TL;DR: Just when most of the rest of the world’s inflation rates are falling, Aotearoa-New Zealand faces high inflation and mortgage rates for longer next year as record high net migration, rising rents and council rate hikes tolerated and provoked by the new National-ACT-NZ First Government’s policies inflate housing costs for all.

Elected to lower the cost of living, the coalition’s policies are actually unleashing a wave of new Government and council fees, rent hikes, council rates increases and domestic inflation that will keep mortgage rates and housing costs higher for longer for all.

Councils and Government departments starved of funds by the Beehive, are preparing to increase their rates, fees and charges through 2024 and into 2025, just as the effects of record-high net migration over the last 18 months and earlier tax breaks for landlords ripple through into higher rents, house prices and demand-push domestic inflation.

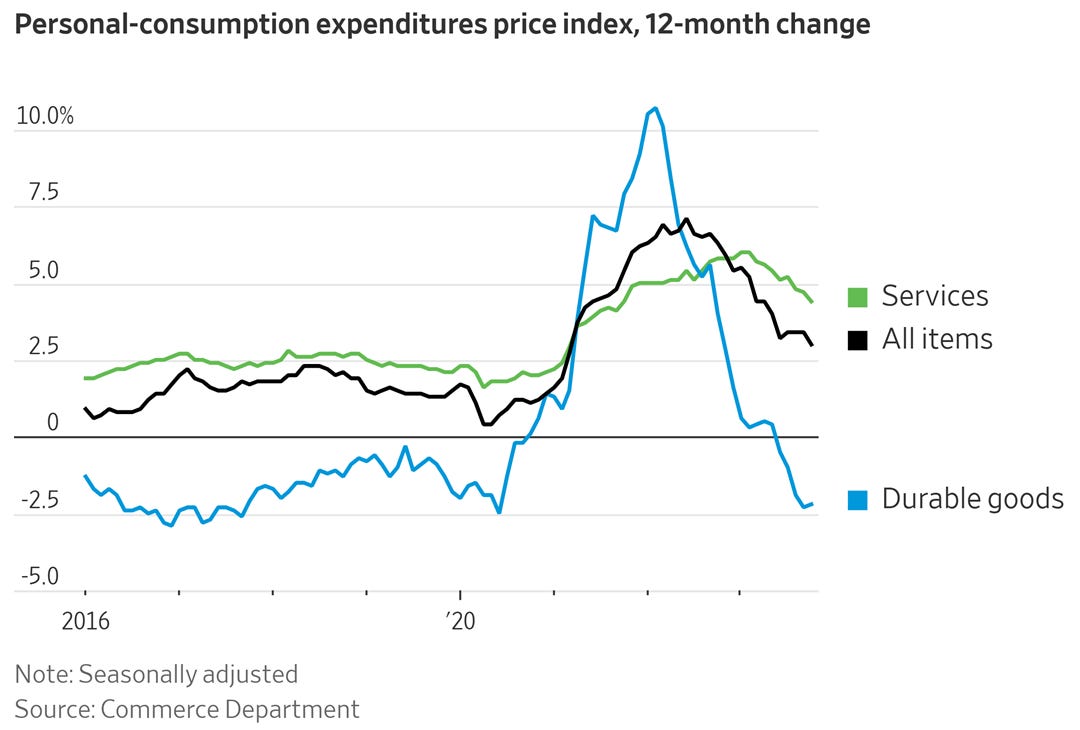

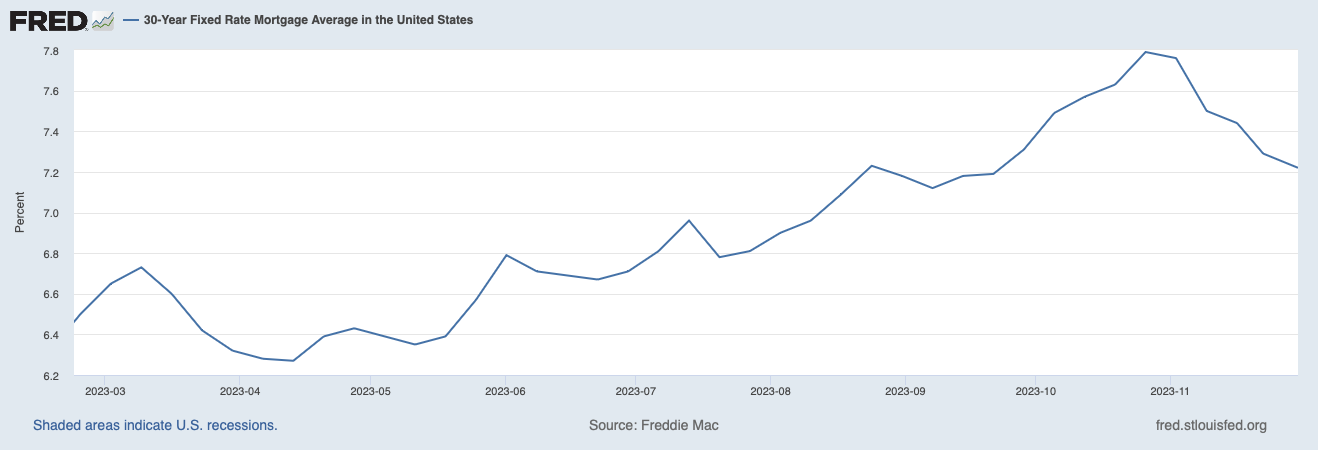

The rest of the world is already seeing deflation in some prices and markets expect official rate cuts next year in ways that are already taking pressure off their mortgage rates. Meanwhile, Te Pūtea Matua (The Reserve Bank) has this week repeated and reinforced its warnings that it may have to hike its Official Cash Rate as soon as February 28 because of persistent domestic inflation, driven by high migration, rising Government and council fees, rates and charges, and a lack of competition that has pumped up profit in some sectors. (See more below the fold)

Elsewhere in the news overnight:

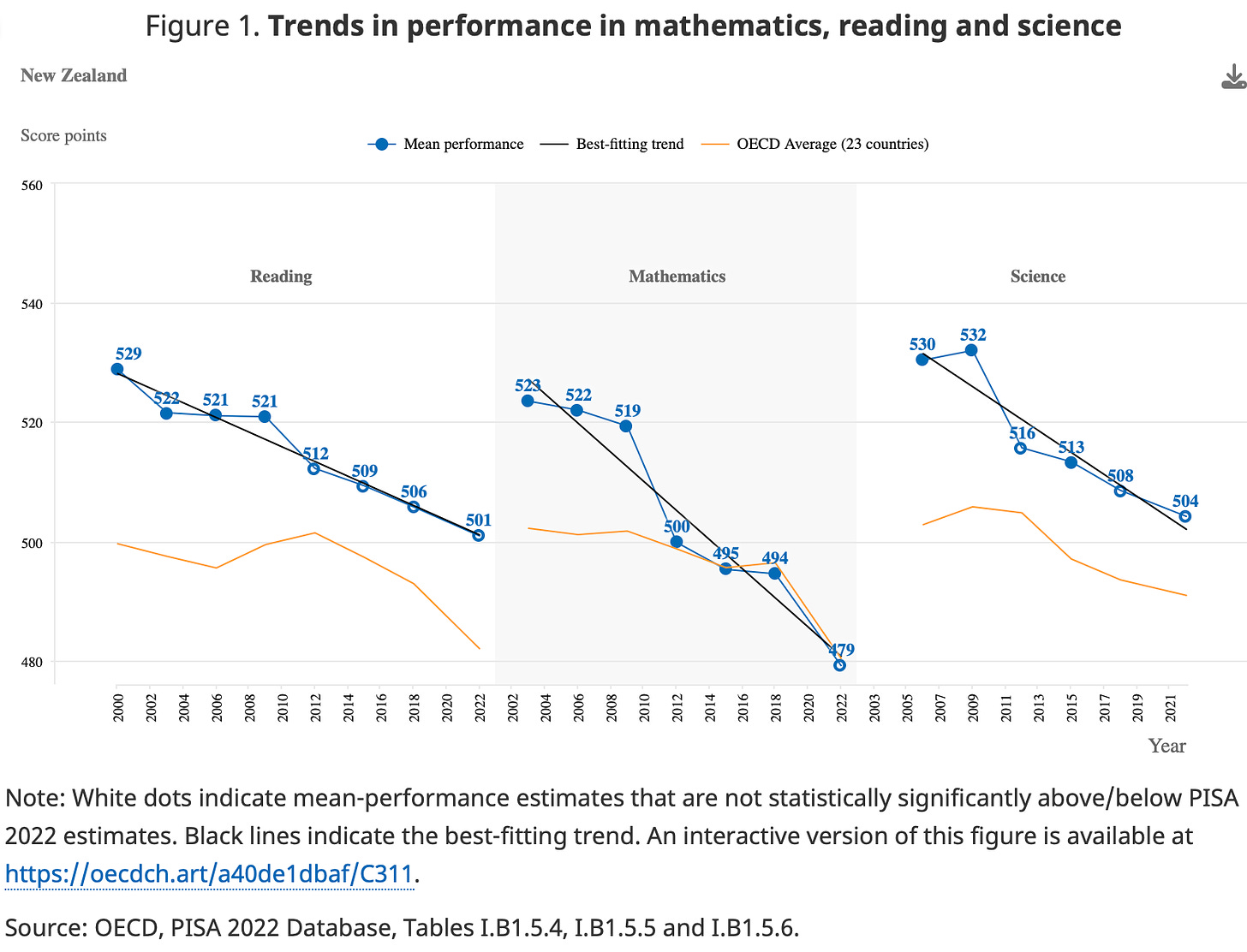

The OECD released overnight its once-every-five-years PISA results on educational achievement, including results for Aotearoa showing another worsening in maths performance, but an improvement in the performance gap between the poorest students and richest students for maths (see chart below); and,

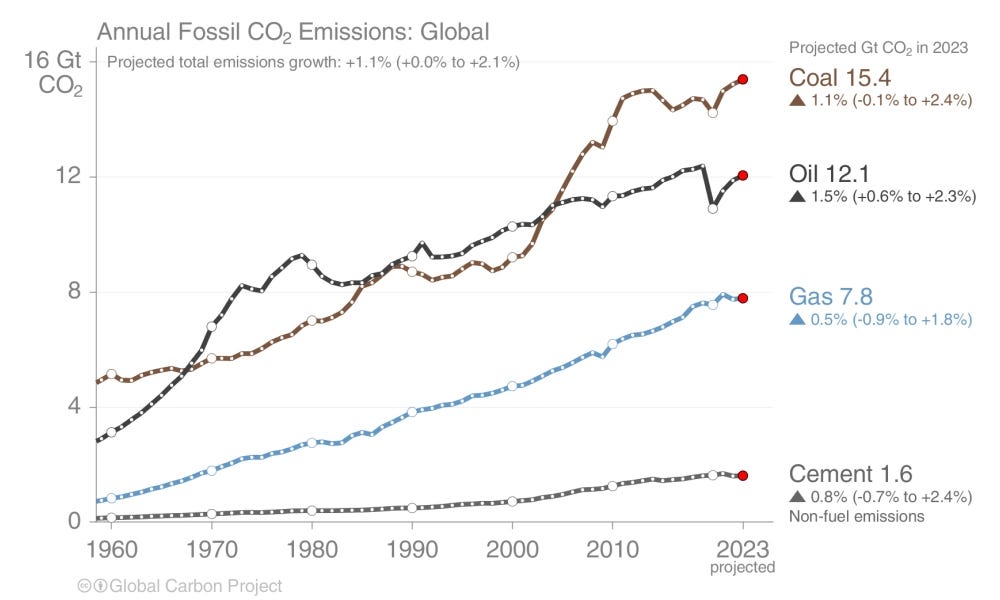

Global climate emissions were projected1 overnight to rise 1.1% in 2023, more than double the average growth rate over the last decade and now 6% more than 2015, the year 196 countries agreed in Paris that emissions should peak in 2025 and fall 43% by 2030 to try to keep temperatures from warming more than 1.5 degrees above pre-industrial levels (see chart below).

Paying subscribers can see and hear more detail and analysis in the podcast above and below the paywall threshold here.

Rents, rates, fees and charges inflating the outlook

They may have unintended inflationary consequences, but they’re nationwide consequences none-the-less of a new coalition Government pushing the effects of its own tight budgets and investment freezes down to councils and departmental heads. A likely further loosening of migration settings will amplify the inflationary effects on housing costs.

Jammed up against debt limits and budgetary sinking lids, these local officials and bureaucrats are being given permission or ordered to impose new and higher local user-charges and rates that effectively substitute for tax increases centrally.

A wave of these new and higher fees, rates and charges will ripple out over the economy in the next 18 months as mayors, councillors, heads of department and price-setters for utilities such as gas, electricity, water and parking ramp up the charges.

Council rates increase announcements have cascaded through the high-growth cities Auckland (13.75%), Wellington (17.8%), Christchurch (18%), Tauranga (9.4%), Hamilton (25.5%) and Queenstown (14.5%) in recent weeks and all have signalled double-digit percentage rates increases in future years, along with ramping up parking and consenting fees, and calling for congestion charges for major roads and motorways. Transpower announced two weeks ago it had asked permission to increase its charges by 39.5% in the 2025/26 year to pay for grid upgrade investments.

Here’s the latest example via RNZ:

A number of councils are proposing massive double-digit rate rises as part of their long-term plan discussions. Mayors are warning that residents across the country are likely to face the same pain, with the alternative being significant cuts to essential services. They are calling on the new government to start fixing a "broken" funding model for councils.

Hamilton City Council has proposed a 25.5% rate hike for the 2024-2025 financial year, as part of its draft long-term plan.

Mayor Paula Southgate said the increase, which the council estimates is an extra $722 a year for the median ratepayer, would be tough for many people.

“We know that New Zealand is going through a cost-of-living crisis at the moment, so we know they are already hurting But I would think most mayors would agree we don’t want to run our city or our place backwards into the ground.”

Southgate said the council was grappling with rising interest rates, inflation, and looming water infrastructure costs, like many councils across the country. RNZ

The new Government will this launch a frenzy of regulatory and legislative repealing and uncertainty in the next two weeks that has left councils no choice but to hike rates, while some Government departments are rolling out big fee increases to offset budget tightenings.

Yesterday, RBNZ Governor Adrian Orr again warned markets and borrowers not to expect early rate cuts, and said a rate hike remained on the table because of domestic inflation pressures from high net migration, profit-led inflation and the potential for an inflation boost from tax cuts, which are being accelerated and may be backdated for landlords.

"This is the challenge for monetary policy, we have to lean against that desire to tuck a little price increase in behind generalised inflation hoping no one notices.” Adrian Orr via Interest.co.nz

Meanwhile, overseas, inflation is falling fast and expectations are growing on rate cuts next year. Our central bank does not see rate cuts until well into 2025. US goods prices are already falling and US average mortgage rates have fallen from 7.8% to 7.2% in the last month.

Charts of the day

NZ’s educational performance keeps worsening, along with OECD

How the world is failing to achieve the Paris Agreement targets

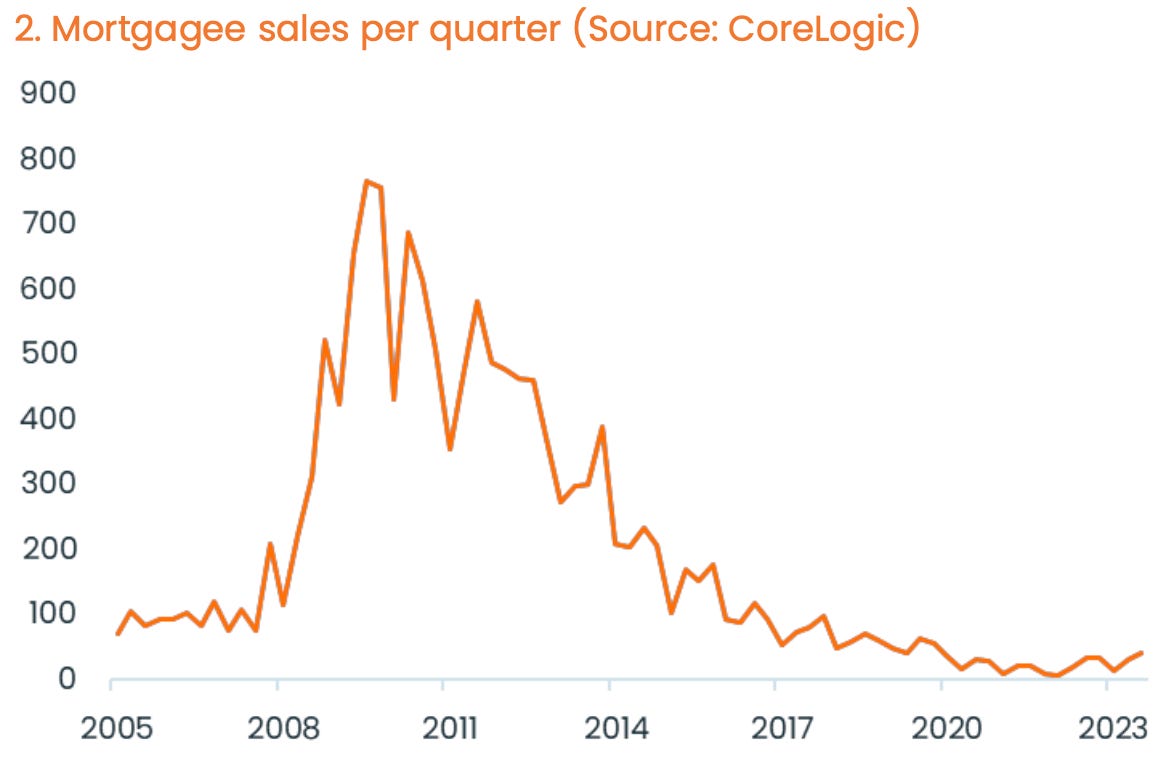

Actually, NZ’s ‘stressed middle’ of mortgaged owners aren’t too stressed

Video of the day

Just a snapshot of our broken housing market (with bits tacked on)

Cartoons of the day

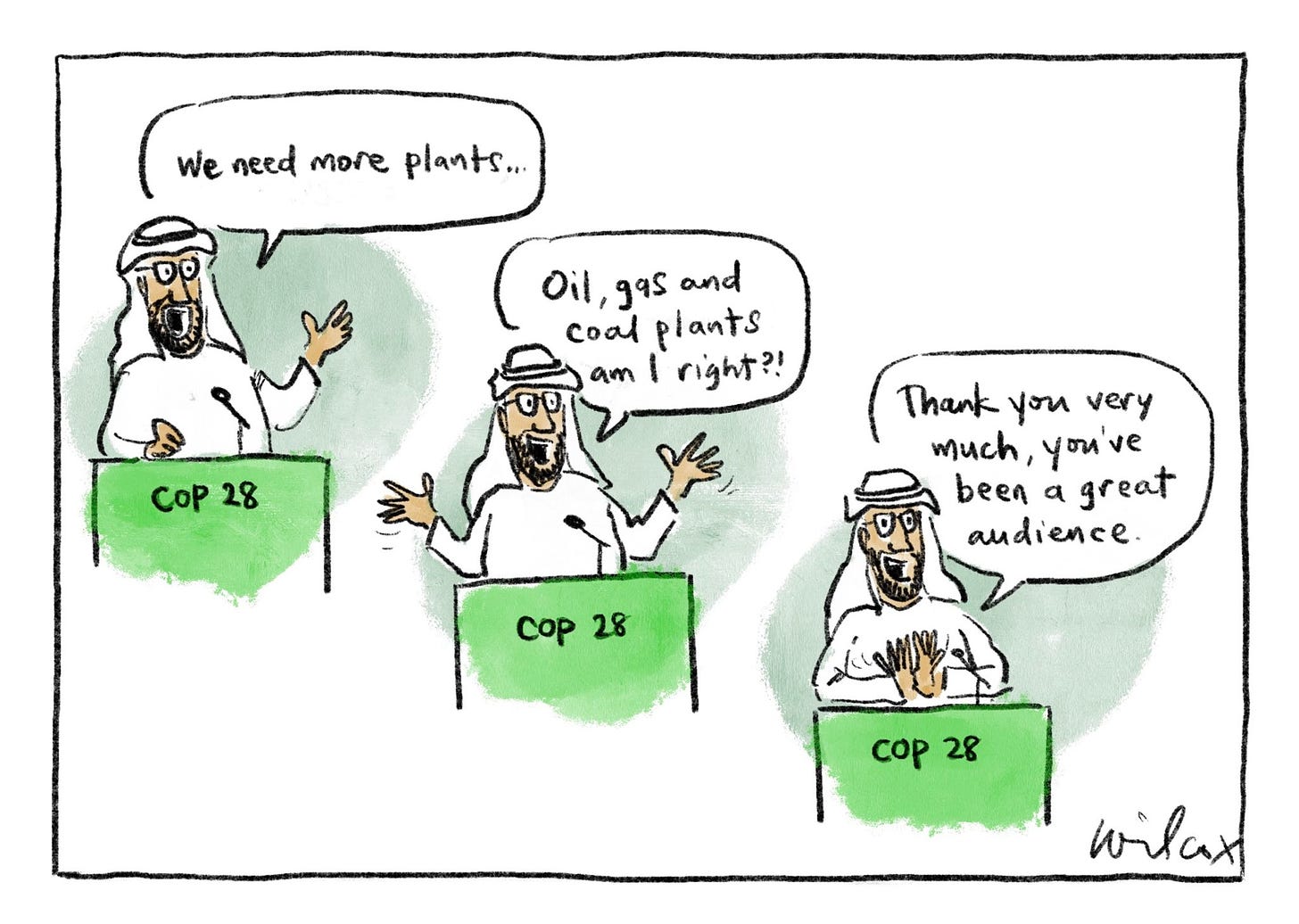

We’ve been a great audience

‘Can I offer you some oil and/or gas’

We have been warned

Timeline-cleansing nature pic of the day

Ka kite ano

Bernard

Norway’s Global Carbon Project published its annual analysis of trends in the global carbon cycle in the journal Earth System Science Data

Share this post