Long stories short, the top six things in our political economy around housing, climate and poverty on Wednesday, February 5 are;

Housing Minister Chris Bishop yesterday announced Kāinga Ora would be stripped of its ‘non-core’ activities of developing new land, managing First Home loans and KiwiSaver withdrawals and consenting its own projects;

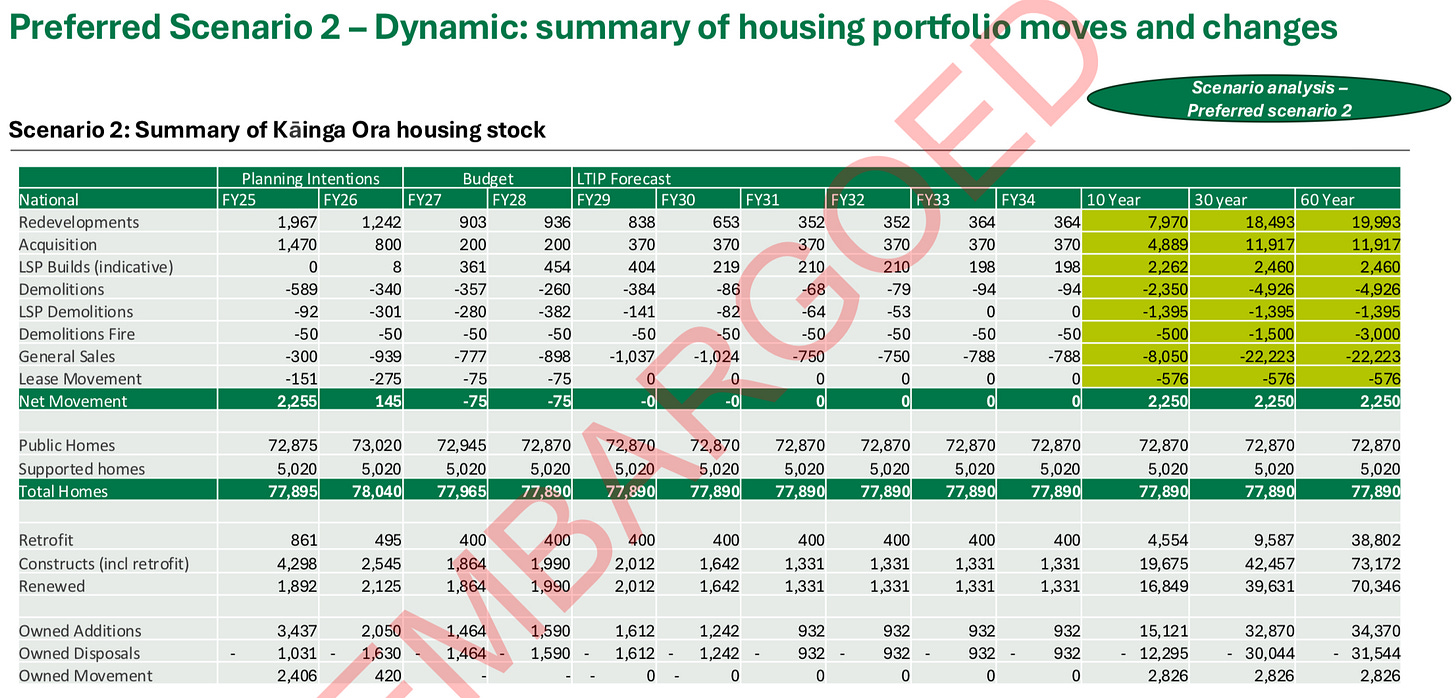

Bishop detailed plans to add a net 145 new homes this year before capping the state housing stock at 78,000 for the next 30 years, with renewal and renovations of an already-tired housing stock paid for by land and home sales in leafier suburbs;

He said around 800 state homes on land in suburbs such as Remuera would be sold to deveopers in the current year, with ongoing sales in the years to come of around 900, with the potential to also sell bare land bought previously for redevelopment;

The combined proceeds from land sales would amount to billions per year and would allow Kāinga Ora to generate ‘sustained cash surpluses’ from the 2027/28 fiscal year, which would allow borrowing to stop and dividend payments to resume;

Cabinet decided to cut around 1,000 jobs from Kāinga Ora to save $1.4 billion over four years, including by demolishing surplus homes rather than transporting them to iwi, cutting maintenance spending by $50 million a year and reducing the size and quality of new homes away from the Homestar Six rating; and,

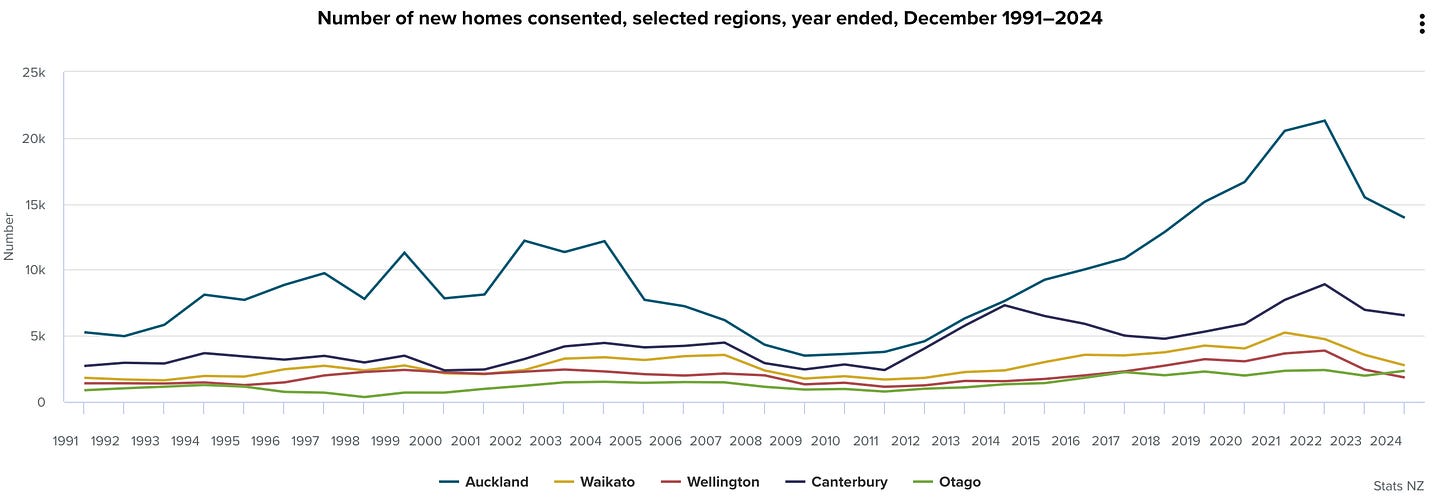

Stats NZ reported yesterday building consents fell 9.8% to 33,600 in calendar 2024 after the Government suspended Kāinga Ora’s new building work and high interest rates quashed private sector demand, leading to collapses of building firms and the loss of 13,000 jobs in construction last year.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers. If we get over 100 likes from paying subscribers we’ll open it up for public reading, listening and sharing.)

Government plans billions of dollars of housing land sales

Chris Bishop yesterday unveiled plans to cut Kāinga Ora back to being a landlord of a maximum of 78,000 state houses, including building just 145 net new homes this year, with renewing an already-tired stockpile to be paid for by ‘asset recycling’ of homes in leafier suburbs and the potential sale of bare land bought under Labour for redevelopment.

Kāinga Ora plans to be in a cashflow generating position within two years, which would give it the capacity to stop new borrowing and start paying dividends again. It would also resume annual reviews of tenants with the aim of encouraging tenants able to afford private rentals again to go out and rent privately.

Here’s the detailed plan for Kāinga Ora’s building stock:

The scaling back of Kāinga Ora came as Stats NZ reported a fall in building consents in calendar 2024 to a level of 6.3 consents per thousand head of population, down from 9.7 two years ago, with the biggest fall in Auckland.

Today’s pick ’n’ mix of scoops, news & deeper-dives

A first person deep-dive: My ancestors were colonisers. A stunning essay from Max Rashbrooke examining his ancestors' role in the shaping of Aotearoa, and what that means for his own role in its future. The Spinoff

An Op-Ed from Craig Renney on corporate tax via his substack:

A chunky & useful climate & decarbonisation chart pack:

An Op-Ed from Zeke Hausfather via his substack on January’s hotness:

Charts of the day

A big myth busted big time…

MusicalChairs produced a tour-de-force set of charts last night via BlueSky (starting here) showing how the ‘crazy’ fiscal stimulus between 2020 and 2023 wasn’t that crazy after all.

Not very stimulative at all after the current account drain

Cartoon of the day

Timeline-cleansing nature pic of the day

Ka kite anō

Bernard

Share this post