Long stories short, the top six things in Aotearoa’s political economy around housing, climate and poverty on Thursday, February 13 are:

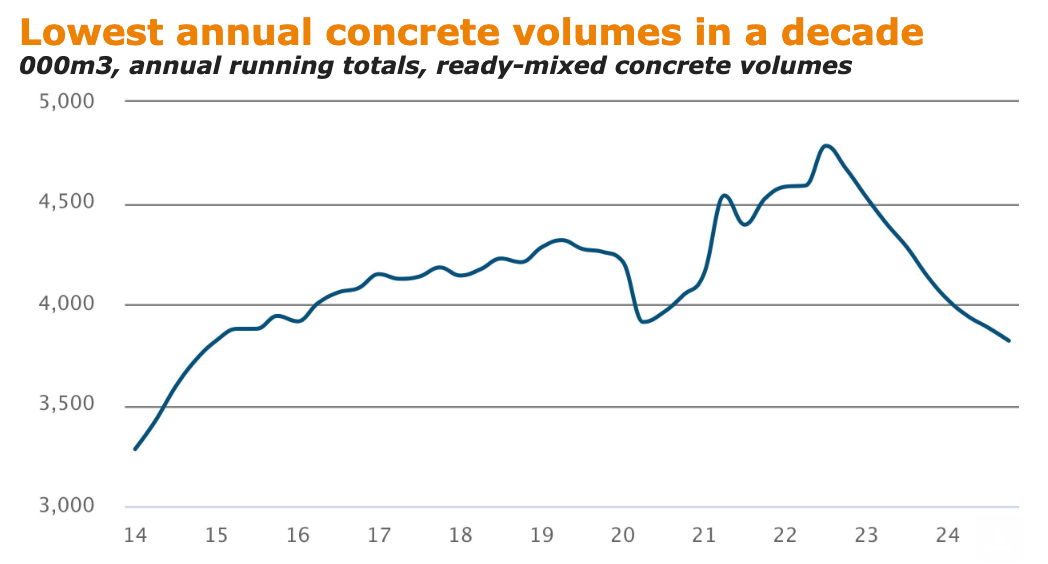

The coalition Government’s early 2024 ‘fiscal emergency’ freeze on funding, planning and building houses, schools, local roads and hospitals helped extend and deepen the economic and jobs recession through calendar 2024, as evident in concrete production figures released yesterday, which showed output fell 7.7% over 2024 to a five-year low that is 10% below 2019 levels;

Finance Minister Nicola Willis is expected to lay out the groundwork for a third player to enter New Zealand’s supermarket scene in a speech this morning, although the Government itself isn’t expected to be that player or fund it1;

Just 573 of 21,000 eligible families are getting the full $150/week childcare tax credit promoted as a major part of the National-led coalition’s tax cut package2;

Pressure is mounting in the provincial heartlands of National’s support base to reverse the blanket speed increases rammed through under previous Transport Minister Simeon Brown, with school mums becoming most active in local campaigns and on social media3;

In the wake of Kāinga Ora’s announcement last week it would add just 145 homes to its housing stock next year, housing advocates are accusing Finance Minister Nicola Willis of breaking a personal pledge4 she signed in 2023 to “continue to increase Auckland’s state/public housing stock by at least 1,000 houses a year,” and,

A local protest group is forming of Manawatū residents at a higher risk of developing bowel cancer who are vowing to fight a pause on surveillance colonoscopies at Palmerston North Hospital, with some already having gone private to get the procedure done.5

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers. If we get over 100 likes from paying subscribers we’ll open it up for public reading, listening and sharing.)

The concrete stats showing what 2024’s fiscal freeze did

There’s nothing more concrete in the leading and lagging indicators of real economic activity in residential and commercial construction and local water and roading infrastructure than concrete production figures. They are the ‘show me the money’ moment in the construction and development sectors that reveal what has actually been committed to and what work is being done.

Statistics NZ reported December quarter ready-mixed concrete figures reported yesterday showed exactly how the Government’s big ‘fiscal emergency’ freeze on building new homes, schools, pipes, hospitals and roads in early 2024 did to the economy.

In essence:

ready-mixed concrete volumes fell to 3.81m cubic metres in calendar 2024, down 7.7% from the December 2023 year to their lowest level in a decade;

quarterly volumes fell to their lowest levels since June 2014; and,6

volumes in the December quarter fell in most regions from the September quarter, with Canterbury down 17%), Northland down 8.4% and Waikato, Bay of Plenty down 3.6%), with only West Coast, Tasman, Nelson, Marlborough riseng 1.3% and Auckland up 0.1%.

Infometrics economist Matthew Allman cited the tight fiscal outlook in his note on the figures, saying:

“Non-residential building consents temporarily showed a bit of strength in October and November before recording a much weaker month in December. However, the pipeline of non-residential work is showing signs of contracting, and we expect and weak economic conditions and restricted business investment to drag down demand for concrete in 2025.

“Tight fiscal conditions will also limit the scope for additional public sector projects not yet signalled from entering the pipeline. There is some upside risk to our view of a limited recovery in residential consent numbers, as the government focuses on growing housing supply.

“The government’s appetite to boost investment in infrastructure could also help put a floor under concrete volumes over the next 18 months. However, overall we expect weak investment intentions and tight fiscal conditions to dominate, meaning the pipeline of construction activity and concrete demand is likely to continue to narrow.” Infometrics Economist Matthew Allman

Chart & Thread of the day

Cartoon of the day

Timeline-cleansing nature pic of the day

Kā kite ano

Bernard

As reported by Luke Malpass in The Post-$$$ this morning.

Excluding the lockdown-affected June quarter of 2020

Share this post