Long stories short, the top six things in our political economy around housing, climate and poverty on Friday, February 7:

PM Christopher Luxon and Finance Minister Nicola Willis are set to announce another apparently splashy growth policy on Sunday of offering residence visas to wealthy migrants, but like the Invest NZ foreign direct investment policy announced last month, it is another low-impact and slow-burn measure that won’t do much to juice economic growth this year;

The political imperative is growing for the personally-unpopular Luxon to fire up economic growth fast, given the usual suspects are absent because of the Government’s restrictive Budget policies on investing the Government’s own money, its only-just-begun fiscal tightening and lending restrictions on landlords;

New Zealand’s economy also faces new economic headwinds globally as Donald Trump’s tariff (and other) shocks derail investment and spending plans, as well as potentially generating another covid-style shock to global supply chains;

The Government’s hope that a sharp and extended drop in mortgage rates would fire things up in 2025 is beginning to fade as the US interest rates that underpin our fixed mortgage rates that most borrowers use are holding higher for longer, thanks to fears Trump’s tariff war and tax cuts will pump up US inflation;

Willis has begun in recent days floating the prospects for a corporate tax as a way to juice economic growth, but past experience shows it hasn’t increased investment from either local or foreign investors, and would also place an extra drag on Government revenues at a time it says it wants to tighten policy (see chart below);

Luxon’s choices for juicing growth are narrowing to a tool that would quickly ignite the animal spirits in the economy and allow him to soften some of the political pain coming his way from restrictions on spending in health, construction, transport, education and social services: a fiscal policy loosening in the Budget on May 22.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers. Normally, if we get over 100 likes from paying subscribers we’ll open it up for public reading, listening and sharing, but after recent feedback and experience this week I’m opening this one up early.)

Substack post of the day

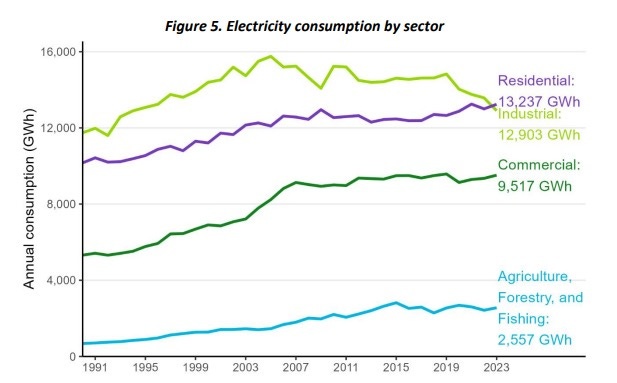

This is an interesting post from NZ Energy on why we have a recession that we can’t seem to shake off. We don’t have enough electricity and gas, which is a factor in an accelerating de-industrialisation.

“This is different to any other recent recession. In the past economic activity could be stimulated by monetary policy because we were not energy constrained.

“This time the economy needs energy, not monetary stimulus to grow.“ NZ Energy

Chart of the day

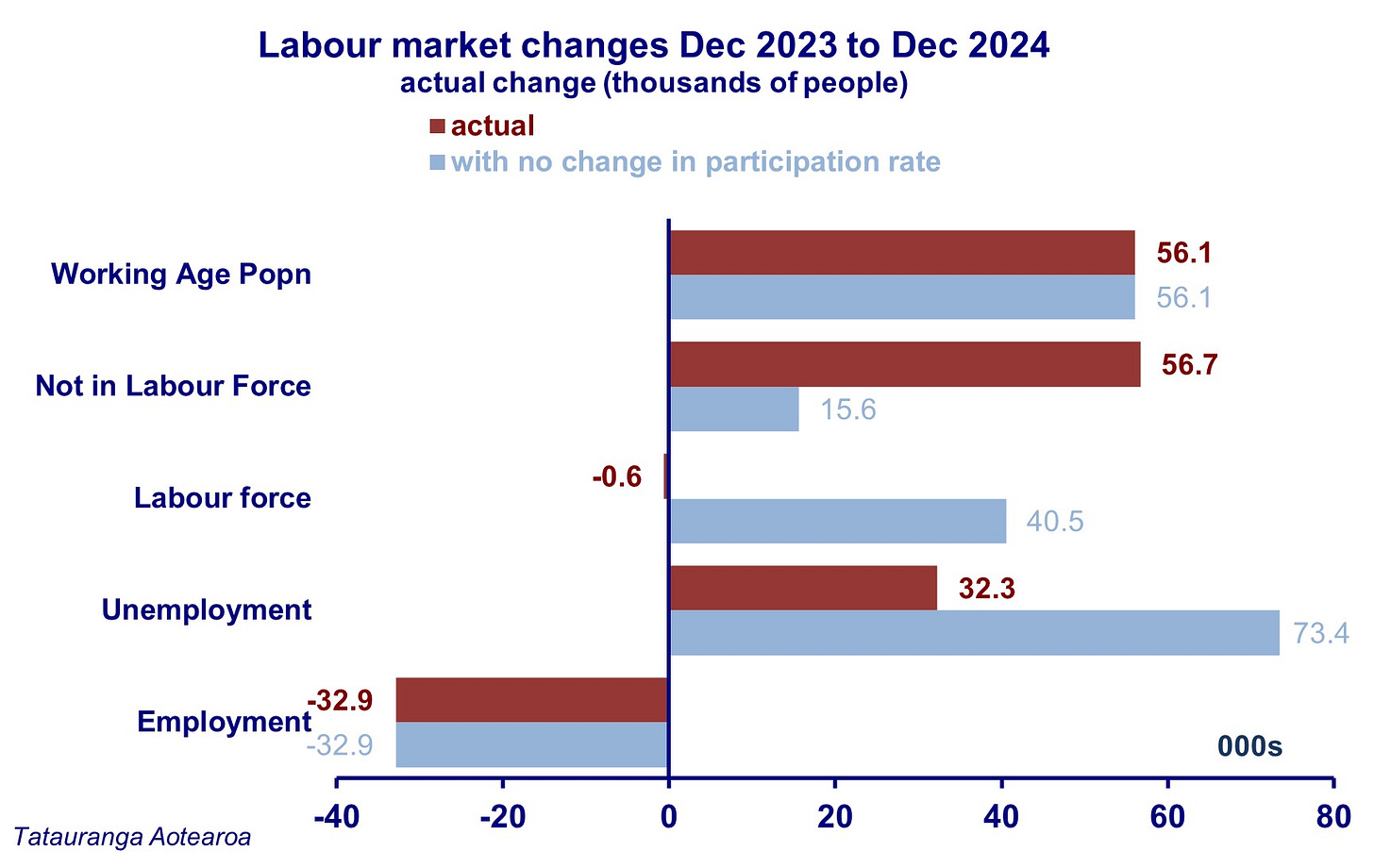

‘It could have been worse’

Ganesh Nana makes an excellent point via Notes that the fall in the participation rate in the last year has disguised an awful deterioration in the jobs market.

“If the participation rate has remained unchanged, then the change in the labour force would have been about 40,000 over the year. As pictured, this scenario would have resulted in the official unemployment number rising by a catastrophic 73,000; with the total at 190,000 - or a rate of 6.2%.

“So, thanks to those staying not entering the labour force (or exiting) over the past year, the picture can be reported as bad, rather than as catastrophic.” Ganesh Nana via Notes

Further reading

Cartoon of the day

Timeline-cleansing nature pic

Ka kite ano

Bernard

Share this post