TLDR & TLDL: Grant Robertson and the Labour Government have effectively given up on making housing affordable for most home buyers any time in the next couple of decades. Robertson admitted that yesterday when saying he wanted house price stability, rather than the big drops most voters want and the OECD fears in the wake of the 40% spike in the last two years.

Robertson said he didn’t believe home owners wanted their own house prices to fall and has effectively repeated the Prime Minister’s underwriting of house prices at current levels. He is saying house prices only ever ratchet up. They can never, and will never, be encouraged or allowed to ratchet down in a way that would make housing affordable again for current generations of first home buyers.

(I have published this for all and opened it up for the public. I’m able to do this sort of accountability and explanatory journalism on housing, poverty and climate because over 1,300 people have become paid subscribers. I’d love you to join as a full subscriber, which allows you to comment below and gives you access to all my daily emails, and access to my weekly webinars and chat threads. Come and join us.)

Yesterday the OECD issued its biennial survey of New Zealand’s economy and included some analysis of what it would take for house prices to become more affordable again, or at least as affordable as the ‘housing crisis’ levels Jacinda Ardern pointed to in 2017 when pledging a housing affordability transformation to get elected.

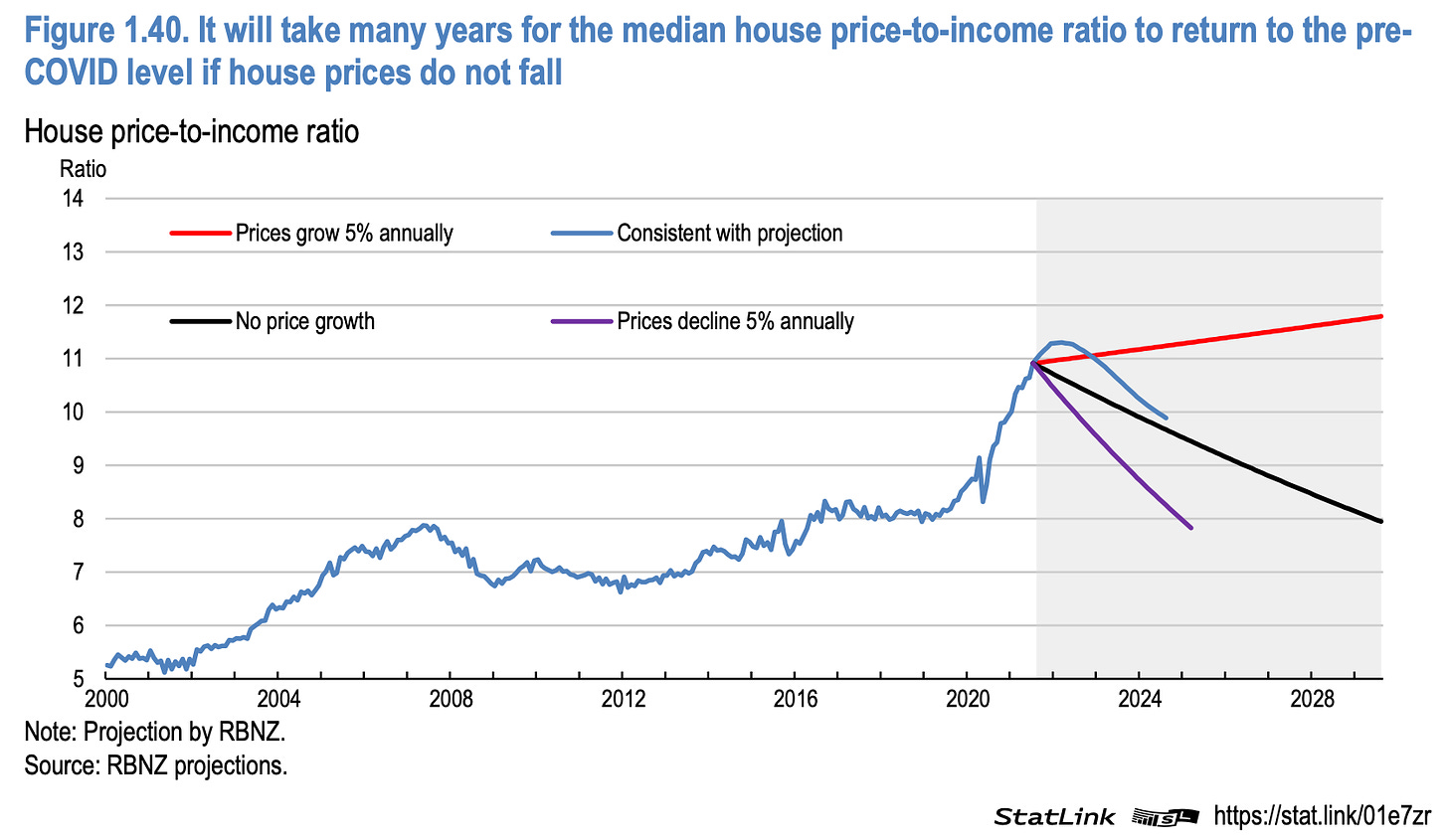

This chart below shows just how much the horse has bolted in the last four years since then, and what it would take to make housing more affordable. Even a 5% fall in house prices per year, year upon year, would be required to return affordability to 2017 levels, as measured by price to income ratios, and even then it would take four years. Simply holding prices stable would mean it would take eight years to get back to eight times income. The implied trajectory would not see affordability back to 2013 levels until 2040, and not until 2060 to get back to five times income. That was previously seen as the upper end of the affordable range.

Instead, the PM’s preferred house price growth of around 5% per year would see housing affordability worsen to 12 times income from eight times income when Labour took office.

Anything sooner than 2028 would require a 20-30% fall, which is line with the 47% of voters in this week’s 1News/Kantar poll who said they wanted house prices to fall “a lot”. A further 29% wanted prices to fall “a little,” while only 18% wanted no fall.

The OECD is so concerned at how over-valued the market is it is concerned about a sudden correction.

So what does the Government actually want?

So I asked Deputy Prime Minister Grant Robertson yesterday at the weekly post-cabinet news conference whether he also wanted house prices to fall a lot, and whether the Government would intervene to stop that happening. He essentially didn’t answer the questions by saying he didn’t see it happening, and didn’t think New Zealanders really wanted that.

Here’s the transcript of our exchange (the audio is in the podcast above):

Bernard Hickey: The OECD said they were worried about a possible sharp drop in the housing market. Would the government act to ensure that that didn't happen if it was threatened?

Grant Robertson: There's a lot of forecasting speculation on it in the OECD report and so I tend to listen to that but also listen to what we see from forecasters here in New Zealand, the Reserve Bank, Treasury and others. They are not forecasting the kind of sharp drop that you're talking about. They are forecasting over the course of the next year or so. As I've often said, our position is we do want housing to be more affordable, and that we will take action to do that. But I haven't seen anything in the forecasts that we rely on here in New Zealand that would cause me to intervene in that situation.

Bernard Hickey: Do you agree with the 47% of people on the one news Kantar poll who said they wanted to see house prices fall a lot?

Grant Robertson: The message I get from that is that New Zealanders want housing to be more affordable. They want people to be able to buy their own home and live in the home and they want to make sure that the price of housing reflects that value. That doesn't necessarily translate to people wanting the value of their own home to drop.

And so I do think you've got to be a little bit careful about polling questions like that. Regardless, we share the aspiration of New Zealanders that we want more people to own their own home. It is a long journey to come back from around 30 years of the way in which our housing market has gone in the direction it has, but we believe we're undertaking the things that need to be done in that space.

Robertson was later asked if average house prices of almost $1m in some provincial cities and outer suburbs (Hastings, Lower and Upper Hutt and Porirua) were affordable for first home buyers. His answer was it would take some time, especially as he wanted stable prices. Here’s the transcript: (The bolding is mine)

Robertson: “We don't believe that the price inflation we've seen in the housing market in recent years is affordable and so we've been taking actions both in terms of the supply side building more houses, we've got record consents, and on the demand side, to be able to dampen particularly investor and speculative demand. I've often said I don't sit here saying I want house prices to go down by X percent. We set the criteria. We set the rules so that they can have a more affordable housing market. And that's what we'll be worried about.

“There's drops forecast by both the Treasury and by some economists at the moment. That is the nature of the nature of the housing market, and some of the changes we've made, some of the changes that the Reserve Bank has made. I'm not expressing a view either way on that here. I answered Bernard's question before about not intervening. We're trying to set up a stable housing market in New Zealand and we put the rules in place that I believe will both help do that and make housing more affordable, but it doesn't happen quickly.”

Which begs the question: how can the Government possibly be credible in saying it wants affordability when its own preference is for no improvement any time soon.

Here’s my final exchange with Robertson (bolding mine):

Hickey: Just finally on housing affordability. How are you going to get to an affordable housing level, whatever that is, without a big drop in house prices?

Grant Robertson: The forecast that we're seeing now from the likes of the Treasury and a number of banks do see drops in house prices. We've always said as that we will set the rules to try and make house prices more affordable, whether that involves a drop of the kind that’s been forecast from the Treasury or not.

How do we do it? We do it unfortunately, over a long period of time, because it takes a long time to build up the stock of houses that we need, because we inherited such a large deficit in that stock, but we're making progress in that regard. We do it by on the demand side, making sure that we, for example, remove foreign buyers from the existing home market, by making sure that we don't allow advantages to speculators. It has to build up. The Reserve Bank has its role as well, which obviously they're continuing to work on.

His comments imply an acceptance of the status quo, and that the Government has no intention of ratcheting prices down, or improving affordability any time soon, or even for decades. Why not? Is the market now too big to fail or fall for political and financial reasons?

Here’s the final exchange from yesterday (bolding mine):

Bernard Hickey: Is this market now too big to fail? You can't afford for it to drop quickly. So you're going to essentially sentence another generation of first homebuyers to having to wait decades and decades before it gets affordable.

Grant Robertson: Now I don't accept that in terms of the overall premise of that. We've taken a number of actions to make the housing market more affordable. We will continue to work on those and we will continue to make sure we build more houses. This is a problem decades in the making that unfortunately is going to take some time to solve.

OECD cites RBNZ actions in big house price move

Robertson and the Reserve Bank have previously denied responsibility for the surge in house prices after their decision to print $58b to unleash a ‘wealth effect’ boost for the economy. But the OECD sheets the blame straight back to the Government and the Reserve Bank in its report (bolding mine).

“Runaway house prices are a major drag on wellbeing in New Zealand, especially for first-home buyers, and are by far the greatest concern identified by households in the IPSOS NZ Issues Monitor. Real house prices had already increased much more than in most other OECD countries since the turn of the century before the COVID-19 pandemic hit but went on to rise by another quarter since then, largely owing to the monetary policy measures implemented to support the economy House prices have also increased more relative to fundamentals – household income and rents – than in most other OECD countries. The large rise in house prices has increased wealth inequality between house-owners and non-owners.” OECD

We are different and it is a crisis

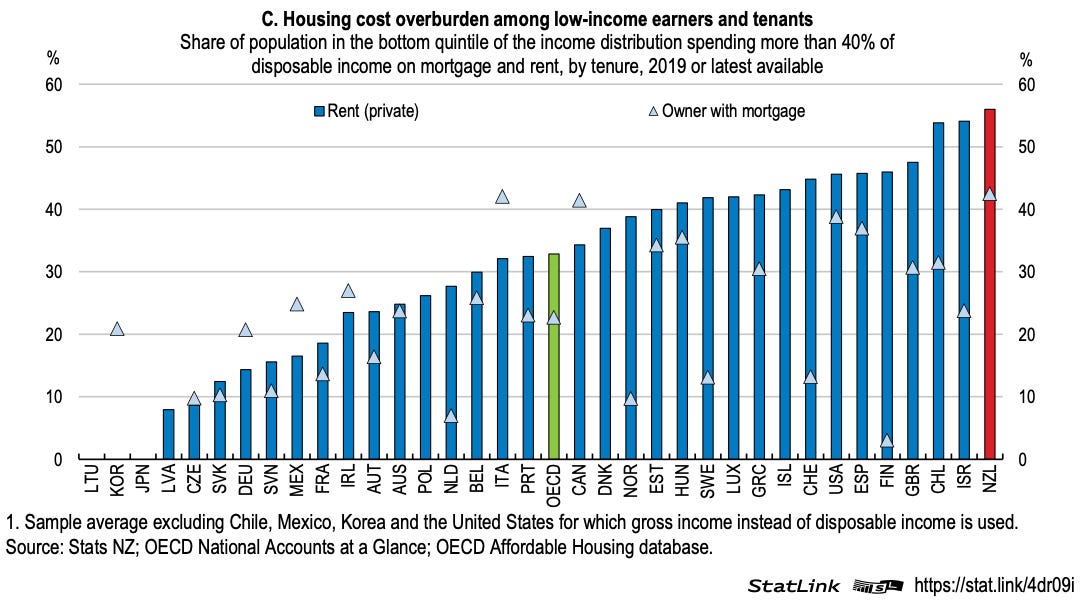

Here’s the OECD’s charts showing the scale of New Zealand’s exceptionally awful housing and rental affordability numbers.

Here is the final nail in our society’s housing coffin. This chart shows the share of the population under intense rental stress. We are the worst in the OECD.

We can’t wait for 40 years

The implications from the PM and the Deputy PM’s recent statements are that everyone will just have to wait a few decades for this to solve itself.

In my view, we can’t wait that long, if only because of the massive costs everyone will have to pay in decades to come in terms of child poverty through the justice, health and education systems, but also the lost productivity growth because another entire generation is shackled, living in unhealthy, expensive, insecure and overcrowded houses.

Ka kite ano

Bernard

Share this post