TLDR & TLDL: The Government has scrambled to arrest the slide in the housing market (and its poll ratings) by tweaking tough new lending rules in line with bank suggestions. The tweaks announced this morning will allow borrowers to get mortgages without having to be interrogated by their bankers about their spending and saving habits.

I wrote on February 16 that the Government was set to honour the implicit guarantee under the housing market by tweaking the CCCFA in line with bank suggestions, which is what has just happened. Here’s an earlier article I wrote about the supposed lending crunch through December and January after the CCCFA kicked in on December 1. Here’s the first article I wrote on November 23 noting the earliest signs of the crunch. (See more analysis and detail on these CCCFA tweaks below the fold.)

Elsewhere in the news this morning:

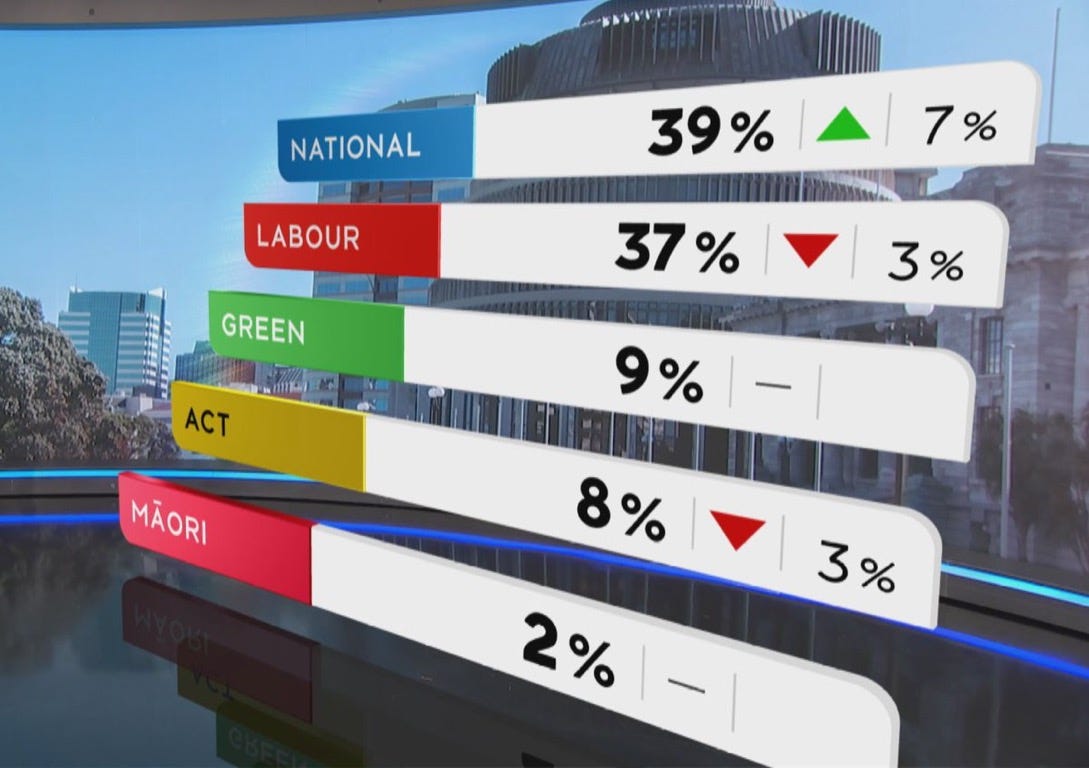

National took the lead over Labour in TVNZ’s Kantar poll out last night, and Christopher Luxon is now neck and neck with Jacinda Ardern as preferred PM;

The European Central Bank surprised investors, traders and economists with a hawkish decision overnight to wind back its money printing and bond buying faster than expected this year, which forced global bond yields up and European stocks down; and,

peace talks broke down this morning between Russian and Ukrainian officials as Vlodomyr Zelenskyy accused Russia of genocide and Russian (and Chinese) media suggested a pregnant women being removed from a destroyed maternity hospital was a ‘crisis actor’.

Paid subscribers should watch out for my email invite to the weekly Ask Me Anything thread just before midday for an hour, and for the invite to our weekly ‘hoon’ webinar with Peter Bale, and Robert Patman again (because Ukraine is by far the biggest story in the world). The link to watch the webinar live for an hour from 4pm to 5pm today with a gin and tonic is below the fun things again, and I’ll also send it in an invite email shortly before 4pm.

Government to the rescue for home owners again

Right on cue, the Government has tweaked the new CCCFA rules to remove the blockage in the credit pump keeping the bubble in house prices nice and tight and high. That blockage had appeared to be stopping sufficient credit being pushed in to replace the air going out the top, although there were other limits to credit growth that may be just as much to blame.

Commerce and Consumer Affairs Minister David Clark began the statement by saying there would be “practical amendments to responsible lending rules to curb any unintended consequences being caused by the Credit Contracts and Consumer Finance Act.”

Here’s Clark explaining the sequence of events:

“Following my meetings with the banks at the end of last month to hear their concerns, I detected little enthusiasm for wholesale changes to the Act, but instead a preference for some practical amendments to be made to ensure the purposes of the legislation are best met.” David Clark.

The announcement came just hours after Labour’s worst poll result since the 2020 election and the worst result for PM Jacinda Ardern ever. It also came after the first fall in house prices in its four years in office.

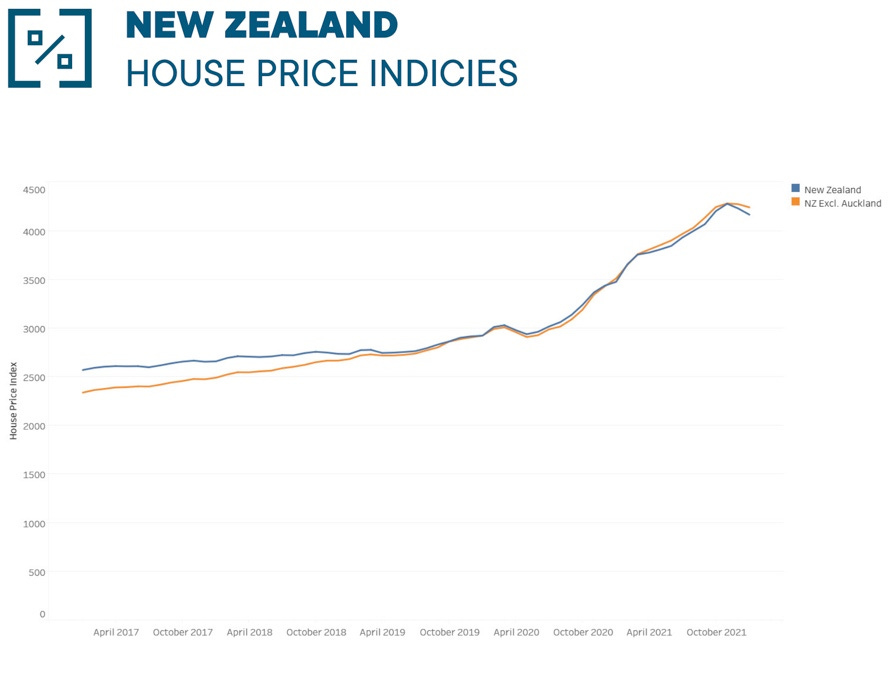

House prices fell a total of 2.7% in December and January from a peak in November. The CCCFA rules that were blamed by banks and mortgage brokers for a hard stop in lending growth kicked in on December 1. Here’s the REINZ House Price Index showing a fall from 4,281 in November to 4,164 in January.

The CCCFA wasn’t the only factor

But the house price fall wasn’t all the fault of ‘unintended consequences’ from the December 1 introduction of the CCCFA.

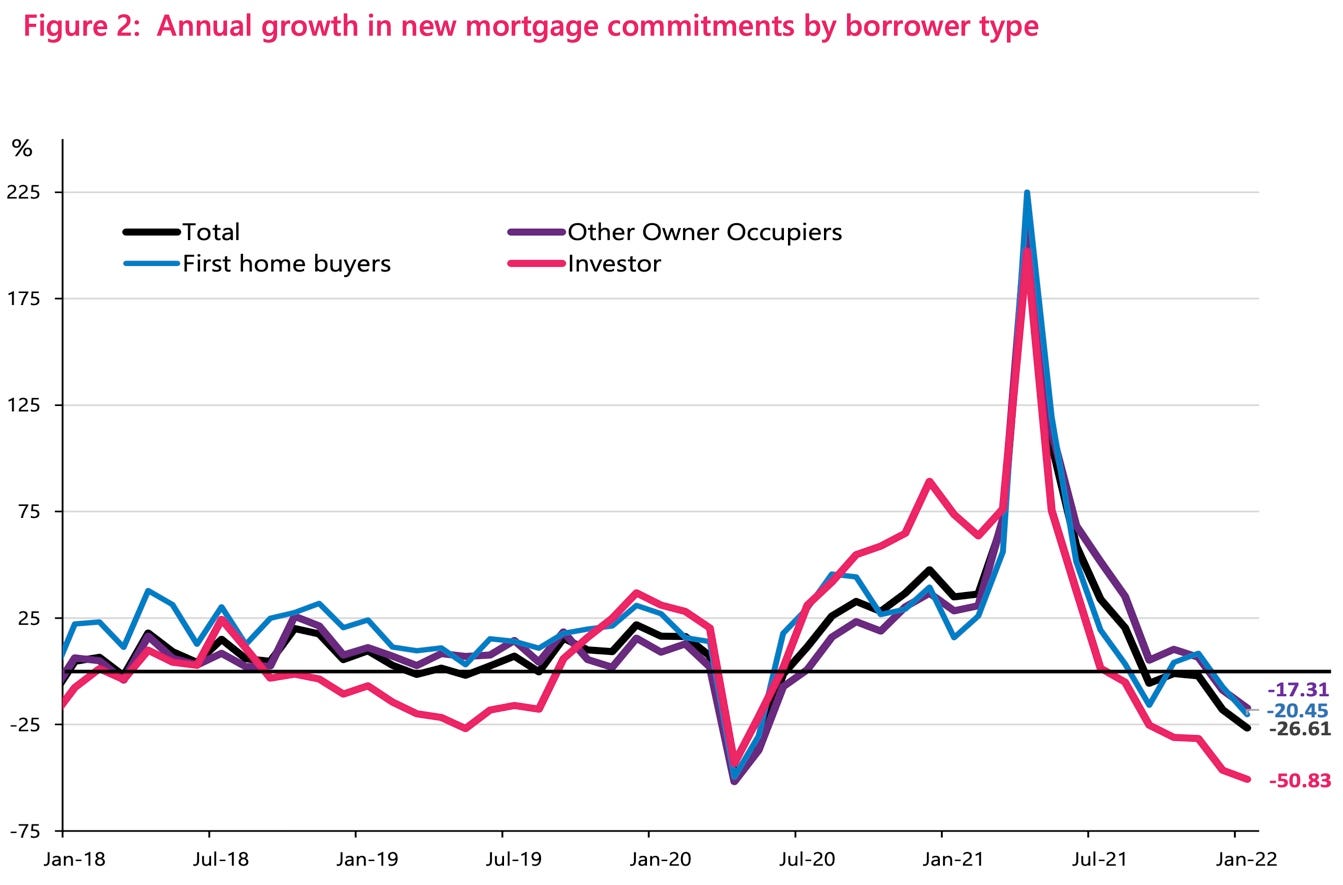

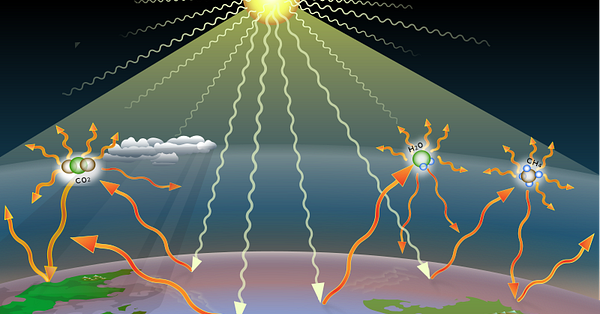

The Reserve Bank chart below shows what happened to lending growth late last year, although you can see it had been falling well before December 1 and it was at least partly due to a tighter high LVR lending limit. That was announced in late September and kicked in from November 1.

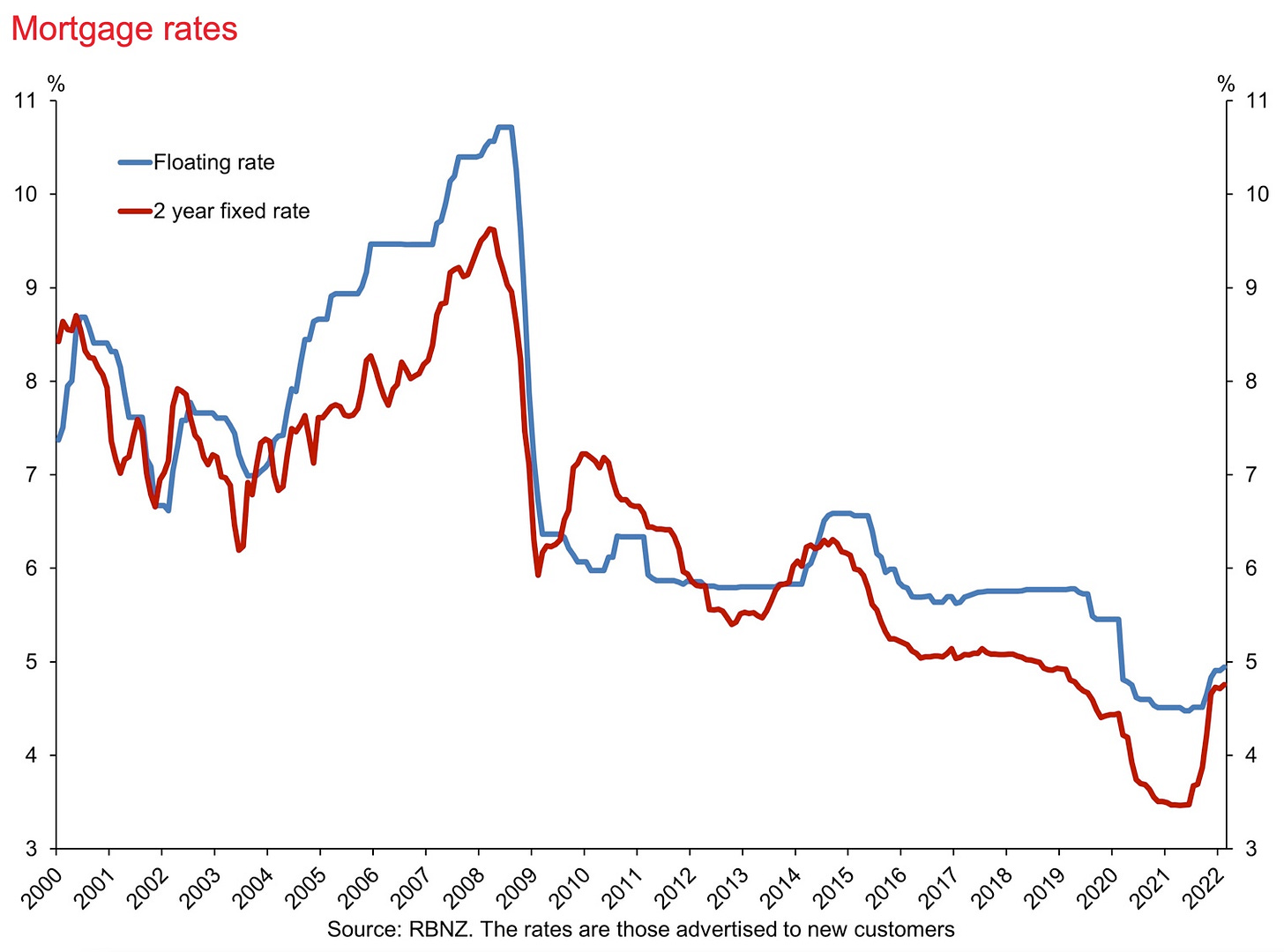

A significant rise in interest rates has also been a factor, but it has been useful for banks and brokers to blame the CCCFA rules, rather than the Reserve Bank, which regulates the banks, or their higher mortgage rates.

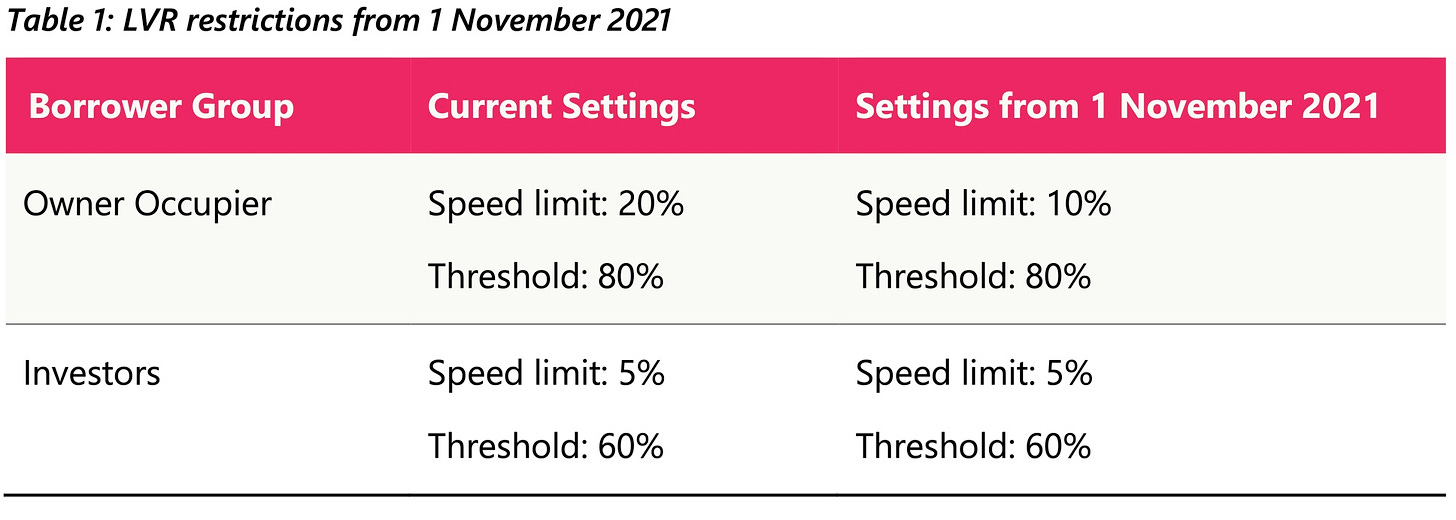

Here was the first factor that dragged the lending growth lower: the Reserve Bank’s September 23 tightening of LVR restrictions.

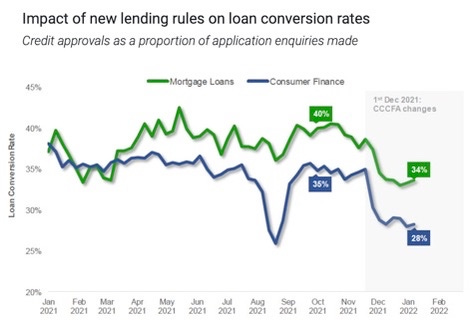

Then came the December 1 introduction of the new CCCFA rules, which forced more prescriptive ‘anti-loan shark’ rules on bank lending officers that meant they took a much more conservative approach on assessing affordability, including interrogating buyers about their past spending habits and including future savings and investments as commitments that could not be changed.

ASB estimated in early February the changes had forced it to reject seven percent of applications from mortgage borrowers.

Credit reference checking firm Centrix reported approval rates for mortgages dropped from around 41% in September and October to 33% in January, before bouncing to 34% in February. That bounce before the changes were confirmed suggest more was afoot than just the CCCFA, or bankers had been reassured by the Minister’s comments in January that an easing was coming.

However, mortgage rate increases would have also had an effect. They started to rise sharply around July.

Clark was at pains to also say that the CCCFA was not the only factor at work in the slowdown in lending and the housing market, but it’s clear he was responsive to the banks’ concerns about ‘unintended consequences’.

Here’s Clark downplaying the CCCFA changes:

“Thus far investigations have thrown up no reasons to believe the CCCFA is the main driver in reduced lending. The Reserve Bank’s December figures highlight seasonal variation as a prominent contributor. In fact, December 2021 was still above trends from the same month in 2017, 2018 and 2019.

“It is also important to note that banks may be managing their lending more conservatively and this is likely due to global economic conditions. And that a number of factors affecting the market have occurred at the same time as the CCCFA changes, including increases to the OCR, LVR changes and an increase in house prices and local government rates.” Clark.

However, it’s inconvenient that since the December figures, there’s also been January figures issued by the Reserve Bank here, in which the bank said (bolding mine):

“There is typically a substantial seasonal fall in new mortgage commitments in January, but this is the largest percentage fall on record. In the current market, a variety of other factors could have influenced the fall, such as rising interest rates, LVR policy tightening, and changes to the Credit Contracts and Consumer Finance Act.” Reserve Bank commentary.

Most important to stop house prices falling

In theory, the Government could have ignored the banks’ call for tweaks and allowed the blockage to remain, thus allowing more air out of the bubble and making housing more affordable for first home buyers.

But the combination of unhappiness over the Covid response, problems with MIQ and catastrophic levels of consumer confidence all led the most important numbers of all for the Government.

Last night’s TVNZ-Kantar poll showed National ahead of Labour for the first time since the 2020 election and Jacinda Ardern’s lowest personal popularity figures ever.

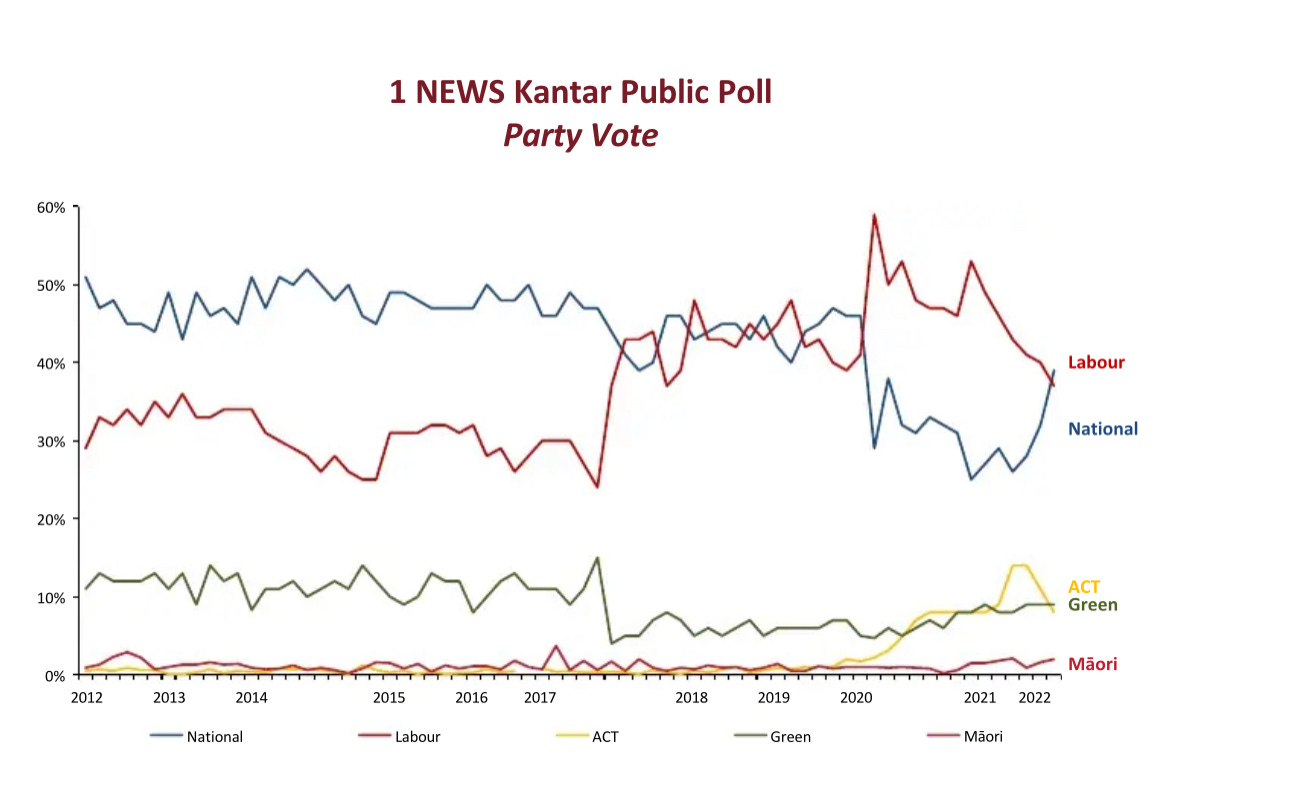

As this chart of the party positions in the Kantar poll show, Labour has been falling since early 2021, but the trajectory steepened in January and February as prices fell.

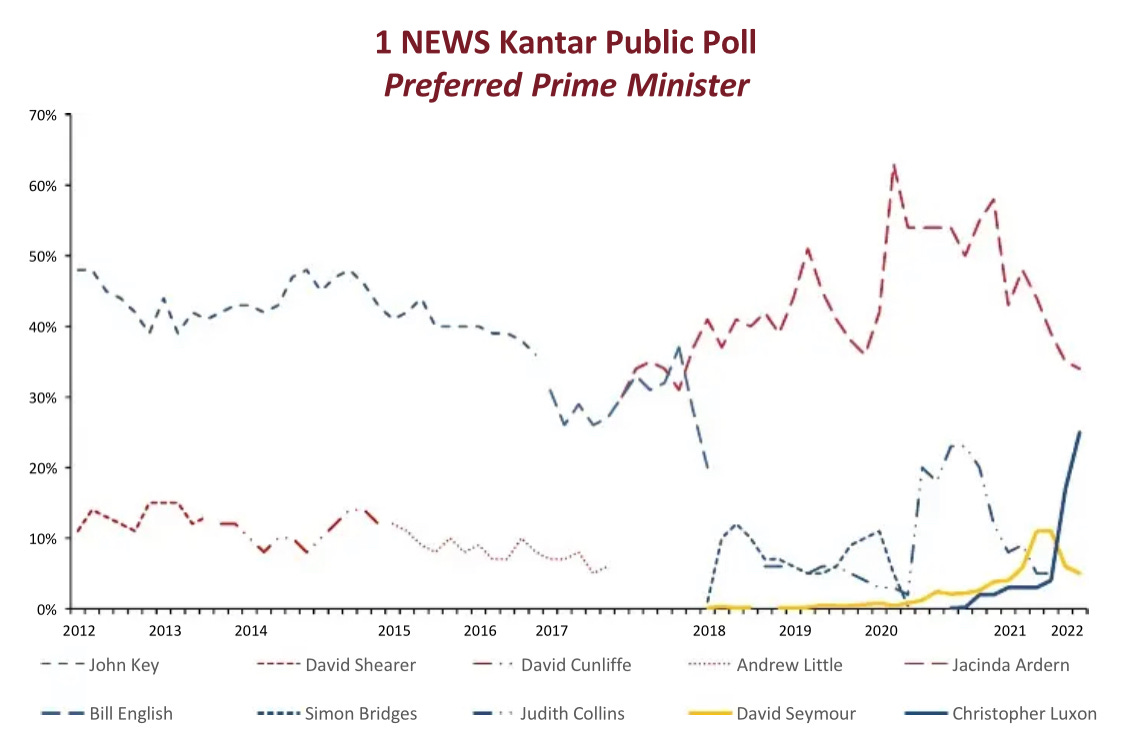

And it’s not just the party standings. Ardern’s popularity fell to its lowest level ever, as measured by the broad preferred PM question.

The numbers for the PM look even worse when the question is a simple choice between her and new National Leader Christopher Luxon. The Kantar poll found 46% preferred Ardern and 45% preferred Luxon.

So how will this unblock the credit pump?

Clark said banks and other lenders wouldn’t have to ask borrowers about their recent living expenses or include regular savings and investments as examples of outgoings. He said lenders would in future only need information from borrowers directly, rather than information from bank transaction records.

Guidance about when a loan was deemed affordable would also be changed, he said. Clark reaffirmed that the changes were in response to suggestions from banks for regulatory tweaks, rather than a wholesale change in the new act CCCFA, as National had recommended.

Scoops and news of note elsewhere this morning

Genocide accusation – Ukrainian President Vlodomyr Zelenskyy accused Russia of genocide overnight after a bombing of a maternity hospital in Mariupol. Russian state media suggested one of the pregnant women taken out of the hospital on a stretcher was a ‘crisis actor’ planted to make Russia look bad. Meanwhile, China’s state-run television and online news networks are spending millions on Facebook to promote pro-Russian articles and videos globally. Peace talks broke down.

New inflation record – US consumer price inflation rose 7.9% in February from a year ago and was 0.8% higher in the month from January. This was the highest annual US inflation rate in 40 years and reflected prices set before the war in Ukraine sparked 30% rises in oil and grain prices. The result was in line with economists’ forecasts, but it has reinforced expectations the US Federal Reserve will have no choice but to begin putting up interest rates in the world’s largest economy, starting from next Thursday morning NZ time. Economists expect six or seven US rate hikes this year.

Goalposts moved - The Government changed the definitions and reporting of Covid deaths. It frustrated some.

“We've had two years to get this right and all of these data definitions really matter if you're trying to understand the impact of COVID-19 on our healthcare system.” Michael Baker via Newshub.

Intense pressure - This Ruth Hill report via RNZ gives useful detail about the pressures inside hospital system right now, and Hutt Hospital in particular. She reports 15% of staff are off with omicron, a third of patients have it on arrival and some are refusing to be tested.

These details were particularly alarming and indicate the austerity mindset remains dominant at DHBs (bolding mine):

Morale had also been hurt by stalled contract negotiations, including the zero percent pay offer to senior doctors by DHBs last year, (Emergency Doctor Tanya Wilton said.

"Comments by the DHBs' negotiating team that healthworkers must have their 'year of pain' were not especially helpful.

"Nurses also want to see progress on their request for safe-staffing levels. That would really show we're appreciated."

A senior nurse, speaking anonymously, said Wellington Hospital was already understaffed before the pandemic, but it had got much worse.

"Nurses tend to want to look out for each other, so they'll come in if they're not feeling particularly well just to make sure their colleagues aren't left really, really short-staffed. There are constant texts going to staff members to come in and help or stay late - and that sort of behaviour is now the norm rather than a rarity. It's becoming a risk for staff."

One department had lost 50 nurses out of 120 in the last two years - and more would leave now international borders were opening, she said.

I still don’t understand why employers in Wellington and Auckland in particular are not screaming from the rooftops for more affordable housing and urgent Government action because it is high rents and house prices that are driving the exodus of skill.

Near capacity - Jonathan Leask also reports for RNZ that the Christchurch hospital is also near capacity and will wind back to focus on covid next week.

Canterbury incident controller Tracey Maisey said the CDHB was in stage two of its planning where it was consolidating services in preparation for the peak.

"We've combined wards, particularly in our non-acute facilities, both (in) Ashburton and Burwood [hospitals], and proactively relocated some residents from our rural facilities to enable some staff to be redeployed."

Maisey said the DHB is considering moving to the next phase of its Omicron response but the decision has not yet been made.

"The next phase includes deferring non-urgent elective care, postponing non-urgent outpatient activity and increasing the utilisation of telehealth appointments."

Once they reduced some services and other deferrable care, potentially next week, they would be redeploying staff to open those remaining beds.

Partnerships - Anne Gibson has an excellent piece via NZ Herald-$$$ on how some developers are working well with iwi. She quotes Deloitte partner Leon Wijohn and Tāmaki Marutūāhu Collective chair Paul Majurey.

"For every development which runs into problems or has that perception, there are many which proceed smoothly which one hears little about. We've seen some high-profile developments on land which might be sensitive where iwi have been crucial to its success. If you look at Tara Iti and Te Arai [golf courses] to the north, Te Uri o Hau and Ngāti Manuhiri have been key partners.

"Where iwi are going to be involved, most developers know to engage early, build relationships, involve them where appropriate. Marutūāhu and [developer] Ockham developed a relationship on an initial development. The relationship is now a partnership that is strong and enduring and building quality residential developments across Auckland which reflect the world views of Marutūāhu.” Paul Majurey

Useful longer reads and listens

Thread of the day

A fun thing

Ka Kite ano

Bernard

PS: Here’s the link to join me and Peter Bale and Robert Patman for the weekly ‘hoon’ webinar on the events around the world and at home this week.