TLDR & TLDL: House prices have fallen for two consecutive months and are now 2.7% below their November peak, setting up a challenge for a Government wanting affordability without a crash. Should it now tweak new consumer credit regulation to restart the flow of credit into the market?

That would allow it to honour its defacto promise to median voters not to let their main financial asset fall in value. That easing of credit regulations is my current base case of what happens.

The jury is almost about to return with a verdict: a rescue of sorts is required and will be delivered in short order.

Commerce Minister David Clark has already indicated he wants he fast regulatory changes like those suggested by bankers he met two weeks ago to the Dec 1 CCCFA rules that have tied up mortgage loan approvers in knots. Real estate agents are certainly worried the flow of credit has dried up and is slowing the market, but they are hopeful it will restart soon to enable an autumnal surge of first home buyer and investor buying. See more on that below the paywall fold, including how home-owning voters, rather than renters, actually don’t want house prices to fall. At all.

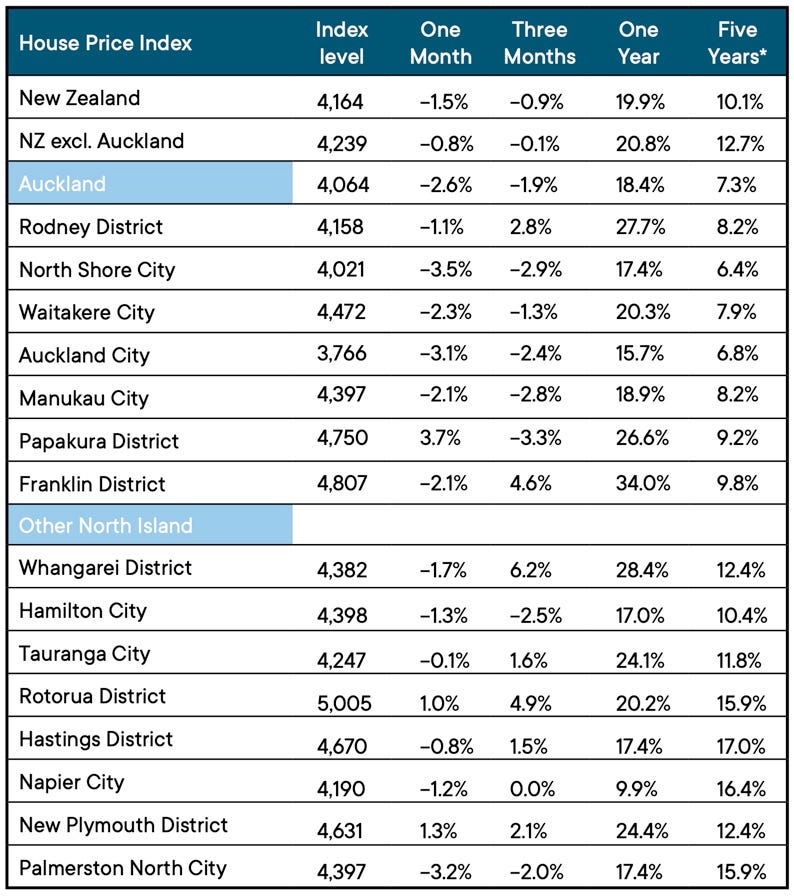

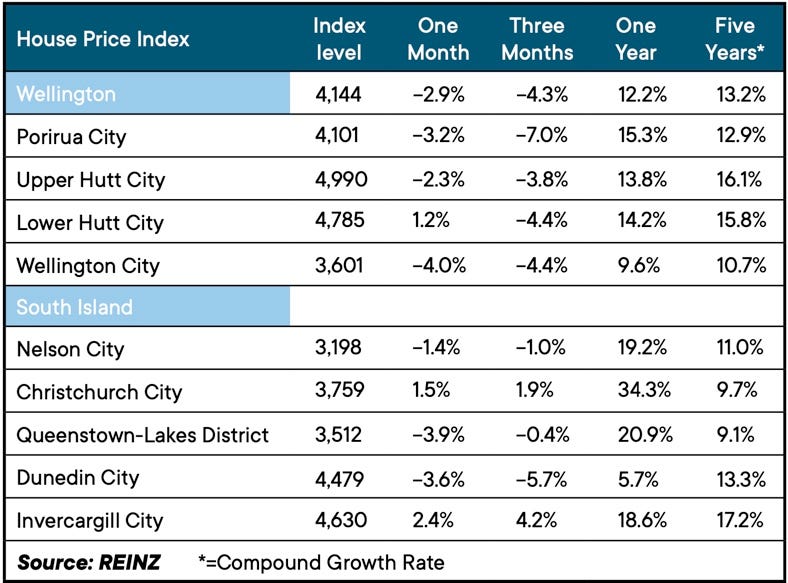

Porirua house price index down 6.5% in two months

The Real Estate Institute published its January sales volume and price figures yesterday, which showed the New Zealand House Price Index (HPI) down 1.5% in the month and down 2.7% from its peak in November.

Some of the previously most-fevered markets have come off the boil more aggressively. Porirua’s house price index was down 3.2% in January and is now down 6.5% from November and 7.0% from October. Auckland City is down 6.0% from its November peak and fell 3.1% in January from December.

Here’s the detail from the REINZ from its House Price Index report.

The Real Estate Institute’s CEO Jen Baird cited the Dec 1 start of the CCCFA in the slowdown, which saw the number of sales in January down 28.6% from January 2021 and the lowest for any one month in 11 years, excluding April of 2020 during the first Covid lockdown.

“Feedback from agents across the country suggests a decrease in the number of first home buyers and investors in the market, noting quieter auction rooms and open homes.

“Many point to access to finance, exacerbated by changes introduced in December to the Credit Contracts and Consumer Finance Act (CCCFA) — currently under review, as having a major impact.

“This is a sentiment echoed in a survey conducted at the end of January by economist Tony Alexander in collaboration with REINZ, which noted that the predominant concern for buyers is no longer availability of stock but rather financing.

“While hard evidence is lacking in terms of the impact of the CCCFA, data from Centrix, a New Zealand credit reporting agency, found the percentage of home loan applications that were approved dropped from 39% in October to 30% after December. The longer-term impact will be seen in the numbers of buyers in the market in coming months.” REINZ CEO Jen Baird

Banks and mortgage brokers are also pushing for tweaks to the CCCFA to relieve them of what they call prescriptive rules for checking affordability, which they have blamed for a higher rejection rate of loan applications.

Don’t worry. The tap is set to to be turned back on

Commerce Minister David Clark is clearly moving to relieve the restrictions on mortgage approvals. Last week he rejected a proposal from National for a legislative carve-out of the banks, but instead suggested smaller regulatory tweaks were likely to be faster and were what banks wanted.

“Quite aside from the time it would take to draft new regulations, and consult with the banks and other lenders, the approach you propose would result in undue delay to consumer benefit from possible tweaks that could be made to regulations and guidance in the nearer term.

“Based on my meetings with the banks last week, I detect little enthusiasm for an entirely new set of rules for banks, and other regulated lenders.”

“Banks have suggested small tweaks that could be made to ensure the purposes of the legislation are best met.” David Clark quoted in Stuff by Rob Stock.

A Government Guaranteed housing market

PM Jacinda Ardern last week repeated comments from late 2020 and late 2021 that she didn’t want the housing market to crash, renewing the effective guarantee for home owners that house prices will only be allowed to ratchet up — never down.

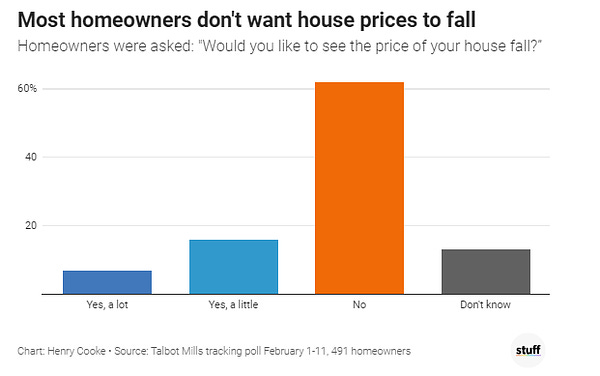

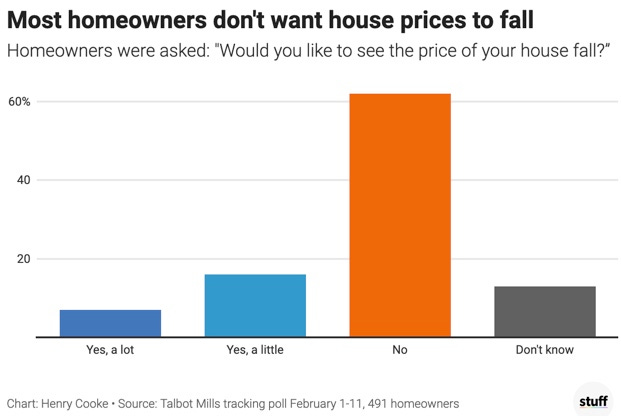

The motivations are clear. Median voters who decide elections are mostly home owners and are regularly focus-grouped by Labour’s pollster Talbot Mills. We learned yesterday via this Henry Cooke article in Stuff that Talbot Mills asked voters earlier this month, including the 58% of the electorally representative sample that are home owners, whether they wanted to see their house prices fall.

The specific poll question for home owners was (bold mine): “Would you like to see your house price fall?” The poll found 62% didn’t want prices to drop, while 18% wanted them to fall a little, and 7.0% wanted a serious fall in prices.

This appears to contrast with the results of a 1News/Colmar Brunton poll taken in January, which showed 47% of all respondents wanted house prices to fall a lot, while 29% said they wanted prices to fall “a little”, and only 18% did not want a fall. The poll did not break out what homeowners and renters thought, and whether they had different views.

However, the poll results aren’t so different under closer inspection. Assuming 58% of poll respondents are home owners and 42% are renters, then the 47% wanting a big fall is in line with the combination of the 42% who are renters and the few home owners who do want big falls. The wording of the question in the Colmar Brunton poll was also different, being (bolding mine): “Would you like to the see the price of housing in New Zealand fall?”

That is a more passive framing, which may have allowed some to think the market generally could or should fall, but not their houses specifically.

‘Sure. They can fall. Just not for me. Or now.’

This is another case of the magical thinking that politicians are also guilty of falling back on.

Everyone wants to see housing affordability improve and emissions reduce, but just not for them and not now. The pain has to be borne by someone else, whoever that is.

Another example is a Auckland Transport poll taken in May last year (and reported on in January by Stuff) showing 78% of Aucklanders supported immediate change to reduce emissions and 59% thought it would affect their lifestyle. However, just 43% said they were reducing or considering reducing their driving. Only 37% believed private vehicles contributed most to global warming and 45% saw trucks as the main culprit.

Auckland Council agreed last year to reduce carbon emissions from transport by 64% or 3.1m tonnes from its 2016 levels of 4.9m tonnes to 1.8m tonnes by 2030, and to halve overall climate emissions to 5.4m tonnes by 2030. The most recent regional statistics on climate emissions showed Auckland’s total emissions were 11.2m tonnes in calendar 2019, up from 2016’s total of 10.8m tonnes, including transport emissions being unchanged at around 4.9m tonnes. Car usage would have to fall at least 40% over the next eight years to achieve the 1.8m tonne target.

Yet Auckland Council and the Government have effectively cut real and per-capita public transport spending over the last six years, including the Auckland Council’s decision during Covid to cut transport and climate spending rather than let its credit rating fall from AA. For example, Auckland Transport delayed a shift to electric buses and both AT and NZTA decided not to proceed with reconfiguring various roads in Auckland for cycling and walking in the wake of the Arthur Grey Low Traffic Area pilot project’s early closure last year. (See more on that here from me at The Spinoff)

Real housing and climate action outside the ‘Overton Window’

This essential reluctance of median voters to understand and act is why the Government (and the Opposition) are not acting to improve housing affordability or reduce climate emissions. They know median voters say they want those things, but not for themselves, and not now. Neither of the two main parties are willing to move out beyond the bleeding edge of a very sharp Overton Window1

It means that centrist politicians tend to be ‘fast followers’ whenever public opinion moves, rather than leaders of public opinions with new ideas or policy proposals. Typically, those ideas are generated out of academia or thinktanks. Our universities have largely given up that role and we only have one established and substantial policy thinktank, which is the business-funded NZ Initiative.

How can that window be opened or renovated?

I see my role as testing the edges of the window and giving it a nudge here and there, or at least calling out the magical thinking of both voters and politicians who say they believe or are pursuing action on issues such as housing affordability, climate change and child poverty when the results on the ground and maths show they are not.

One of the axioms of modern politics is that being seen to want something to change is often enough for voters who actually don’t want the inconvenience or pain of change of pain for themselves personally. Politicians know this and see it in the results of polling about the views of the broad middle.

The magical thinking of politicians at any one time is in many ways just the miror image of median voters. But it can change over time, albeit usually very slowly. The only times this window of discussion can move in big ways is in the wake of substantial economic or political shocks.

What’s in the window now?

Up until the early 1980s, the broad middle of New Zealand’s voters accepted the large role of Government, high taxes and limited choice in goods and services, especially from overseas. It was also socially conservative. That changed dramatically in the late 1980s and has only crept in various directions ever since.

The broad current consensus now is that low and relatively flat income taxes that restrict the size of Government to about 30% of GDP are what median voters want, and that proper wealth or capital gains taxes would unravel the financial futures they now take for granted, which are based on realising capital gains from their own home(s) over time to supplement the adequate (for owners) Universal Basic Income of the NZ Superannuation, which is set at 2/3rds of the average weekly wage for a couple from the age of 65.

The areas currently ‘verboten’ for real discussion outside the Overton Window now include:

No extension of the retirement age beyond 65;

No means testing of NZ Superannuation or change in the 2/3rds of average wage indexation;

No capital gains tax or wealth tax;

A permanent bias in core Crown debt to return to 20-30% of GDP in the immediate aftermath of any crisis that increased that debt;

No reduction in Council credit ratings because of a rise in debt to income above 270-300%;

No increase in income or other taxes unless revenues are hypothecated (directly connected) to a fund providing a specific service (NZTA’s Land Transport Fund, ACC, Income Insurance);

No increase Government spending unless it is effectively revenue neutral (Emissions Trading Scheme to pay for climate action); and,

No suggestion of further privatisations of Crown or council assets.

The point of my mentioning the polling above and the Government’s current policy rhetoric and actions is to show that this ‘window’ has not moved much over the last 30 years. If anything, the 2011, 2014 and 2017 election defeats for a capital gains tax have hardened that window in place.

It is now like one of those sash windows in a suburban villa where the sash cords have been cut and the window frames have been painted over. The window is immovable.

The most effective ways for politicians to paint another layer over the window frame is to promise to resign if they ever even mention the issue again. It worked for John Key on NZ Superannuation and has for Jacinda Ardern on Capital Gains Taxes. It also worked for Labour and the Greens in 2017 when they committed to no new taxes and to keep the size of Government around 30%, with a reduction of net debt to GDP into the 20-30% window.

I do not see any signs of that changing with the current parties or personnel in or around Parliament. Activists outside of Parliament are the only agents chipping away at the paint. I see my role, in part, to shake the frames occasionally to see if it is moving, or could move.

Useful longer reads

Chart of the day

Thread of the day

Profundities, spookies and curiosities

The Craic

Some fun things

The Overton Window is a group of policies or ideas that the broad swathe of the public deem acceptable for ‘sensible’ discussion by ‘sensible’ politicians. Anything outside that window is seen as radical and unlikely to win the broad middle of public opinion at any one time. Here’s one definition. But it can move over time. For example, the idea of homosexual law reform or gay marriage was deemed politically radical in the 1970s, but has been legislated for in the last 20 years.

Share this post