Long story short, I interviewed Reserve Bank of New Zealand Chief Economist Paul Conway yesterday in the full video above about:

the Monetary Policy Committee’s decision to cut the Official Cash Rate by 50 basis points to 3.75% last week;

the bank’s projection in its Monetary Policy Statement (MPS) for three more 25 basis point cuts over the next six months or so;

its forecasts for modest recovery in economic growth later in the year to start reducing unemployment, now that interest rates are lower and the benefits are flowing through in a lagged fashion to fixed mortgage borrowers rolling onto lower interest rates;

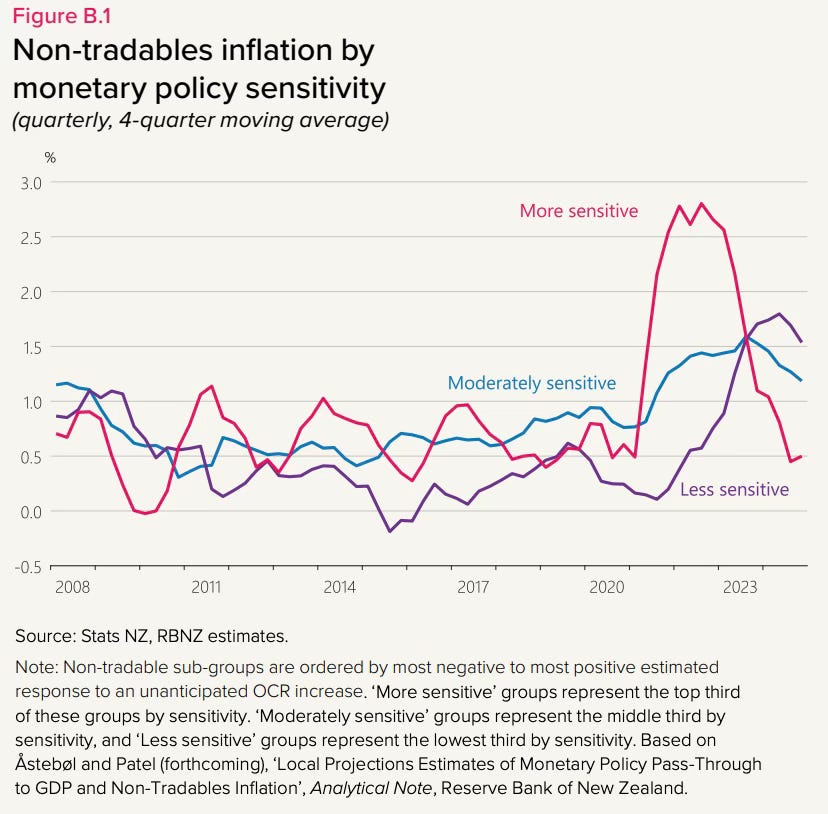

the bank’s study in its MPS (Box B on page 18) of how different types of inflation are tracking, ranging from the most sensitive to OCR changes, through to the least sensitive, including prices administered by councils and the Government such as rates, fees, charges & fines; and,

the risk that this administered inflation, which spiked up through 2024 as other inflation was easing, may turn into a more generalised rates & fees-to-general-prices spiral.

Conway said the bank was not seeing any evidence of that yet, but was watching it closely.

I also asked him if the bank was concerned that previous under-investment in infrastructure and shifts by both councils and Government to avoid taking on more debt by instead using congestion and water charges to service non-Government debt represented a type of one-off shock where capital costs were being included in consumer price inflation.

The Reserve Bank is directed not to consider capital costs or value in its targeting of consumer price inflation, which means, for example, that house prices and interest rates are not included in the Consumer Price Index.

Here’s the transcript of our conversation around administered price inflation:

Bernard Hickey: 12:30 I'm interested in the administered prices, particularly local government fees and charges, government fees and charges.

And I wonder whether some of that inflation we've seen is not what you'd call normal inflation in the prices of goods and services, which the Reserve Bank can focus on, but is actually a type of capital charge as governments catch up on previous under-investment in capital or look to shift the capital cost from government debt to maybe local government debt or private debt. And in effect, you're seeing some inflation and capital costs bleeding into the Consumer Price Inflation Index.

Now, the Reserve Bank … doesn't focus on capital costs or capital values. It doesn't respond to a big shift in prices of houses or stocks or anything. So is there a risk here that you're having to respond to a type of inflation which is a one-off shock, a structural shock, and which actually is not really consumer price inflation. It's capital inflation.

Paul Conway: 13:45 Yeah, I definitely think that's a thing. Rates is the clearest example of that. I live in Wellington. Rates have gone up significantly, even though house prices have fallen by a quarter.

There is a sense of councils catching up across the country and certainly here in Wellington. So rates are catching up just, given depreciation in the capital stock, in our case the pipes and associated infrastructure.

I think you sort of hit the nail on the head there when you said one-off. Ideally they are one-off. And if they are one-off, then that's a relative price shift going on for a particular reason.

Council sort of fell behind in terms of paying for depreciation and keeping the quality of capital where it needs to be. And we can debate whether or not that's ideal and they should have been sort of more on the button from day one.

But from a monetary policy perspective, as long as they do stay as one-off, then that's fine. They sort of have their effect on overall CPI. They pass through. They don't get incorporated into people's wage demands. So we're not getting people sort of overreaching on pay beyond productivity growth.

And they don't get incorporated into firms pricing decisions and sort of getting into that sort of price wage spiral. And we're not seeing any evidence of that, you know, thus far. Quite the opposite, really.

A year or two years ago when we had a serious inflation problem, inflation was sort of 6-7%, the committee was way less accommodating about those types of charges because in that environment, there's a chance that they do feed into that generalised price and wage pressure with inflation at 2.2%.

You know, where a negative output gap is significantly negative. So the productive capacity of the New Zealand economy is significantly above where the level of sort of aggregate demand in the economy is at the moment.

So it's not the sort of business environment in which firms will go, ‘my rates bill has gone up, therefore, I'm going to charge people more for my product’. And, off we go into a spiral.

The MPC, the Monetary Policy Committee, is increasingly confident that we're not in that sort of world. So those relative price shifts, they can pass through.

And that's normal. Of course, we remain very vigilant to the risk that they do bleed into more generalised inflation pressures. So we're not that relaxed.

Chapters

00:00 Monetary Policy Decisions and Economic Forecasts

07:09 Understanding Inflation Dynamics

16:02 Challenges in Economic Growth and Investment

21:04 Impact of Interest Rates on Mortgages

Ka kite ano

Bernard Hickey

This was published to all immediately as part of our public interest journalism mission.

Share this post