TLDR and TLDL: A New Zealand Herald-Kantar survey published this morning has found 64% say house prices need to fall, which is up from 52% who said that just before the last election. Nurses voted overnight to strike at all DHBs on Wednesday and SkyCity’s shares are expected to slump this morning after Australia’s anti-money laundering watchdog launched an inquiry into its Adelaide casino.

Overseas, G7 finance ministers agreed over the weekend to make big multinational firms pay more tax in the countries they sell their goods and services. Also, Fiji recorded another 64 Covid-19 cases overnight and Melbourne recorded 11 new cases. Australia’s PM hopes Victoria can end its lockdown this week.

Briefly in our political economy

Really? A survey for the NZ Herald has found 64% of respondents believed house prices needed to fall, up from 52% who thought that in a survey before last year’s election. It also found 31% of home owners would not be worried if house prices fell by a quarter from current record highs, albeit back to January 2020 levels. However, 47% said they would be worried if prices fell that much, including 19% who said they would be very worried.

So what? I doubt this changes the political calculus much for either major party, given the sensitivity of median voters to any suggestion about price falls. There’s more than enough latent political pain in the 47% worried about house price falls to maintain the ‘to big to fail’ implicit Government and Reserve Bank guarantee now in place under house prices to change much. The PM said last year she saw her role as protecting the main asset of most New Zealanders. (NZ Herald-$$$)

Wage inflation? The New Zealand Nurses Organisation announced late yesterday that over 30,000 nurses had voted overwhelmingly to go on strike at DHBs for eight hours on Wednesday after they rejected a second pay offer from DHBs that included a one-off $4,000 lump sum payment, partly as backpay for a pay equity settlement. Nurses said it didn’t address the problem of overloaded staff and low pay in the long run.

Why it matters: This will be an interesting test of the ongoing weakness of wage inflation, despite stresses on staff numbers, high vacancy rates and low unemployment. So far, in New Zealand, wage inflation has run at less than 2%. The Government’s attempt last month to signal public sector pay restraint was condemned by workers. We’ll see. My current view is the fears about an explosion in wage inflation globally are overdone because the globalisation via the appification of services sectors such as health, education and financial services has only just begun. A similar globalisation of the goods sectors over the last 20 years blew strong deflationary winds at product prices and wages as the workforces of China and Eastern Europe joined the global economy.

Covid latest: There was more worrying news out of Fiji overnight with another 64 cases recorded yesterday, on top of 85 on Sunday. However, Melbourne is expected to end its snap lockdown later this week with just 11 new community cases reported yesterday. Prime Minister Scott Morrison said he expected Victoria to lift the lockdown this week. There was good news though on Australia’s AstraZeneca-led vaccine rollout, with doctors saying they had significantly lowered the death rate from blood clots from the AstraZeneca vaccine, with just one death from 31 cases of blood clotting from 4.3m vaccination doses. (Sydney Morning Herald)

The bottom line: The current view of the Australian Treasury is Australia won’t begin opening up beyond New Zealand until the second half of next year. Our Treasury’s assumption is early 2022, but I think a fuller re-opening is unlikely until Australia reopens, given our Trans-Tasman bubble makes us reliant on Australia’s timetable. It would be regardless of the bubble as most of our tourists and migrant workers either come from Australia itself, or bounce on through to us via Australia. That means I won’t be booking any travel beyond Australia until late 2022 at the earliest. Sadly.

In business here: SkyCity’s shares are expected to fall at least 8% this morning when the NZX restarts trade after it announced yesterday its Adelaide Casino was being investigated by AUSTRAC, Australia’s anti-money laundering regulator. SkyCity described the “potential serious non-compliance” as focused on “high risk and politically exposed persons” in the 2015/16 and 2018/19 financial years. SkyCity’s shares traded in Australia yesterday because it wasn’t a public holiday there and fell 8.3%.

Why it matters: Until now, SkyCity has not been pulled into the huge controversies seen in Australia in the last year over the Crown Casino’s potentially risky use of so-called junket operators who fly small groups of wealthy individuals from China to gamble privately in Sydney and Melbourne. Crown faces massive fines and sanctions, while its controlling shareholder James Packer was forced to give up voting control.

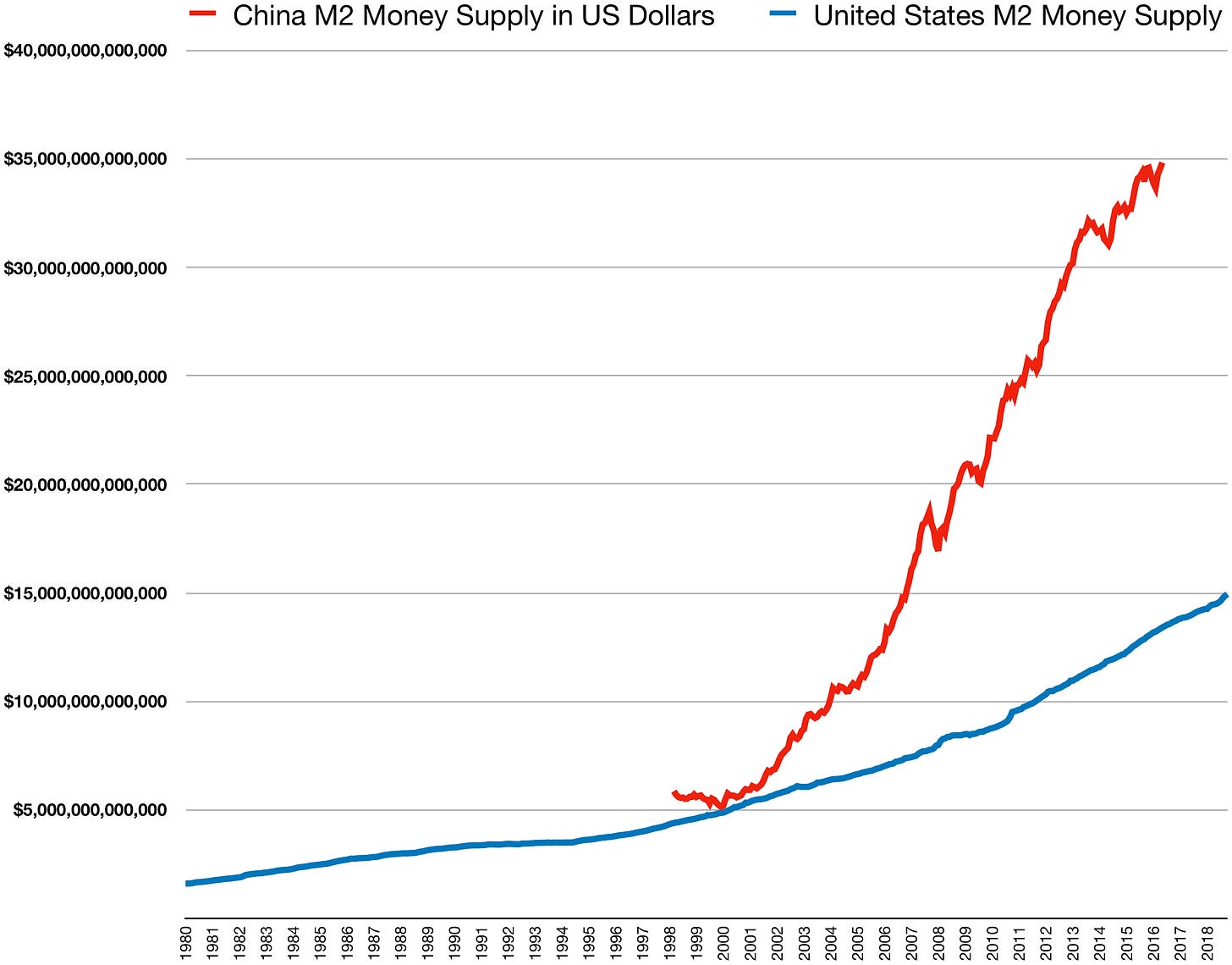

Again, this is all about how wealthy people in China try to smuggle and filter money out from behind China’s tight capital controls into assets and spending in the rest of the world. It’s worth remembering that China’s state-controlled banks have created US$30t worth of money inside China’s borders in the last 20 years, which is the equivalent of twice its GDP, twice the size of US money supply and almost 50% larger than US GDP itself. If controls were relaxed, it would flood out into asset markets globally. It’s why New Zealand should keep a close eye on capital flows, even the informal ones, coming from China. This chart of China’s money supply vs America’s over the last 20 years shows how much money could burst out if allowed.

Briefly in the global political economy

Taxing the tech giants? The G7’s Finance Ministers agreed over the weekend to move ahead with a new global minimum corporate tax rate of at least 15%. This is aimed at large multinational firms who have profit margins of more than 10% and aims to have them pay at least 20% tax in the country where they make their sales, over and above that 10% margin. America is driving the deal, which is designed to remove the ‘rogue’ digital sales taxes being applied by Australia, Britain, France, Italy, Austria, Poland, and Spain.

The idea is global tech firms such as Facebook, Apple, Google and Microsoft would stop re-routing their profits through low-tax jurisdictions such as Ireland (12.5%), the Caymans, Hong Kong, some American states and the Channel Islands because they would be forced to pay at least 15% tax in the countries they operate in. But the devil is always in the detail. This deal still needs to be agreed by the G20 nations next month in a summit in Venice, and then later this year in negotiations involving 139 countries at the OECD in Paris. The OECD reckons this deal could generate an additional US$50bn-US$80bn a year in tax revenues globally.

So what? The devil is always in the detail and the 15% rate seems low. It is lower than the initial proposal put forward by US President Joe Biden a couple of weeks ago and global tech tax activists say it needs to be higher. For example, New Zealand’s corporate tax rate is 28% and America’s is 27%. Even Britain’s is 19%. However, the effective tax rate in America and elsewhere for these firms is lower as they divert sales through tax havens and charge big services fees to countries where they sell their products, but don’t have many staff or do much R&D or have many assets.

The idea is that the 15% minimum would apply to a designated group of very large multinationals with profit margins to sales of over 10% in non-home countries, but that locally-based firms would still pay their country’s corporate rate. There are two so-called ‘pillars’ to watch in this debate. ‘Pillar one’ refers to how sales outside of home countries are taxed by the non-home countries. ‘Pillar two’ applies to the way companies are taxed by their home countries. So far, America has only talked about ‘Pillar two,’ while European Governments have talked about Pillar One. America would also need to get its ‘Pillar One’ rate deal through its Congress, and through its Senate in particular.

This is a useful comparison tool from KPMG on global corporate tax rates now and how they’ve changed over time, and this is a useful research paper from the Institute of Development Studies in March this year on the scale of the tax avoidance.

This paper estimated large multinationals shifted US$1 trillion of profits to tax havens in 2016, which in turn implied US$200-300 billion in revenue losses for other countries. It estimated the revenue losses for New Zealand at around $300m for 2016. It would be larger now given sales of there products here by Google, Facebook, Apple, Microsoft, Netflix and Amazon are likely to be well over NZ$2b.

The bottom line: I’ll believe it when I see it and I hope this doesn’t delay any moves to bring forward New Zealand’s own digital sales taxes. The sooner they are in, the sooner the pressure is ramped up on the digital giants to pressure America to agree. It’s so easy for these massive firms to play countries off against each other. The Prisoner’s Dilemma is their best friend. Just witness the way Amazon has sweet-talked our Government into massive subsidies for its movie and TV-making here, offering the carrot of potential data centres and distribution warehouses, and the stick of doing the filming elsewhere. Politicians usually can’t resist the photo opportunities of a sod-turning, ribbon cutting or movie premiere. Hence the race to the bottom.

If this actually happens, the main losers would be the tax havens such as the Caymans, Bahamas, some US states and the likes of Ireland (12.5%), the Netherlands (15%), Hungary (9%) and Cyprus (12.5%). Shareholders in the tech firms might lose, but their shares haven’t done much over the long weekend. Countries such as New Zealand might gain hundreds of millions in tax revenues. But there’s a lot of detail to be agreed among dozens of politicians. A good time to be a tech firm lobbyist.

Watch out this week for…

In the local political economy, the big setpiece is the release of the Climate Commission’s recommendations for policies to get to carbon zero by 2050, along with the Government’s response, early on Wednesday afternoon after a couple of hours of lockup in the Beehive. I’ll be in there for that and I’ll be doing my Spinoff podcast this week on that.

Parliament is sitting this week and the caucuses will meet later this morning, before question time at 2pm. There’ll be a post-cabinet news conference at 4pm today, which I’ll attend. I welcome your questions in the comments below.

Overseas in politics, the big news this week will be anything coming out of the G7 leaders meeting in Cornwall in Britain on Friday, ahead of next Wednesday’s Biden vs Putin matchup in Vienna.

On financial markets, watch out for US inflation figures on Friday morning NZ Time, along with the European Central Bank’s latest decision and comments on Thursday night. The US inflation figures are particularly crucial for the inflation and interest rates outlook. Figures for last month (April) spooked everyone with annual consumer price inflation of 4.2%. Economists expect annual inflation of 4.7%. The debate is all about whether the spike is temporary, and in particular whether it is accompanied by a breakout of wage inflation. The US Federal Reserve thinks it’s temporary and doesn’t expect to increase interest rates any time soon. But if that view changes, get ready for market ructions because an end to a multi-decade bond rally would upset the apple cart.

There are all sorts of anecdotes around inflation globally that show something is happening. De Beers increased its diamond prices 10% overnight. US employers are offering sign-on bonuses and one fast-food chain in Florida is offering a new SUV in a lottery for new staff members. We’ll see. My view is wage inflation is endemically weak because unionisation rates are still very low, the contracting-out platforms are gaining strength and the appification of the services sectors globally has barely begun.

Share this post