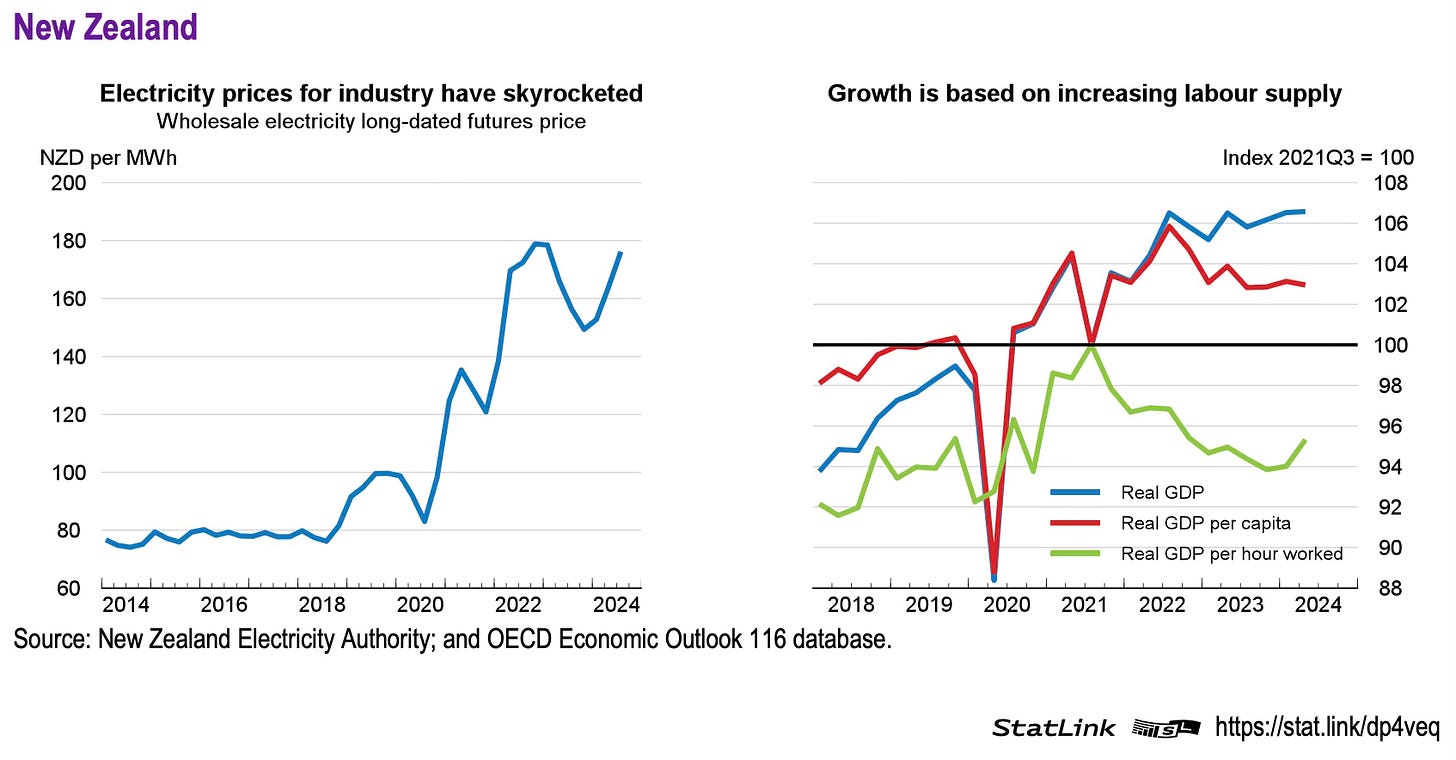

The Government talks a good game on productivity, but does little. The OECD this week again proposed via its 2024 Economic Outlook report (NZ is on page 215) that it break up the gentailers.

The OECD arguing New Zealand’s productivity growth had fallen markedly since 2021 because (bolding mine):

“GDP growth has been driven by an expansion of labour supply via migration, 80% of which is low and medium skilled. High bank margins and capital costs reduce demand for credit, and a lack of competition reduces pressure to invest and innovate.

“As a result, the capital-to-labour ratio and business R&D as a share of GDP are low. The government should foster productivity growth by increasing competition, including by lowering barriers to entry for digital banking platforms.

“High futures electricity prices for industry will exacerbate productivity problems by weakening business investment, especially in the green and digital transitions, as electricity is a core input for both. The electricity regulators and the government have launched reviews of the electricity market.

“Despite previous reforms to improve competition, electricity futures prices are high and above the threshold considered sustainable for the economy in the long run. These reviews should re- examine separating the generation and retail operations of large electricity companies to boost competition in the futures market and provide industry with more hedging options.” OECD report

The OECD report out on Thursday night was itself based on a more detailed report specifically on New Zealand’s competition reform in August.

Both reports are attached below.

Oecddec4note

7.77MB ∙ PDF file

Oecdonnzcompetition

1.12MB ∙ PDF file

Charts of the week

Commerce Minister Andrew Bayly announced a ‘major review of competition to lift productivity’ on the same day as the OECD report came out. We’ll see.

5. ‘We’ll get someone else to pay (ie: it probably won’t happen)’

Infrastructure & Housing Minister Chris Bishop announced on Monday the Government’s infrastructure funding strategy of using private finance and user charges to both pay for and limit the amount built, rather than using Crown borrowing. His speech included more details.

In my view, that’s unsustainable and unnecessary, given our $100 billion-plus infrastructure deficit, still-rapid population growth and huge structural, local and global demand for New Zealand Government and Council bonds, rather than the debt crisis portrayed by the Government.

6. Our homelessness crisis got much worse over the last five years

Stats NZ reported on Wednesday the 2023 Census found there were 112,496 people (2.3% of the population) living in severe housing deprivation, up from 99,462 in 2018, with 18,761 either sleeping rough or in tents, boarding houses or marae, up 62%.

In my view, this has worsened because we haven’t built enough affordable houses for decades and housebuilding is dropping again because of the new Government’s actions, particularly the suspension of new Kāinga Ora home-building to reduce the Government’s deficits and debt — unnecessarily in my view.

The lack of new housebuilding is because Governments of both flavours have chosen a small-state and low public debt way to govern without the need to tax capital or wealth, unlike in every other country. That means they have underinvested in infrastructure and extended the massive tax incentives for borrowing and buying residential land, rather than investing in real businesses.

TKP 26/50: I don’t believe this will change until the tax incentives playing field tipped back up to the set of incentives used overseas to invest in R&D, business development, training, and productivity improvement that increases real wages. That means taxing land and/or capital gains and/or wealth while restoring incentives to save in pensions. That means using that tax revenue to invest in the infrastructure for affordable, warm, dry and cheap-to-live-in homes that connect with well-developed public transport, cycling and walking networks.

Table of the week

Ngā mihi nui

Bernard

Join me for my next live video in the app

Share this post