TLDR: Now we have a climate liability number to measure the potential failure of the RMA reforms with. Along with housing affordability effects, I think it’s the lens through which we should assess all our big decisions and changes.

A damning and detailed report by Sapere for the Infrastructure Commission (Te Waihanga) on the RMA reforms was released this morning. Sapere forecast the expected delays in the new system could block projects responsible for up to 34% of the emissions reduction needed to hit our net zero targets by 2050. It estimated that meant Aotearoa faced climate liabilities worth up to $16 billion by 2050.

The RMA reforms designed to improve our environment and wellbeing look set to make things worse without themselves being reformed again. A great example emerged yesterday when the Government announced it had punted a decision on whether to build the Lake Onslow dry-year hydro-battery project three years into the future, with building it taking a further seven to nine years at a cost of $15.7 billion (vs the $4 billion cost estimated in 2006 when it was first looked at).

That’s 2035. And the Government’s also looking at an alternative battery project made up of a grab-bag1 of projects and technologies costing $13.5 billion to build, but being more costly to run in the long term. When in doubt and bending under the pressure of a looming election reeking with the smell of bread and butter, a Government has yet again bought popularity at the expense of time, and cost for future generations.

Just as the first RMA enabled a deliberate starvation of infrastructure investment for 30 years to protect a low-tax and low-public-debt fiscal framework that delivered the most unaffordable housing market in the world and among the highest per-capita emissions in the world, the second RMA looks set to worsen the damage.

National Energy Spokesperson Stuart Smith said National would cancel Lake Onslow if elected in October and “focus on making it easier for renewables to be consented and built.” National’s Infrastructure Spokesman Chris Bishop described the Sapere report as a “giant wake-up call for Labour on their failing RMA reforms,” although Bishop has yet to say National would oppose the reforms in Parliament.

Here’s the key details from the report:

Sapere forecast total demand for consents would rise 40% by 2050;

Aotearoa is on track to not deliver between 11% and 15% of the necessary emissions reductions from energy and transport by 2050 because of consenting delays, which would incur emissions liabilities of $5 billion to $7 billion;

Delays may create a threshold where the projects don’t happen all, which would see total emissions fall 29% to 34% short of commitments, creating a potential liability of $13 billion to $16 billion; and,

Achieving net zero would require the new RMA to be in place by 2028 and for consent times to halve from what is expected.

News elsewhere today

Debit Suisse - Credit Suisse announced overnight it planned to borrow US$54b from the Swiss central bank to buy back debt and calm the farm with its very nervous savers and shareholders. Its shares closed up 19% overnight and the immediate price of the bonds expected to be bought back surged, but later maturity bond prices and the price of insurance against its bonds defaulting (Credit Default Swaps) remained at crisis levels.

‘We’re here to help’ - America's biggest banks, including JP Morgan, Bank of America and Wells Fargo, are in talks to deposit billions of dollars into the San Francisco-based First Republic Bank. It had US$213b in assets at the end of 2022 and has suffered in the last week as its mostly high-net-worth clients withdrew money to put into those other big banks. It was downgraded to junk status by S&P yesterday. Here's how the WSJ's editors described the situation this morning:

"The rescue would be an extraordinary effort to protect the entire banking system from widespread panic by turning First Republic into a firewall. Two banks have already failed in the past week after depositors withdrew billions, and fears have grown that First Republic could be next." Here's a free link to the full story on WSJ.

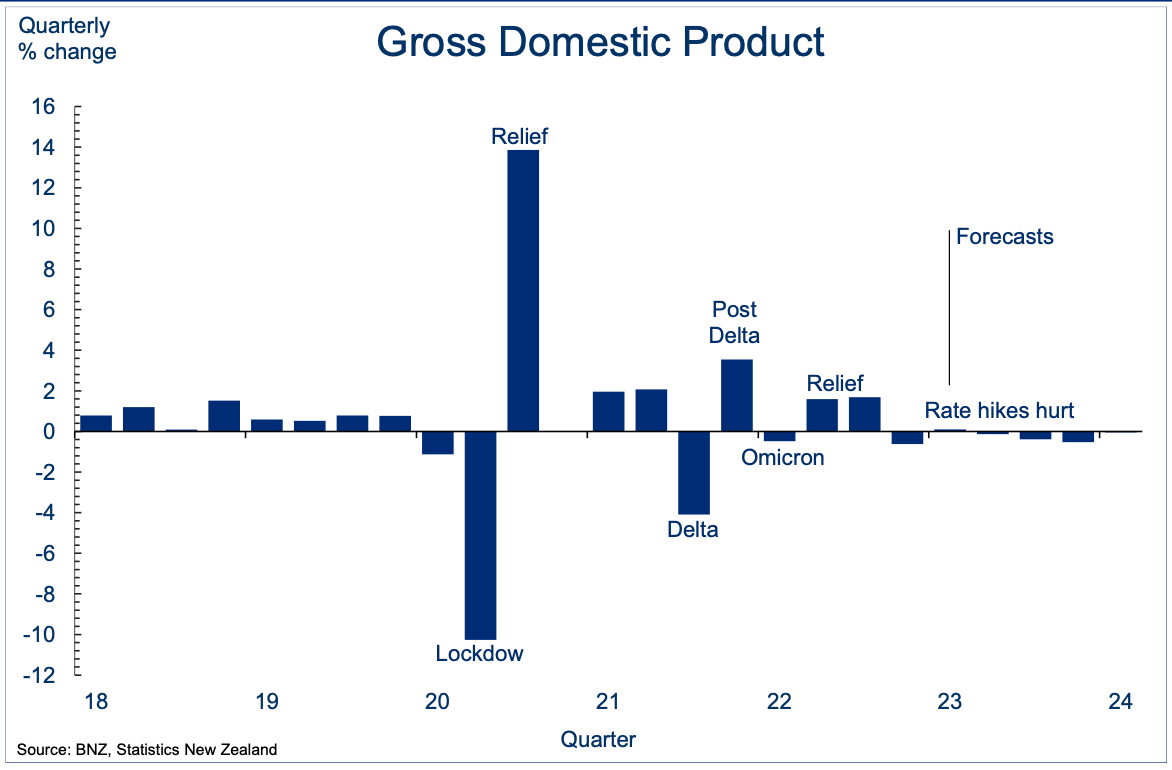

Swings and roundabouts - Stats NZ reported yesterday our GDP fell 0.6% in the Dec Qtr, which was down from a revised 1.7% surge in the Sept Qtr. That was a bigger fall than expected (especially the Reserve Bank, which forecast a 1.7% rise), but it's pretty noisy data. A big swing and a big roundabout. It didn't change the overall view on the economy still being too inflationary, albeit it's becoming clearer the RBNZ's hikes are now starting to bite.

Not so high for not as long - But one bank did change its OCR view. Westpac revised its forecast peak to 5.0% from 5.5% in a note late yesterday. That means just one more 25 bps hike to 5.0% on April 5. Most of the other banks are clustered around 5.25% as the peak. The RBNZ itself forecast a 5.5% peak for the OCR on Feb 22, but that's a bit out of date now.

“We suspect that the December quarter was more of an air-pocket during our descent, rather than an earlier and harder landing than the RBNZ was aiming for. Even so, the RBNZ will need to adjust its flight path accordingly.” Westpac Acting Chief Economist Michael Gordon in a note.

He has previous - It turns out Attorney General David Parker formally warned Stuart Nash not to breach the cabinet manual by commenting publicly on prosecutions way back in 2020. The Solicitor General even considered prosecuting Nash, but decided not to in the end, 1News reported last night. The Opposition called last night for him to resign his Economic Development, Forestry and Oceans and Fisheries portfolios, as well as the Police he has already given up. PM Chris Hipkins said it was in the past, but Nash is clearly on his last warning and his position in Cabinet is hanging by a thread.

Ka kite ano

Bernard

The Government used the word ‘portfolio

Share this post