TL;DR: Finance Minister Nicola Willis has delivered her first Budget, deciding to go ahead with long-promised tax cuts despite a weaker economy that is forcing the new Government to borrow a net extra $68.3 billion by mid-2028.

The income tax cuts are costing $14.7 billion over four years. Net debt will rise by 68.3 billion to over $220.7 billion over that period, which is $12 billion more than Treasury forecast in December. Willis argued the tax cuts were ‘fully-funded’ by spending cuts and a bunch of little fees and tax increases, and therefore she was not borrowing to pay for tax cuts. That would be true if the economic forecasts had not changed between the election and the Budget, but they have in a way there’s less money to spare.

The Government chose a mix of policies in the current economic environment that will increase net debt by at least $12 billion more than would otherwise have been the case. ‘Fully-funded’ is dancing not-so-daintily on the head of a fiscal pin.

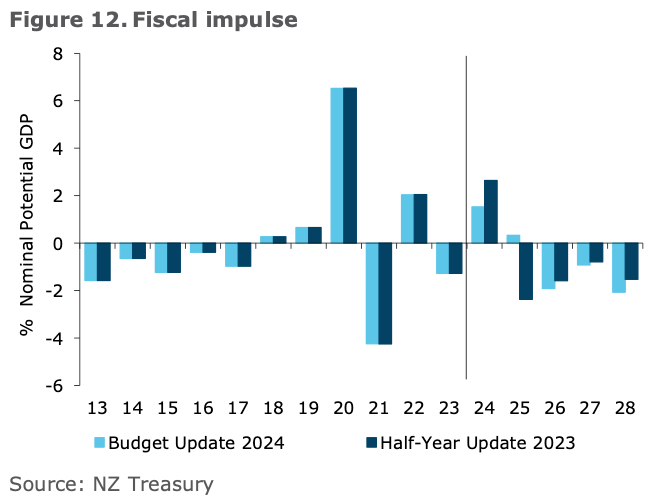

The new Government also promised not to increase inflation pressures with its tax cuts and spending. That assertion can also be challenged, given a slightly larger fiscal stimulus is expected this year, before bigger contractions follow in the next three years. Some economists said the tax cuts and some early capital expenditure may add a little to the inflationary pressures the Reserve Bank is dealing with this year. Most said Budget 2024 was unlikely to force interest rates any higher, but may further delay mortgage rate relief into next year.

‘Fully-funded’ is dancing not-so-daintily on the head of a fiscal pin.

Meanwhile, costs of living and direct inflationary pressure will be elevated by decisions in Budget 2024 to:

re-impose a $5 prescription charge on most adults;

nearly triple the visitor conservation and tourism levy to $100 per visit;

increasing waste disposal levies by an average of $5 per household per year and $45 per new house to raise an extra $175 million over four years;

increase the interest rate for students loan recipients overseas and late-paying local students by one percentage point to 4.8%; and,

re-introducing tuition fees for first-year students and increasing overall fees by 6%.

That comes on top of fee increases and Government decisions previously announced that increase the fees and charges portion of CPI inflation directly or indirectly through;

removing subsidies for bus fares;

imposing road user chargers for electric car owners;

increasing car registration costs by 50% to $93.50 by 2026;

planned fuel excise increases totalling 22c per litre from 2027 to 2030; and,

widespread double-digit rates increases that councils have blamed on Government funding shortfalls.

The Reserve Bank pointed out last month that ‘administered services’ inflation, which includes rates and Government fees and charges, was 8.8% in the March quarter from a year ago, making up more than a third of the non-tradables inflation that is stopping the Reserve Bank from cutting interest rates. Fees and charges inflation so far under National has doubled to 2.0% per quarter from the Labour Government’s run-rate from late 2017 to late 2023 of 1.0% per quarter.

In summary, in my view, the Government’s actions since its election and in this Budget have increased inflationary pressures and have contributed to the Reserve Bank not cutting interest rates. The immediate big freeze in funding and grants for house-building, school-building and rail-building, along with sacking 5,000 public servants, has also slowed economic growth in a way that has added to the Government’s net debt track.

So far, the Government has increased the cost of living and increased Government debt while suspending the nation’s water, housing and public infrastructure building pipeline. All in the name of delivering tax cuts for wage earners and landlords that will barely offset the extra costs imposed on many since its election.

Some poorer and younger taxpayers and students who rent are already significantly worse off after paying higher bus fares and higher rents. Soon, they will also face paying higher student fees, prescription fees and a myriad of little fees and charges designed to offload Government costs back onto taxpayers individually.

(Paying subscribers can see and hear more detail and analysis below the paywall fold. The podcast above is a recording of a ‘pop-up’ Hoon discussion I had with

last night and is available for all. We’ll open up the full article for public reading, listening and sharing if we get over 100 likes to indicate approval from paying subscribers.Update: Achievement unlocked!)Six things to note in Budget 2024

1. Cutting $14.7b of taxes while also borrowing $12b more

National campaigned with a promise to cut taxes in a way that would not increase Government borrowing nor increase inflation because those cuts would be offset by spending cuts and a few little revenue increases. Finance Minister Nicola Willis argued yesterday she achieved that, but the raw figures detailed in the Budget show both a $12 billion increase in the debt track, relative to the forecast in December, and a slightly more inflationary Budget in the coming 2024/25 year than was forecast in December.

She blamed the weaker economic outlook inherited from Labour for the deterioration in the debt track, but much of that deterioration has come in the first 200 days of the coalition Government, as shown by first a surge in business and consumer confidence in November and December upon the Government’s election, but then a slump from January through May as businesses started feeling the effects of the funding freezes and job cuts. Construction sector bosses pleaded with Chris Bishop last month to unfreeze the pipeline and give them some certainty.

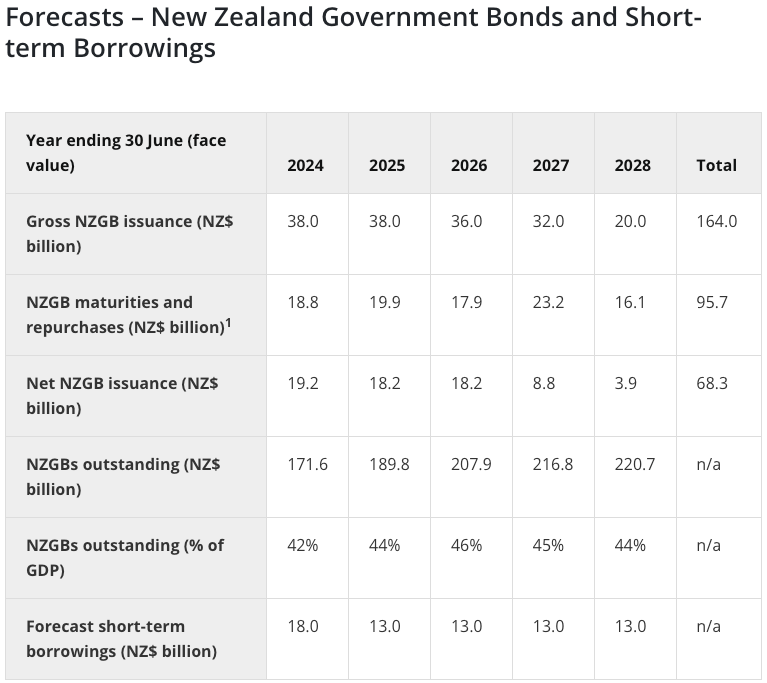

Here’s the table released yesterday NZ Debt Management Office in Treasury showing the increased borrowing:

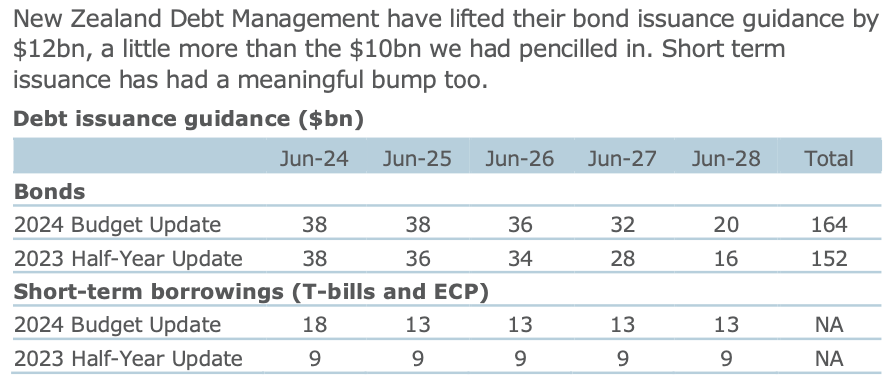

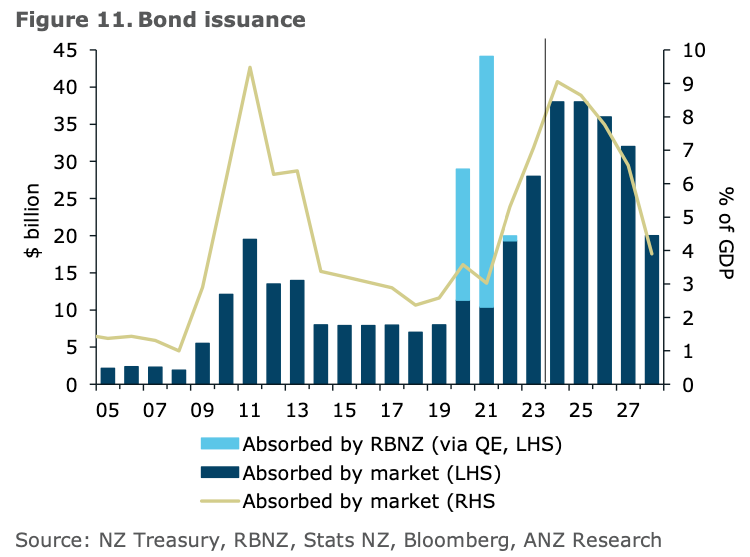

Here’s is a table and chart via ANZ showing the bond issuance over the longer term and in the short term:

Here’s a Westpac chart showing the different debt tracks forecast before and after the Budget, showing the Budget has slowed the fall in the debt track towards the Government’s target.

2. Extending high interest rates for even longer

The Government was elected on a promise to deliver cost of living relief by both reducing consumer price inflation and therefore allowing the Reserve Bank to cut interest rates earlier than it would have under Labour. Instead, the Reserve Bank has extended its forecasts for keeping the Official Cash Rate at 16-year highs well into next year, citing high domestic inflation caused partly by extra Government fees and charges and the risks of stimulation to spending from the Government.

Economists said the Budget may have added a bit more inflationary pressure in the short term, although the Reserve Bank is likely to look through that.

“On balance, we’d characterise the fiscal policy reshuffle as being marginally inflationary in the near term (given the timing of tax cuts), but disinflationary over the medium term (as capex tends to have a smaller multiplier impact than opex). Whether the RBNZ sees it that way is yet to be seen.” ANZ Senior Economist Miles Workman in a research note last night.

“Given current pressures on inflation, the RBNZ is likely to regard the reprofiling of the fiscal impulse as unhelpful (particularly in the current year), although we doubt this will be a game changer.” Westpac Senior Economist Darren Gibbs in a note last night.

Here’s the chart showing the differences in the fiscal stimuluses to the economy between December and yesterday’s Budget:

3. ‘Those future cuts are unsustainable’

One standout feature of Treasury’s Budget Economic and Fiscal Update (BEFU) document was a box on page 37 titled: Pressures on future Budget operating allowances.

In it, Treasury essentially called bullshit on the Government’s decision to cut its operating allowances in the out years (2025/26, 2026/27 and 2027/28) to $2.4 billion in each of those years from $3.2 billion in 2024/25, saying that would barely cover inflation in the main spending areas, leaving little room for error.

Treasury says it best:

“Although inflation is forecast to decline, based on high-level analysis, it is estimated that departments’ baseline expenses could need to increase by around $2.5 billion in the 2025/26 year to maintain the existing level of services. This analysis does not take into consideration additional demand pressures on services (eg, demographic changes), spending on new policies, or the crystallisation of specific fiscal risks or contingent liabilities. Some of the Budget 2025 and Budget 2026 allowances have been pre-committed to cover a significant part of this such as health sector cost pressures. However, this limits the flexibility to trade-off across sectors in future Budgets.

“The high-level analysis indicates that the future budget allowances are unlikely to be sufficient to cover future cost pressures on existing services. This means any shortfall and spending on new initiatives will need to be offset by expenditure savings, reprioritisation or revenue raising policy changes for each of the next three Budgets for the Government to manage within the signalled budget allowances. This will involve difficult choices and trade-offs for the Government which are likely to become harder over time.

“If the Government is unable to achieve the level of savings or revenue raising policy changes required, there would either be less funding available for new initiatives or cost pressures or, all else being equal, there will be direct impact to the fiscal indicators, which could impact on the Government meeting its short-term fiscal objectives.” Treasury’s Budget Economic and Fiscal Update (BEFU) document. Page 37 box titled: Pressures on future Budget operating allowances.

4. Promises made, promises kept and promises broken

The Budget acted as a natural book end to assess which promises were made, kept and broken by the National-ACT-NZ First coalition.

Here’s my tally of news and positions adopted before and in the Budget for promises made by National and kept:

Income tax threshold changes were broadly in line with National’s promise, although the start date of July 31 was a month later than promised;

In-work tax credit increased by $25 a week;

Independent earners tax credit upper threshold lifted from $48,000 to $70,000; and,

Restoration of interest deductibility and the brightline test for landlords.

National’s broken promises and unexpected surprises:

Repeal of Smoke-free legislation and other moves to reduce smoking;

Cancellation of first home buyers’ grant;

Delaying funding of 13 cancer treatment drugs indefinitely;

Increased student fees and interest costs on student loans;

Breaking of promise to lift the Working For Families abatement threshold from $42,700 to $50,000 in coalition talks;

Increasing fuel excise levies by 22c/litre from 2027-30

Introducing road user charges for electric cars;

Increasing car registration charges by 50%; and,

Increasing waste management levies.

5. The collateral damage

The Budget included a range of unexpected spending cuts and office closures, including:

The closure of the Consumer Advocacy Council;

A $60 million cut in funding for Māori housing and rangatahi transitional housing;

A $38 million cut in funding for the Community Renewable Energy Fund over four years;

Funding cuts of $178 million in funding cuts for the Energy Efficiency and Conservation Authority (EECA), which will force the end of Warmer Kiwi Homes subsidies for hot water heaters, energy-efficiency measures, an LED lighting scheme, and community-focused outreach for hard-to-reach households.

The ambulance at the bottom of the cliff

The Budget included $600,000 to investigate buying a tug to tow broken-down ferries back from the middle of Cook Strait.

Mā te wa

Bernard

Share this post