TLDR: Growing calls for a return to ‘business as usual’ with tighter Government spending and a return to budget surpluses are premature and risk embedding a massive Covid injustice. Those who did well out of Covid should help those who did badly before they move on. In my view, they should do that by returning the taxpayer cash and capital gains they received as Covid windfall refunds to the Government.

Asset owners did fantastically well during Covid because of Government policies, including $20b of cash handouts to businesses and $55b of money printing by the Reserve Bank that helped push up asset values of households and businesses by $824b.

In my view, the Prime Minister and Finance Minister should call on boards and owners of companies to return to taxpayers as much of the $20b in Covid cash handouts that they can and no longer need. Businesses have $96b in cash in their bank accounts, up $23b from December 2019.

It’s also worth asking whether owners of residential land that captured $378b in unearned (and almost totally untaxed) capital gains because of Government actions should pay a one-off Covid refund of $20b from a one-off land tax. They could afford it – households made an overall $621b in windfall gains from higher asset values during Covid, including shares and equity in businesses. They also have an extra $35b in cash in bank accounts, holding $227b as at the end of March.

The proceeds of these windfall taxes could then be applied to ‘Building Back Better’ for renters and the young who have been hit hardest during the Covid ‘Rekovery’, including by implementing the recommendations of the Welfare Experts Advisory Group to fully increase cash incomes for those on benefits, and to forgive all beneficiary and student debt incurred over the last two years. It could also be used to repay debt and/or invest in infrastructure for affordable housing and public transport.

Tax the Covid windfalls to build back better

There was a flurry of pointless clickbaitery on Friday that seemed to capture the zeitgeist of how many on both sides of the political divide feel about this next phase of the post-Covid lockdown period. One side believes the Covid ‘cash handouts’ should stop, but doesn’t believe the ones they received counted or should be returned. The other side is increasingly calling for the beneficiaries of unearned Covid-era gains to hand back at least some of their windfall gains to taxpayers at large, to help those hurt most during Covid.

Here’s the latest skirmish. The NZ Herald and NewstalkZB removed an article on Friday by Newstalk ZB deputy political editor Jason Walls that challenged what he described as $20,000 of NZ Film Commission funding for a short documentary made during the first Covid lockdowns about public scientist Dr Siouxie Wiles. The bolding is mine.

“I'm just so sick of everything getting taxpayer money for these projects. Why can't people just pay out of their own pocket? I just keep seeing these things crop up time and time again, when we have hospitals overwhelmed. Twenty thousand dollars is not tons of money in the grand scheme of things, (but) that sort of stuff keeps adding up.” Newstalk ZB deputy political editor Jason Walls on air last week, as RNZ’s Colin Peacock reported yesterday.

An article summarising Walls’ views was published online afterwards, although removed on Friday after Wiles publicised her unhappiness with it.

“Would you pay $20,000 for a documentary about ‘science superhero’ Dr. Siouxsie Wiles? Because you already did,” the Herald’s story began.

The implication was that $20,000 of taxpayers’ money was ‘wasted’ on publicity for a scientist. As it turned out, the $20,000 referred to was for another unfinished project and the project had actually cost the documentary maker $8,000, with a further $7,685 in funds raised via a kickstarter campaign from the public.

Aside from the factual issues with the piece, it struck a nerve with Wiles’ supporters. It also struck a particular nerve of mine, regarding NZME’s use of publicly provided funds during and since Covid, and the apparent hypocrisy of some of its commentators about private use of public funds.

I tweeted this on Friday night in response to Wiles’ tweet.

NZME got $12.9m of public cash & will pay $15m in cash to investors

The owner of NZ Herald and NewstalkZB, NZME, received $8.6m of wage subsidies, which it has refused to repay (detail here via RNZ). That is on top of $4.3m of public funds from the Public Interest Journalism Fund and other public funds to pay for journalists working for NZME and specific projects over the last two years. The $12.9m in public funding helped stablise NZME during Covid, but the company has now returned to growing its operating profits and has reduced debt substantially.

In fact, NZME is now in the process of returning $15m in cash to shareholders through share buy-backs and special dividends. It is not the only one. Fletcher Building received $68m in wage subsidy cash during 2020 and has refused to repay it, despite an increasingly robust profit and balance sheet. It paid $140m of cash dividends to shareholders in April this year after reporting solid profit growth and a strong outlook because of a boom in house building and building materials sales. NZME and Fletcher Building are just two among many large and small New Zealand companies that have refused to repay the cash, despite reporting profit growth and higher cash reserves.

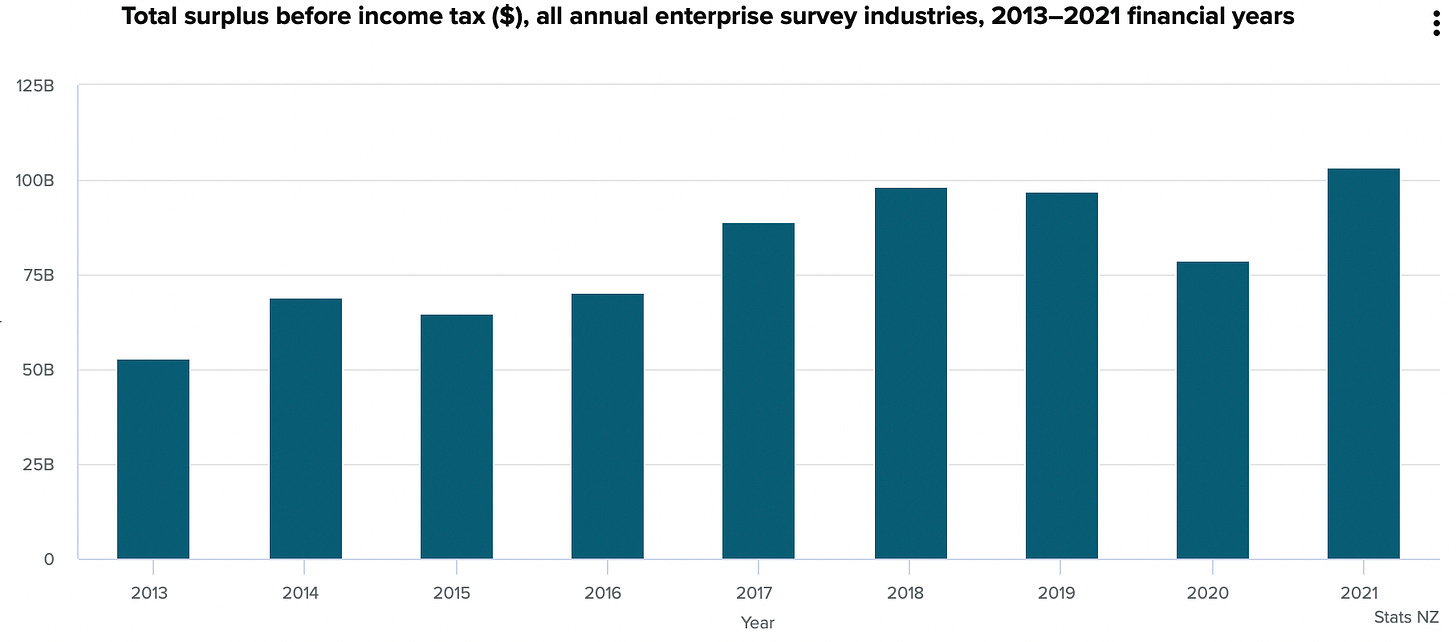

Overall, the Government gave $20b in cash to companies during 2020 and 2021 as wage subsidies, but less than $1b has been returned, which companies were supposed to do if they found they did not need it. Meanwhile, company profits have surged over the last two years, despite a sharp rise in costs and wages because of inflation. Those higher profits are due at least partly to the cash windfalls from Covid, and partly to profit margin expansion during the surge in inflation.

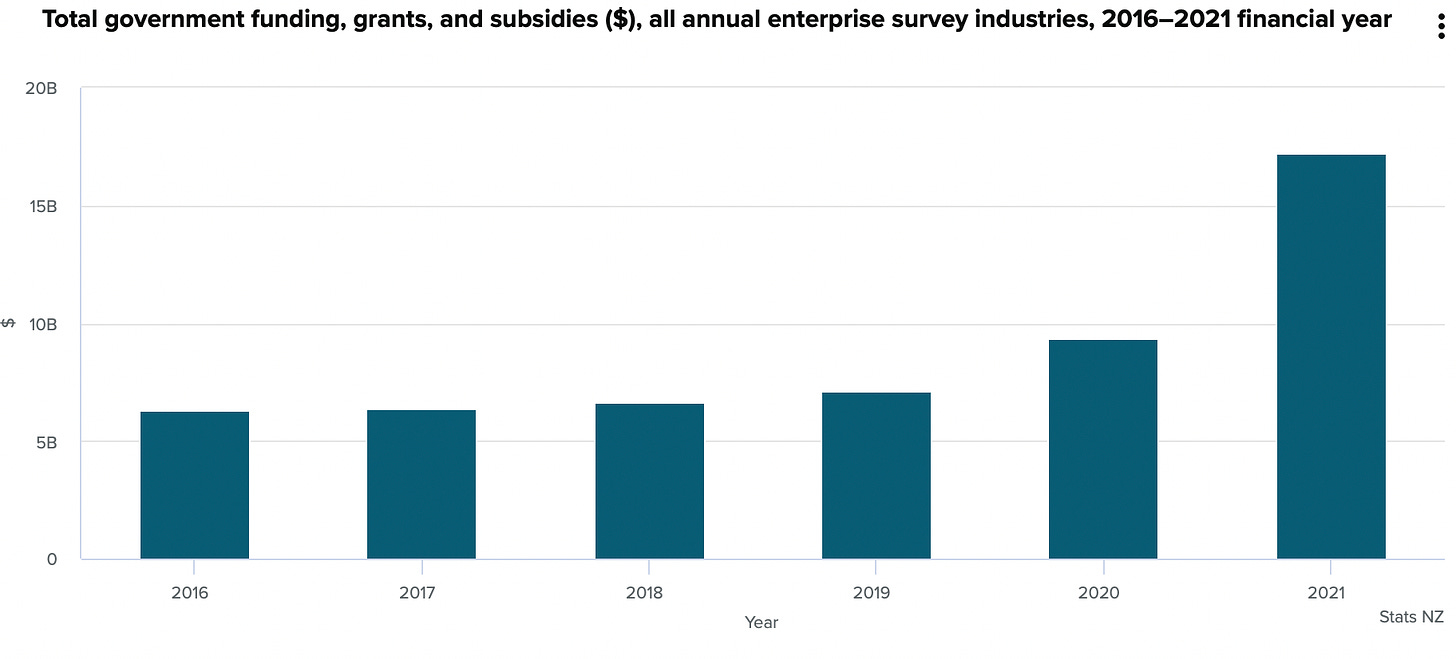

Stats NZ’s most recent annual enterprise survey for the year to June 30, 2021 found company profits rose by almost $25b to $103b from the previous (also) Covid-affected 2019/20 year, and were up from the last non-Covid year’s profit of $97b. That came after Government grants of $17.2b in 2020/21 and $9.4b in 2019/20, which followed $7.1b in 2018/19. That is also before the second round of wage subsidies in the second half of calendar 2021 in response to the delta lockdowns from August onwards.

Profits up $25b after $20b of cash payments from Government

More than 60% of the increase in profit in 2020/21 came from just three sectors: banking and insurance (up $10.6b), rental and real estate (up $3.7b), and construction (up $1.7b).

The Auditor General has criticised the Government’s failure to properly chase up those who incorrectly kept the wage subsidy money. Prime Minister Jacinda Ardern and Finance Minister Grant Robertson have repeatedly refused to call directly on companies to return the cash. MSD, the original distributor of the funds, has made a few prosecutions, but is spending more chasing and prosecuting beneficiaries to repay their $1b in debt to MSD.

Then there’s the unearned gains on assets

The other major interventions of the Government during Covid were through the Reserve Bank, which removed LVR restrictions, printed $55b to buy Government bonds to lower mortgage rates, and lent $12.7b cheaply for banks to lend on to home buyers. Those moves were all approved by Robertson. The central bank’s deliberate aim was to make asset owners feel wealthier so they would spend, lend, invest and employ to soften the economic shock of Covid.

It worked, but it also delivered asset owning households $621b in increases in net worth to a total of $2.4t between the end of December 2019 and the end of the March quarter of 2022, according to Stats NZ’s National Accounts data.

These accounts also show financial enterprises, which include banks and insurers, reported $6.6b in gross disposable income (equivalent to pre-tax profit) in the two years to the end of March 2022, up from $5.5b in the previous two years. Banks did not take the wage subsidies, but did benefit from cheap Reserve Bank loans and the removal of LVR restriction in 2020. This same data shows non-financial businesses made gross disposable income of $114.1b in that two-year period, up from $74.4b in the previous two years. This data also shows the equity held by non-financial businesses rose by $203b to $1.275t in the two years to the end of March.

So Covid policies helped increase the net worth and equity of households and businesses by $824b in 2020 and 2021 ($621b for households and $203b for businesses), including $378b from the rise in residential land and house values to $1.31t, caused largely by lower interest rates.

How to refund the Covid windfalls

There are various ways the Covid support could be refunded to taxpayers at large by business and home owners, including simply repaying the bulk of the $20b in cash support for businesses. It would require direct requests for repayment from the Government, which we have yet to see. CTU Economist Craig Renney has also suggested a windfall tax on bank profits, which are currently running at an annual rate of $6.8b per year, and reflect the big surge in mortgage lending done through the last two years of Covid and cheap funding from the taxpayer-owned Reserve Bank.

The refunds of unearned Covid gains could also be done through a one-off 0.2% tax on the value of all residential-zoned land, which would raise around $20b.

That combined $40b of windfall refunds to the Government could be used to both increase incomes for the lowest paid and reduce Government debt, or alternatively, to invest in infrastructure to allow much greater supply of affordable housing.

I think a debate about the wealthiest returning their near-$1t in windfall gains from Covid policies is more useful than debating whether $20,000 of public funding for a documentary on a public scientist can be justified, especially when the debater’s employer recieved $12.9m of taxpayer cash and is paying it all back in cash dividends to its fund-manager owners.

Elsewhere in the news overseas and here this morning:

Recession fear - An early S&P survey for July showed US and European factory confidence sunk into recessionary territory, forcing share prices 1-2% lower on Friday night and dragging bond yields significantly lower as fears about inflation receded somewhat. The US 10 year bond yield fell 14 basis points to 2.77% and the German 10 year ‘bund’ yield fell 17 basis points to 0.97%. Longer term global interest rates that set our mortgage rates are peaking because recessions will reduce inflation.

Shaw’s future in doubt - James Shaw was ejected as Green Party co-leader on Saturday night in vote that opened up his position to a wider contest and revealed deep divisions in the party. There were 32 delegates out of 107 who voted to reject Shaw’s annual re-appointment as co-leader, passing the 25% threshold needed to open up the position. Shaw has said he has yet to make a decision about whether to stand again, although Prime Minister Jacinda Ardern said he supported retaining Shaw personally as Climate Change Minister. Some Green activists are unhappy with a lack of progress on climate change action and poverty reduction. Shaw must decide within a week and a fresh vote will be held in five weeks.

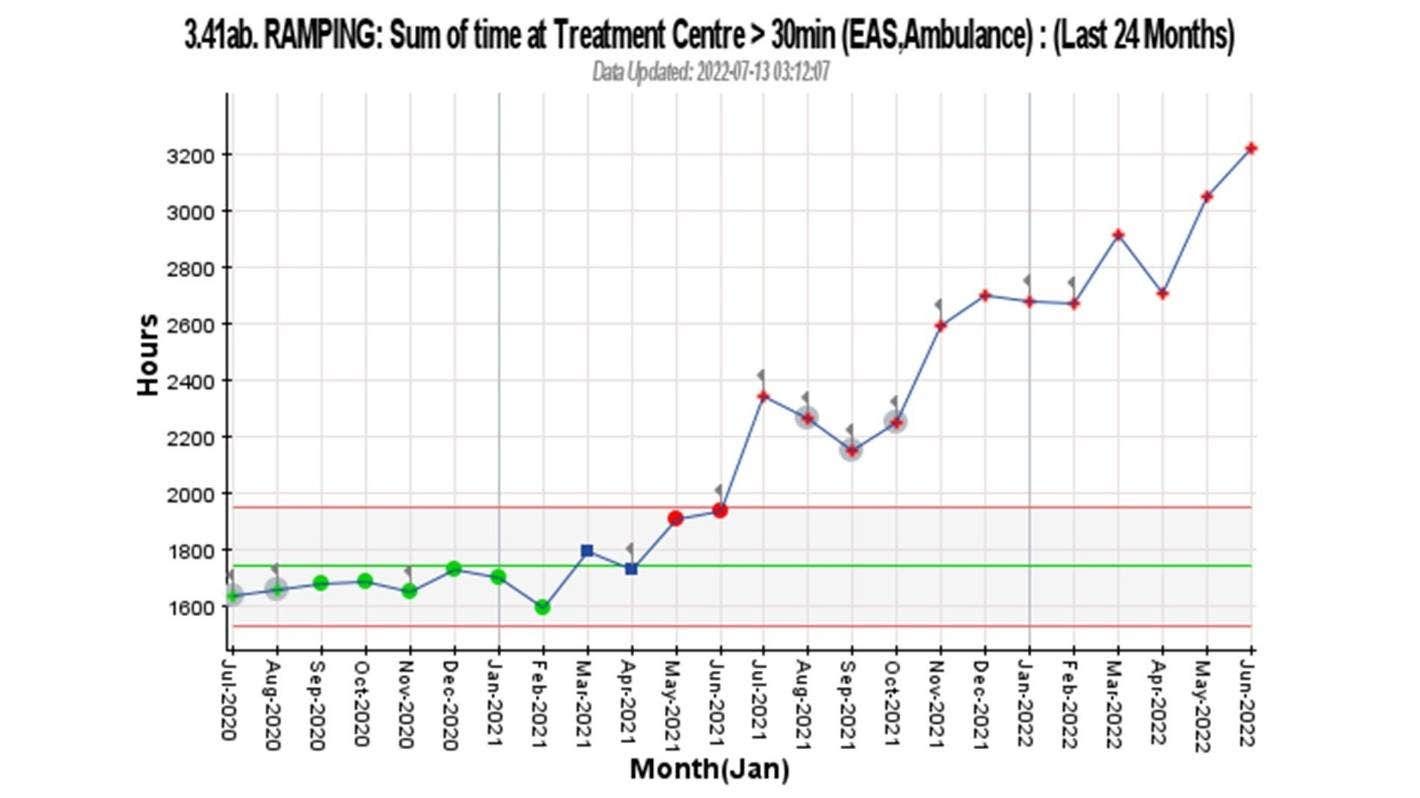

Chart of the day

Time ambulances spend waiting to discharge at A&Es

Quote of the day

Why Green members voted to oust James Shaw

“Our Government, led by James as Minister, has been shown not to be reducing emissions, not to have ambitious mandatory targets, but to actually be weak. You have to remember you're in the Green Party - you're not here to placate Labour and necessarily stay in power for the sake of it." Former Green MP Catherine Delahunty via Newshub

Some fun things

Ka kite ano

Bernard

Share this post