Kia ora. Long stories short, here’s my top six things to note in Aotearoa’s political economy around housing, climate and poverty on Friday, September 13:

Treasury told the new Government it considered a 50% net core crown debt limit fiscally prudent under the Public Finance Act (PFA), but the National/ACT/NZ First coalition decided in Budget 2024 to go ahead with a 20%-40% target range.

Treasury warned the new lower 20%-40% range might undermine the coalition’s aim of building a stable public investment pipeline and risked “passing up on productivity and growth enhancing investments.”

In solutions news, Climate Change Minister Simon Watts said this week it was unlikely the public would accept the Government spending billions on overseas emissions credits, meaning any Government would instead have to do a lot more to reduce emissions locally, although he didn’t say how, and noted it was getting very late in the day to do that without reneging on the Paris Agreement.

In Quote of the Day, outgoing Climate Change Commission Chair Rod Carr cursed politicians elected to lead, but who don’t on climate change.

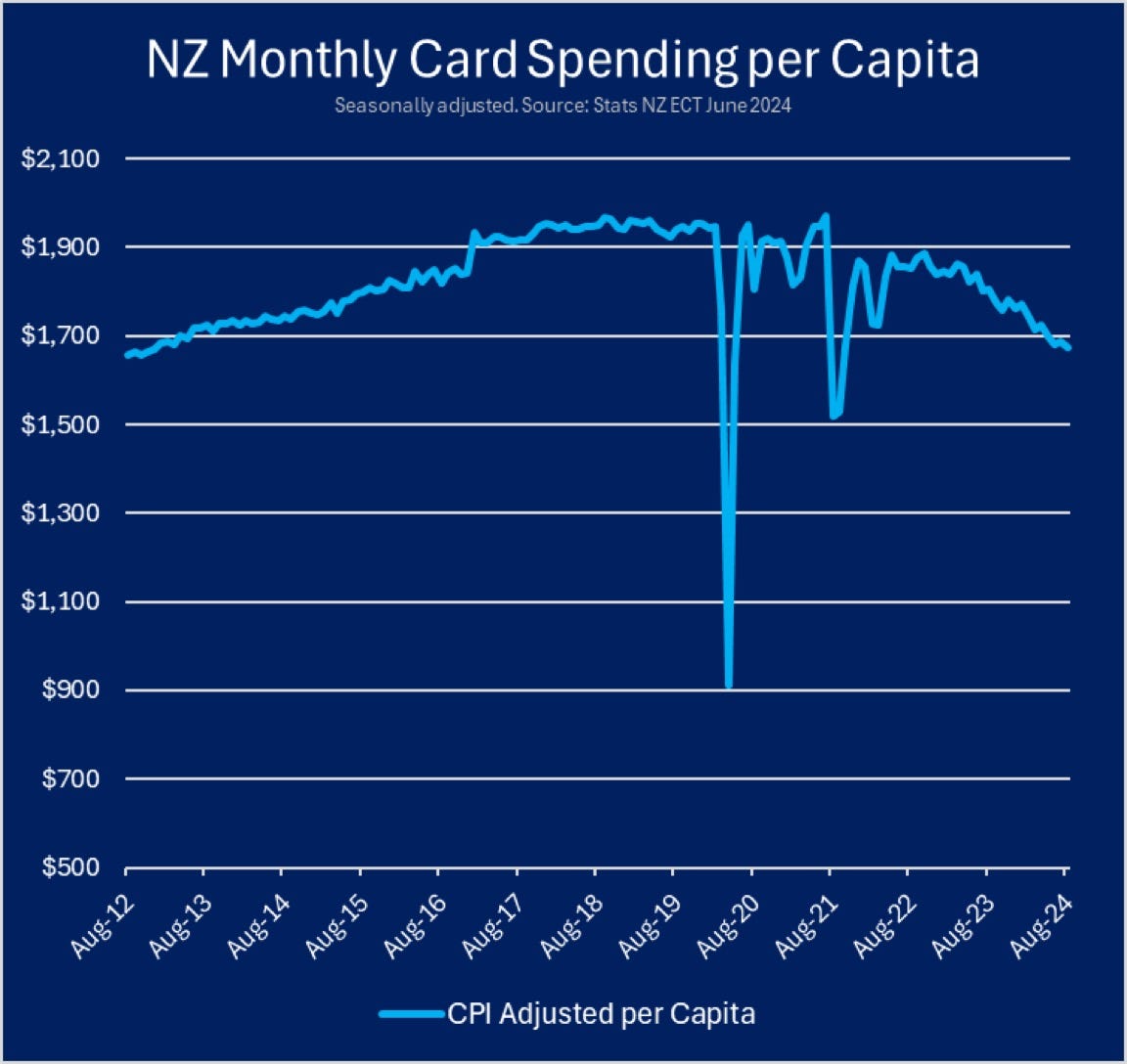

Our Chart of the day shows real per-capita consumer spending with credit and debit cards in New Zealand has fallen to levels last seen 12 years ago.

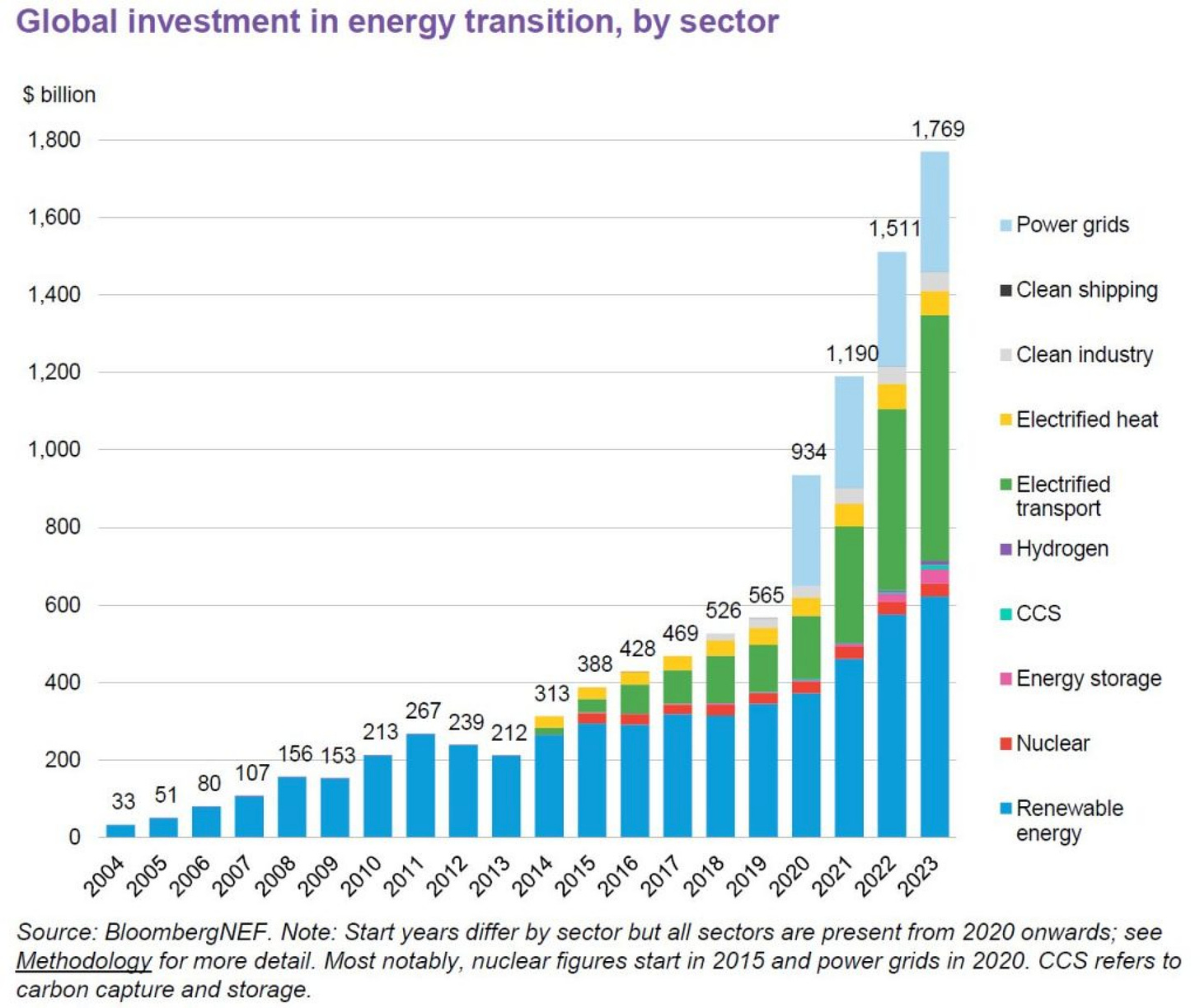

Our Climate graphic of the day shows a massive increase in renewable electricity generation globally over the last four years, and much more than in New Zealand.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers.)

The Top Six on Friday, September 13

1. ‘You can actually safely borrow $80b more’

Treasury published its advice and a range of papers for ministers and Cabinet used to prepare Budget 2024 yesterday, including advice the new Government could actually prudently carry net core Crown debt of up to 50% of GDP, rather than than the 20% to 40% chosen by the Government as its target range.

In effect, Treasury told the Government it could safely borrow around $80 billion more over the coming years to invest in a pipeline of ‘productivity-enhancing’ investments if it wanted. The official advice went so far as telling the National/ACT/NZ First Coalition that choosing the lower target range meant the Government would be “passing up” opportunities to establish a decent pipeline of infrastructure work that would enhance the potential for the economy to grow real wages.

Instead, PM Christopher Luxon and Finance Minister Nicola Willis chose to portray the Government’s finances as in such a mess the new Government had no choice but to carve 6.5% to 7.5% off most ministerial budgets in often arbitrary ways to pay for tax cuts that Treasury advised would mostly go to those on the highest incomes.

Here’s how Treasury framed the situation:

“Treasury has done extensive analysis on the maximum sustainable debt level in 2022 and considers that a net core Crown debt level of up to 50% of GDP is prudent.

“The increased emphasis on the debt objective (20%-40% of GDP) may result in sharper trade-offs between the Government’s fiscal strategy and the objective of increasing the stability of the capital investment pipeline,” Treasury advised in various papers before the May 30 Budget, which included the new Government’s Fiscal Strategy.

It also included this advice to the Government in several papers:

“The Treasury’s indicative forecast update shows that net Core Crown debt may not return to within the 20-40 % of GDP range until well after the forecast period. The proposed objective could therefore create additional pressure to offset capital investment with future forecast operating surpluses.

“Moreover, the increased emphasis on the debt objective may result in sharper trade-offs between your fiscal strategy and your objective of increasing the stability of the capital investment pipeline. In the event that operating deficits increase in response to an economic shock, there would be stronger incentives to reduce investment to meet the debt objective (assuming that it is not suspended).

“Note that a 20 – 40% debt range based on net core Crown debt would be a more binding debt objective than recommended by the Treasury, and is more likely to create a tension between the fiscal strategy and a stable pipeline for capital investment.

“The implication of a more binding debt rule is that it will be more likely to constrain your future fiscal decisions, potentially including your ability to borrow to finance future capital investment.

“We understand that you would like to ensure that any debt objective does not cut off opportunities for high-quality public investment, given that additional capital investment and making better use of existing asset may help boost long-term productivity growth.

“The Treasury’s early analysis suggests that a 20 – 40% debt range could create additional pressure to offset capital investment with increased forecast operating surpluses.” Treasury advice.

2. ‘You’re passing up productivity-enhancing investments’

Its starkest framing of the issue was in one paper with talking points in Q&A form for the Government (bolding mine):

“Will the new debt objective mean that there is less room to borrow to undertake capital investments?

“Having a range for debt levels recognises that pursuing very low levels of debt can involve reducing capital investment and passing up on productivity and growth enhancing investments.” Treasury advice

3. Solutions news? Or setting us up to renege?

‘We’ll have to do more here to meet our Paris commitments’

Climate Change Minister Simon Watts made some comments earlier this week to the Climate Change and Business Conference in Auckland that raised quite a few eyebrows around whether the Government remained committed to reaching our Paris Agreement Committments to reduce climate emissions, which are now hard-coded into our trade agreements with the EU and UK.

Carbon News’ Liz Kivi reported Watts told the conference it was unrealistic for the Government to spend billions on emissions credits overseas needed account for 100 million tonnes extra of emissions to meet our Paris Committments, even though that is the current avowed strategy, under both Labour and National. A charitable interprepretation is the minister was foreshadowing a significant ramping up of emissions reductions efforts by the Government to meet our targets wholly domestically.

Here’s the key quotes:

“When I stand up and say, ‘Guess what, I'm going to write a cheque for $4 billion in your taxpayer money to some country overseas,’ you know people go: 'I sort of want my hospital and I want my health care over that. You know, I love it, but I sort of want other stuff.'

“The political reality of writing a cheque to someone overseas, for benefits that will be achieved overseas, is sort of nice, but I don't think it's realistic, and hence why the conversation, from a government point of view, is we need to do everything possible in order to reduce our domestic emissions at a profile that doesn't decimate our economy.

“We didn't inherit a plan when we came in that would have hit that target, let's be really clear about that, other than writing a cheque overseas,” Watts said. “The reality in a deficit situation, and a fiscal situation is politically, and I think just realistically, that is not the option that I think the majority of Kiwis want their government [to take]. They want us to do everything that we can do back here at home.

“All options are on the table in the context of us being able to do that. The challenge is, and I've got to be realistic and up front, even if we did everything that I could do today in the next 65 months, because time is my biggest challenge really, what can you do in 65 months?” Simon Watts talking at the conference, quoted by Carbon News.

Climate Change policy academic and ETS expert Christina Hood noted the comments in this LinkedIn post (bolding mine):

“Some astonishing comments reported here from the NZ Climate Minister Hon. Simon Watts - at face value contradicting the government's election promise (and repeated recent assurances to Pacific nations and trading partners) that the NZ government is committed to the Paris Agreement and to achieving our NDC.

“If paying for Article 6 cooperation is "unrealistic" that would mean New Zealand reneging on its Paris Agreement NDC, given that use of Article 6 is essential to meet that target.

“If he means something different, he'll need to clarify.” Christina Hood

4. Quote of the day

‘I curse those who we elect to lead and fail’

"I think we are making a horrible mistake when we make climate-related investment decisions discounting the future as if it was some sort of financial instrument at a 6% discount. You halve the value of the future every 12 years.

“Thirdly, I curse those who we elect to lead and fail. On behalf of all New Zealanders, I curse those who only pander to their stakeholders and vested interests.” Retiring He Pou a Rangi-Climate Change Commission Chair Rod Carr speaking with RNZ’s Eloise Gibson at this week’s Climate Change and Business conference. Via BusinessDesk-$$$’s Greg Hurrell

5. Chart of the day

The true scale of our retail and hospo recession. Back at 2012 levels.

6. Climate chart/pic/graphic of the day

‘Always look on the bright side of life…then some whistling’

The best of the rest on Friday, September 13

Top six scoops, deep-dives, columns & Op-Eds

Health: 'Unfair and illegal': GPs lay complaint with Commerce Commission NZ Herald’s Michael Morrah

Science; Cost cutting could ‘devastate’ research on NZ’s biggest tsunami threat - 85 experts NZ Herald’s Jamie Morton

Op-Ed by Dr Art Nahill in NZ Herald-$$$: 'I Can no longer bear to patch people up' - retiring doc's fix for failing health system

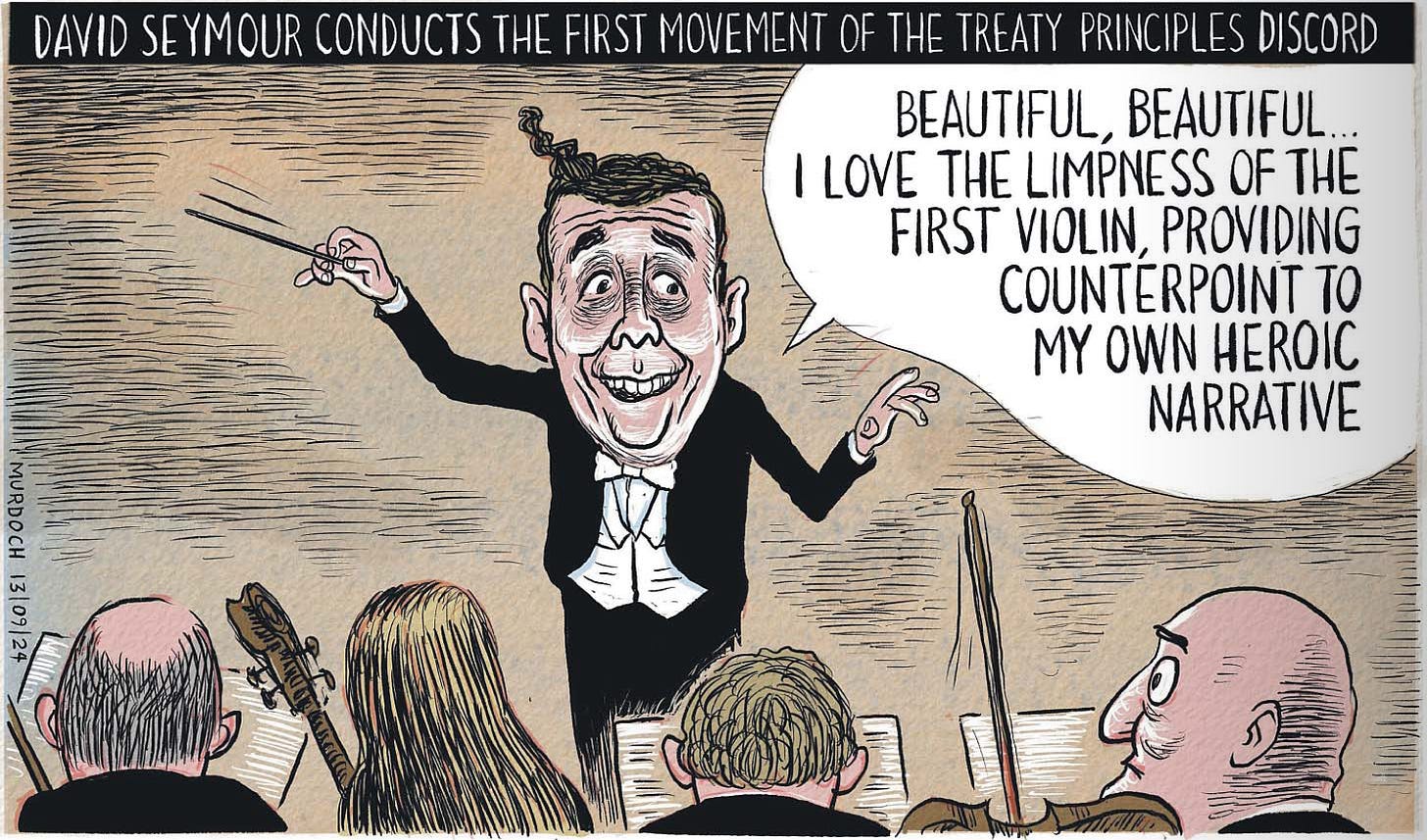

Column by Audrey Young in NZ Herald-$$$ Audrey Young: David Seymour's Treaty bill is already a disaster

Deep-dive: Budget docs: Treasury recommended less health funding, lower tax cuts NZ Herald

Poverty: Govt aware of school lunch benefits before cutting funding RNZ’s John Gerritsen

The Kākā’s Journal of Record for September 13

Energy: Ministry of Business Innovation & Employment data showed that, due to low hydro lake levels, more coal and gas were needed to meet electricity demand between April and June. Despite a 50% increase in wind capacity, coal generated more electricity than wind for the first time since June 2021. BusinessDesk

Climate: A report published in The Lancet Planetary Health differentiated between 'safe' Earth-system boundaries, which ensure the basic stability of Earth systems, and 'just' boundaries, which would allow for a minimum standard of living to be enjoyed by everyone on Earth. The report builds on 2023 research which argued that seven of eight safe and just boundaries had already been exceeded. Guardian

Health: Associate Health Minister Casey Costello announced that disposable vapes will be completely banned under the new Smokefree Environments and Regulated Products Amendment Bill. The Bill also increases fines for sales to under 18s, and introduces restrictions on the visibility of vape products and the proximity of vape stores to ECE centres.

Economy: Stats NZ reported that NZ food prices increased 0.4% in the year to August 2024, with restaurant/cafe food and ready-to-eat foods mostly responsible. Fruit and vegetable prices fell 12.2% in the year to August, however, driven by kūmara, potatoes, and lettuce. RNZ

Health: Health Minister Shane Reti elaborated on the Government’s health targets, including increasing childhood vaccination and reducing wait times for cancer treatment and emergency departments. Reti said the Government is planning to deliver more community chemotherapy centres and radiography machines, and increase the number of beds, and operating theatres in public hospitals. 1News

Health: The Public Health Communication Centre warned that NZ's decision to opt out of proposed joint Australia-NZ infant formula marketing standards could undermine infant health. A study in the Lancet found that infant formula sales are driven by misleading claims with little to no supporting evidence, and recommends that infant formula marketing should be banned.

Finally, some fun things

Cartoon of the day

‘Yes, Maestro…’

Timeline-cleansing nature pic

Some colour to brighten up our days

Ka kite ano

Bernard

Share this post