TLDR: Reserve Bank Governor Adrian Orr appeared to suggest the Government could cool its spending to help the central bank fight inflation. Acting PM Grant Robertson said in response Orr was speaking broadly and denied government spending was responsible for inflation. National Finance Spokesperson Nicola Willis called on Robertson to listen to Orr and exercise fiscal restraint.

In the podcast above, I include my questions to Grant Robertson and Nicola Willis this afternoon and their answers in full, along with the full comments from Adrian Orr in an interview released today with the IMF’s Acting Director of the Asia and Pacific Department Anne-Marie Gulde-Wolf.

A plea for Govt to be more of a monetary policy mate?

Reserve Bank Governor Adrian Orr gave a video interview to the IMF’s Anne-Marie Gulde-Wolf last Thursday after the Reserve Bank’s 50 basis point hike in the Official Cash Rate to 1.50%. The interview was released this morning. Orr detailed how the bank was up against the threat of higher inflation expectations becoming embedded as inflation headed over 7% early this year and that “we’re not in a great place right now”.

He reiterated that the bank’s move last Wednesday, its first 50 point hike in 22 years, was about “doing it sooner rather than believing we have to do more”.

But it was Orr’s comments about how fiscal policy could help central banks use monetary policy to fight inflation that got the most attention from the Opposition and, in response, the Government.

In his opening comments Orr said the following (bolding mine):

“Without doubt, central banks around the world are currently challenged by a very high and sustained inflationary pressures. The challenges are familiar one. But I would say that the background and the setting is unique. I mean, central banks now have to meet our low and stable inflation and contribute to employment mandates. We have to do that in the context of a large evolving severe health shock to the global economy, exacerbated by the Russian invasion of Ukraine at present.

“So it is incredibly uncertain environment. The challenge in front of us is central banks, and I'm talking in general because we're all in this together at present, is really how do we tighten our monetary policies to constrain inflation expectations, but without creating a recession. So the challenge of a soft landing coming out over the next two years.

“For us though, of course, we're considering this in this unusual environment, we have extremely volatile near term data. So getting a starting point or launching pad is very hard to estimate. There have been dramatic changes in the way people are behaving either through regulated constraints or through natural human concern going on from the health shock. And there are an unbelievable number of continued economic shocks hitting the environment, whether they be health, geopolitical concerns, and of course, underlying this the continued climate change challenge that we have, I would say that central banks aren't going to achieve these mandates on their own — low and stable inflation and maximum sustainable employment — we are going to need support.

“Central banks are going to have to communicate very, very clearly about our purpose and why we are looking to lift interest rates in the current environment. We're going to have to be very clear with our fiscal authorities around what we're doing, and how they could assist around more targeted effective fiscal policies. And I would say, speaking to the global institutions here, we really do need to get on and make progress, work collaboratively on what I would call common issues, or issues of the common.” Adrian Orr speaking in an IMF interview.

Orr seemed to suggest later in his comments that Government spending or demand was less of a factor than supply constraints (bolding mine). He also indicated monetary policy had to do the work.

“The big lesson for us is, we have to work very closely with the fiscal authorities to understand what they can do and can't do, and hence what we need to do, in addition, with monetary policy. And really, it's been the supply constraints and supply side of the economy that a lot of learning is well underway.

“Here for us, you know, I think the main things we need to do is remove any remaining unnecessary monetary stimulus with that view, that focus on the domestic driven part of our inflation. We have to retain an anti-inflation bias in everything we do. That is our role as central banks, to head off that headline, inflation expectations becoming baked in to price setting.” Orr

‘Listen to what the Governor says. He wants help’

National Finance Spokeswoman Nicola Willis then put out a statement calling on Finance Minister (and currently Acting PM) Grant Robertson to listen to Orr “about the need to use his fiscal tools to help control inflation.”

“The Finance Minister must heed this warning. It’s not credible for Grant Robertson to keep claiming inflation is a mysterious visitor from overseas over which he has no control.

“He must do his bit to remove inflationary pressure in the domestic economy: stop adding costs to business, quit wasteful spending & remove bottlenecks to productive growth.

“This is absolutely not the time to put fuel on the fire with the biggest Budget spending allowance in history, which he has foreshadowed for his May Budget.

“Grant Robertson should take the Reserve Bank Governor’s comments seriously and rein in his extravagant spending plans.” Nicola Willis in a statement.

‘He didn’t point at me. And what would you have us cut?’

Robertson then held the regular post-Cabinet news conference as the acting PM, giving us a chance to ask him if he was being enough of a mate.

He denied the Government was responsible for inflation, which he argued was coming from the Covid and Ukrainian war shocks to fuel, food and other logistics costs.

He then challenged the Opposition to say what spending it would cut and said any Government decision to cut health spending would not reduce food or fuel inflation.

“I think it's really important still to note that the big drivers of cost of living pressures are ones that are generated offshore. So in particular the COVID 19 pandemic and the pressure that's put on supply chains. Obviously we've got war in Ukraine now that is putting through the pressure on that. And so while we have to be careful with our spending, we've got to continue to be balanced in the way that we approach our government spending, it is important that we don't cut our nose off to spite our face and take away funding that's really important in areas like health or educational housing.

“We're not going to reduce the price of food at the supermarket by cutting health spending. We have to look carefully at all of our initiatives to make sure that their value for many and that they're doing the things that New Zealanders would expect us to do. But in this budget for example, we are completely rebuilding New Zealand's health system. There is a one off component to the operating allowance which is for that purpose. Other than that the operating allowance is similar to levels that we've seen recently. But the job of making sure that we carefully balance our spending is one meanings when I take seriously. I know that the job of making sure that monetary policy plays its role is one that the Governor of the Reserve Bank takes seriously.

“In terms of fiscal policy, we will continue to operate a carefully balanced policy. There are areas of investment in New Zealand society that we need to continue with. The building of state houses for example, there are areas such as the health system where I think COVID-19 has shown New Zealanders the importance of the kinds of reforms that we're proposing, and I believe we need to carry on with those. But every decision we make at the budget is based on whether we get value for money and how we can best make sure that New Zealanders benefit.” Grant Robertson talking at the post-Cabinet news conference.

Robertson downplayed Orr’s comments about targeted fiscal spending to help control inflation.

“I think he made those comments in the context of all central banks around the world. And I agree with him that we've got to make sure that our spending is targeted, and make sure that it goes to the right places. It's the reason why we've focused our cost of living attention on those on low and middle incomes with our April 1 package. And with the winter energy payment coming back in on the first of May, rather than untargeted tax cuts that benefit people who earn more than $180,000 a year as the National Party would have it.” Robertson.

I then asked whether Budget 2022 due on May 19 would tighten or loosen fiscal policy. Robertson did not answer directly, citing instead indications of new fiscal rules. The old rule adopted pre-Covid by Robertson was that the Government looked to keep net core crown debt in a range of 15-25% of GDP, which was different to the below-20% lid set before 2019. Robertson has said he’ll update this debt rule before the Budget.

“We will be setting new fiscal rules because the last couple of years is obviously seen as needing to suspend some of the targets that we've previously had. I'm also on the record as saying that I think it's really important that we use fiscal policies sensibly to be able to make sure New Zealand not only keeps a lid on debt, but also make sure that we invest in the right things such as infrastructure, long term. And so I have more to say about all of that before the budget and on Budget Day.

“We will continue to keep a lid on debt. It is important for New Zealand that our debt levels return down from where they are now. We will well served by having relatively low debt as we came in to a crisis like COVID-19, but I also had to balance that against the fact that New Zealand has a massive infrastructure deficit, which we will continue to invest in.” Robertson

After the news conference I spoke with Willis in an interview, in which she again accused the Government of wasteful spending and pointed to official findings that the Government’s plans for nearly $2b of mental health spending had been ineffective.

The full interview is in the podcast above.

But just how stimulatory is the Government right now?

The Government certainly did add to demand in 2020 and 2021 when it gave $20b in cash to businesses as wage subsidies and resurgence payments. The net effect of that spending was a near equivalent increase in cash deposits for households and businesses. The 40%-plus rise in house prices caused by this monetary and fiscal stimulus also bolstered the ‘wealth effect’ on consumer spending and some business investment.

But that broad spending has now stopped. The Government did indicate it would have a new operational spending allowance of $6b for this current Budget to help pay the one-off costs of health system restructuring and to reduce climate emissions.

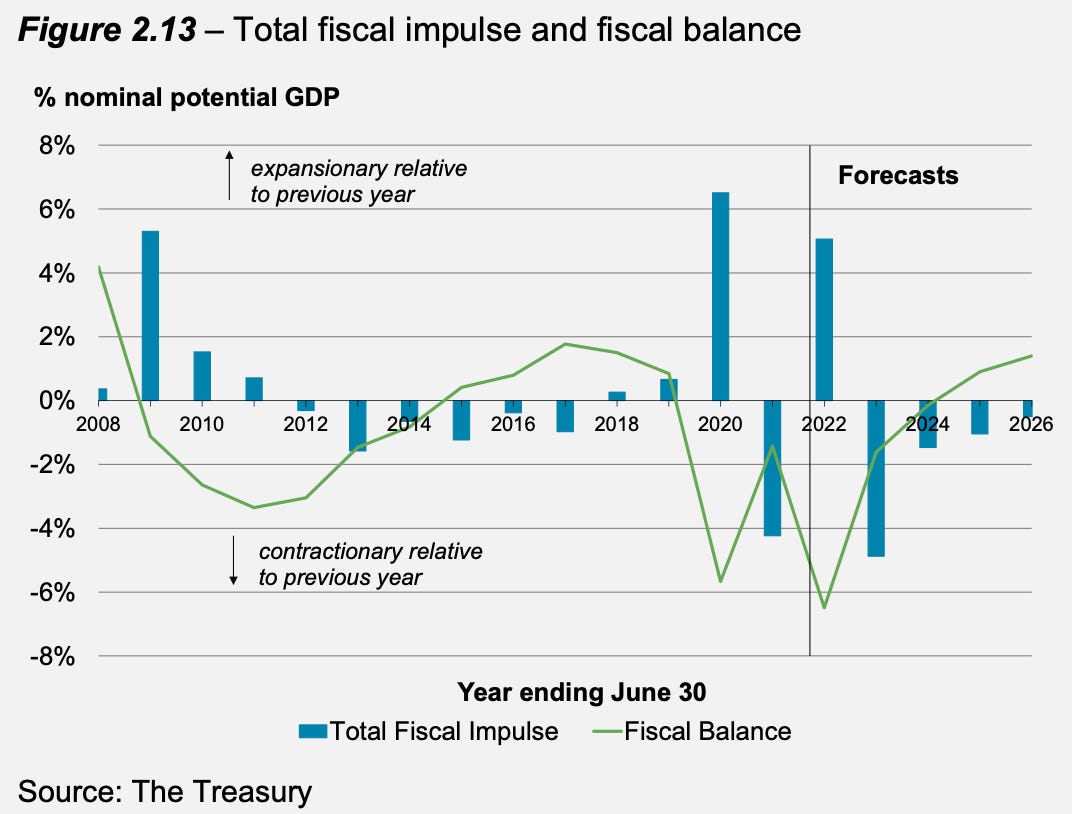

But the December Half Yearly Update actually showed (see chart below) the net fiscal impulse from this plan was a net detraction from GDP of 2.8% over the next four years. In reality, that detraction will now be larger because the Crown Accounts have shown smaller than expected monthly deficits since December.

This actually shows the Government is tightening fiscal policy as the Reserve Bank is tightening policy through 2022 and 2023. The broader question should be whether it is enough.

This is not a plea for a monetary policy mate. Yet.

In my view, I don’t think Orr’s comments were a carefully designed shot across the Government’s bows or a public plea for more fiscal restraint. He was speaking broadly about central banks generally. It would also be highly provocative to use an interview with the IMF to slap the Government about the face. It would be akin to saying into a hot mic that the whole school could hear that you had just dobbed the headmaster into the ministry for fiddling the school’s books. Orr is blunt. Just not that blunt.

He commented in the interview that central banks should talk clearly with Governments if their help is needed. He will if it’s necessary, but right now the Government is actually contracting, not expanding, fiscal policy.

But the Governor is right that they have to work together. It could be argued in hindsight that they both put their policy-easing pedals ‘too close to the metal’ in 2020 in 2021 by pumping in $20b in cash, slashing interest rates and removing LVR restrictions. They only really started taking their foot off the accelerator late last year.

I don’t think the LVRs should have been removed in the first place and that the bond-buying programme was only really effective in the first few months of the pandemic in calming a dysfunctional bond market. Orr said himself in the interview that the bond buying, which ended in July 2021 with $55b worth of bonds bought with invented money, did most of its work in the early months.

The Reserve Bank bought $17.5b in the three months to the end of June 2020, but kept plugging away to buy $55b by July 2021 and had also pledged to buy up to $100b. Also, somewhat surprisingly to me, the bank’s Funding for Lending Programme (FLP) of discounted loans to banks at the Official Cash Rate is still going. It has now lent $8.3b to banks, including $5.1b lent after the end of the bond buying.

I asked Robertson about why it was still going and his eyebrows were also somewhat raised in this response:

“I'm sure the governor is, and you could certainly put the question to him, as aware of the role that it plays. And if he's looking at the broader tightening, it may be an area he chooses to look at.” Robertson.

So what now?

The Opposition is on to a political winner by blaming the Government for both higher inflation and higher-than-necessary interest rates. The coup de grace would be to extend the blaming to lower house prices, caused by higher interest rates.

However, it’s a relatively easy shot. No Opposition will ever have to specify what it would cut. It can make broad accusations about Government wastage, more bureaucrats, fewer contractors and higher inflation. All it needs is a few high-profile examples of bad value for money and the broad accusation will stick, even if the numbers don’t justify the specific accusation about inflation.

The Government can rightly argue that cutting spending on infrastructure, housing, health and all the other public services that got us through Covid would be counter-productive, especially if the problems of housing affordability, climate change and child poverty are to be solved.

In reality, about half of the inflation is generated by local demand and supply issues. The biggest causes of inflation flowing to the peak in the first quarter of this year were 2% mortgage rates, rampant high LVR lending and $20b of cash payouts through 2020 and 2021. All of those factors are finished now and the effects will flow through in late 2022 and 2023.

Aggressively tightening both fiscal and monetary policy now would just turn into a pro-cyclical feedback loop that worsens any slowdown into a recession next year. But calling for the Government to act like a household and ‘balance its books’ is always good politics when those households are feeling the pain right now of inflation.

Short-term pain converted into long-term pain

But it has been exactly the attitude that has left us with the 20% debt millstone around our necks stopping us from investing properly in infrastructure, health and housing. Politics work in lizard brain timeframes that convert short term pain into long term pain.

We’ll see whether Robertson is able to shift the debt narrative much over the next couple of weeks before the Budget. He may be able to nudge the range out a bit from 15-25%, but not in a meaningful enough way that changes the outlook for infrastructure under-investment, housing shortages and the feedback loops turning today’s poor kids into tomorrow’s poor grandparents with poor kids.

Meanwhile, the Reserve Bank should shut down its FLP programme and the Government should allow the bank to use the Debt To Income multiple tool it wants to take some of the leverage out of the economy. Both are unlikely in the next year or so while the Government tries to get re-elected.

How to win elections

The rule of thumb for any Government in the modern era is that to get re-elected, interest rates need to be falling, house prices need to be rising, taxes need to be flat or falling vs GDP, and inflation needs to be low.

The only way to square that circle is constantly squeeze down the size of Government and prefer the interests of asset owners (mostly home owners) over the interests of renters and PAYE wage earners who spend 100% of their pay packets on goods and services taxed at 15%.

By the way, here’s the full post-cabinet news conference if you’re really into the political and economic geekery. Hopefully I’ve saved you a bit of time with the detail above…

Share this post