TLDR & TLDL: New mortgage lending figures for the first month of operation under the CCCFA suggest the ‘credit crunch’ talked about by mortgage brokers was less of a crunch and more of a slight grind down.

Reserve Bank figures out yesterday showed there was still $7.9b of new lending in the month of December, which was down 13% from November, but in line with the $8.3b average for the rest of 2021 and above the $7.2b seen for the last two years. New first home buyer lending of $1.56b was down just 10% from November and in line with the monthly average for 2021.

See more of my analysis below the paywall fold on why there’s still plenty of credit being pumped into the housing market and still listings shortages in the hottest markets. Also, more detail on why the David Clark-ordered MBIE review of bank lending under the CCFA is rightly sceptical of the very crunchy crunch talk.

Elsewhere in the news this morning:

almost half (47%) of people polled by 1News/Kantar said this month they wanted house prices to fall “a lot,” while a further 29% said they wanted them to fall “a little,” while 18% wanted no fall;

the OECD is calling again for Aotearoa-NZ to extend the retirement age beyond 65 to contain the growth of long-term debt (OECD);

the US and UK threatened financial and other sanctions on Vladimir Putin’s family and close circle of fellow Russian oligarchs that they said would cut them off from the international financial system and stop them parking money in West or sending their kids to top Western universities (Reuters); and,

Charlotte Bellis hit back overnight at Chris Hipkins’ statement yesterday challenging her view about there being no MIQ places for her, describing it as “incredibly disrespectful”. (Stuff, NZ Herald)

Later today, I’ll be covering an online OECD news briefing with Grant Robertson and OECD Secretary General Mathias Corman on its survey of New Zealand, its first since the onset of Covid. I’ll also be watching out for the Reserve Bank of Australia’s interest rate decision at 4.30 pm NZT, where it is expected to bring forward the timing of its first rate hike from next year to later this year.

Not as crunchy as we were all told

We finally got the real data to test all the anecdotes we’ve been hearing for a couple of months from mortgage brokers about it being virtually impossible for first home buyers and any non-standard landlords to get new loans because of the December 1 introduction of the CCCFA.

I’ve been wary of buying into the all the noise suggesting some sort of complete stop in lending or that the CCCFA and the Government are solely to blame for a looming ‘credit crunch’ caused by overzealous bureaucrats and bank loan officers and directors being too freaked by the threat of legal action to sign any loan documents.

The Reserve Bank’s tightening of LVR restrictions in November is also a big factor, as is a natural and sensible caution by banks themselves not wanting to overexpose themselves to a market most say is over-valued. It’s much easier to blame the meddling Government’s bureaucrats than either the Reserve Bank, which grants them the license they have to literally invent money, or their risk managers back in Sydney or Melbourne.

It turns out all the noise about a collapse was mostly noise. The actual figures show the slowdown wasn’t that serious in the first month under the CCCFA.

Reserve Bank figures out yesterday showed there was still $7.9b of new lending in the month of December, which was down 13% from November, but in line with the $8.3b average for the rest of 2021 and above the $7.2b seen for the last two years.

New first home buyer lending of $1.56b was down just 10% from November and in line with the monthly average for 2021. It was still above the December levels of the previous three years.

The investor share of high LVR lending (albeit with their 60% threshold rather than the first home buyer threshold of 80%) did rise above the first home buyer share for the first time in over a year, but remains well below the extreme levels of early last year.

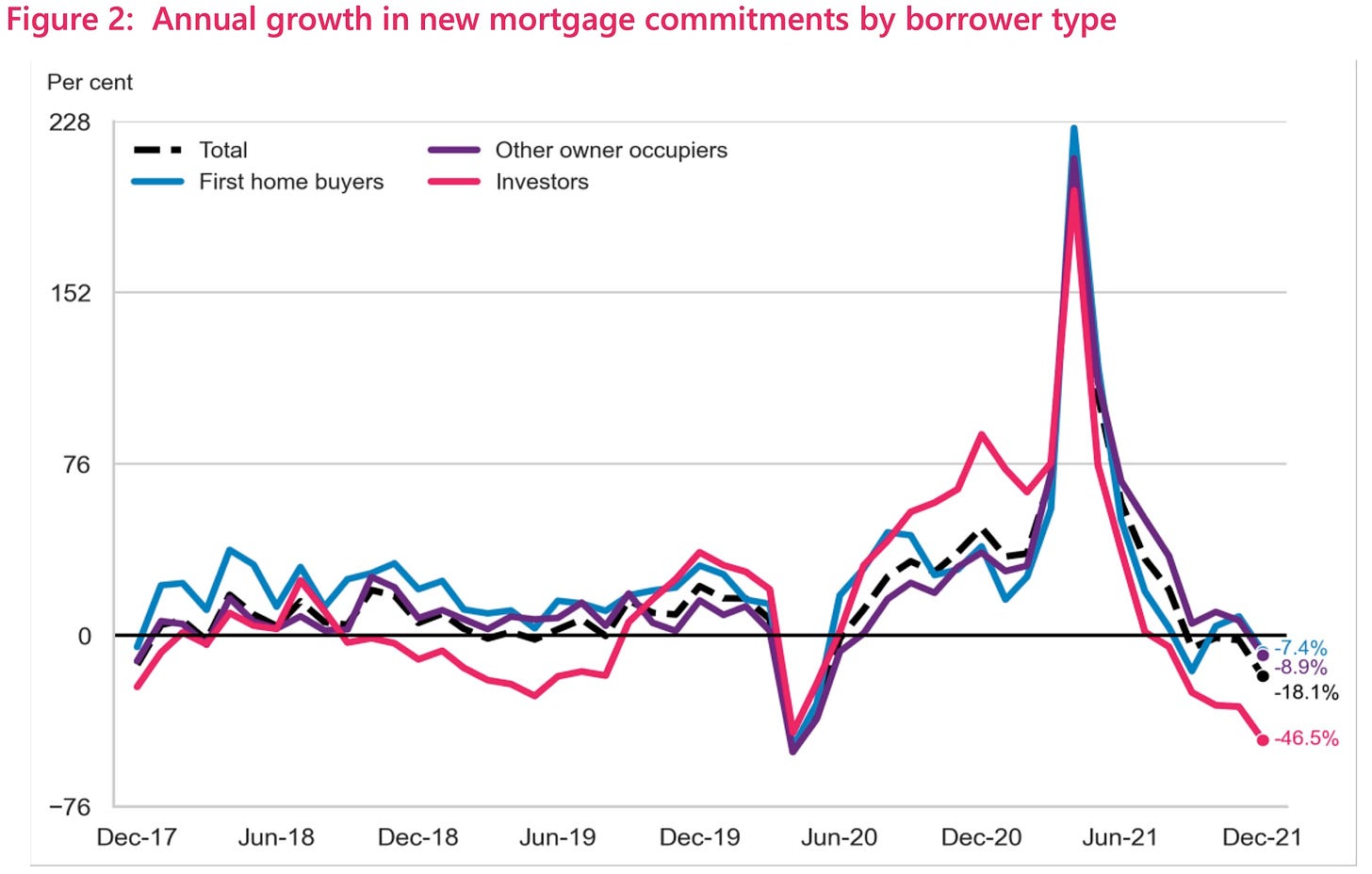

The annual growth figures do look very low in comparison with the growth rates seen in the times of explosive growth seen in late 2020 and early 2021, especially as banks looked to finish all the deals started when the Reserve Bank’s high LVR shackles were off and as they were about come back on in early 2021.

Yesterday David Clark also released the terms of reference for MBIE’s inquiry into potential unintended consequences of the CCCFA rules, which are also suitably cautious about taking the mortgage broker complaints hook, line and sinker. An initial report is due with Clark next month and a final report is due in April.

Clark told Jenee Tibshraeny at Interest.co.nz he had asked to meet with the heads of the big banks later this week. Reading between the lines, he is also challenging the narrative that the CCCFA is solely to blame.

“It is important we get to the bottom of exactly what aspects of the CCCFA responsible lending rules were not being adhered to by some banks previously. Anecdotal evidence to date suggests the new lending requirements have presented a greater challenge for some parties.” David Clark.

By the way, check out the crunchy peanut butter ad from the 1990s. A blast from the past from us oldies. Way before the days of gourmet peanut butters…

Scoops, news snippets and useful longer reads

What has our world come to when a tenant renting a shed for $220/week ‘thanks their lucky stars’ (TVNZ)

Unlike in 2020 when the Government pulled out all the stops to home the homeless at risk of getting Covid and being on their own on the streets, it’s taking a less blanket approach and is back to giving grants to food shelters and others (RNZ)

Christopher Luxon is reported to have said yesterday at National’s annual caucus retreat in Queenstown (sans its board members) that he wants to show voters the party cares about poverty. He even ordered Simon Bridges to read Max Rashbrooke’s book about wealth inquality Too Much Money over the summer. (TVNZ,

Tauranga’s rental market is in crisis with listings down 30% and up to 100 people showing up to viewings (NZ Herald) It also reports Wellington’s rental market much worse than everyone thought. NZME’s Aaron Dahmen also reports from inside Wellington’s rental hellscape.

Nicky Pellegrino’s feature on Russell Lowe, the man who saved the Kiwifruit industry from PSA by finding the SunGold variety being tested was more resistant, is excellent. The rest is history of how an industry on its knees used the solution to vault into something much bigger. (Stuff)

The detail in this Stuff report on a new 1,200 home subdivision just outside Morrinsville is useful, including that the town's median house price was $879,500 in December and that most of the houses being built in the next stage are retirement homes. That’s where the equity is coming from.

Thomas Coughlan reports via NZ Herald-$$$ the new 39% top tax rate for those earning over $180,000 had captured 119,000 taxpayers, which was more than the IRD originally forecast.

Chart of the day

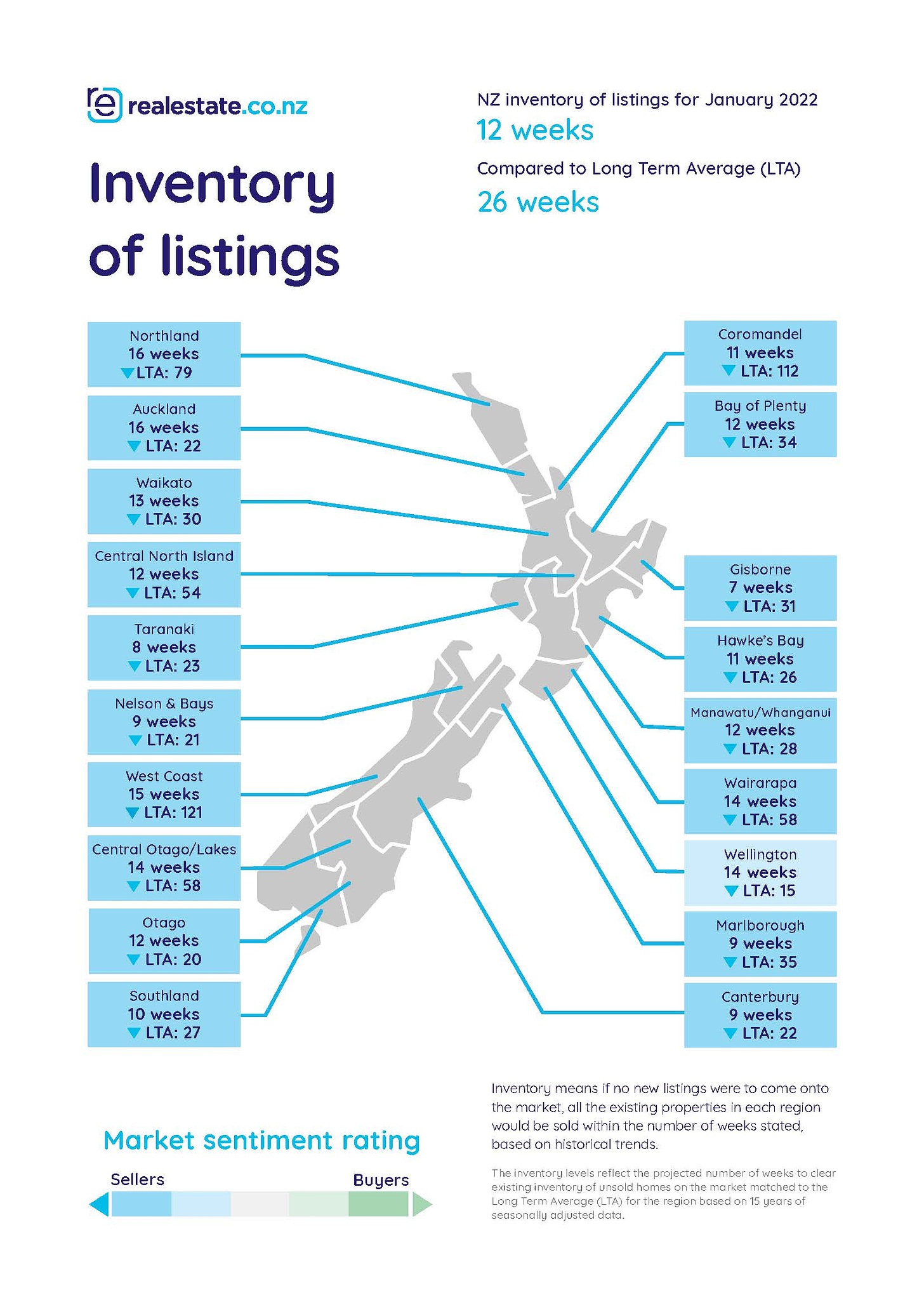

Listings are up in most markets, but the ratio of listings to sales remains much tighter than long-term averages, keeping most of the power in the hands of sellers and keeping upward pressure on prices, as this RealEaste.co.nz chart shows.

Spookies and profundities

The craic

Fun things

Ka kite ano

Bernard

Share this post