TLDR: Inflation pressures in the world’s dominant economy eased more than expected in July, which has increased hope that central banks won’t have to hike short term interest rates too much, which in turn would lead to soft landings globally.

US inflation data out overnight showed the annual rate fell to 8.5% in July from a 40-year high of 9.1% in June, with prices actually flat overall in July from June. US stock and bond markets surged this morning on growing hopes that central banks won’t have to tighten monetary policy quite as aggressively as once expected, allowing the world’s largest economies to have softer landings with only mild or no recessions.

Paid subscribers can see more analysis, charts and detail below the paywall and in the podcast above.

Inflation is peaking (yes I wrote it out loud)

It’s been a while since I’ve reaffirmed my membership of ‘Team Transitory’ in seeing high inflation as a temporary phenomena that will recede without the need for extended and painfully high short-term interest rates from central banks. But regular readers and commenters will know I never handed in my membership card, although it has been an uncomfortable position to hold for many a month this year.

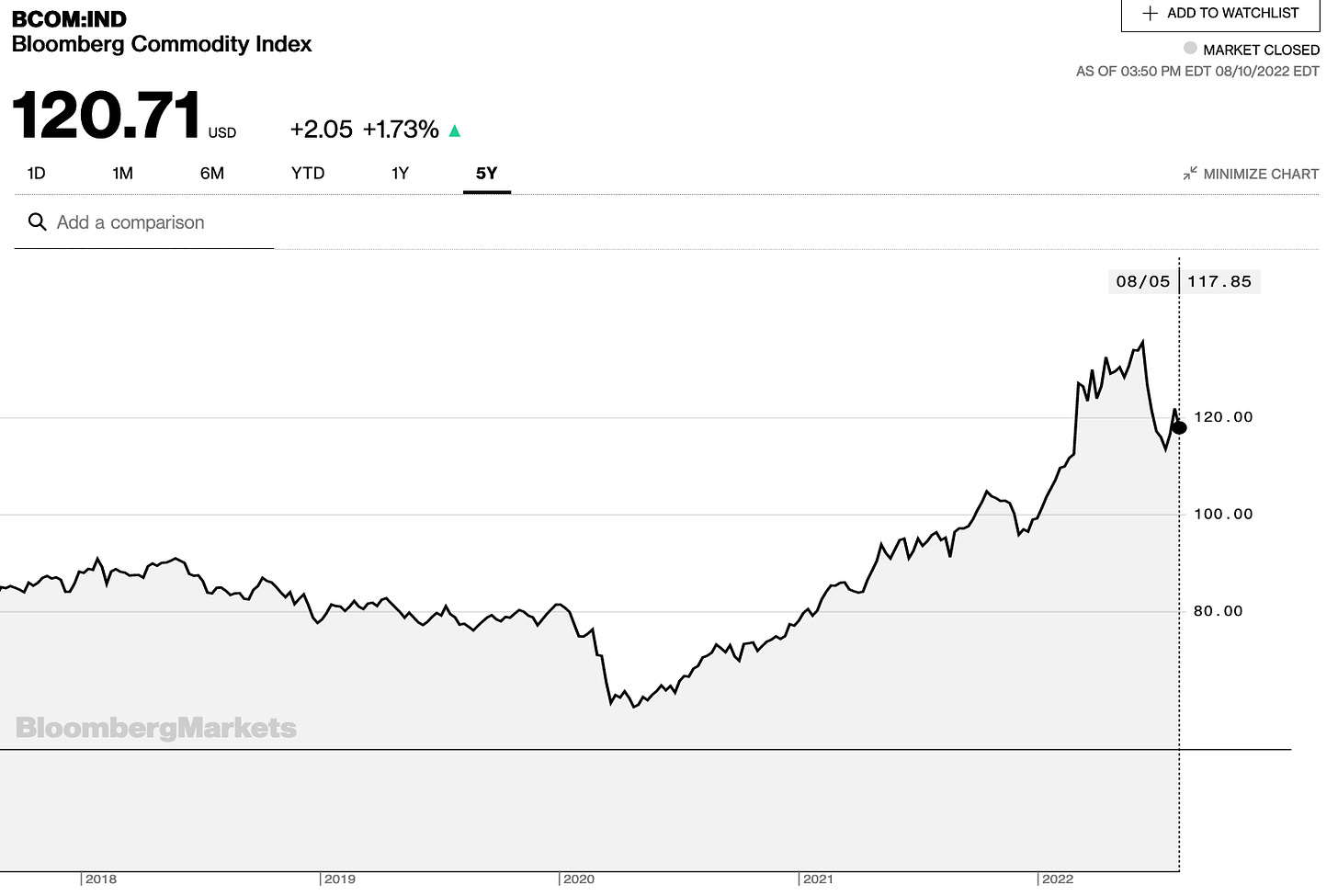

Today, I’m happy to brandish the ticket again and say things are looking much better for Team Transitory in the wake of last night’s inflation data from the United States and China, the world’s two largest economies, and after recent slumps in commodity, shipping, computer chip and most asset prices (see charts below). The chill winds of disinflationary pressures are blowing again around the global economy, as they have for almost all of the last 30 years.

Just like any Warriors supporter, I think ‘my’ team will win in the end.1 That’s because the underlying forces of disinflation have not gone away. If anything, they have intensified in many places. Those main forces include:

Savings gluts - rising inequality driving more and more cash into passive and low-risk investments that are not recycled into job-and-productivity creating investments in infrastructure;

Flights to safety - climate change and political instability slowing economic growth, worsening the savings gluts and adding to the feedback loops worsening inequality;

Services deflation - an extension of the evaporation of services industries (health, education, finance) into the globalised cloud run by tech giants able to both reduce prices for consumers and pressure down wages for workers;

Depowered labour - the continuation of weak labour power because of a multi-decade and systemically driven reduction in union penetration and worker rights, along with a further deepening of outsourcing and contracting out, both online and on the ground;

Labour migration - Covid slowed the growing flows of temporary (and permanent) migrant workers from low cost climate-and-war hit areas such as Africa, the Middle East and central Europe to richer countries with ageing workforces, but they are resuming to meet insatiable demand from employers needing cheap labour to keep growing in the absence of productivity investments;

Globalisation is surviving - There’s been plenty of talk that de-globalisation, on-shoring and ‘friend-shoring’ will unwind the deflationary effects of China’s embedding in globalised supply chains, but despite the noise after Russia’s excision from the global economy2, that has yet to actually happen, largely because China and globalised companies doesn’t want deglobalisation when push comes to shove;

Cheaper energy - the eventual switch to renewable electricity globally will reduce and stabilise transport and other costs because solar and power costs are ultimately cheaper and less volatile than fossil fuel costs, largely because supply is local and not dependent on unstable producers such as Saudi Arabia, Russia, Iran and Veneuzuela; and,

Cheaper basic food - the use of genetic modification has only just begun to improve the efficiency of food production, along with shifting grains production away from emissions-heavy animal feed, will see basic food costs subside (although don’t expect cheap cheese, meat or fish).

Some temporary members of Team Transitory

The central banks themselves were in Team Transitory until late last year. The Reserve Bank of New Zealand jumped out earliest, stopping QE last July and hiking for the first time in October. The US Federal Reserve did not leave the club until December. The Reserve Bank of Australia stuck to its transitory guns until its first rate hike in May. The European Central Bank only hiked for the first time last month. The Bank of Japan has yet to abandon its ‘Team Transitory’ stance of printing money to keep interest rates low.

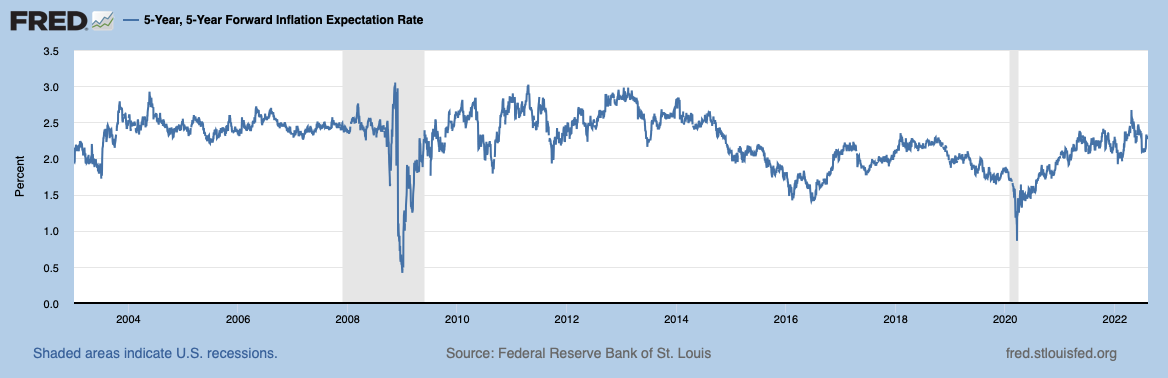

Some investors and traders in Government bonds got a bit nervous earlier this year as US inflation headed towards July’s peak of 9.1%, but inflation expectations measured in the differences between regular bond yields and inflation-adjusted bond yields have never shown the ‘smart money’ thinking inflation was getting out of control.

Cash gluts keep starving economies of real investment

Some argue those low bond yields3 are distorted by savings gluts and inequality as the richest and oldest owners of assets are more interested in capital protection than capital growth, but even if they are, it becomes a type of self-fulfilling prophecy. Cash parked in low-interest-rate bank accounts and Government bonds is unlikely to be invested in physical and social infrastructure that would unleash the type of strong real worker income growth and demand growth created by the massive state and corporate investments in the developed world from the 1940s to 1980s.

Those investments were driven mostly by fear of communism and the perceived need to invest in defence, soldiers’ skills and basic infrastructure for war fighting. They were funded by relatively high tax rates and a consensus that investing for future generations was a better choice than consumption now. The end of the Cold War (and history), along with victories for low-tax and small-government campaigning political forces, slowed those often-state-backed investments in productivity-enhancing infrastructure, training and worker welfare.

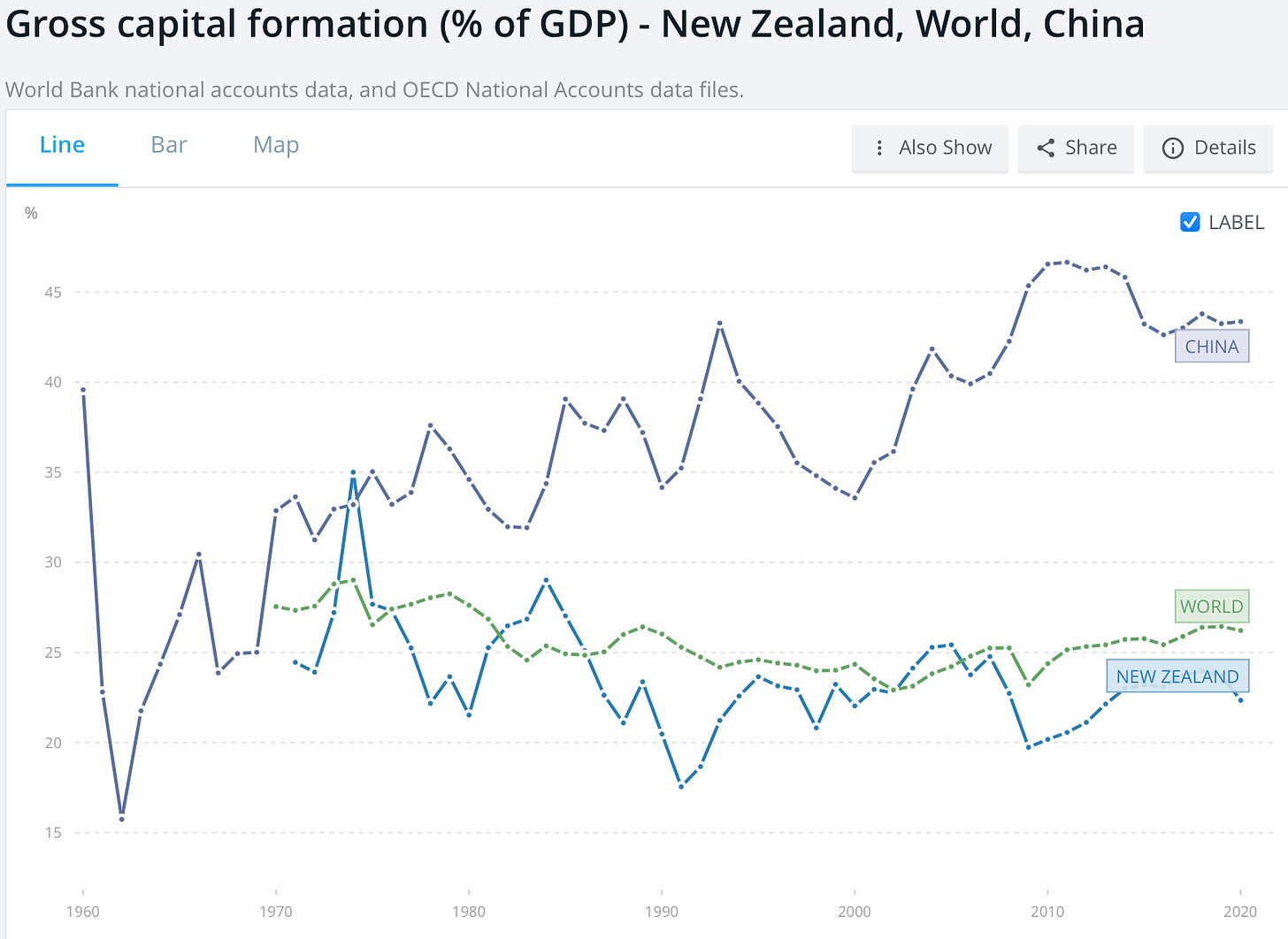

This Martin Sandbu piece in FT-$$$4 tells the story of the multi-decade investment drought well. Here’s the investment comparison for Aotearoa-NZ vs the World and China, which has avoided the problem of politically-inspired investment droughts.

The caveats?

It’s always helpful to have a few life preservers around when you set out for a quick trip across the forecasting Atlantic in winter. Here’s mine:

Warmageddon - All bets are off if China invades Taiwan or a war starts accidentally in the Taiwan St;

DeTrumpification - All bets are off in the very unlikely event that the political forces needling and funding the Trumpified political forces in developed economies go away and come back with a more enlightened view that raising taxes, sharing wealth and investing cash is better in the long-run than lowering taxes, concentrating wealth (in their hands) and hoarding cash; and,

Climatastrophageddon - All bets are off if climate change accelerates much faster than even the most gloomy forecasts and sparks the sort of destabilising wars and the destruction of the globalisation of labour and services that removes those inflationary pressures.5

But is inflation actually about to fall?

Oh yes. Here’s a collection of the latest data points and charts showing what’s happened to US CPI inflation, commodity prices, shipping rates and chip prices in the last couple of months.

Elsewhere in the news overnight and this morning

In geo-politics, the global economy, business, investing and markets

A flat July - The US Bureau of Labor Statistics reported overnight that a 7.7% fall in gasoline prices helped offset higher rents and food prices in July, meaning the ‘all items’ index of prices was flat for the month.

Soft landing celebration - The S&P 500 was up 1.9% and the Nasdaq was up 2.6% at 7am NZT as traders lowered their expectations for ‘peak’ US short term interest rates later this year to around 3.4% from 3.6% previously. CNBC

Rate peaks trimmed - Expectations of a 75 basis point rise in the Fed Funds rate next month also fell. The US 10 year Treasury yield initially fell as much as four basis points, but bounced in late trade to be flat at 2.79%. The US 2 year Treasury yield, which is a proxy for Fed Funds rate expectations over the next couple of years, fell 12 basis points to 3.16%. CNBC

Oil back on - The southern branch of the Druzhba pipeline pumping 250,000 barrels of Russian oil through Ukraine to Hungary was turned back on overnight after transit fees were paid to get around financial sanctions on Russia. That helped keep Brent Crude oil prices down around US$97/barrel overnight. Reuters

Chinese inflation weak - China’s consumer price and producer price inflation rose at a slower pace than expected in July as more Covid-19 lockdowns squashed consumer demand. CPI inflation was 2.7% for July from a year ago, which was below economists’ expectations for around 2.9%. Monthly inflation of 0.5% met expectations. Producer price inflation was 4.2% for the year, below expectations for 4.5% and at a 17-month low. Reuters

China’s drills finish - China’s People’s Liberation Army announced overnight it had finished its training drills in and around Taiwan, but would continue regular patrols. The move eases tensions between China and the United States somewhat in the wake of Nancy Pelosi’s visit to Taiwan last week. BBC

Here in Aotearoa-NZ’s political economy, business and markets

Uffindell’s bra hook - The ODT reported this morning on how Tauranga MP Sam Uffindell’s student flat in Dunedin was notorious in 2005 for being a haven for vermin and disease by health inspectors, and prominently displayed a coat hook with women’s underwear hanging from it.

Almost the last to know - National Leader Christopher Luxon said yesterday staff in his office were told months ago about the allegations surrounding Uffindell’s expulsion from Kings College because of his violent assault on a fellow boarder, but had mistakenly neglected to tell him. RNZ The list of those in the National Party (and it seems a few in the Labour Party) who knew about Uffindell but did not tell Luxon includes:

then-National President Peter Goodfellow;

current National President and HR expert Sylvia Wood;

current senior National Caucus member Todd McClay;

six other members of the candidate selection committee;

several members of Luxon’s office; and,

a Labour supporter who tweeted to Labour MPs Jan Tinetti and Marja Lubeck on June 9 that “someone needs to ask Sam about his King's college days and why he was asked to leave,” Politik-$$$ reported this morning.

Lush vs Shadbolt - Talk-show host, documentary maker and Invercargill City Councillor Marcus Lush announced overnight he would challenge Tim Shadbolt to become Mayor. Elsewhere, councils are concerned by the low numbers of candidates putting themselves forward before tomorrow’s close of nominations. Stuff

In the balance - An online poll of over 1,000 voters by Horizon Research found Labour and the Greens could still form a Government with Te Pāti Māori. Stuff

Work trumps study? - Tourism Minister Stuart Nash has suggested universities change their calendars so students can work in February and March. Stuff

A fun thing

Ka kite ano

Bernard

But unlike the actual Warriors, disinflation and deflation do always win in the end. :)

Russia is a tenth the size of China, much less engaged in global trade and has also avoided a lot of the sanctions.

Remember that bond yields fall as prices are pushed higher by buyers of fixed interest securities such as bonds. IE As Governments reduce their investing and borrowing, there is less supply of bonds for the richest investors who mostly want to put their money into the ‘safest’ investments of bonds. They can afford to lose a bit because of inflation and negative real yields, but are most interested in capital retention and regular rent-like cash income.

This is a ‘gift’ link that can be opened three times by anybody. First in, first served.

So basically, a return to hot or cold wars, or a fast climate meltdown, would save me embarrassment… Job done. :)

Inflation pressures easing globally