Mōrena. Long stories short; here’s my top six things to note in Aotearoa’s political economy around housing, climate and poverty on Friday, September 6:

The Government keeps arguing its cuts on spending in real-percapita terms in health, education, child welfare, housing and public transport are needed to both pay for ‘income tax relief due to a cost of living crisis’ and to deal with ‘the dire state of the Government books we inherited.’ It also argues there’s ‘no money left’ when saying it will have to use private finance, tolls, water levies and congestion charges to pay for new roads, pipes, hospitals and schools, rather than Government borrowing.

But the professionals who analyse the Government’s books and have to put their money and careers on the line week after week by buying NZ Government Bonds (NZGBs) think there is no crisis whatsoever. Just last week, local and international bond fund managers and central banks bid a record $22.76 billion for an initial offering of $3 billion worth of a new 12-year Government bond with a fixed interest rate of 4.25%. The demand was so strong Treasury decided to double the amount of bonds it sold to $6 billion.

In solutions news, the opportunity for the Government and councils to signal a bi-partisan and decades-long programme of water, housing, transport, health and education investment funded from the Crown’s balance sheet from borrowing is obvious to these professionals, but not to either of the main parties. They remain trapped in the thought processes forged during the real Government economic crises of 1984 and 1991, back when the Crown had to beg foreign investors to stay and there were no KiwiSaver or NZ Superannuation funds to lend to the Government.

In Quote of the Day, an emergency medicine and patient safety doctor at Middlemore Hospital points out funding restrictions on GPs and primary health care are rebounding into even more demand to already-stretched EDs.

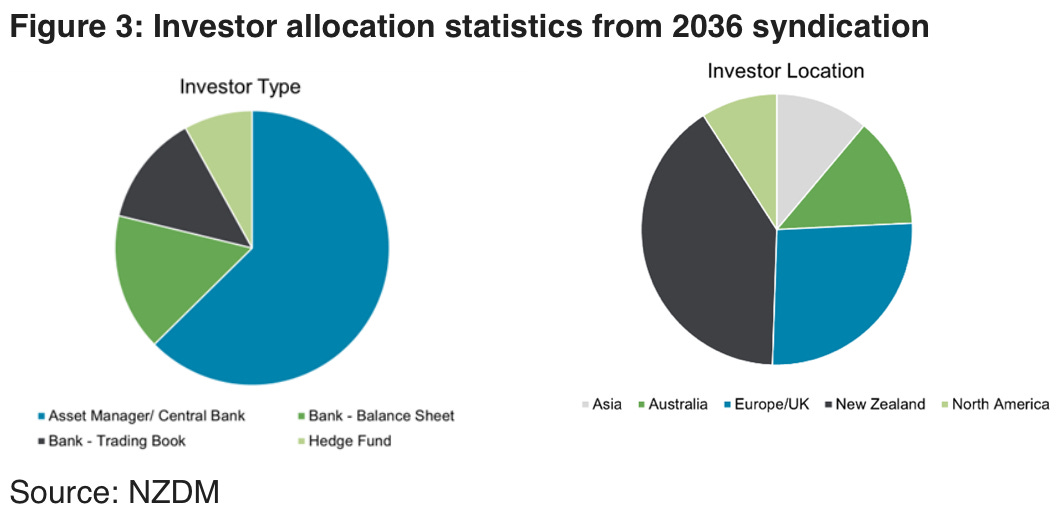

Our Chart of the day shows how massive demand for Government bonds comes mostly from New Zealand and mostly from banks and central banks who are literally forced to buy these bonds by savings surpluses among the richest households of New Zealand, Europe, Japan, China and the United States.

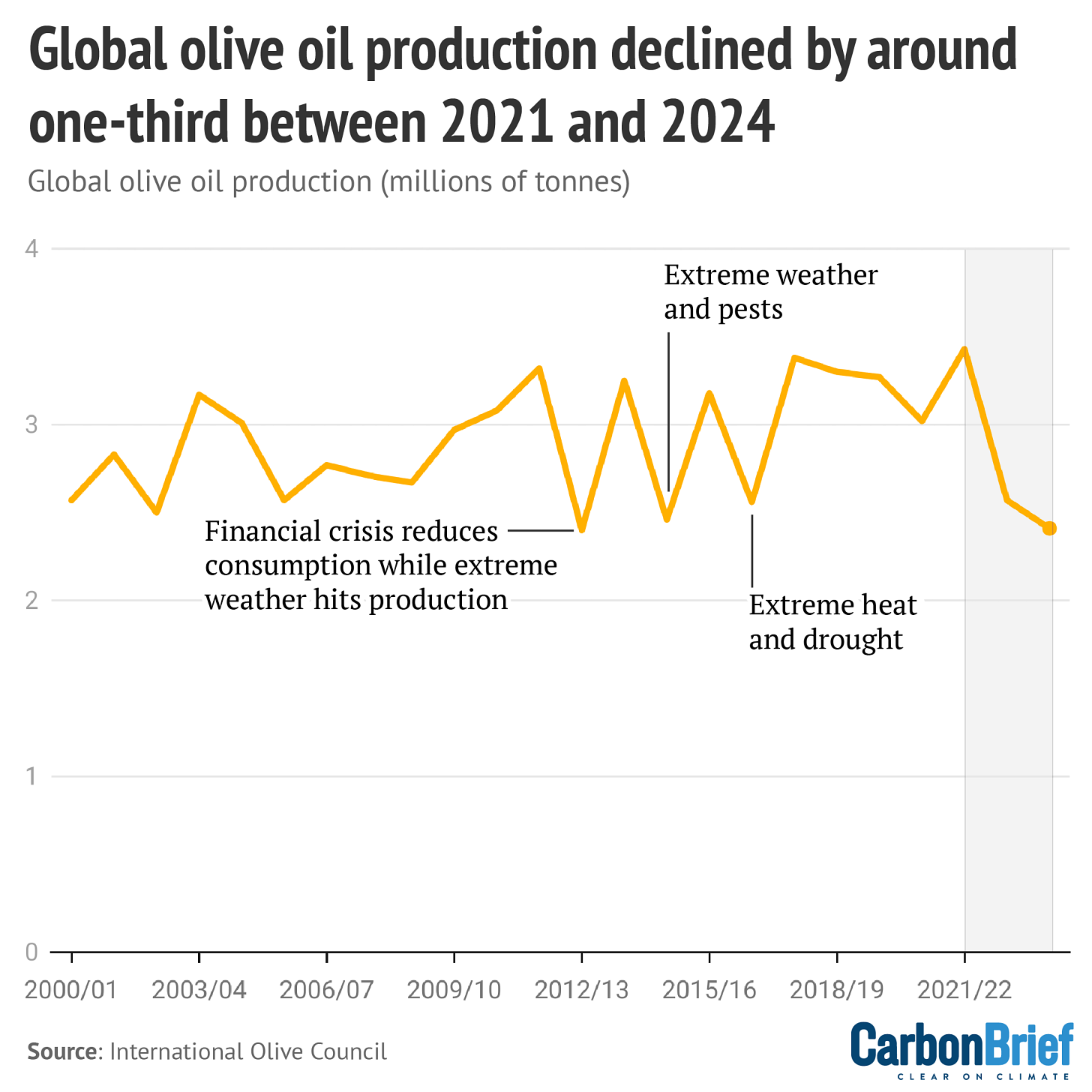

Our Climate graphic of the day shows how climate change has played a role in a drop in global olive oil production by a third in recent years.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers.)

The Top Six on Friday, September 6

1. There is no fiscal crisis in New Zealand. Full stop.

Lenders actually clamour for Government to borrow much, much more

You wouldn’t know it by listening to ministers of the Crown talking about the nation’s finances and why they can’t afford to build new hospitals or pay enough to GPs, nurses and doctors to avoid them burning out and flying to Australia.

But there is actually no ‘shortage of money’ nor a financial crisis that means the Government has to cut spending abruptly and abandon plans to resolve a $100 billion infrastructure deficit. There is no burning platform. There is no mess to clean up, no fiscal cliffs or fiscal holes.

How do we know? We know because the professionals who are paid more money than even PM Christopher Luxon to know about these things and make judgements are week in and week out desperate to lend to the New Zealand Government at historically very low interest rates. They would lend tens of billions more to the Government in a heartbeat if politicians of both sides said the nation wanted to borrow for long terms to invest in infrastructure that would make us all healthier, happier, more productive, earning higher incomes and therefore massively increase future income tax and GST revenues in amounts far higher than the interest payments on the debt.

“Asset managers are screaming out for supply.” Westpac Head of Debt Capital Markets Mat Carter

Yet that is not what we hear from our leaders, both from the new Government and the Labour-led Opposition who just left Government. From Luxon all the way down through Finance Minister Nicola Willis, Housing Minister Chris Bishop and to Infrastructure Under-Secretary Simon Court, there have been a series of sometimes hysterical and sometimes sombre drumbeat warnings of a fiscal crisis. They talked repeatedly of how, just like households, the Government’s finances were in trouble and the Government needed to ‘tighten its belt’ to restore Budget ‘sanity’.

Here’s Court last week saying in a speech to the infrastructure industry that the Government’s plans were based on the assumption that the Government simply could not afford to fund new infrastructure itself, and needed to bring in private finance in the form of Public Private Partnerships (PPPs) (bolding mine):

“Alongside that enabling resource management work, we are laser focused on providing fit for purpose funding and financing tools to unlock infrastructure delivery, for which the NIA (National Infrastructure Agency) announced yesterday by Minister Chris Bishop will be a front door to access. This work accepts the reality that tapping into private capital, capacity, and capability is a necessity and not a choice, especially given the dire state of the government books we inherited”. Simon Court

‘There are fiscal cliffs & holes. We have no choice. There’s no money left.’

Willis talked regularly about fiscal holes and cliffs as the Government abruptly stopped billions of dollars of construction work on new buildings, roads, footpaths, cycleways and homes by Kāinga Ora, the Ministry of Education, Waka Kotahi and Te Whatu Ora earlier this year. Civil contractors lamented the complete stop to new orders and work digging, pipe-laying and road building, while housing consents have dived. Social service providers report their bills being unpaid and unspent payments being clawed back. Principals were aghast at previously planned new buildings being cancelled at the last minute.

The Government even removed the board of Te Whatu Ora and parachuted in an emergency manager with an order to cut $1.4 billion of spending immediately, triggering a hiring freeze and delaying and downsizing hospital building plans in Dunedin, Nelson, Wellington and Whangarei. It even reneged on KiwiRail’s already-signed ferry building contract mid-construction in a move that may endanger our diplomatic relations with one of our biggest trading partners.

Those abrupt actions, shock firings and tearing-up of contracts sure sound like the sorts of thing a household would do when it ran out of cash. But why is the Government doing it? It must have run out of cash too, right? Surely, the banks are about to close the proverbial ATM and tell the computers that the Government’s cards should trigger ‘insufficient funds’ warnings?

Because that’s what a household would do if it had just been told by the bank that the overdraft won’t be extended and the customer’s credit rating was about to be downgraded.

There is no shortage of cash or a lack of lenders. Exactly the opposite.

So where’s the warnings of sovereign credit rating downgrades? Where are the spikes in interest rates on NZ Government Bond (NZGB) markets? Where are the Treasury bond auction failures? Where are the ratings agencies saying ‘something must be done’ to resolve this ‘fiscal crisis’?

We haven’t seen them because they’re not there. In fact, the exact opposite is what is happening on bond markets, in bond auctions and in discussions among the actual experts who have to stake their bonuses and careers on the line daily with their judgements about the creditworthiness of the New Zealand Government. They are saying the Government has low levels of debt, can easily pay the interest and they would lend much, much more to the Crown if only it asked.

Yet no one is, and it’s not because there’s no work that needs doing or no actual holes and shortages in health, education, welfare, transport and housing. The Infrastructure Commission says there is at least a $100 billion deficit. See quote of the day below to see what endemic under-funding is doing to the health system, let alone the health and productivity of workers, which means taxpayers.

2. A bond auction to prove there is no crisis

A moment of truth shows huge demand to lend long-term to the Crown

Late last month, Treasury’s Debt Management Office decided to launch a new 12-year government bond through a syndicate of bankers. This is a big deal in bond markets and has the ability to go badly if the timing is wrong or there is shortage of demand from fund managers and bankers. It offered $3 billion of bonds maturing in 2036 and offering a coupon (fixed interest payments) of 4.25% each year for 12 years. It said the most it could offer was $6 billion and indicated the final price would be somewhere between seven and 11 basis points over the May 2025 bond already trading on secondary markets.

So what happened? Surely, if the professionals believed Luxon, Willis, Bishop and Court, they would be reluctant to lend? Or at the least would only lend with high interest rates? Nothing of the sort. The wisdom of the crowds in financial markets is that New Zealand Government bonds are AA+ ok.

The auction gathered a record-high $22.7 billion worth of bids for the $3 billion of bonds. Treasury decided to borrow the maximum $6 billion and was able to do it at nine basis points over the market yield for the May 2025 bond. That meant the final ‘yield to maturity’ for lenders was 4.36%. In bond market terms, that is a stonking success and indicative of huge demand.

This actually wasn’t a surprise to the professionals. All the time that Willis and her colleagues were scaring the press gallery and voters with tales of fiscal holes, they had been talking amongst each other about how attractive New Zealand bonds were and how much demand there was from banks and fund managers, both here and overseas.

Here’s a sample from a panel discussion in Wellington in June hosted by KangaNews, which is a trade publication for bond managers and traders (bolding mine):

“Although in New Zealand we have good reason to focus on our debt levels, foreign investors view them as quite positive compared with many other countries. For NZDM, having a bigger issuance programme has actually had some benefits – we receive feedback that it has improved liquidity and global participation in our market.” NZ Debt Management’s Kim Martin

“New Zealand’s geopolitical stability presents an attractive future and supports investment in the jurisdiction. In short, New Zealand remains a key diversification market for some investors and provides a stable and reliable option for those looking to mitigate risk.” World Bank Capital Markets Financial Officer Chihiro Fujimoto

“Our orderbooks over the last two years have largely been driven by the domestic investor base, in particular bank treasuries. Regardless of where rates are, these investors need to buy for their liquidity portfolios so I expect there will continue to be demand domestically.” Nordic Investment Bank Head of Funding and Investor Relations Jens Hellerup

“About five years ago, annual programmes were about NZ$6-8 billion (US$3.7-4.9 billion). If you told me then that NZ$38 billion was going to be business as usual I would have been sceptical – but this is what we delivered last year and are intending for this year.

“Domestic capacity is finite: all the bank balance sheets need to buy our bonds to a certain level. There is also the regular inflow into KiwiSaver – some of which makes its way to NZGBs – and there are fund managers making choices every day. But our growth really is offshore.

“We are pretty comfortable with demand: our proportion of offshore ownership is more than 60 per cent and we see some new names every time we run a syndication. The bigger programme has made NZGBs more attractive to global investors that previously thought the credit story was fantastic but the market was just too small to invest time into looking at NZDM as an issuer.” Martin

“In the year to date, we’ve had reasonably robust supply from high-grade issuers excluding the (Supranational, Sovereign and Agency) SSA sector. But in the here and now there is absolutely an imbalance. Asset managers are screaming out for supply.

“For bank balance sheets, there has been a focus on the higher capital requirements coming in 2028. They are concerned about whether issuance in senior format could cannibalise their future capital programmes, including the continued refinancing of these programmes.

“Lack of supply in the Kiwi market is leading investors to look at Australian dollars, outright and on a swapped basis.” Westpac Head of Debt Capital Markets Mat Carter

3. Solutions: Decide our infrastructure deficit is fixable

Perhaps both major political parties should look at what lenders to the Crown are actually saying and doing, rather than using the ‘greatest hits of the 80s and 90s’ again and again about a ‘debt crisis’ and ‘cutting our cloth to fit’ and ‘living beyond our means’.

4. Quote of the day

The most awful feedback loop in our health system

“Seeing the flow on effects from this in the ED at Middlemore. Can’t access primary care = worsening of condition = come to ED in worse state, and in high numbers ++.” Carl Horsley, an intensive care specialist and Clinical Lead for Patient Safety at Middlemore Hospital commenting via X upon seeing the photo and article in the NZ Herald on queues for doctors in South Auckland.

5. Chart of the day

Huge demand for NZ Government bonds

6. Climate graphic

The best of the rest on Friday, September 6

Top six scoops

Politics scoop: Secretive legal advice argues charter schools likely to breach labour rules RNZ’s John Gerritsen and Russell Palmer

Health scoop: New advice about when to prescribe ‘puberty blockers’ has been kept sealed. Stuff’s Glenn McConnell

Housing scoop: Govt to bear more building consent liability BusinessDesk-$$$’s Dileepa Fonseka

Tax interview Labour Leader Chris Hipkins paves way for capital gains or wealth tax Stuff’s Tova O’Brien

Energy Interview Max Bradford says we should be open to nuclear options. Wairarapa Times Age-$$$’s Piers Fuller

Transport interview: The Nat MP who lobbied for speed humps at his local school Newsroom’s Jonathan Milne

The Kākā’s journal of record for Friday, September 6

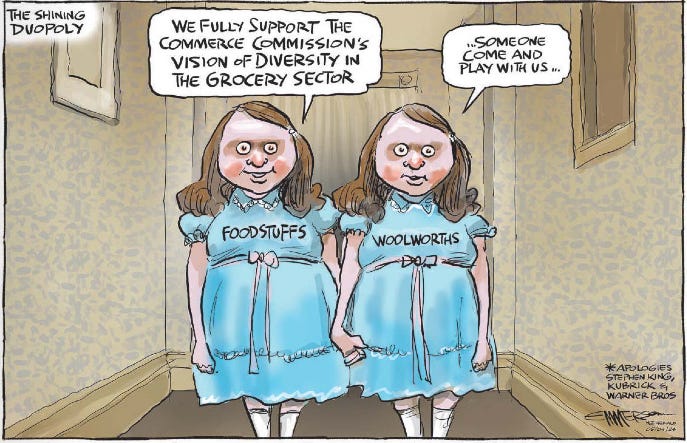

Economy: Commerce and Consumer Affairs Minister Andrew Bayly announced the Government would reform laws to make it easier to borrow, saying New Zealand had an overly "conservative lending environment". It would reform laws so lenders would not be punished if there was a “lack of financial harm,” and ensure directors and senior managers would not have personal liability for Credit Contracts and Consumer Finance Act breaches. NZ Herald

Infrastructure: Building and Construction Minister Chris Penk announced legislation to allow a wider range of building products to be imported, claiming a lack of competition in the construction supply chain was responsible for an over 40% increase in building costs since 2019. Upcoming legislation would also exempt projects under $65,000 from the building levy, and allow builders to make minor customisations to projects without needing a new building consent.

Economy: Reserve Bank manager Christian Hawkesby gave a speech about the RBNZ's financial stability framework for resilience and competition in the economy, aiming to maximise both where possible.

Environment: Forestry Minister Todd McClay announced proposals to remove what he called an "unworkable regulatory burden," on the forestry sector by replacing a number of council-applied standards for commercial forestry with one nationally applied standard. He specifically proposed to repeal a clause that allows councils to apply stricter rules. RNZ

Economy: The Commerce Commission announced that mobile network operators need to make it easier for New Zealanders to compare coverage between providers. The Commission said mobile providers should standardise their coverage maps to allow customers to switch providers without penalty.

Economy: ANZ's Commodity Price Index for September found that NZ exporters are reporting increased shipping costs due to congestion in the Port of Singapore. The volume of cargo through the Suez Canal is now at one third of normal levels due to tensions in the Middle East.

Finally, some fun things

Cartoon of the day

‘Spooky in a bad way’

Timeline-cleansing nature pic

‘Shut up! I’m trying to sleep off a migraine. Too many squishy berries.’

Ka kite ano

Bernard