TLDL & TLDR: The biggest electricity buyers in New Zealand have had enough of a doubling of wholesale electricity prices over the last three years. This week they accused the biggest hydro-power producer of making super-profits. They’re right, and the market should be reformed, but won’t be because the Government has other fish frying and median voters don’t care much.

Meanwhile, those wholesale prices have fallen magically for no particularly clear reason in recent weeks as the publicity around the industry’s failures and this latest report have focused the fleeting attention of politicians on the issue. My bet is they’ll rise right back to the most profitable levels once the latest noise dies down.

This week biggest power buyers called out the biggest hydro-power generator retailer, Meridian Energy, over what they say are $3.5b of excess profits generated in a market that has disconnected long run prices, from the marginal long run costs of new generation, or even the short run costs from lake levels and gas supplies.

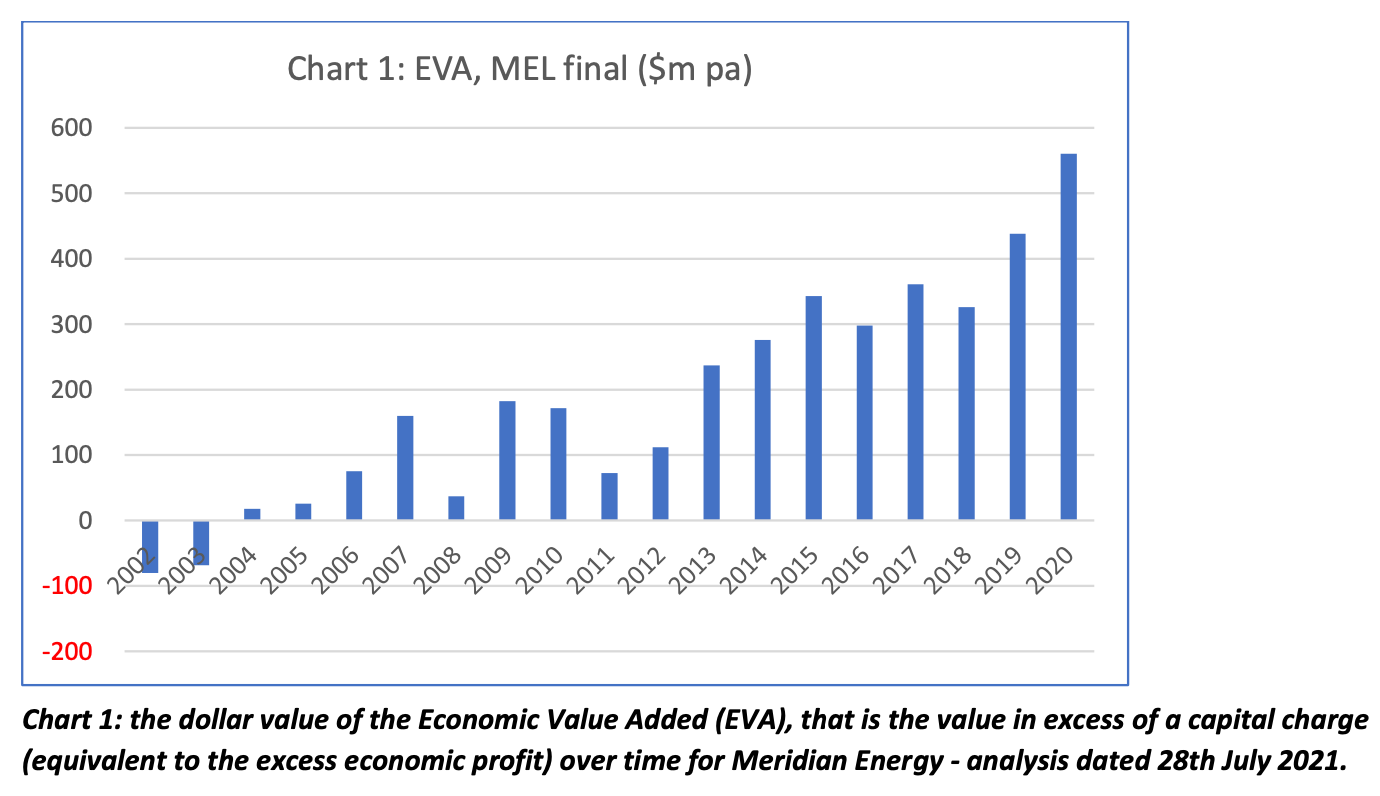

The Major Electricity Users Group (MEUG) issued a report on Wednesday accusing Meridian Energy, of making $3.5b of profits above its cost of capital over the last 20 years.

MEUG’s members includes the likes of Fonterra, BusinessNZ, NZ Steel, Tiwai Pt and Progressive (Countdown-Woolworths) and has been doing the analysis since early 2020. The report uses the same principles as the Commerce Commission’s explosive analysis of supermarket super-profits.

MEUG accuses the gentailers of starving the market of new generation capacity and running it on the brink of undersupply, given the market structure ensures the marginal price applies to the entire market and is set at the margin by short term supply and demand.

“In a workably competitive market, you’d expect to see downward pressure on prices through competition and we just don’t see that in New Zealand. Generators themselves are almost incentivised to keep the market on the ‘precipice of shortage’ because that is where they can sell the individual units at the highest possible price.” MEUG Chair John Harbord.

I spoke to John and you can hear the interview in the podcast above.

Here’s a couple of charts going to the heart of that analysis. They look remarkably like the ones produced by the Commerce Commission in its ground-breaking Supermarkets Market Study, which found a duopoly were making super-profits.

Stuff’s Tom Pullar-Strecker this week quoted Energy Minister Megan Woods as saying the MEUG report ‘raised questions about whether the electricity wholesale market was operating as it should.’

“The electricity system must be fit for purpose in terms of security of supply and it must also be fair to consumers, whether they be large industrial users or residential users.” Megan Woods

Meridian rejected the report and said it was out of line with the government’s Electricity Price Review done over 2018 and 2019. Woods has previously also been lukewarm on structural separation, saying in April she wasn’t looking at it for now, and: “Is it something that may have to be revisited in the future? Probably, maybe.”

Woods has repeated the industry’s line that the higher wholesale prices were due to water and gas shortages.

But the EPR report was a whitewash

The EPR’s final report in May 2019 “found no evidence of generator-retailers making excessive profits, although data limitations mean we cannot be definitive in this assessment.” It came out against structural separation of generators and retailers, arguing the costs to investor confidence outweighed the benefits.

“Forced separation would also be disruptive, undermine investor confidence and

stall or delay the huge amount of generation investment needed to move to a low-carbon economy. However, the benefits of allowing vertical integration should be shared more widely – hence our recommendation for mandatory market-making.” EPR report.

However, as Pullar-Strecker pointed out, the EPR said in detailed reports to MBIE there were “ongoing questions about whether generators are making excessive profits at the expense of consumers.”

Little has changed since the EPR report came out. The Electricity Authority (EA) is still years away from a permanent market maker solution to improve the confidence of any independent retailers who might want to use the hedging market.

In my view, the EPR was mostly a whitewash which has led to no real change in the industry. The report was written by MBIE officials with Concept Consulting, which is led by former Contact Energy CEO David Hunt and former Contact executive Simon Coates. The EPR panel’s special adviser was former Trustpower CEO Keith Tempest.

The LRMP is nowhere near the LRMC

Wholesale electricity prices have doubled in the last two years to around $175 /MWhr, despite flat demand and flat supply, raising questions about whether the long run marginal cost of production is anywhere near the wholesale price in the long run. Generation capacity actually fell 1.4% in the last two years to March 2021 to $10,140 GWhr per annum, while consumption fell 0.8% to 9,255 GWhr, MBIE figures show.

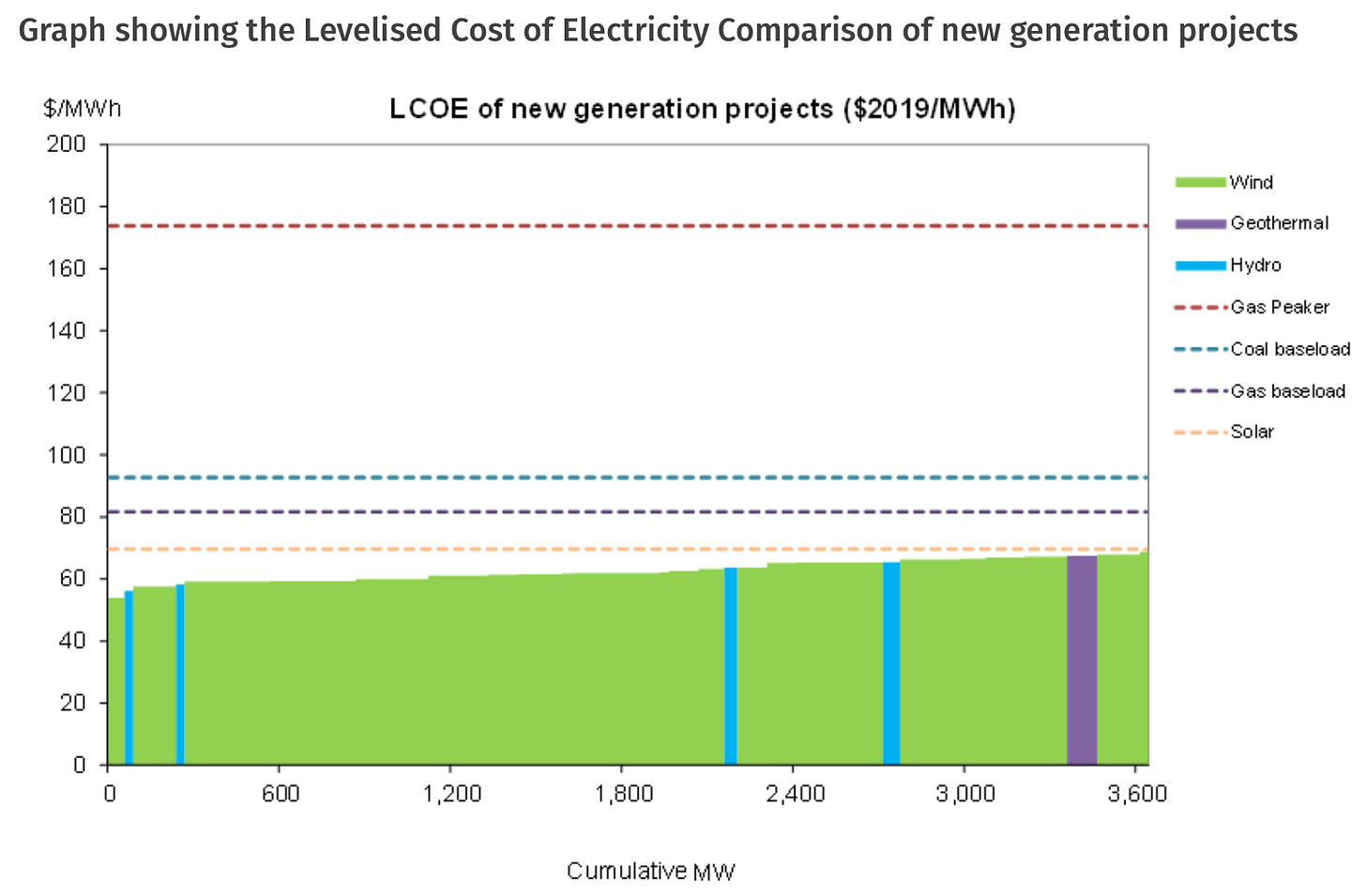

Typically, new solar and wind developments cost around $60-70/MWh. MBIE reports the gentailers currently (as of early 2021) have 13 wind projects with a combined capacity of 6,360 GWhr MWh that are consented, with only two currently being constructed. Their combined capital cost is estimated to be $4.04b and their Long Run Marginal Cost is estimated to be $72/MWhr. This 2019 chart shows solar costs being the cheapest, but at that point there were no plans by gentailers to build solar farms.

So why aren’t the higher prices creating a lot more supply, particularly the renewable kind needed to meet our zero carbon targets? If anything, Aotearoa-NZ has gone the other way, reducing generation capacity and burning a lot more coal — one million tonnes last year. As the EA has pointed out, the industry has avoided investing in net new renewable output, instead relying on cheaper-to-build and carbon-intensive-to-run new generation at the margins. That has kept prices high.

“Since the New Zealand wholesale electricity market began operating in October 1996, around 1600 MW of new renewable generation has been built in this country, and around 1500 MW of existing thermal generation has been retired. Projections generally suggest that new renewable generation will need to be built at a rate materially faster than the industry achieved over the market’s first 15 years.” EA Market Development Advistory Group

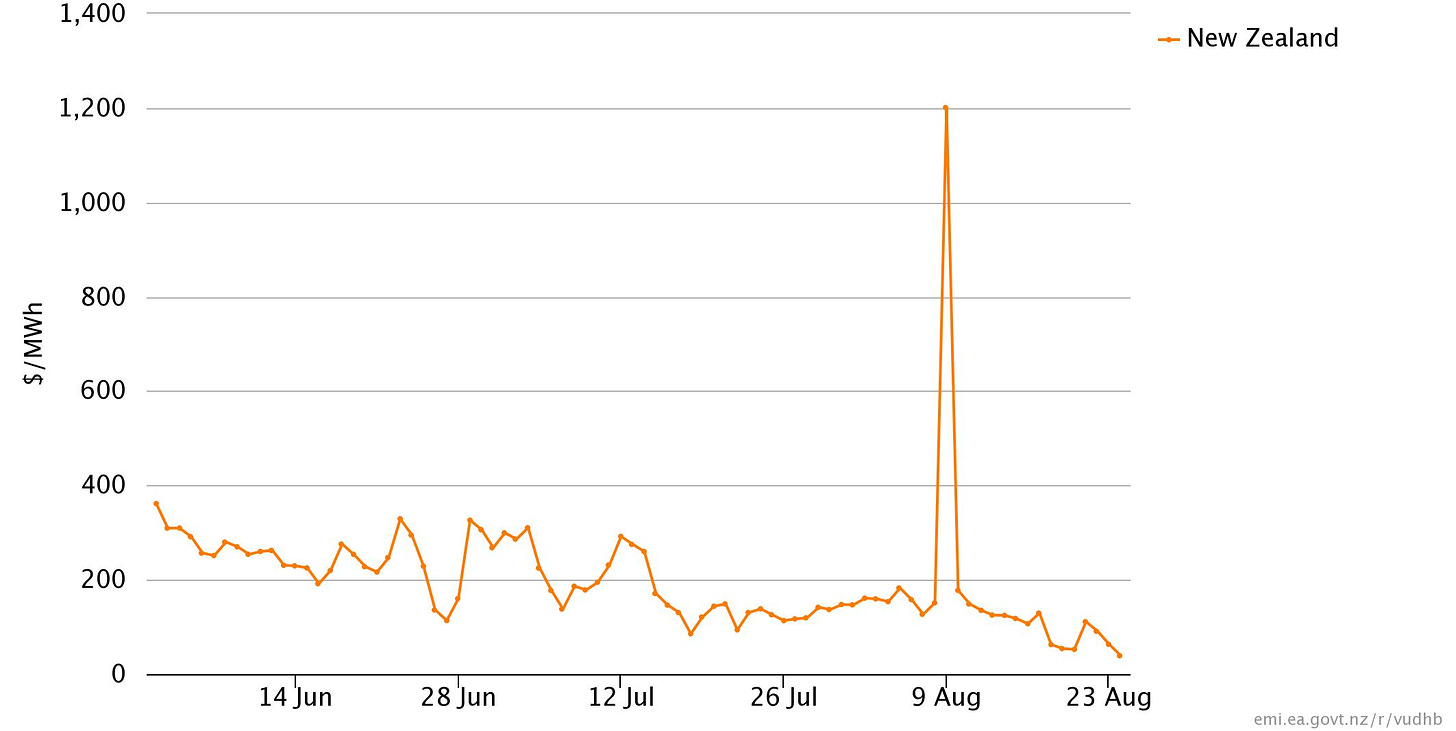

In the short term at least, the August 9 blackouts transformed the debate about the electricity market, which was already bubbling after the NZ Herald’s Hamish Rutherford reported on July 14 ElectricKiwi had written a letter to Megan Woods in April saying the market was broken and it was moving its investment plans to Australia. Flick Electric then launched a petition calling for the structural separation of gentailers. Woods said then she had asked for advice on stripping the EA of its market supervision powers and was looking at whether to structurally separate the gentailers into generators and retailers.

Surprise, surprise? Prices have fallen sharply since the blackouts

Perhaps coincidentally … wholesale prices have fallen sharply since mid-July, and took a particular drop after the August 9 blackouts, which I wrote at the time had removed any final shred of social license the gentailers had. The New Zealand average daily wholesale price spiked to $1,200 MWhr on August 9, having averaged $207/MWhr in the previous 68 days of trading. It has since fallen to $39.08/MWhr as of Tuesday. The drop since July 13 is particularly noticeable and the price on the day of the MEUG report release, was the lowest in two years.

MEUG’s Harbord said there were often periods where prices made no sense.

“We are seeing events where wholesale prices do not follow hydrology. We have had high wholesale prices for three years. All of those years have not been dry years. In June and July this year it rained in the hydro catchments and the price went down as you’d expect. In May it rained in the hydro catchments and the price went up.

“Gas shortages are contributing to high wholesale prices, but gas and coal has over the first quarter of this year directly set the marginal price of generation only 15% of the time.

“We expect prices to remain volatile and unexplained material events need to be a focus of comprehensive review of the market rules to encourage certainty and confidence in the system going forward.” MEUG’s John Harbord.

The gentailers have pointed to dry winters, gas shortages, unscheduled station maintenance, weeds in intake races and a variety of other surprise supply constraints in the last couple of years for what appears to be structural rise in long run wholesale prices without much change in underlying supply or demand.

Well, lookee here…

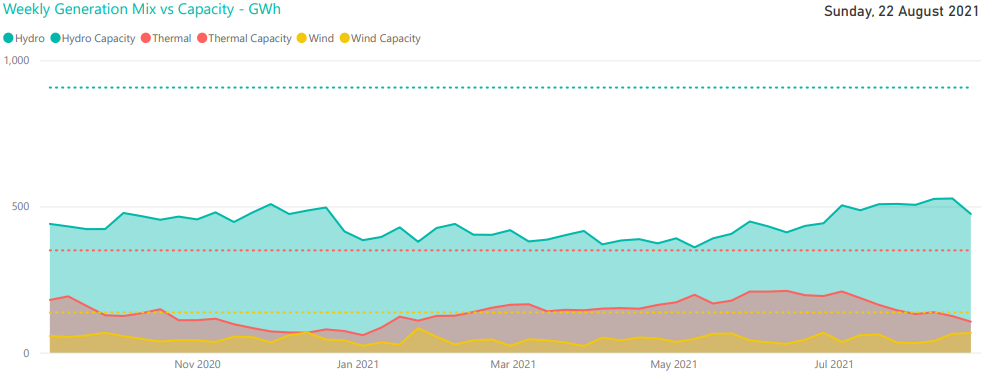

Perhaps coincidentally with the publicity about super-profits and talk of re-regulation, prices have dropped and electricity generation from hydro, the lowest cost source, has risen (as can be seen with the blue section of the chart below). Lake levels have also risen with rain in recent weeks, but not to the extent that would explain a 75% fall in prices to two-year lows.

So what might happen now?

We’ll watch next for the Electricity Authority’s report into the wholesale market, which is due with Minister Woods next month.

My view is the market is broken from a retail consumer affordability and a carbon zero point of view. I think the first option to look at is structural separation, with the Government’s 51% shares in Meridian, Mercury and Genesis translating into more integrated state control and planning of generation. That allows the climate and affordability objectives to be prioritised over profit and dividends, and for a fair wholesale price to be set that bares some relation to the long-run cost of generation.

It would also allow a lot more freedom for distributors and independent retailers accessing power sold at the long run marginal cost to unleash a wave of distributed solar generation with batteries that improve the resilience and efficiency of the grid.

But will this Govt do it?

My feel is no. Megan Woods is slammed with the housing crisis and the Government has shown no appetite to challenge anything that would endanger its adherence to the Public Finance Act’s requirement the Government run surpluses to repay debt in all but the most extreme situations.

During a Covid recovery, the billions of dollars of dividends from super-profits will be too juicy to give up, and the Government has not seen much political fallout from failing to follow up on its pre-2017 rhetoric favouring consumers and industry reform. The Government has already judged electricity industry reform as too distracting to focus on. Its ham-handed handling of the EPR showed that. Right now, it is dealing with an existential Covid threat, an endemic housing emergency and it is reforming the RMA, DHBs, Three Waters and trying to dream up climate emissions reductions that don’t anger ute owners.

Nothing much will happen, with the issue kicked back into the weeds of the Electricity Authority to allow the gentailers to continue to do what monopolies do: to delay, to deny, to deflect and to distract their way to many more years of profits.

Median voters rule the political economy

Meanwhile, the industry’s critics will continue to wait for the next review or working group to come back with more watered-down recommendations from industry experts bound inexorably to the status quo. Consumers struggling to pay their power bills will remain frustratingly confused and distracted. The median voters, who own homes generating more capital gains each year than their salaries and wages, pay their power bills on time and are unlikely to change their votes on this issue.

Most of these voters, who are the ones listened to in focus groups by both main parties, would be unable to name their retailer or the price they pay per KW/hr and view those who turn off their heaters in winter as ‘poor managers of their finances and multi-generational losers who should stop whining.’ The get irritated when they hear they’ve missed out on the prompt payment discounts so the poorest aren’t punished so much. Their bigger concerns are around how they can get their kids into their own homes so they can pay their power bills on time too.

Keep an eye on retail prices

The only caveat is if household power generation and retailing prices (as separated from transmission and lines charges) rise sharply. Retail prices (as opposed to transmission and lines charges) have flattened over the last couple of years and inflation has been slowing since 2014, when more serious competition from independent retailers such as Flick and ElectricKiwi entered the market. They have relied on buying in the wholesale market, but the volatility and higher prices in recent years have either driven them out or stalled their growth.

The gentailers may be tempted to ‘pass on’ the higher wholesale prices of recent years (even though their internal transfer prices are much lower) and to pay for new or replacement generation plans. If they do aggressively raise prices, median voters and the politicians may take more of an interest.

So why will not much happen?

Because its profitable for both private and Government shareholders, and the political costs are not high for the voters who matter. I hope I’m wrong, but I’ve taken the view for a couple of decades now that the median voter rules in our political system, and right now, the phone is off the hook for them in this power debate.

Also, the gentailers have pulled their heads in and wholesale prices have ‘magically’ fallen 75% to two-year lows in the last two weeks. A meteorologist would point to the skies at some recent rain and snow melt. Some economists would point to the power of the invisible hand in a perfect market. A cynic would wonder if a few very profitable firms got a bit of a regulatory fright and have stopped taking the piss for a bit.

We’ll see how long those short-term profitability and dividend-loving instincts take to return and trump fear of re-regulation.

Your view? Comments below please.

Share this post