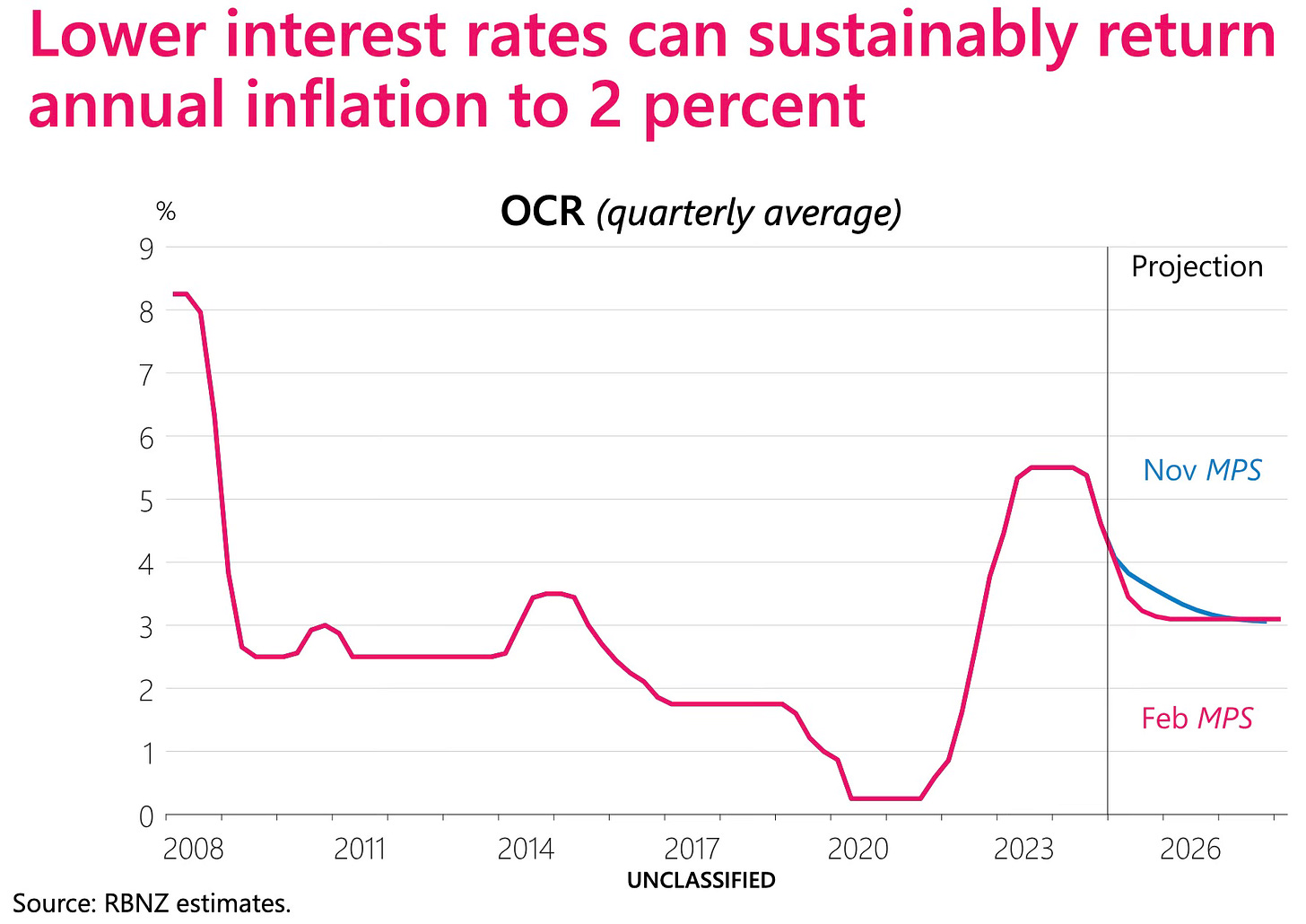

Long story short, I spoke to Core Logic Head of Research Nick Goodall & Real Estate Institute of New Zealand (REINZ) CEO Jen Baird for a 15 minute mini-Hoon last night after the Reserve Bank of New Zealand announced it had cut the Official Cash Rate 50 bps to 3.75% and projected another 75 bps of cuts this year. We also spoke in the video and podcast above about the REINZ's January sales data showing another slight fall in house prices with a rise in sales volumes.

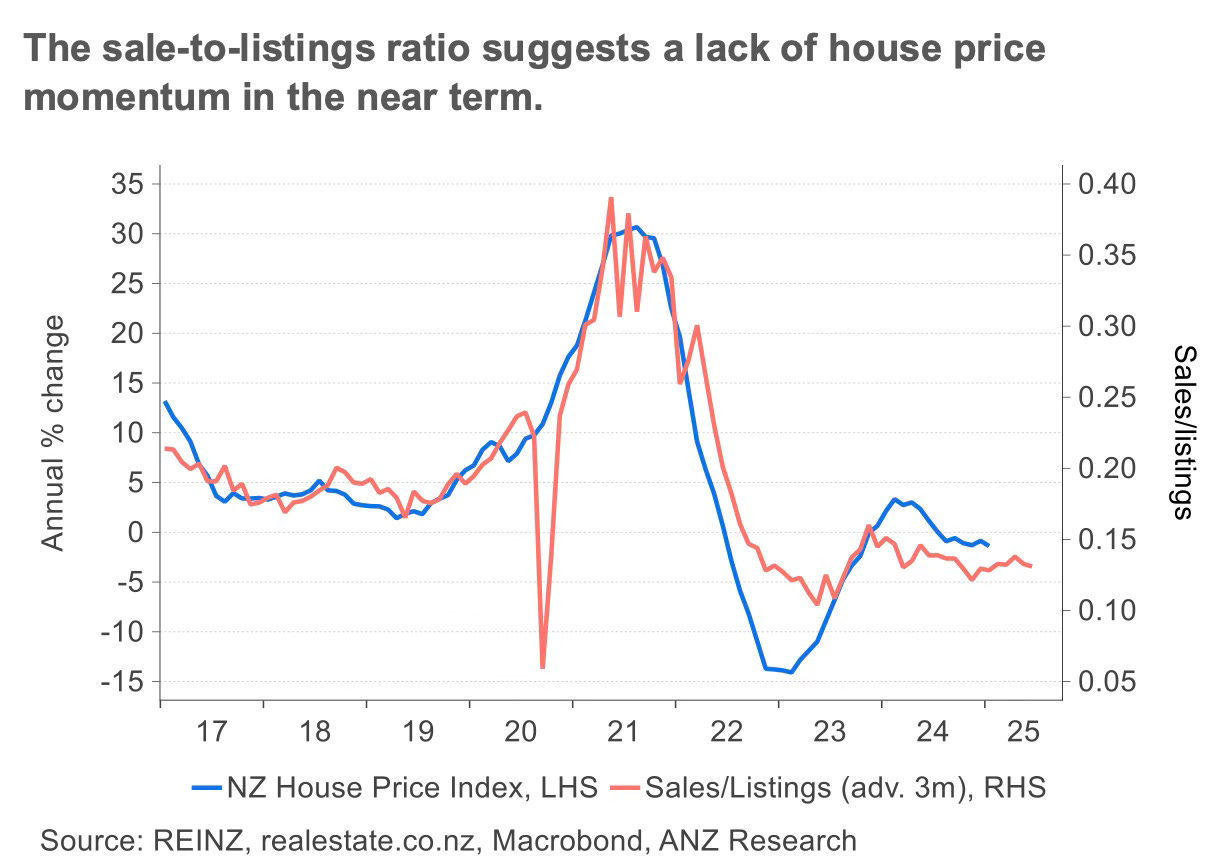

In essence, we agreed the as-expected rate cut and the RBNZ’s acceleration of three projected rate cuts in yesterday’s projections would improve sentiment in the housing market, but that the RBNZ’s Debt To Income (DTI) multiple limit of seven for rental property investors was starting to kick in and would limit any explosiveness of housing and economic activity. Also, housing market data shows the long standoff between over-optimistic and not-pressured sellers vs cautious and stretched buyers remains, dampening volumes and leading many to list, and then pull their homes off the market.

The key things to know from the RBNZ decision, its Monetary Policy Statement (MPS) and its news conference were:

RBNZ Governor Adrian Orr indicated in the news conference there would be three more cuts of 25 basis points each of the three next decisions in April, May and July;

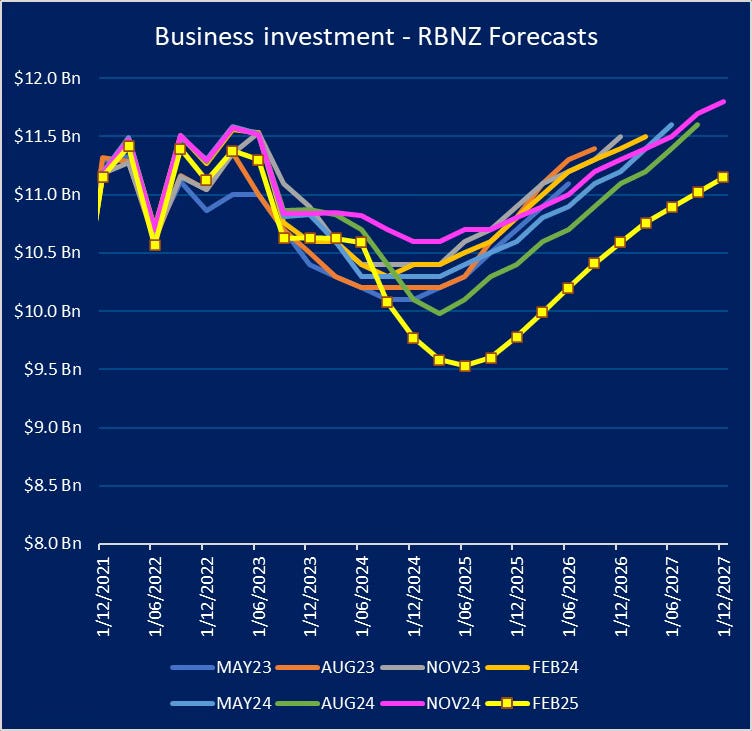

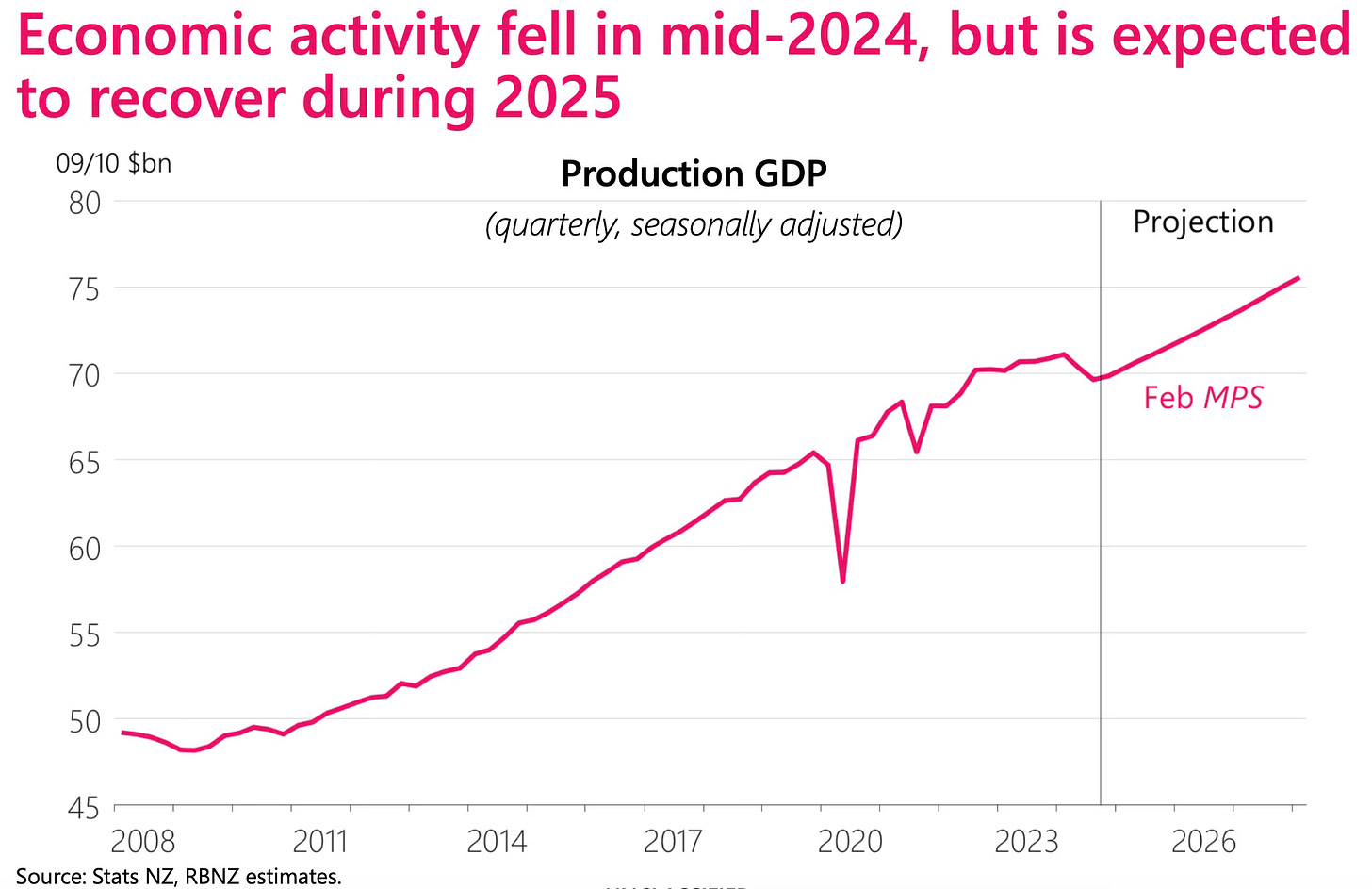

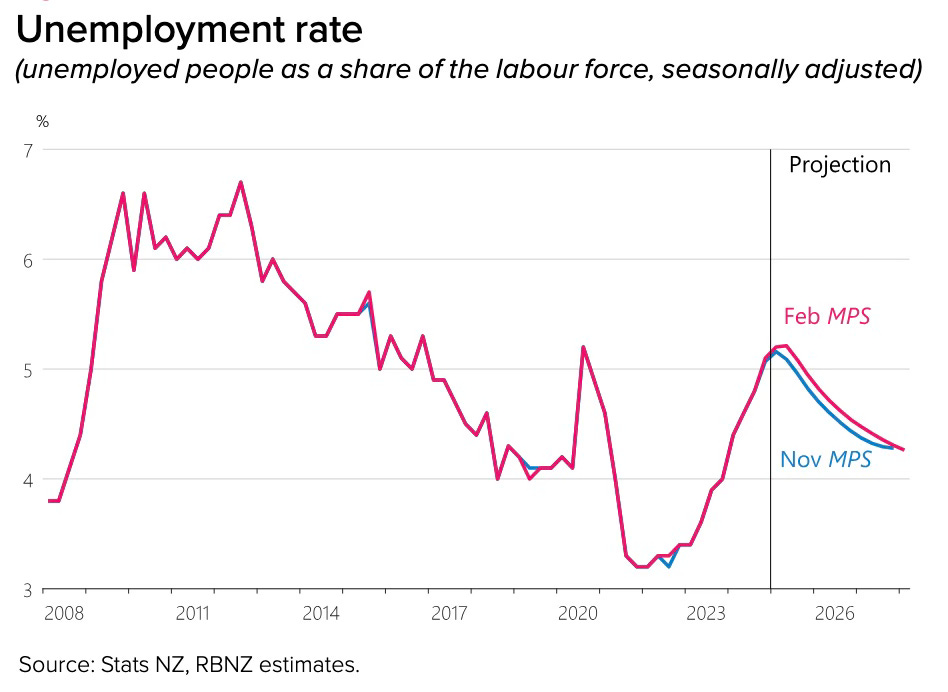

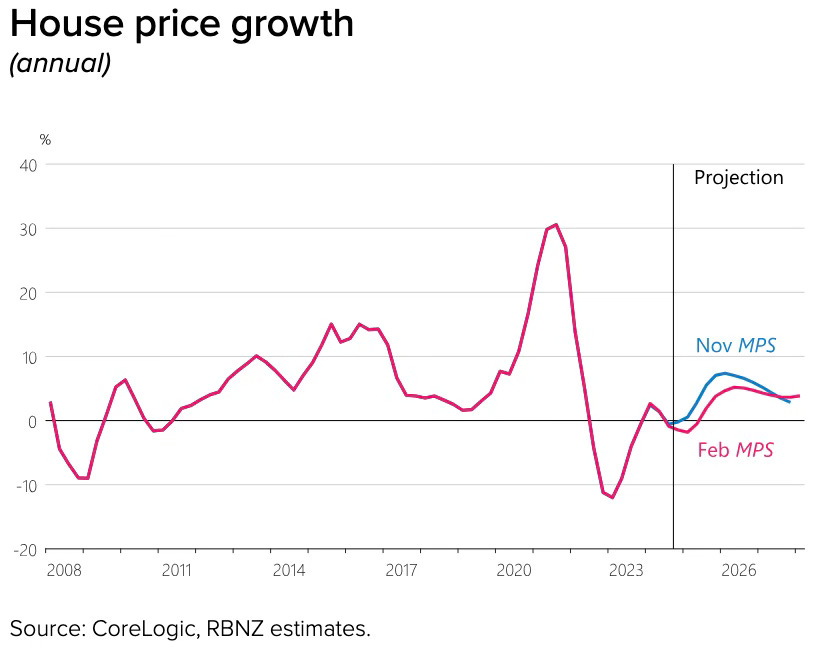

The RBNZ also projected a marginally higher GDP track than in the November MPS, a slightly higher inflation track, a higher unemployment track, lower business investment, lower migration, less contractionary Government spending and taxation and lower house price inflation;

The RBNZ doesn’t expect longer-term fixed mortgage rates to fall much further because the global bond yields these fixed rates are mostly priced from remain elevated because of fears about Donald Trump’s tariffs sparking resurgence of inflation globally;

RBNZ Assistant Governor Karen Silk said: ““I would say the expectation of the longer-term rates coming substantially lower is probably a lot less now. That depends on the funding costs for banks and that’s again being influenced by what’s going on in those global rates.”

She said the lagged effect of borrowers moving off their older higher fixed rates would see the average mortgage rate paid to fall just 50 basis to 5.7% by December from 6.2% now; and,

Orr said the bank’s DTI limits “will act as a good moderation for lending behaviours,” this year as mortgage rates fall.

Here’s the key detail, charts & video from the RBNZ decision and news conference in Wellington, which I attended, along with the key detail from the REINZ data yesterday:

What happened in the housing market in January

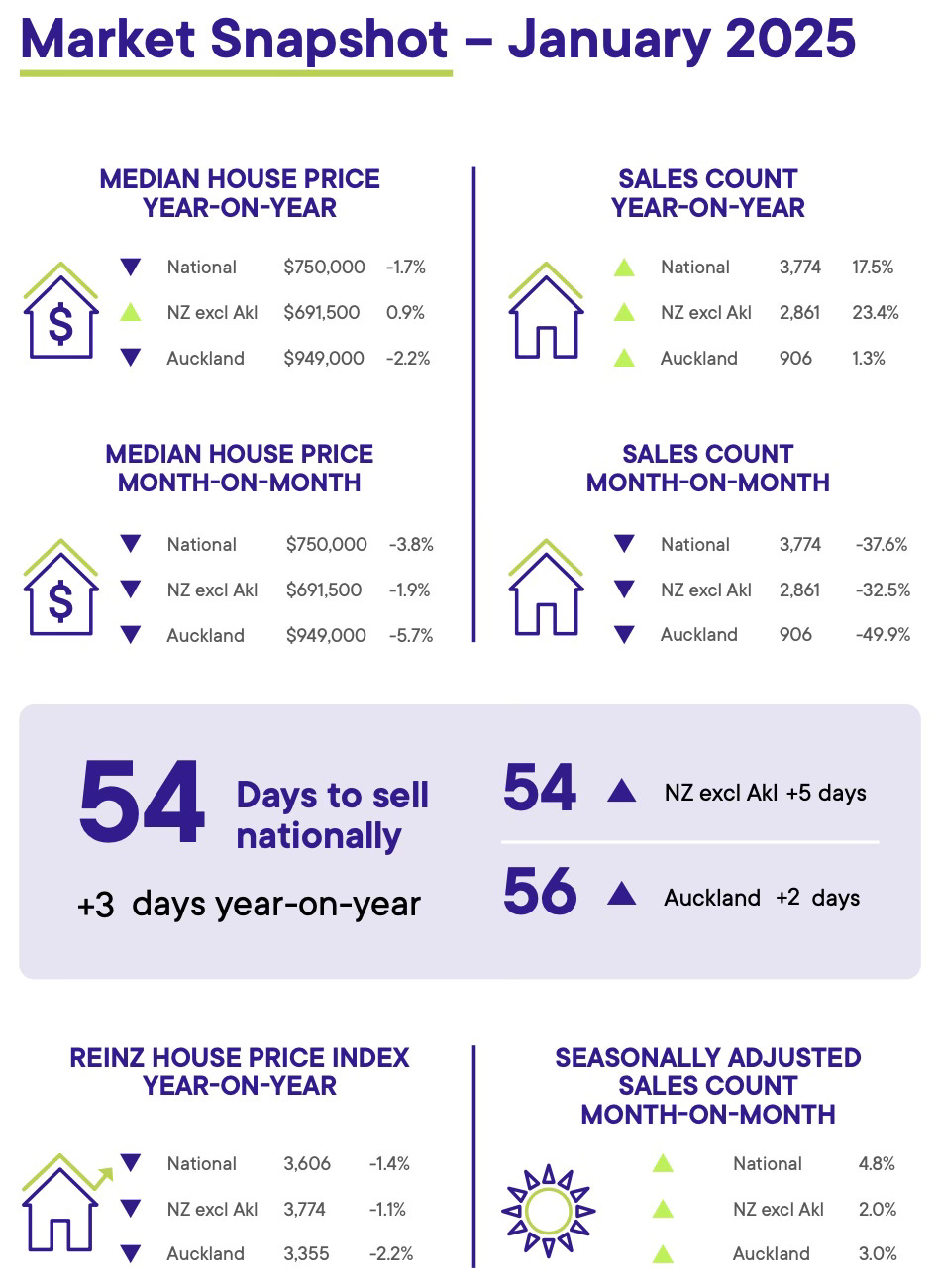

REINZ’s data for January showed a slight rise in volumes, a fall in median prices and a lower House Price Index in January than in December. Here’s more detail:

Sellers increased their listings, but often remained wedded to expectations of higher prices reached in 2021 and 2022.

Ka kite ano

Bernard

Share this post