TLDR: A report into electricity ‘gentailer’ dividends has again exposed how successive Governments over the last 30 years have prioritised cash extraction from public assets built mostly by post-war generations of taxpayers.

In effect, voters from the 1990s onwards chose big dividends and lower debt for now over investing in future renewable generation that would have reduced climate emissions and costs for consumers of tomorrow.

Ultimately, land-owning median voters and the politicians that represented them chose over the last decade in particular not to invest for the future, and instead chose lower Budget deficits and (therefore) lower interest rates. That made political and personal financial sense because lower interest rates boost the leveraged value of residential land, and those gains are tax-free.

The costs of those decisions are landing now on today’s renters and will increase the climate costs of future Governments and consumers. It is a silent and massive theft from the future that is now embedded in household balance sheets to the tune of $2.4 trillion, and will come home to roost in the form of tens of billions in emissions credit costs, climate disaster and mitigation costs, and health, education and other costs.

All because our political economy is captured by power of massively leveraged and tax-free household wealth driven by real estate, banking and electricity industrial complexes that argue any investment in future supply of infrastructure for homes and electricity will put up interest rates and endanger the scarcity of the housing and power supplies holding up asset values now. It is a classic tragedy of the owners of today’s assets refusing to use surpluses to invest in future generations because they value the present more than the future, and themselves more than their children.

Yet again, the bulk of voters in the last 30 years are choosing to strip mine the assets built for them by their parents, and to hand on polluted and gutted husks of assets that will cost much, much more for their children and grandkids (assuming they still live in Aotearoa) to clean up and live with.

So how did this happen?

Egged on by Treasury’s convenient obsession with keeping public debt down around 20-30% of GDP, National chose to sell shares in the generator/retailers in 2014, in part to reduce public debts built up during the Global Financial Crisis (GFC) and the Christchurch earthquakes. Then both National and Labour were more than happy to accept dividends that were more than net profits from the three ‘gentailers’ the Government still owned 51% stakes in: Meridian, Mercury and Genesis. Contact, also a former state-owned asset, was fully sold and listed in 1999.

This week the CTU, First Union and climate activist group 350 Aotearoa published a 31-page report into the big four ‘gentailers’ profits and dividends since those part-privatisations. It’s called: Generating Scarcity: How the gentailers

hike electricity prices and halt decarbonisation. The found $8.7 billion in dividends were paid between 2014 and 2021 off $5.35 billion earned in profits, delivering $3.7 billion in excess dividends, including $1.35 billion to the Government through its 51% stakes in Meridian, Mercury and Genesis.

It found the state-controlled gentailers were able to pay out more than they earned because they didn’t invest in new capacity and kept ratcheting up the value of their assets, which meant their even higher debts did not blow out their debt to asset ratios. Falling interest rates for that period also keep interest costs under control, even though debt grew faster than revenues.

How was this possible in a ‘free’ market?

The CTU/First Union/350 Aotearoa reports argue the way the wholesale electricity market has been run has allowed the big four to keep capacity only just ahead of demand. That means that spikes in demand can only be met by expensive gas and coal generation, especially at Huntly. This sets high prices at the margin, which hits those who don’t have long-term contracts with the gentailers, and especially new retailing competitors who rely on buying on the wholesale market, such as Electric Kiwi and Flick Electric.

This report is not the first to argue the big four have successfully used the market to generate super-profits and strangle new supply. The Major Electricity Users’ Group accused the gentailers last year of making $3.5b in super profits, which I wrote an analysis on. Also, the Electricity Authority found last year that Meridian and Contact had done a deal with Rio Tinto to keep the Tiwai Point smelter consuming Manapouri’s electricity at subsidised prices off the market, to ensure the 13% of Aotearoa’s supply wasn’t dumped on at the margins to depress revenues across the market. The EA estimated that move cost consumers $1.6 billion to $2.6 billion over three years. I wrote about that here last year.

The latest report argues the big gentailers have starved the market of new renewable generation to ensure the capacity at the leading edge of the market was the most expensive, being gas and coal. It found that total capacity had stagnated since the 2014 partial privatisations, and the renewable share had not improved much.

The stagnation in supply was despite many forecasts for the need to increase renewable capacity to electrify transport and decarbonise industry within this decade.

Also, a large amount of wind capacity remains consented, but unbuilt.

So what should change?

The report’s authors, First Union researcher Edward Miller and CTU Economist Craig Renney, called on the Government to lodge resolutions at the gentailers’ shareholder meetings to channel profits into new renewable capacity, and use any dividends to buy back gentailer shares. I have included my discussion with them in the podcast above.

They also argued the Government to commit to spending its excess dividends since 2014 of $1.35b on community and household generation, and to levy a windfall tax on the gentailers for their remaining excess dividend ($2.36 billion).

“The government has recently acted on the banking sector, and on petrol companies to ensure that they are delivering better outcomes for New Zealanders. This report demonstrates that there is a pressing need to do this for the electricity sector as well.

“New Zealand now generates more electricity through coal and gas than we did in 2018. Prices for customers are rising, but new renewable electricity generation that might tackle rising bills and our climate commitments has been missing in action”.

“If the Government wants to honour its commitment to a just transition, it needs to continue to be proactive in holding companies to account.” CTU Economist Craig Renney

Government lukewarm at best on reform

Finance Minister Grant Robertson told me yesterday in the post-Cabinet news conference he would read the CTU-FIRST Union-350 Aotearoa report into power company excess dividends reducing renewable investment, but he didn’t see any major reasons for electricity industry reforms.

He pointed to household electricity prices rising less than inflation in recent years and recently announced plans beyond the big gentailers for new generation capacity as reasons to suggest the current market was working. My questions and his answers are in the audio of the podcast above.

But consumers have a different view

Consumer Advocacy Council chairperson Deborah Hart said of the report that it reinforced views of a market that was not working well for consumers. She pointed to research the Council had commissioned showed 55% of consumers were often only heating the room they were in and 46% reported that they often put on extra clothes to stay warm.

The research found customers had less trust that their electricity providers would provide them with value for money than they had in banks, telcos or Kiwisaver providers to do the same, she said.

More than a third of the 1441 people surveyed reported frequently not putting on heaters over the past year to save money.

Meridian was quoted as disputing the reporting, arguing that real electricity generation prices had fallen in real terms since 2013. Contact said it had launched plans to spend $1b extra on generation.

More coal being burned

One result of the drought in renewable capacity investment and a downturn in gas production has been a five-fold increase in coal burning at Huntly over the last four years, with more than a million tonnes of low-grade high emissions coal from Indonesia now being imported every year.

It is worth noting that for the gentailers, keeping coal and gas as part of our energy mix is a crucial part of the business strategy for keeping profits high. Spot prices on our wholesale energy market are determined by the last form of generation to bid into the market. Renney and Miller.

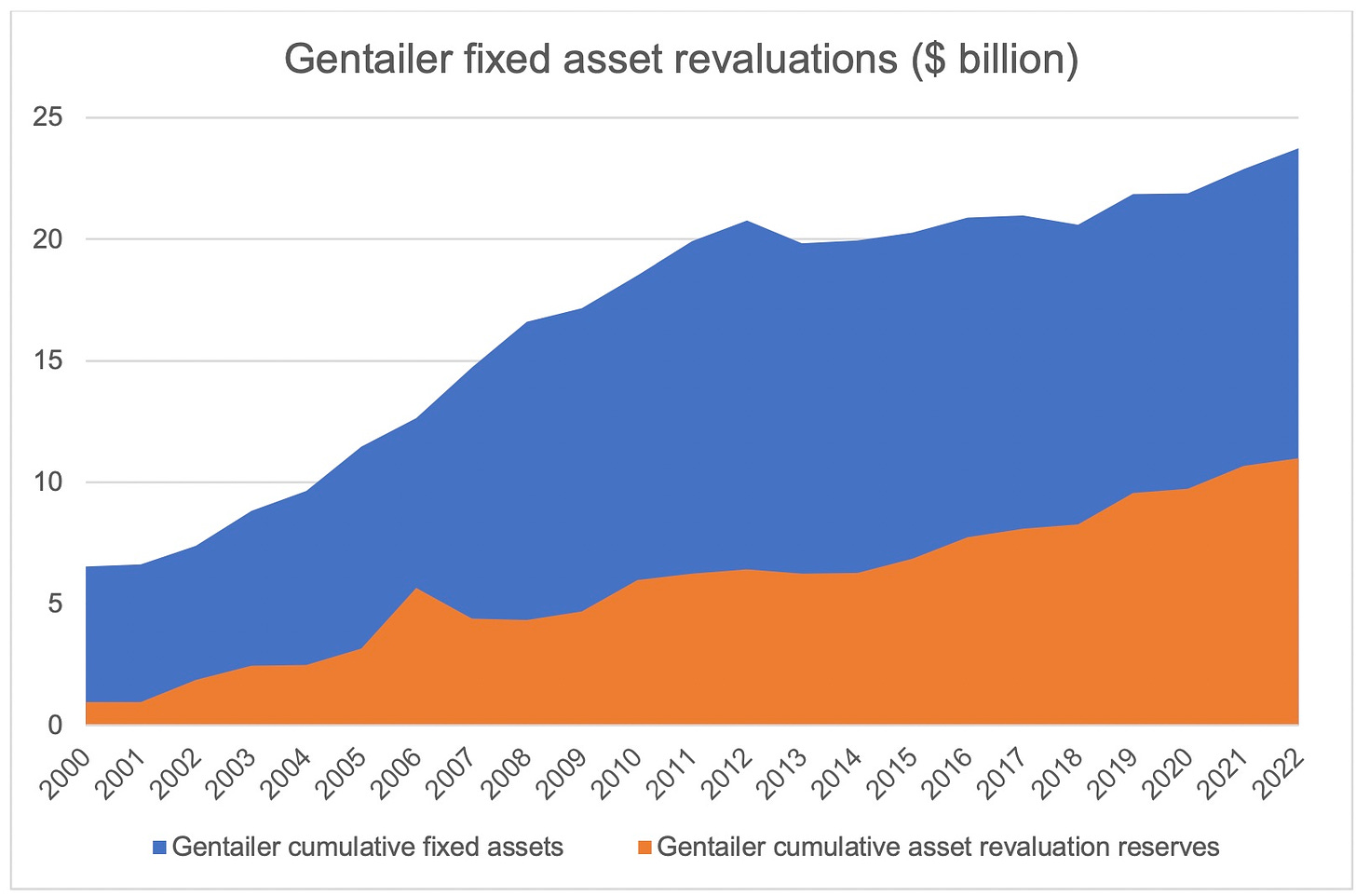

One way the gentailers are able to support paying higher dividends than profits booked is their ability to upgrade their asset values to ensure their gearing does not rise too much.

Asset revaluations now account for 56% of the fixed assets held by the three state-controlled gentailers.

Excess dividend distribution has starved the network of new renewable generation, keeping the high-cost high-emissions coal and gas industries on life support while pushing up prices for residential users and redoubling profits and shareholder dividends. Perversely, high prices have sustained the constant cycle of asset revaluation that has offset the impact of excess dividend distribution on the gentailers’ accounts, preventing their book value from plummeting.

What we are seeing here is asset-stripping that delivers disproportionate benefits to a privileged few at the cost of residential consumers and global heating. It's doubly ironic that this is possible because of the investments made over decades by the taxpayer, yet it's the poorest New Zealanders who are paying the price in higher energy prices. Its beyond time to deliver change - its time for action. Miller and Renney

Ka kite ano

Bernard

Share this post