TLDR: The battle to control inflation will define the era we live in economically. The central banker that matters most globally gave a very tough speech on Saturday morning we should all take notice of. Either he’s right, and will walk the walk from this talk, which will make all our interest rates higher globally for the next year or two. Or he’s wrong and won’t, which would mean our mortgage rates fall next year.

Most investors and traders still think he’s wrong, but they’re getting a bit nervous. That’s why stocks and bitcoin fell sharply over the weekend.

Paid subscribers can see more of my analysis and pointers below the paywall fold and in the podcast above.

Will he pivot?

US Federal Reserve Chair Jerome Powell gave an eight minute speech in the early hours of Sunday morning that underlined the determination of the world’s most important interest rate setter to get inflation lower come hell or high water. Traders and investors had been hoping for some confirmation of their bias that a pivot would come next year to lower short-term interest rates as inflation comes off the boil ‘naturally’. They didn’t get it. Powell gave his most hawkish speech yet.

So what? - US stocks fell 3.4% because expectations of higher interest rates make stocks relatively less attractive, but interestingly (to me), the US 10 year Treasury yield was unmoved at 3.03%. We need to care about this stuff because the Fed sets the base for interest rates globally and this constant battle between what the Fed thinks and what global inflation watchers think determines the base for our interest rates. It also reflects what’s happening in the global economy, which eventually dribbles or floods down to us in some form or another. Think of it as an economic ‘Atmospheric Flood.’

The bottom line? - The Fed is talking tough and may well push up the mortgage rates we pay here through sheer force of will. But ultimately, how far the Fed squeezes will be decided by what happens to inflation on the ground in the Northern Hemisphere. I’m still in ‘Team Transitory’, which was the team Powell joined at Jackson Hole this time last year. He abandoned it by November last year because the facts changed on the ground by then. We’ll see if inflation is turning by November this year. My bet is it will, but it’s worth knowing what the Fed is saying and doing. Fighting the Fed can be a dangerous game for anyone to play.

Dive deeper - US- based British economist Adam Tooze does a great weekly podcast called Onze and Tooze for Foreign Policy. This week he went deep into the history of these Jackson Hole shindigs (which our Reserve Bank Governor Adrian Orr attended this year) before the event. I highly recommend it. Here it is in freely-available blog form too via Adam’s Substack, which I subscribe to.1

Quote of the day

Powell puts his ‘put’ on hold

“The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.

“These lessons are guiding us as we use our tools to bring inflation down. We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.” US Federal Reserve Chair Jerome Powell in a speech at Jackson Hole on Saturday morning NZ Time. The bolding is mine.

Chart of the day

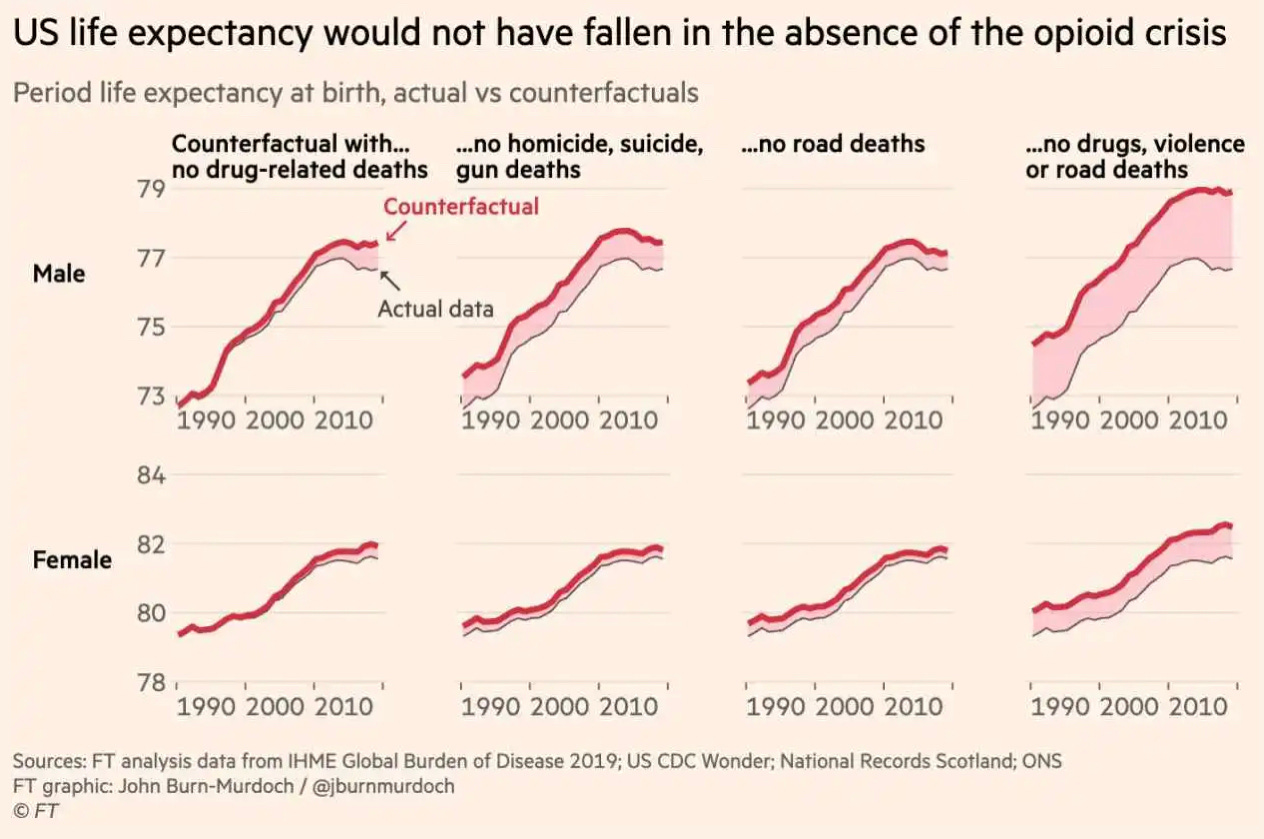

Going backwards - FT data journalist John Burns Murdoch has done a brilliant analysis of global mortality stats that shows America’s opioid, gun crime and obesity epidemics have lowered life expectancy there in recent years, especially for men. It’s today’s deeper data dive2.

Number of the day

1,008 - The Dow fell 1,008 points or 3.03% to 32,283 on Saturday morning NZ Time after Powell’s speech, which was interpreted as the Fed refusing to pivot to softer monetary policy soonish, as many investors and traders had expected or hoped for.

Comment of the day

A big idea in the AMA

“I do so love this hour! It's like a debate of great ideas. I've been mulling one potential solution to climate adaptation. Rather than individually negotiating with the 1000s of people with homes built in unsuitable locations, how about the government identify large blocks of land in safe zones in our inner cities (I'm thinking the Adelaide Rd block up from the Basin in Welly). Acquire the land, build big but beautiful mixed use high rise apartments that can be for climate refugees (both from here and overseas) to relocate to. Highly insulated, no cars (only bus, bike etc). Close to town for jobs. Surely a better use of taxpayer money than rebuilding communities that will only get smashed again. Obviously not a compulsory option but wouldn't it be comforting to give communities another option?” Sonya in Friday’s AMA.

Today’s must read

The Administrative State - Danyl Mclauchlan is one of my favourite writers on politics and big ideas here in Aotearoa-NZ. He has written a Sunday Essay for The Spinoff challenging the amounts being spent on consultants dreaming up massive structural reforms. This Government, like many before it, appears captured.

Here’s the gist (bolding mine):

“Aren’t we seeing an erosion in state capacity alongside all this centralisation and expansion? Aren’t outcomes in health, education and welfare trending down rather than up? What’s going on? You can’t have effective public services without bureaucracies, but it’s not clear that the torrents of money flowing into them are delivering more value to the public or to the marginalised communities some of them are named after. It’s almost as if the primary role of the administrative state is shifting from serving the people to the redistribution of wealth to the staffers, lawyers, PR companies, managers and consultancy firms that work in them, or for them. A billion dollars a year in public sector consultancy is an awful lot of money when you’re running out of teachers and nurses because you don’t pay them enough, and the fire trucks are breaking down.” Danyl Mclauchlan in The Spinoff

Today’s must listen

How to finance a revolution - Irish economist David McWilliams produces a weekly podcast I enjoy listening to regularly. He and his mate John Davis meander around a particular topic and sometimes have guests. This week they took a closer look at how Michael Collins financed Ireland’s revolution by creating a ghost bank and doing a bond issue. Collins worked for JP Morgan in London in his 20s.

Some fun things

Ka kite ano

Bernard

I do wonder sometimes whether my substack earnings are designed to pay for all my substack and other subscriptions!

It’s a gift link from me as an FT subscriber to you. It will open three times so first in first served. If you’re a bit late, just ask for more in the comments below and I’ll put a link in.

Share this post