TL;DR: My six things to note in Aotearoa-NZ’s political economy around housing, climate and poverty on Wednesday, June 12 were:

The Government exempts farm emissions from the ETS, but announces $400 million of subsidies for farmers to reduce emissions by an indeterminate amount over no particular time period. No analysis was released of the impact on Aotearoa-NZ’s climate emissions, our Paris liability or the impact on trade deals requiring us to meet our Paris goals, which we’re currently on track to miss badly.

The Ministry of Justice has watered down a draft code of conduct for lobbyists so much it’s now meaningless, say transparency and civil liberties watchdogs.

Weeks ahead of the removal of the 11.5c/litre fuel levy in Auckland, the Commerce Commission publishes a study showing fuel companies put up petrol prices (but not diesel prices) faster when costs rise than they cut prices when costs fall. The Commission estimated this ‘rockets and feathers’ pricing cost drivers $15 million/year, which was kept as higher profits by the almost-all-overseas-owned firms. (See more detail and charts from the study below)

Thousands of Wellingtonians are homeless, forcing some to squat in dangerously dilapidated quake-damaged buildings. (See more below in quotes of the day)

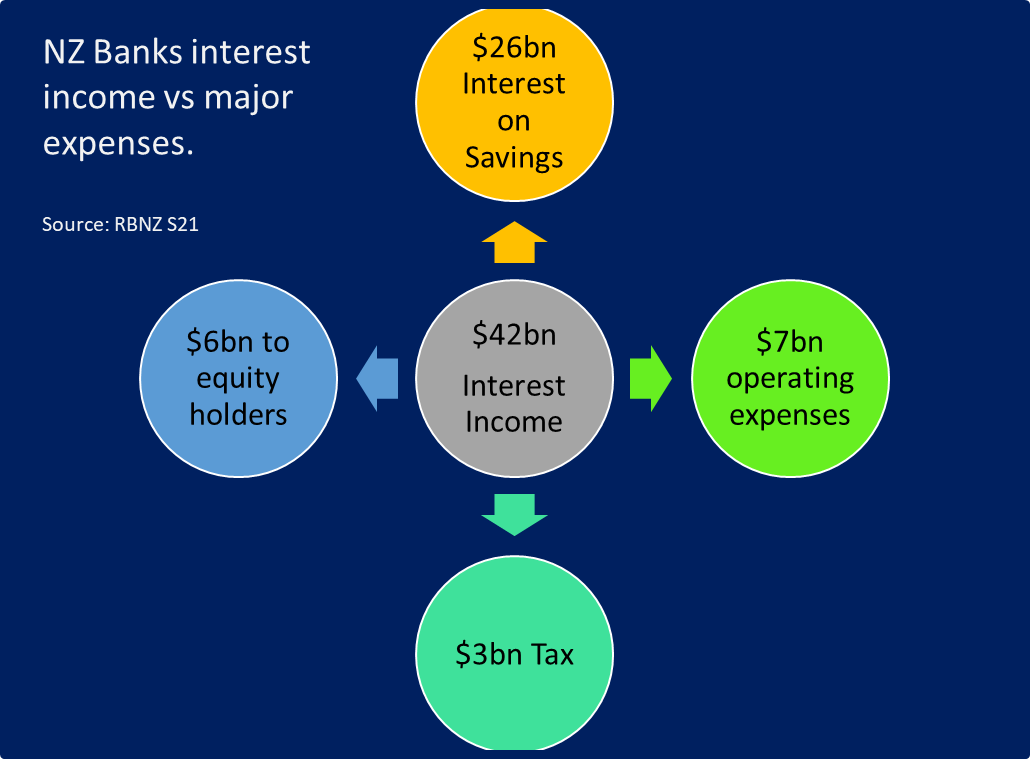

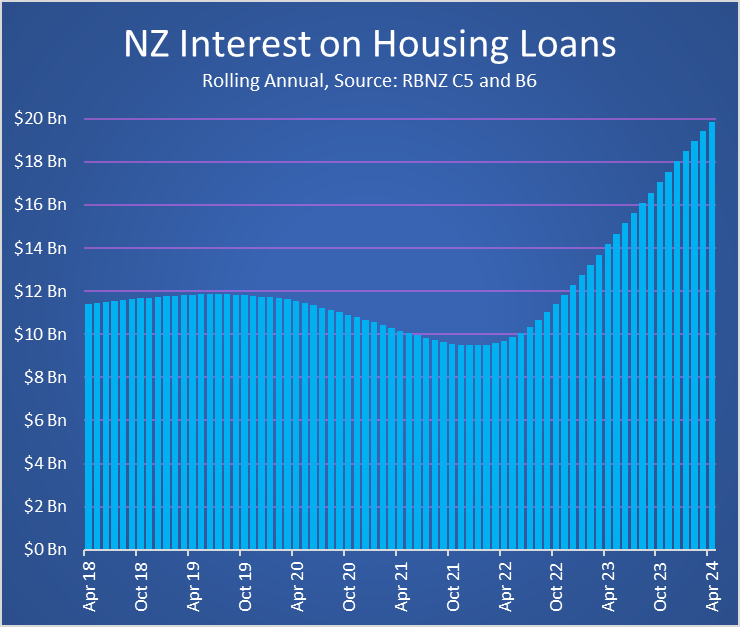

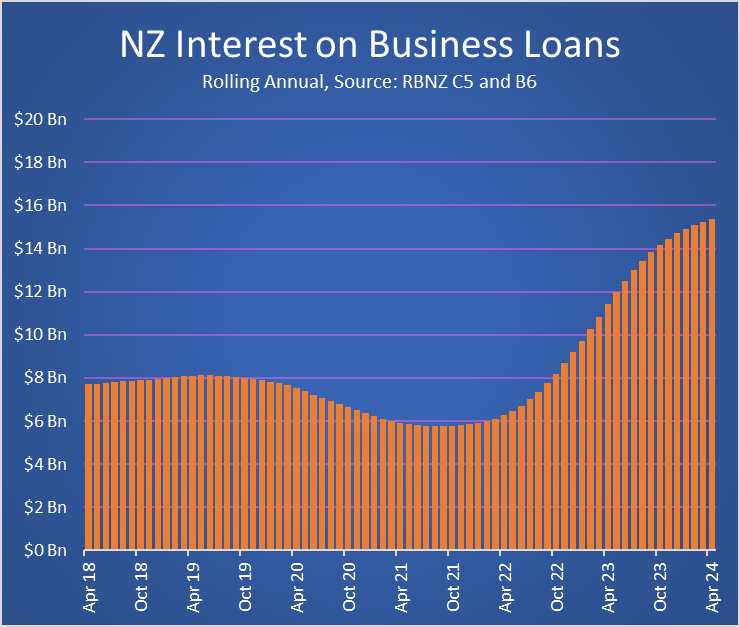

RBNZ figures show banks’ collective net profit from interest on loans and deposits has risen by a collective $9.1 million per day since the RBNZ started hiking interest rates in late 2021 as they keep more interest than they pay out. The tighter monetary policy has increased savers’ incomes by a collective $73 million per day to $120 million per day. (See more below in charts of the day)

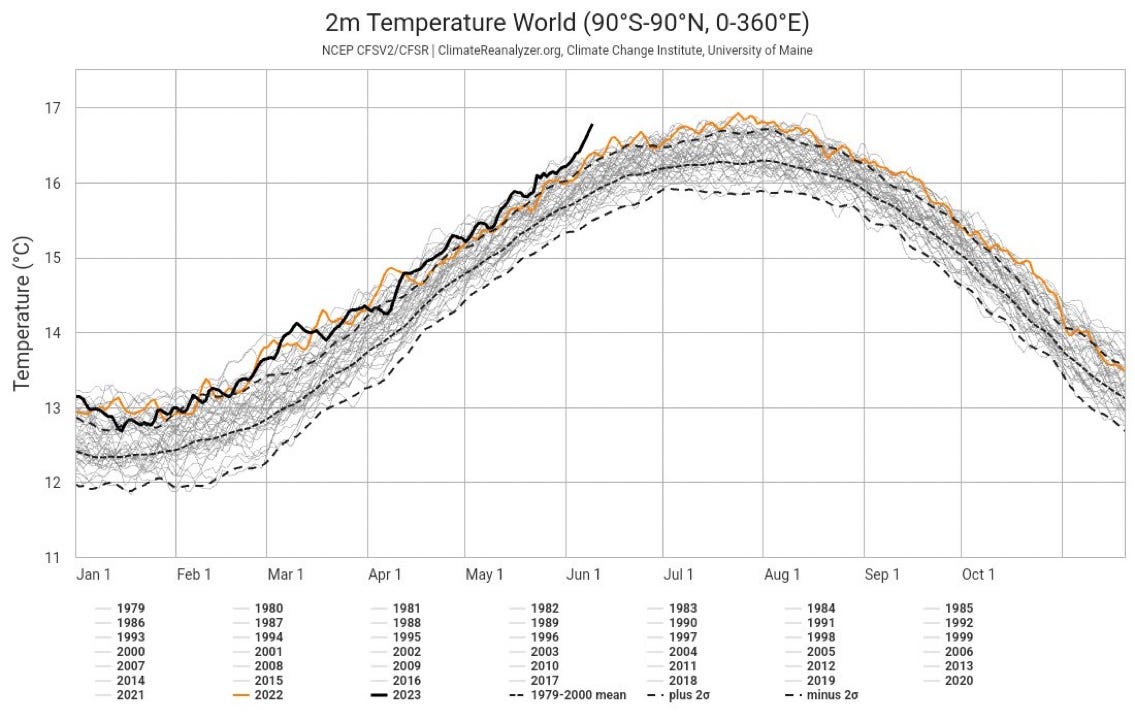

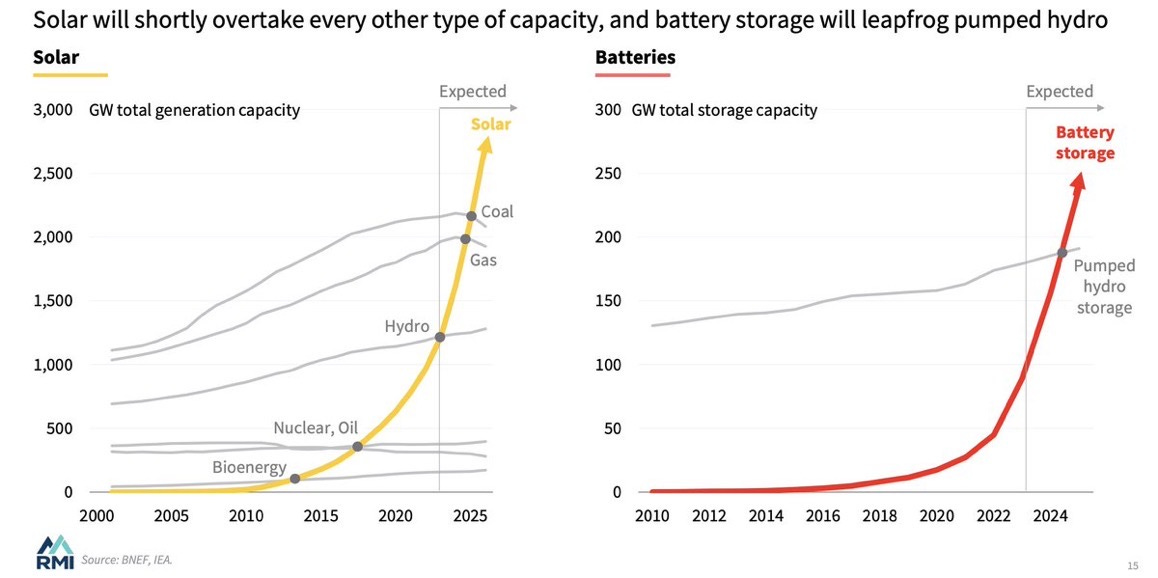

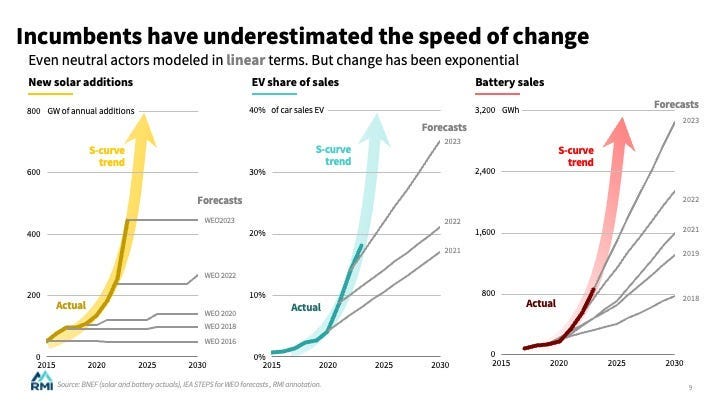

Spikes in global temperatures in May and June are concerning climate scientists, but huge drops in solar panel and battery costs are ramping up adoption of renewable electricity generation. It’s race Aotearoa-NZ is observing, rather than participating in actively at the moment. (See more below in climate charts of the day)

(Paying subscribers can see and hear more detail and analysis below the paywall fold and in the podcast above. We’ll open up the full article for public reading, listening and sharing if we get over 100 likes to indicate approval from paying subscribers. Update. Achievement unlocked!)

Six things to note this morning

1. Farmers get ETS exemption AND new subsidies

Climate & Politics: Trade and Agriculture Minister Todd McClay and Climate Change Minister Simon Watts yesterday announced the Government would amend the Climate Change Response Act (2002) to take farmers out of the Emissions Trading Scheme (ETS) permanently.

They also announced the abandonment of the He Waka Eke Noa (HWEN) joint consultation process set up by the previous Labour Government in 2019 on how to bring farmers into the ETS, as was legislated to happen from January 1, 2025. Instead, they said, the Government would establish a Pasture Sector Group to work on reducing biogenic methane that would include DairyNZ, Beef + Lamb New Zealand, Deer Industry New Zealand, Federated Farmers, Dairy Companies Association of New Zealand, and the Meat Industry Association, but not iwi, Government agencies or environmental groups, who were in HWEN. Links on the Ministry for Primary Industries web sites to HWEN are now dead.

Watts also announced the Government had committed $400 million over the next four years to accelerate the commercialisation of tools and technology to reduce on-farm emissions, including scaling up funding for the New Zealand Agricultural Greenhouse Gas Research Centre, where an additional $50.5 million would be invested over the next five years to find solutions to reduce the sector’s emissions.

There was no mention of whether the Government had analysed the decision’s impacts on Aotearoa-NZ’s climate emissions, or further increased its liability for buying overseas credits under the Paris Agreement, or how failing to meet or reneging on the Paris Agreement would affect trade, given achieving our Paris goals was written into our Free Trade Agreements with Europe and the UK.

In my view, that apparent decision to ignore or not even investigate the economic implications for trade, emissions and the Crown’s liabilities is a financially and economically reckless act. The decision to exempt farmers but also increase subsidies also begs questions about corporate welfare for farmers, but not for other businesses or consumers, given the removal of subsidies to buy electric vehicles and to install electric boilers in factories.

2. Fuel companies overcharging by $15 million per year

Costs of living, climate and politics: On the eve of the June 30 removal of the 11.5c/litre Auckland Regional Fuel Levy, the Commerce Commission announced yesterday it had published a study showing ‘rocket and feather pricing’1 by fuel companies mean consumers are over-charged by around $15 million a year. It warned fuel companies to pass on the removal of the levy much quicker this time around.

The Commerce Commission also described it as ‘asymmetric cost pass-through’:

Asymmetric cost pass-through relates to a form of pricing behaviour that, while not an explicit sign of collusion, has been linked to firms exercising market power. This allows firms to inflate profit margins (most notably in the short term) at the expense of consumers, by pushing cost increases onto prices faster than cost decreases.

Cost pass-through asymmetry has been widely evaluated in related literature with a specific term, rocket and feather pricing, being attributed to a specific kind of behaviour. This term refers to how prices may rise quickly like a rocket when costs increase but fall slowly like a feather when costs decrease.

The result of asymmetric pass-through is an inflation of firms’ profit margins. Commerce Commission study.

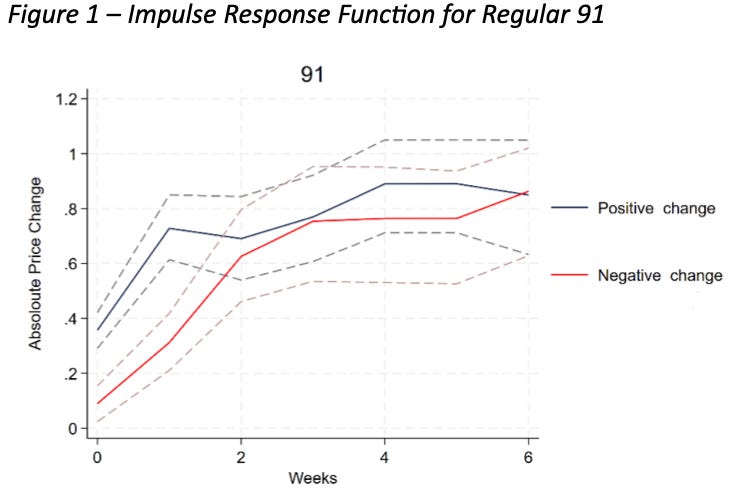

The Commission analysed Gaspy and MBIE data from January 2019 to November 2023, finding evidence of asymmetry in the speed of cost pass-through, albeit only for regular 91 and premium, but not for diesel, possibly because diesel buyers were mostly commercial and compared prices more aggressively and regularly.

For Regular 91 and Premium 95, asymmetric pass-through can be seen both contemporaneously in the week of the cost change and in the first week following the cost change. Only about a third of a cost decrease is passed through after one week; in contrast, 70-80% of a cost increase is passed through in the same time frame. The difference between pass-through rates is statistically significant in the first week. This is not the case after two weeks as the response functions trend closer. Asymmetry then disappears for both fuel types.

The effect of this asymmetry is an inflation of firm margins in the short term. In the initial weeks following a cost decrease, the slow pass-through results in a larger gap between cost and price. Over time this fades away.

In contrast to other fuel types, the diesel market appears to operate as would be expected in a workably competitive market, with no statistically significant asymmetry.

A possible explanation for the difference in cost pass-through between diesel and the two petrol fuels may stem from differences in market composition combined with consumer behaviour. A much higher proportion of diesel buyers is commercial users than is the case for petrol, which is predominantly a retail market. To the extent that retail consumers may undertake less searching for better prices, particularly around times of high cost, this could result in a greater degree of asymmetric pass-through in relation to petrol.16 This is because if petrol consumers are less likely to search for lower prices, there may be less pressure to pass on cost decreases when compared to diesel, resulting in the difference in asymmetry observed.

3. Lobbying code dribbles away into meaninglessness

Politics: Rob Stock reports this morning for The Post-$$$ on the latest from the Ministry of Justice’s consultation on a draft code of conduct for political lobbyists, which the Civil Liberties Council and Transparency International said had now been chipped away through the consultation process to be practically meaningless, as this summary of feedback published last month shows.

“This is exactly the self-interested lobbying that the ministry should have been guarding against, not giving in to. When claims are made that there is no evidence of lobbying improperly changing government work, this is a prime example to contradict such claims,” the Council for Civil Liberties has told the ministry.

“Their aversion to even voluntary and non-binding ethical behaviours makes the case stronger for mandatory lobbying regulation.” Transparency International said.

4. Quotes of the day

‘Squatters in dangerous buildings are an indictment’

Speaking after a squatter fell down a broken stairwell in a quake-abandoned office tower in Wellington, Wellington’s City Missioner Murray Edridge said around 200 people were visibly homeless in our capital city, with thousands more ‘hidden homeless’ and forced to live in caravans, sheds, cars, and crowded into houses with friends, families and others.

“Most people would not consider living in a derelict, risky building. You've got to presume that this was the best option that he had at the time.

"It's getting colder, it's getting wetter, and people are looking for shelter. They're choosing buildings that clearly aren't safe to be occupied."

"The very fact that we've got people seeking shelter in unsatisfactory premises is an indictment."

"There will also be a subset of people who are trying to find shelter and dry accommodation anywhere they can, so I suspect this is not a unique issue that we saw this morning."

"It's the people living in caravans, and sheds, and cars, and crowded into houses.

"We need to say, 'do we want people living in this set of conditions?'

"Or are we prepared to say 'this doesn't happen in our city', and what are we prepared to do collectively to ... provide some appropriate level of accommodation for everyone who needs it." Wellington City Missioner Murray Edridge via RNZ’s Lauren Crimp, reporting on a case yesterday of a squatter in a derelict office building in Wellington falling three storeys down a broken stairwell and now in a critical condition in hospital. The building was deemed earthquake prone after the 2013 Seddon earthquake.

5. Charts of the day

How monetary policy works to inflate bank profits & enrich savers

RBNZ figures (S20) show banks are receiving an extra $6.6 billion in interest payments from households and businesses every 90 days since the RBNZ starting putting up interest rates in late 2021, and they’re paying out an extra $5.8 billion in interest to savers and depositors every 90 days.

That means their net interest income or profit from lending and deposits has risen by a collective $820 million per 90 days, or close to $9 million per day more a day to a total of around $3.9 billion per 90 days, or around $43 million per day.

6. Climate chart of the day

This should be the front page of the NZ Herald

6a: Good news climate charts of the day

Collapsing solar and battery costs are turbo-charging renewables

Cartoon of the day

‘Forward the Light Brigade. Charge for the guns’

Timeline-cleansing nature pic

Dappled light

Mā te wa

Bernard

‘Rockets and feathers’ refers to the practice where petrol prices are put up much faster with the NZ dollar-denominated oil costs than they are dropped when costs fall after a firming of the NZ dollar and/or a fall in the US dollar-price of imported petrol and diesel.

Share this post