Long stories short, the top six things that stood out to me in our political economy around housing, climate and poverty on Tuesday, February 25:

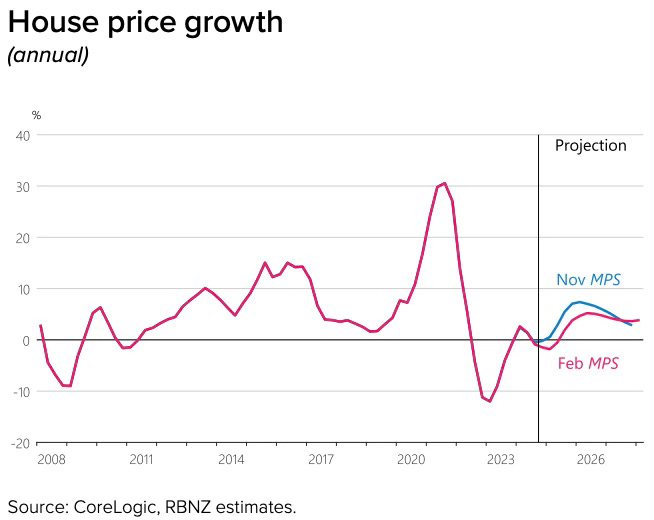

The slump in housing land prices has gone on for three years and the Reserve Bank last week further lowered its forecast for house prices, meaning prices aren’t expected return to their December 2021 peak until mid-2028 at the earliest;

That near-seven-year-long peak-to-trough-to-peak cycle would be double the 3.5 years that the housing market took after the 2008/09 Global Financial Crisis to recover to its pre-crisis peak, and this time around the market is restrained by LVRs and DTIs;

Until now, owner-occupiers and rental property investors have taken a buy and hold strategy, expecting a rapid(ish) recovery to allow them to recover to peak levels and make gains and sales again;

But seven years is a long time for most people to hold on without the liquidity moments needed to realise capital gains and move on with their lives and businesses, even without pressure from a bank, given 40% of borrowers are actually ahead on their payments and just 1.5% are behind;

Listed retirement village companies are seen as crucial players in mobilising those capital gains and cash between generations, but their investor timeframes and bankers are much less patient and they may blink earlier and more; so,

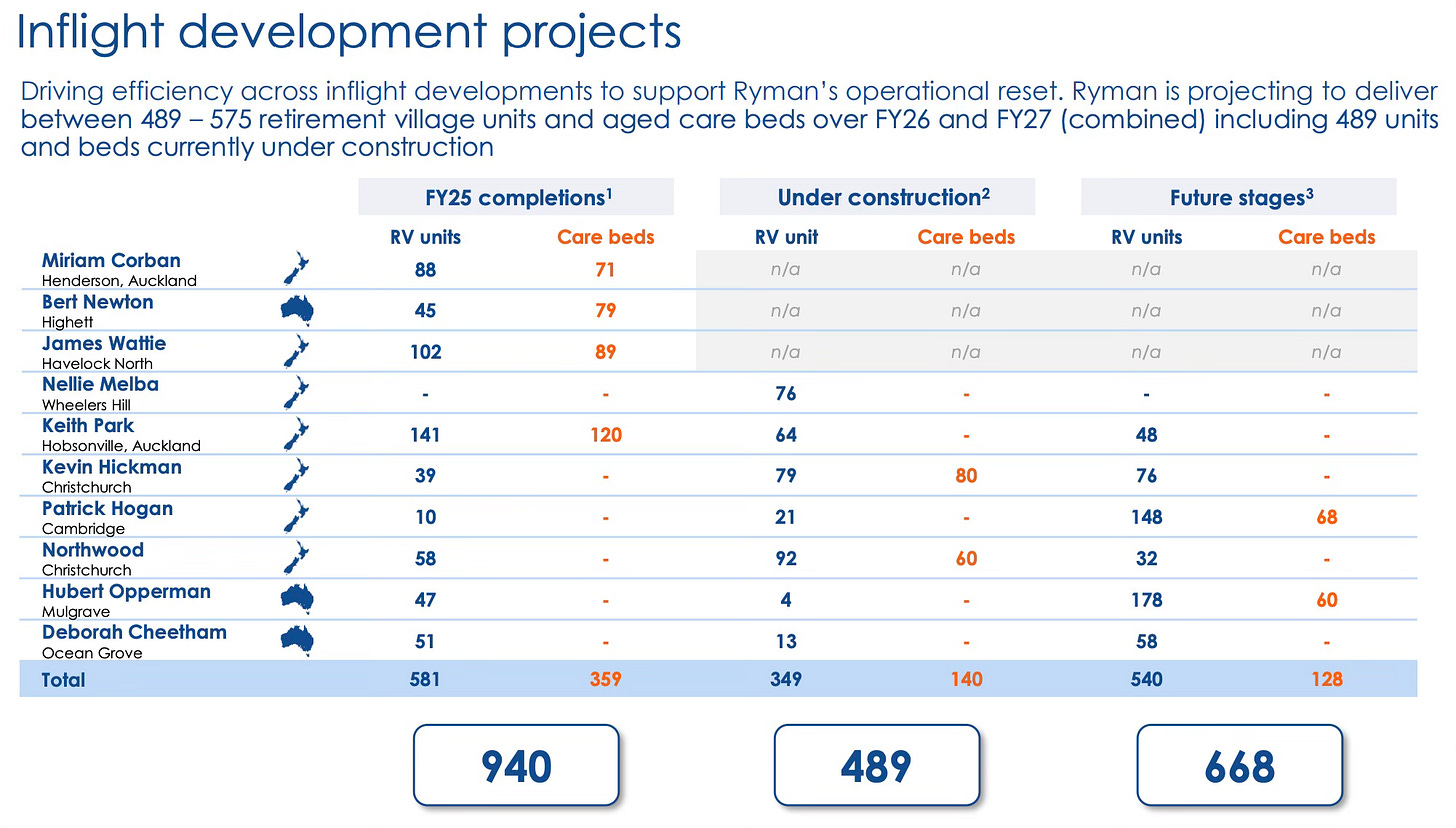

Ryman Healthcare’s decision announced yesterday to slash its retirement unit building rate from 940 this financial year to a combined 489 in the next two years, and to dump some of its landbank valued at $338 million back onto the market, is a key moment.

(There is more detail, analysis and links to documents below the paywall fold and in the video and podcast above for paying subscribers. If we get over 100 likes from paying subscribers we’ll open it up for public reading, listening and sharing.)

‘We can’t hold on any longer. We're selling.’

When should a willing residential home owner-occupier, landlord or bare land-owner sell? Once the price is back near or above CV? Once prices have recovered to their previous peaks? To the highest bidder? Even if it’s lower than expectations, lower than CV, or (heaven forbid) lower than the purchase price? To whoever bids, even if (hell’s-a-freezing-over) there’s nothing left after clearing the mortgage?

It depends, is the trite answer. Often the personal situation of the seller really matters, or the view of the bank if there has been a sustained default on interest payments, or the property is ‘under water’ with a valuation less than that of the mortgage. Forced sales such as mortgagee sales, estate sales or relationship breakdown sales are often the ones where the property gets to ‘clear’ at the true market price.

When the market is subdued, often it is only the forced sales that happen, and the rest of the market is in a state of suspended animation. Unlike in countries where banks are aggressive in forcing mortgagee sales, New Zealand banks tend to force sales as a last resort because they can make anyone with an income to pay the interest first. Typically, a seller will put a property on the market and wait for a bid at or near CV to avoid the pain of perceived or actual loss, especially when they’re not under any bank pressure. Right now, there is very little bank pressure for most. There were just 41 mortgagee sales in the December quarter of 2024, down from over 750 per quarter during the GFC.

Humans hate losing more than they love winning. When there has been a fall in prices, that often leads to a longer standoff. Buyers who feel they are in control and can afford to wait will also be reluctant to ‘overpay,’ especially if there is any prospect of further falls. No one wants to ‘catch a falling knife.’

That moment of recovery when prices are back over the previous peak is often an important one for sellers who aren’t under any pressure to sell. They can then sell, feeling comfortable they didn’t ‘lose’ anything. That means the length of time it takes for prices to recover to their peaks is important. The longer it takes, the longer it takes for volumes to get going again.

‘Show me my liquidity moment’

That ‘liquidity moment’ of a house sale often kick-starts a whole range of other spending by the seller, and can trigger a ‘chain’ of property sales. That’s why the volume of sales often picks up sharply when prices are rising to new peaks, which in turn generates all sorts of economic and social activity, including grandparents moving into retirement villages and freeing up cash for inheritances or deposits for kids and grandkids.

So the moment when retirees move out of their highly-valued suburban standalone homes into retirement village units is a key event in that process of starting the ‘chains’ and restarting the market overall. Obviously, most don’t want to sell for a perceived loss, so watching the sales of retirement units can be a useful leading indicator of a market turning. Most are happy to wait for a year or two, or even the three and half years they waited after the 2008/09 slump, with their lives on hold.

But seven years of waiting?

By now, house prices ‘should’ have recovered to their peak, if that peak-to-trough-to-peak cycle lasting 3.5 years from early 2008 to late 2011 was to be repeated. But the Reserve Bank’s lowering of house price inflation forecasts at its MPS last week (chart below) means that cycle could now last seven years, with the December 2021 peak not recovered until late 2028.

So how long is too long? When does the seller or owner finally capitulate? Three years? Seven years?

Ryman’s capitulation is a moment

Ryman Healthcare is an important player to watch because it is the largest retirement village operator and often the market leader. For much of the last five years it has also been among the top five dwelling unit builders, especially as it has operated an in-house model of development and building, rather than outsourcing to contractors and sub-contractors.

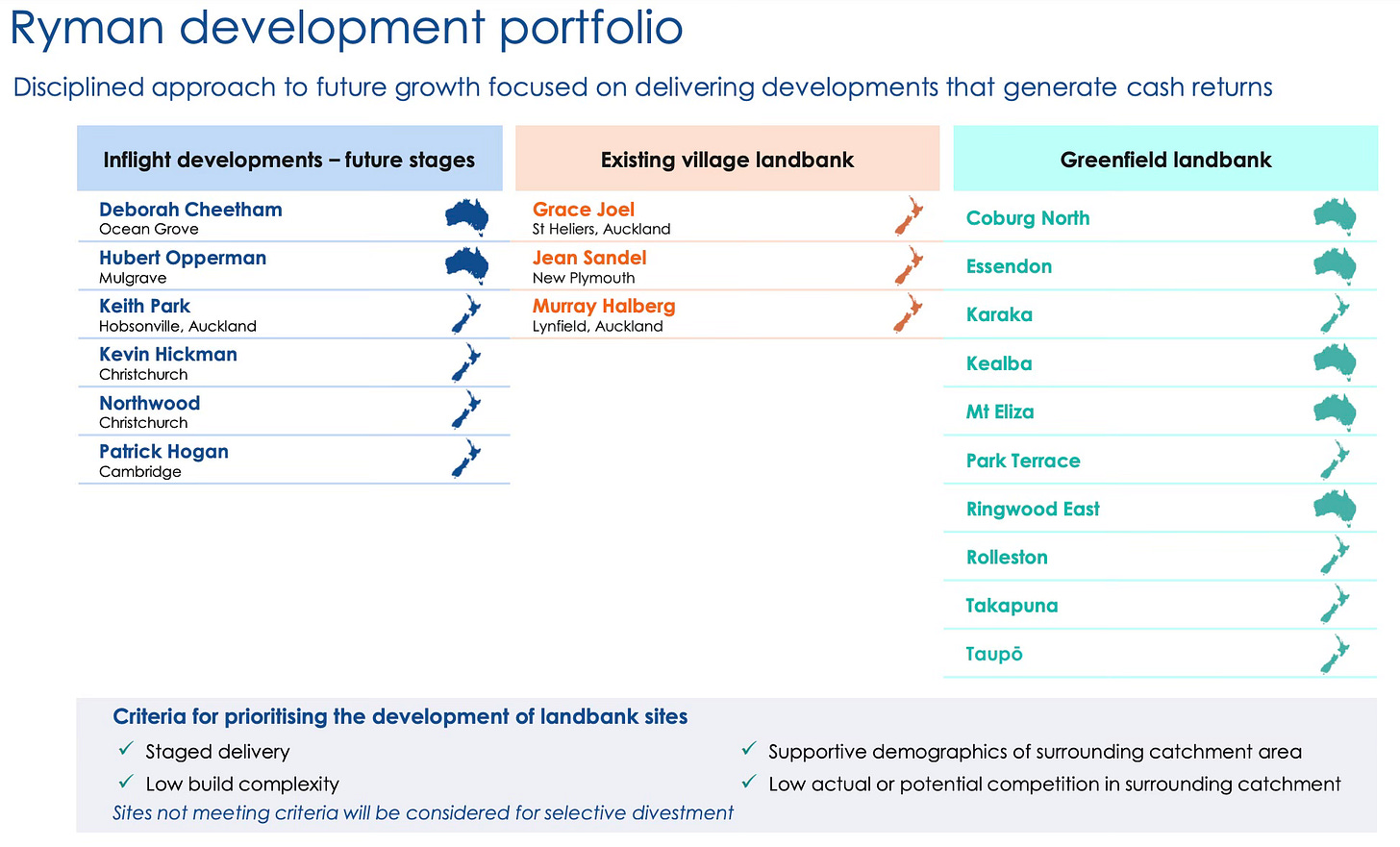

Yesterday Ryman Healthcare, under new management and under pressure from shareholders and bankers, pulled the plug on its in-house, fast-growth and long-pipeline approach to building retirement villages. It announced it had ‘paused’ planning new developments and would slash its build pipeline from 940 ing in the current financial year to between 489 and 575 units combined in the next two financial years of 2025/26 and 2026/27 (ie around 250 a year).

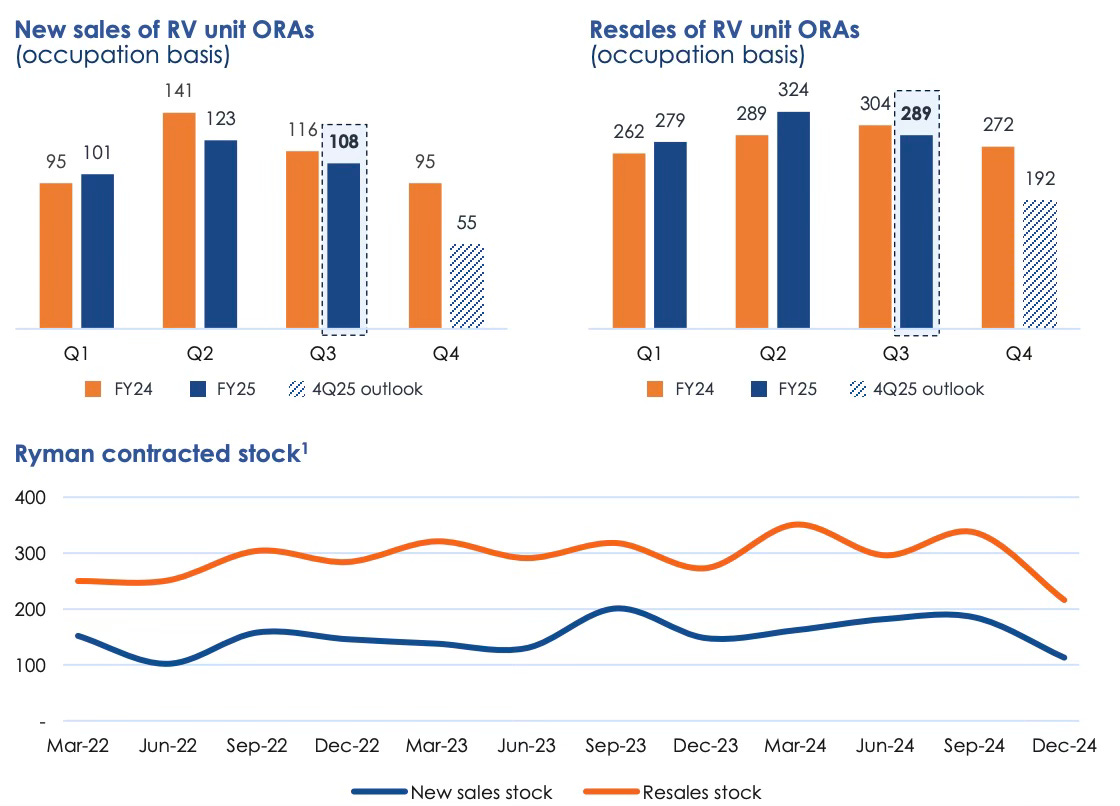

That was after quarterly sales of new units collapsed from 141 in the December quarter of 2023 to 95 in the June quarter of 2024, and then a projected 55 in the June quarter of 2025.

Ryman also announced an equity capital raising of $1 billion to repay debt and said it planned to return $500 million to shareholders over the next three to five years, partly by scaling back its housebuilding and getting residents to invest more, and partly by selling some of its landbank, which it has valued at $338 million. It warned in its presentation for shareholders (page 44) that it may have to slash that book value if it is forced to sell the land at a loss. Here’s how it described that risk (bolding mine):

Landbank WIP (Work In Progress): Pursuant to changes made in 1H25, the carrying value of development land will be assessed, which may result in impairment if a decision has been made to sell the property or if the latest feasibility does not support capitalised WIP.

Work remains ongoing and is yet to be finalised, both internally and with Ryman’s new auditor, and therefore, the need for any adjustments remains uncertain. Currently, Ryman estimates there is potential for downward adjustments to NTA of up to $300 million in aggregate in respect of the matters listed below:

Development land now classified as investment property and held at fair value (previously held at cost) plus capitalised WIP, which is subject to impairment testing relating to development plans.

Ryman may consider the sale of land which is currently held for potential future development opportunities. Any decision to hold these properties for resale or the sale of such landbank assets, or any other asset sale if it were to occur, may not be able to take place at or above the value at which the asset is currently recorded in Ryman’s accounts.

In that situation, Ryman may record an impairment or loss on sale which could have an adverse impact on Ryman’s financial position and performance in the future. Ryman presentation

This potential for a dumping of development land will be unsettling for those hoping to wait for the recovery, and increases the risk the great standoff continues.

‘We need the housing market to fire up again’

The Government is assuming the great standoff ends this year and needs it to end to fire up the economy again.

The longer this period of suspended animation in the housing market goes on, the lower the chances of another surge in the economy like those seen from 2002 to 2007 and from 2011 to 2017 as bank lending fired house prices ever higher.

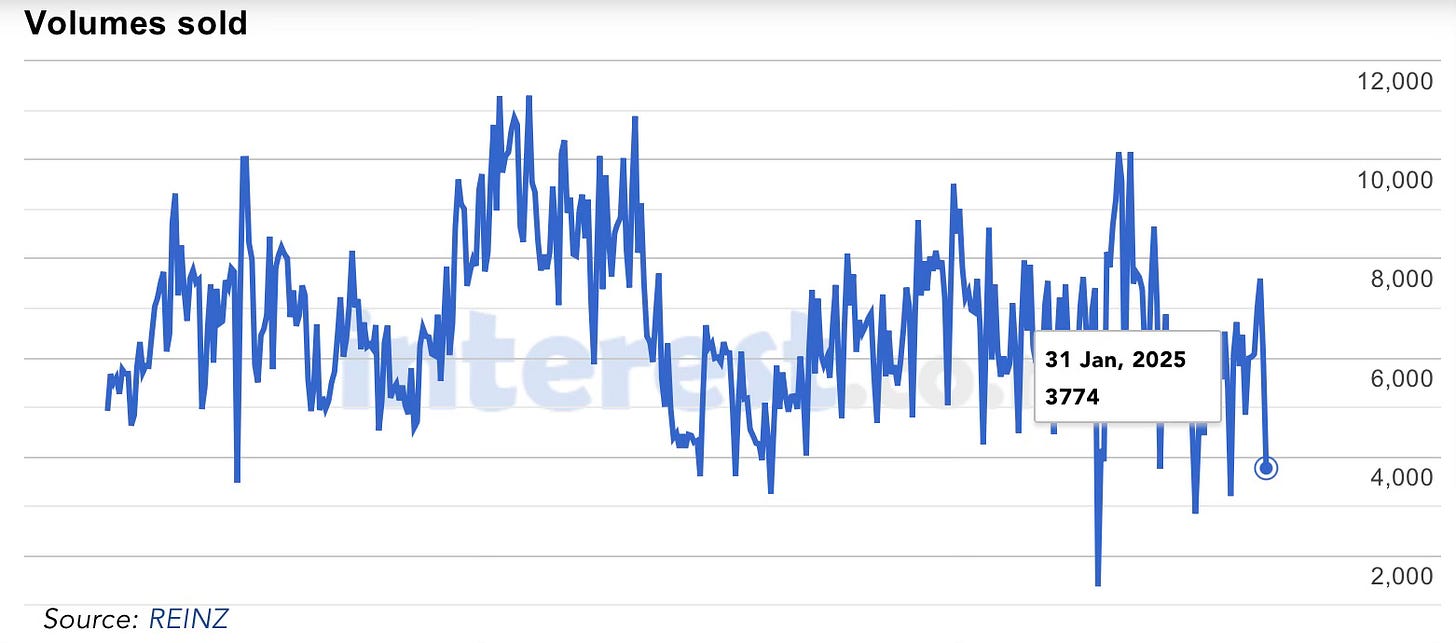

This Interest chart shows just how suspended the animation is, with volumes down nearly two thirds from the 2021 peak and well below the 2002 to 2007 boom times.

A pick’ n’ mix six of further reading elsewhere

Op-Ed in The Post-$$$ by Claire Achmad: Poverty stats show broken promises to children – what happens next is up to us. Children are invisible from the document that sets the scope for the Budget, the Government’s Budget Policy Statement.This has to change, quickly.

Scoop in NZ Herald-$$$ by Thomas Coughlan: Govt mulls extending repeat prescriptions, doctors warn it may lead to ‘catastrophic’ GP shortages

Administered inflation & infrastructure freeze: Tauranga cans waterfront walkway, projects 12.5% rates rise Bay of Plenty Times

Analysis in NZ Herald-$$$ by Jenée Tibshraeny: What will become of Andrew Bayly’s ambitious reform agenda?

Column in NZ Herald-$$$ by Simon Wilson: ‘Chris Bishop is ‘proud to be an urbanist’ and I’m thrilled to hear it’

Scoop in NZ Herald-$$$ by Matt Nippert: US billionaire Peter Thiel winds down NZ business interests25 Feb 05:00 AM

Video of the day

Chart of the day

Cartoon of the day

Timeline-cleansing nature pic

Ka kite ano

Bernard

Share this post