Here’s the six things I think mattered in Aotearoa’s political economy in the week to January 27 around housing, climate and poverty:

PM Christopher Luxon bought himself another six months of National caucus peace and tried to reassure an increasingly restive business community by massively reshuffling his key personnel in the big-spending ministries after just a year in charge;

Luxon then refocused on ‘going for growth’ this year without a viable new strategy, launching a drive to bring in foreign direct investment in public infrastructure that can’t fill a $64 billion hole being dug in the economy by his Government’s own historically extreme spending cuts;

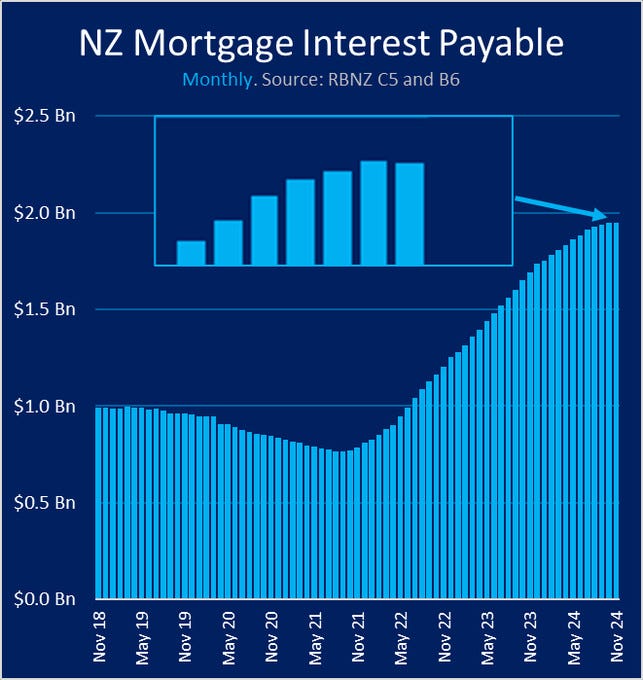

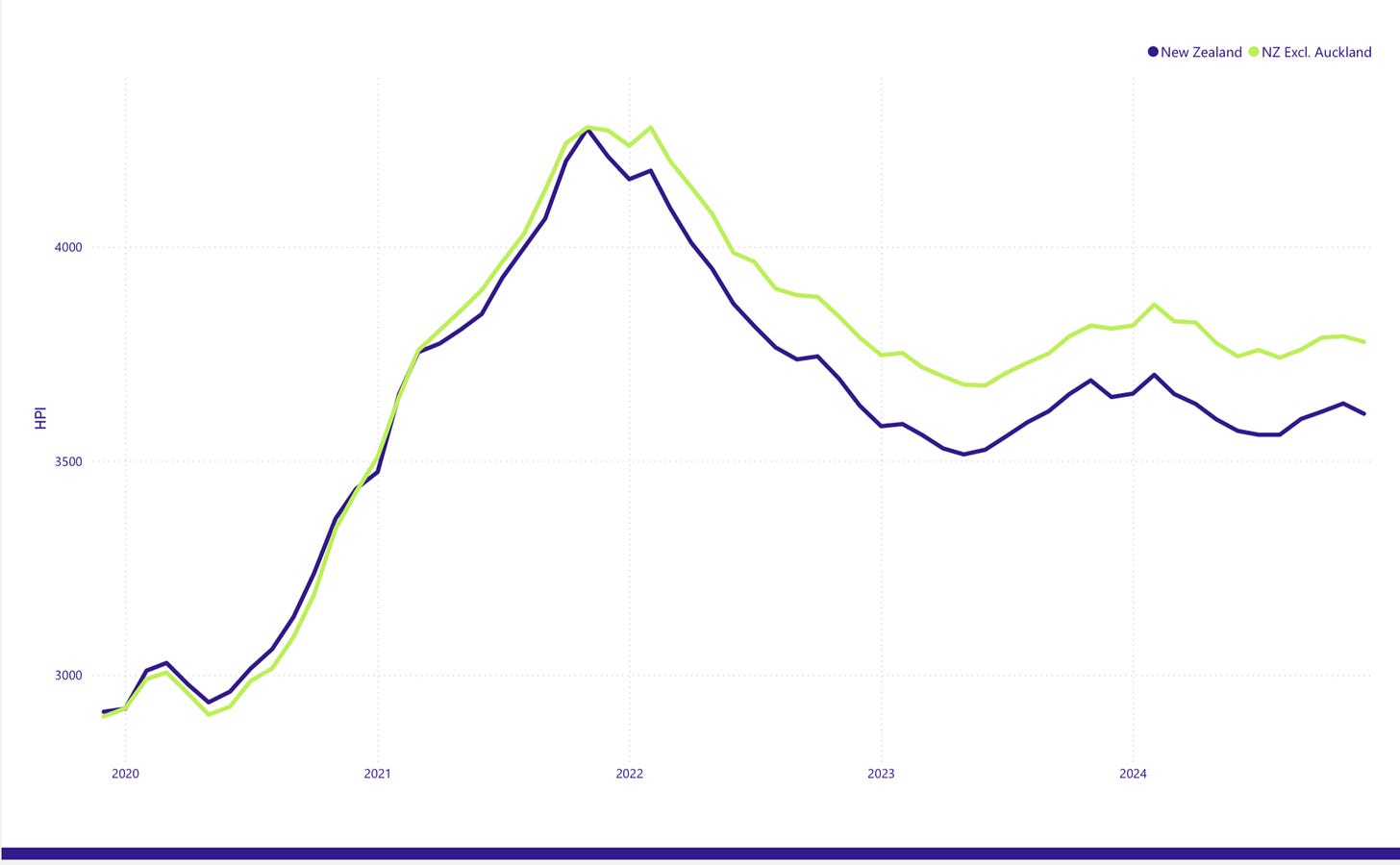

Fresh evidence emerged that the per-capita recession in our housing-market-with-bits-tacked-on economy is dragging on into a third year into 2025, thanks to still-high mortgage costs, the Government’s budget cuts, and an alarming disconnect between business leaders’ confidence about the economy and actual business investment, hiring and new orders;

Luxon and Finance (and now Economic Growth) Minister Nicola Willis said their short-term plan to revive economic growth was to encourage more cheap tourism and expand cheap international tourism, but without building extra homes and public infrastructure to cope with the extra people;

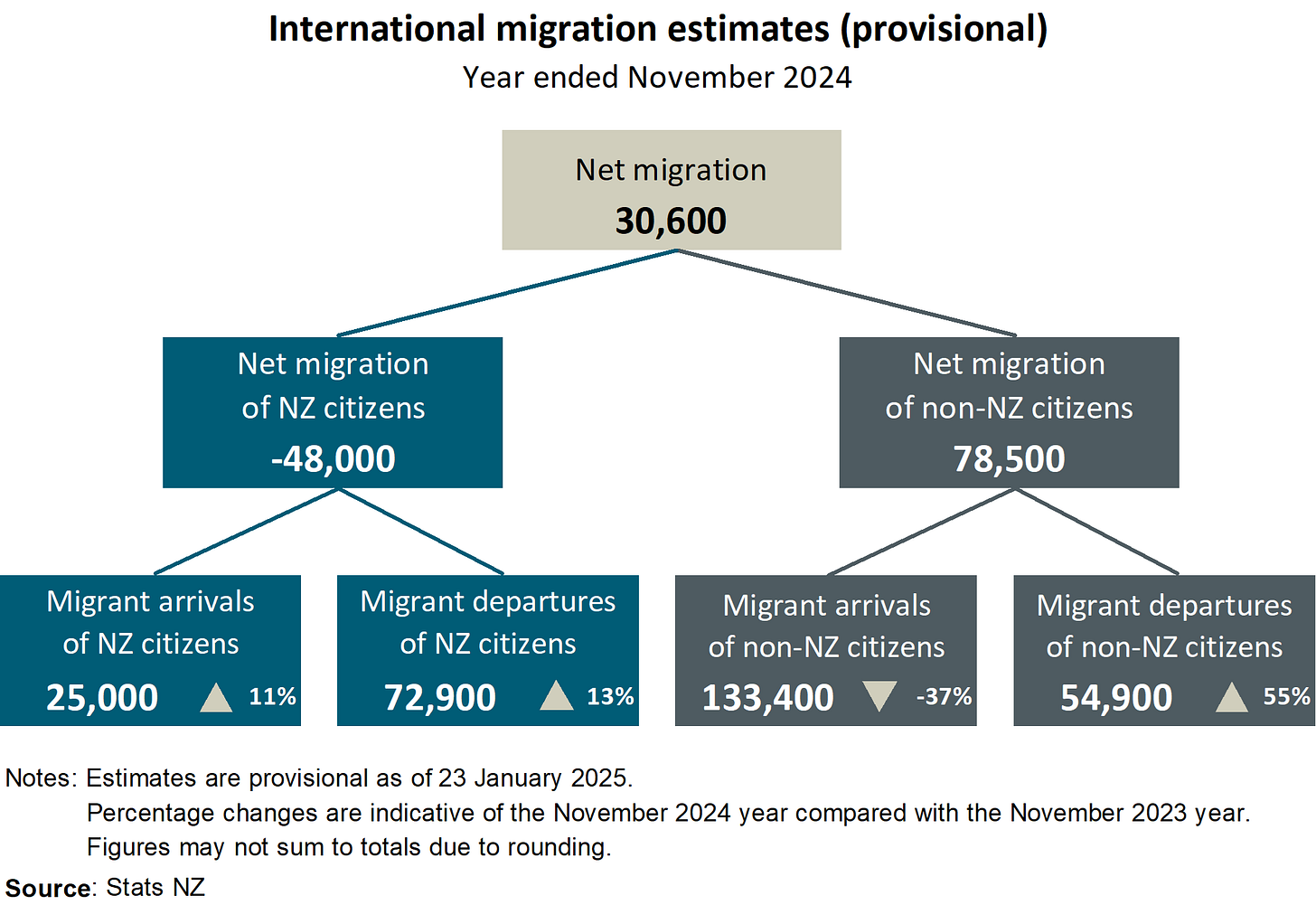

Emigration statistics confirmed that 200 young New Zealand residents a day don’t buy the ‘churn and burn’ approach of running the economy for tax-free and leveraged capital gains on rental property, fuelled by low-wage, migrant-exploiting population growth and environmentally-destructive resource extraction; and,

The Government’s reliance on falling inflation and mortgage rates to fuel a housing market rebound and disposable income growth for home owners is about to be deeply frustrated by Donald Trump’s tariffs, which are already elevating global inflation and the bond yields that hold up our fixed mortgage rates, and by the Reserve Bank’s debt-to-income multiple rules limiting an expansion of household debt to offset the Government’s push to lower public debt.

(There is more detail, analysis, charts and links to documents below the paywall fold and in my Saturday Soliloquy podcast and video above for paying subscribers.)

PM reshuffles most politically-painful ministries

PM Christopher Luxon returned from his summer break to unveil a surprisingly massive cabinet reshuffle last Sunday, removing Shane Reti from Health and replacing him with Simeon Brown. Luxon loaded up Chris Bishop with Brown’s Transport Ministry and gave full control of MBIE to Nicola Willis, adding the renamed ‘Economic Growth’ portfolio1 to her Finance role. Brown’s Local Government and Energy portfolios were added to Climate Change Minister Simon Watts’ workload. Here’s the new and full ministerial list.

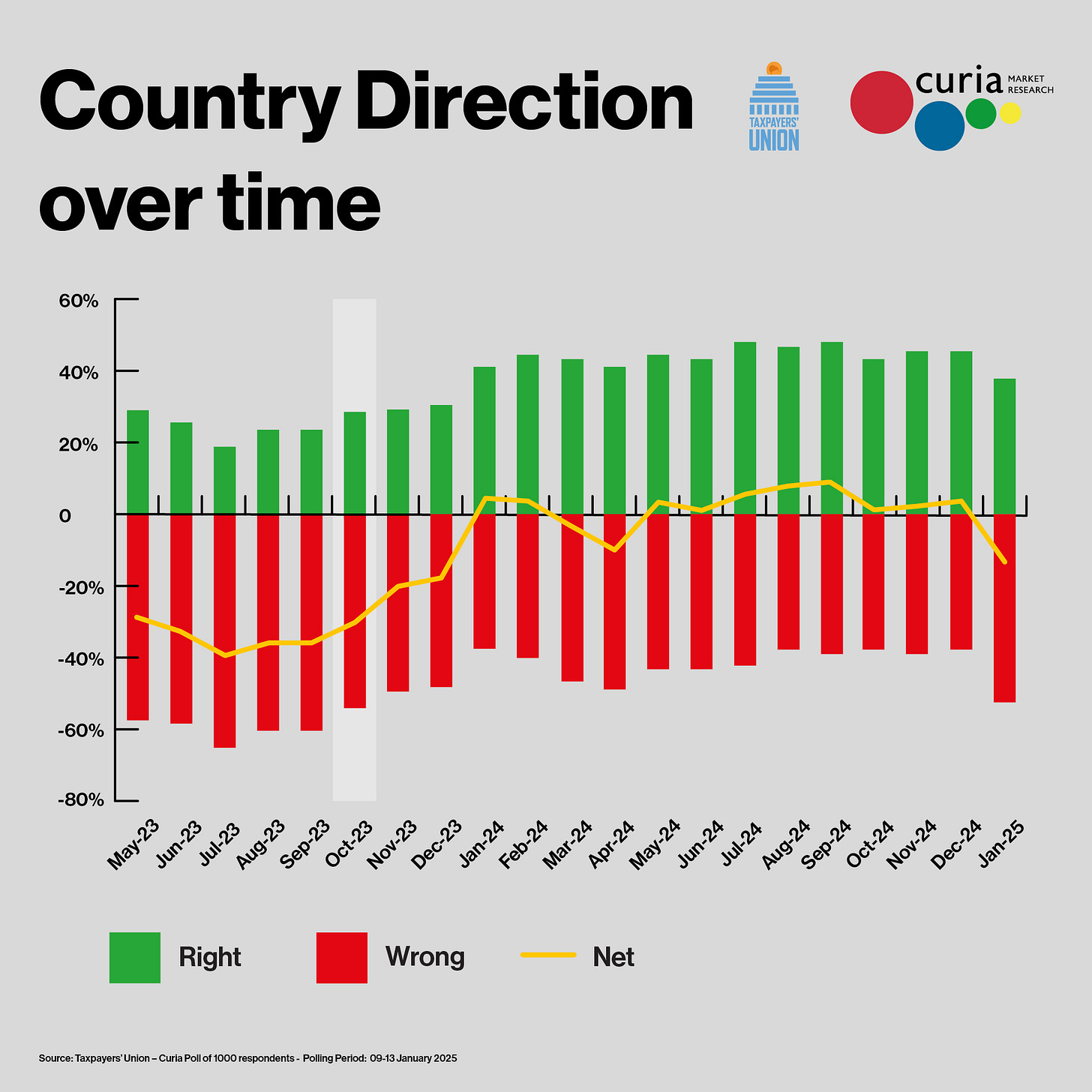

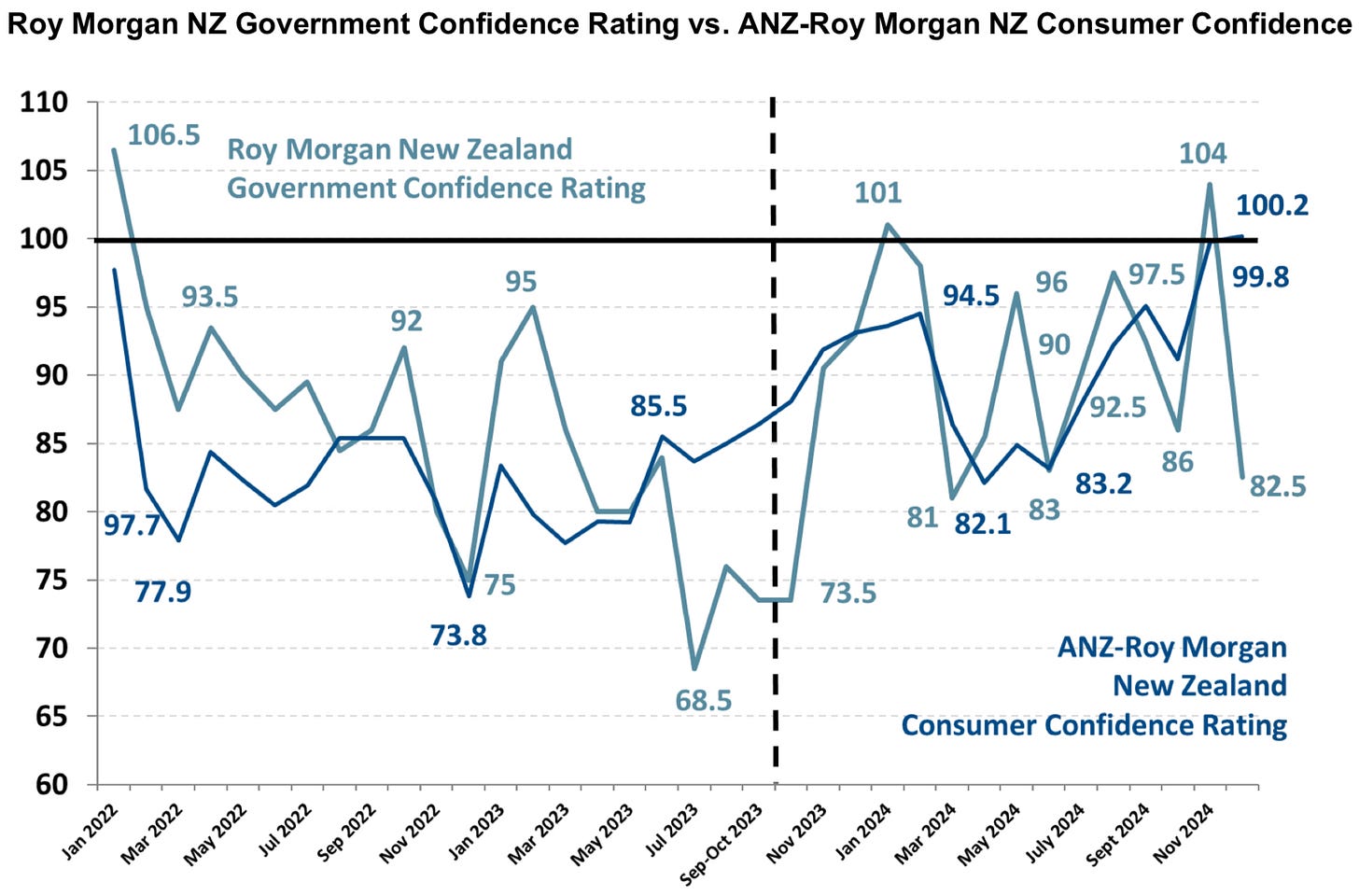

The changes came after National fell behind Labour for the first time since before the election in an opinion poll taken in early January by National’s pollster, Curia, and after both the Curia this month and the Roy Morgan2 poll for December showed the public’s confidence that the economy was on the ‘right track’ slumped back to pre-election levels indicative of an extended and deep recession.

Luxon’s State of the Economy speech without a new plan

Luxon then delivered his ‘State of the Nation’ speech to an Auckland Chamber of Commerce luncheon event on Thursday, pledging to ‘go for growth’ and announcing the creation of a new Invest New Zealand agency within NZTE3 that is designed to chaperone ‘tens of billions’ of Foreign Direct Investment (FDI) into infrastructure & Research & Development here. It will be modeled on similar agencies in Ireland and Singapore.

There are a range of reasons why this is not the golden ticket or silver bullet to restart the stalled economy, including:

The Government is planning to cut its size from 34% of GDP to under 30% of GDP within the next three to four years, which represents a $64 billion hole in spending growth that has to be filled with investment and/or spending by households, locally-owned businesses and international investors, which is unlikely either collectively or individually because they can’t borrow enough or find enough investments;

Foreign sovereign wealth funds and other foreign direct investors prefer to buy Government bonds, rather than do risky, illiquid and expensively bespoke deals to invest in infrastructure and R&D in another country, but the basis of Luxon’s approach is to avoid issuing these bonds wherever possible;

The necessarily higher cost of PPPs vs bonds of around 400-500 basis points vastly reduces the scale of the projects viable for PPPs, meaning there won’t be enough projects to fill the hole fast enough;

Ireland and Singapore were successful at bringing in FDI because they offered themselves as English-language-friendly tax havens that could be bridgeheads with easy access to much bigger trade unions or economic zones, including the European Union and ASEAN respectively;

The last major attempt to bring in FDI from sovereign wealth funds (the NZ Super/CDPQ deal to fund Auckland Light Rail) was gazumped at the last minute when NZ First blocked the deal because it involved foreign investors and, in Winston Peters’ view, was the wrong type of railway with the wrong type of investors4; and,

Singapore in particular is attractive for foreign investment because of its stable and well-educated workforce that is able to live in affordable and stable housing provided by the Government.

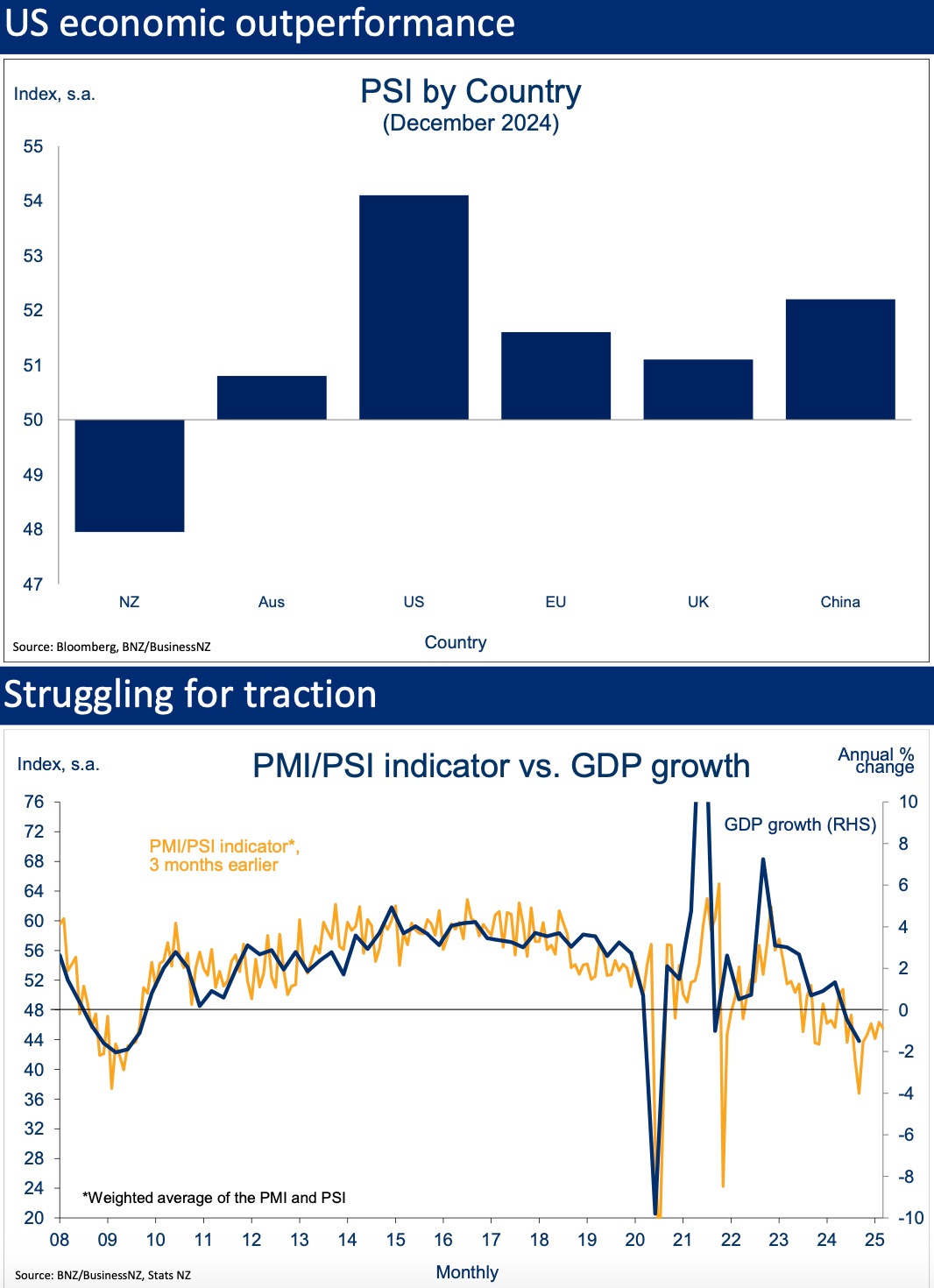

An economy shocked into a state of suspended animation

A range of economic data published over the last week showed the economy remains in shock and in a state of suspended animation that is extending a per-capita recession well into a third year, and in contrast with our peer economies which are growing solidly. The new Government’s decisions in early 2024 to upend, repeal and block various long-term infrastructure, water, rail, ferry, housing, hospital and school building projects that were either well along multi-year planning and design processes or were about to be built was profoundly shocking for many in construction, civil contracting, social housing, local government, project development, hospitals and schooling.

Examples abound of social housing projects, new hospitals, school buildings, roads, cycleways, railways and bus networks being cancelled abruptly, project funds frozen and decisions left in limbo. These shocks from December 2023 through May of 2024 came as new ministers scrambled to shut down as much new spending as they could to comply with the Government’s overall fiscal strategy of reducing spending to under 30% of GDP from 34%, getting the Budget back into surplus and reducing new borrowing. The rapid suspensions and repeal of Three Waters and RMA reforms were a major factor putting much of the long-term development on hold, given the limiting factor in the development of large new housing, commercial and suburban developments are often the provision of drinking, waste and storm water.

Some sectors and cities were particularly affected between December of 2023 and December of 2024, including:

the core public services in Wellington who spent the year restructuring, jostling, litigating and sacking away over 8,000 staff or empty roles;

councils in Wellington, Christchurch, Hamilton and Auckland forced to restructure their financial and development plans when Three Waters was repealed and various chunks of transport funding was repurposed or frozen;

the health sector across hospitals and GP practices as Lester Levy was installed at Health NZ and started freezing and cutting plans-in-train to consolidate health IT systems;

social services Non Government Organisations (NGOs) seeing contracts cancelled and funding decisions put on hold by MSD, Oranga Tamariki, HUD and Kāinga Ora; and,

logistics infrastructure planners and investors waiting for decisions on the key and now-cancelled Cook Strait ferries and port infrastructure.

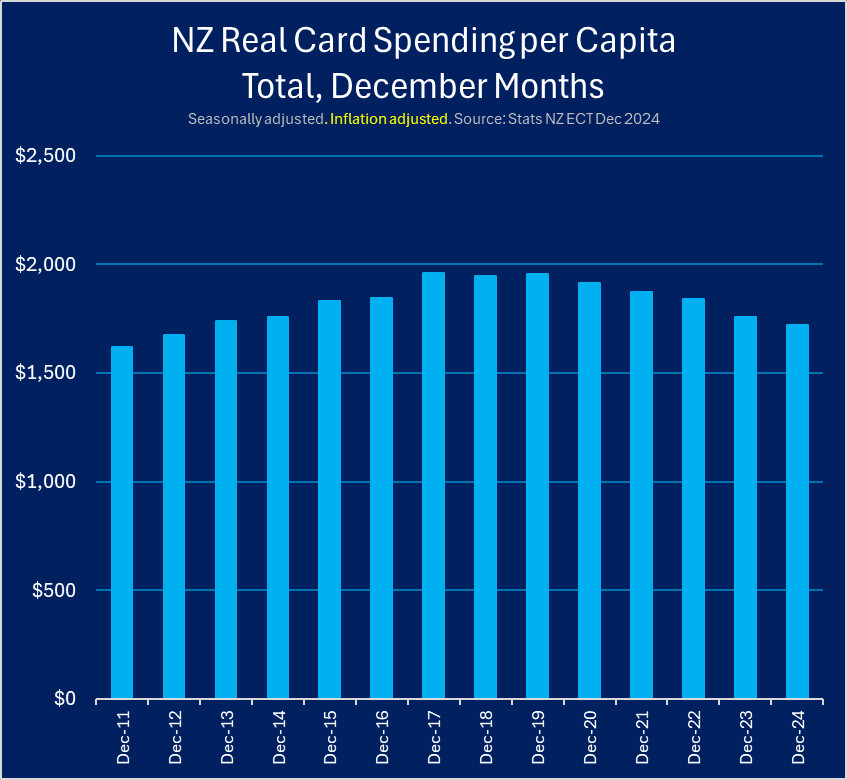

Those funding and planning shocks reverberated out of the government and development sectors into retail spending, hospitality and manufacturing as jobs were lost and many consumers tightened their own belts, having listened to their new leaders saying they had inherited all manner of fiscal calamities and crises. The obvious examples were in Wellington and Auckland where cafes, restaurants, bars and retailers who had held on through the covid lockdowns and protests, and were hopeful a new Government would revive activity, capitulated as the economy finished the year mired in a third year of per-capita recession.

Unfortunately for the economy, this collective fiscal shock treatment through 2024 and its chilling consequences happened at the peak of the lagged effects of the 525 basis points of interest rate hikes administered by the Reserve Bank between 2021 and 2023. It also happened as the Reserve Bank applied a new type of restriction to mortgage lending — debt to income (DTI) multiples — which have suppressed lending growth to investors in particular from July 1. That meant the Government’s main channel for economic growth of landlords borrowing more against their existing equity to gear up into more existing properties was choked off. In retrospect, I’m surprised the Government allowed the RBNZ to go ahead with the DTIs. The last National Government blocked the RBNZ’s previous attempt to do so in 2017.

House sales volumes repressed and output contracts

The end result of all of these forces coming together in our housing-market-with-bits-tacked-on-of-an-economy was sales volumes of existing houses remained depressed, new building consents and commitments to fund new houses were either flat or fell more during a year when many had expected the change of Government would unleash a new burst of housing-credit-fueled activity. Home owners who had listed expecting a surge of activity to allow them to sell at or around their 2021 CVs were disappointed with the offers lower than CV so took their homes off the market. Banks don’t need to force many sales so those hoping to move on into retirement villages, new homes or apartments, or to crystallise equity to downsize or restructure their finances remained stuck in a state of suspended animation.

We saw the end results of this state of economic shock in figures for December in manufacturing, services, retailing and housing that have been released over the last 10 days, including the BusinessNZ PMI & PSI surveys, Seek job ads, Electronic Card Transactions (Retail spending) and REINZ and QV house sale and value data. The charts below tell the stories:

The end result? 200 NZers are emigrating each day

Stats NZ figures last week for November showed how young New Zealanders in particular viewed the combination of the Reserve Bank and Government deliberately causing and deepening a recession at the same time as the Australian Government was stimulating its economy and the Reserve Bank of Australia was holding its cash rate a full 125 basis points below the RBNZ’s Official Cash Rate.

Ka kite ano

Bernard

Economic Growth used to be called the Economic Development portfolio, which was stripped from Melissa Lee, who was demoted out of the executive altogether and back to the back-benches.

The Roy Morgan poll for December released this week showed National improving at Labour’s expense, in contrast with the Curia poll, but both the Curia and Roy Morgan polls showed the ‘right track/wrong track’ slump.

To start with, Invest New Zealand will be ‘incubated’ within NZ Trade and Enterprise, before becoming an autonomous Crown agency.

In particular a foreign one

Share this post