TLDR: All around the world and here in Aotearoa-NZ, politicians and voters are choosing short-term pain-reduction tax cuts and subsidies to deal with the effects of climate change. Often that means encouraging the very burning of coal, petrol and diesel that is making climate change worse.

Last night China announced new subsidies for coal-fired power plants to help them cope with electricity shortages because of a drought. Our ‘temporary’ fuel tax cuts to reduce the pain of higher petrol prices, which will be an inevitable result of climate-emissions reduction measures, look set to be in place for years.

Paid subscribers can see more analysis and detail below the paywall fold and in the podcast above about how our political and financial ‘lizard brains’ are dominating any ‘slow thinking’ efforts to solve a long term problem. Paid subscribers will also get invites today to our weekly Ask Me Anthing session and our weekly ‘hoon’ live webinar at 5pm. The webinar link is below the fun things.

In geo-politics, the global economy, business and markets

When the heat is on

King coal wins again - Here’s one of those sign o’ the times stories that tells you a lot about the predicament we’re in and how difficult it will be to get ourselves out of it. China, the world’s biggest climate emitter, announced overnight it would increase subsidies for coal-fired electricity generators because a drought in China’s south-western Sichuan province (pop’n 80m) has starved its hydro-electric dams of water.1 FT-$$$

So what? - China is doing what most of the world is doing right now in the face of intense short term financial and climate pain. It is turning to the short-term tools it has to deal with the short-term pain, even though it knows it will make the long-term problem of climate change worse in the long-term. Politicians, even the ones in undemocratic dictatorships, are afraid of the short-term consequences of unhappy voters and citizens having to cope with short-term pain.

The bottom line - Aotearoa-NZ is not that different. Our Government cut fuel taxes 25c/litre ‘temporarily’ in March and most think that subsidy will last at least until the next election. Dealing with climate change will require long-term pain (or at least change) to deal with the planet’s biggest long-term problem, yet our collective decision-making emphasises the short term. Our lizard brains are winning in the battle with our thinking brains at the moment.

In Aotearoa-NZ’s political economy, business and markets

He said, she said and much ado about not much. So far.

Sharma drama escalates - Suspended Labour MP for Hamilton West, Gaurav Sharma, accused PM Jacinda Ardern of lying and orchestrating a cover-up last night in an interview with Newshub, although he gave little evidence to back that up.

“On Tuesday the Caucus suspended Gaurav on the basis of repeated breaches of trust. This latest example of releasing and misrepresenting conversations with his colleagues reinforces that decision and will be discussed by caucus.” Ardern’s spokesperson in a statement.

So what? - This is still largely a ‘beltway’ story that is distracting the Press Gallery and the Labour caucus, but if Sharma’s accusations dislodge some more political debris for the PM, it may drag further on her personal popularity, which is already at its lowest ebb. It might slightly increase the currently remote chance Ardern hands over the PM role to Grant Robertson late this year or early next year, which could disrupt the current polling suggesting a National/ACT win next year.

The bottom line - It’s worth ignoring it, unless the PM is clearly proven to have misled the public or knows something much more damaging than is currently out in public. So far, it looks more of a sideshow than the main gig. I’ll keep an eye on it so you don’t have to, until you do.

Quote of the day

“I felt like I was being cooked.” A Chinese resident on Weibo, commenting on problems getting electricity for air conditioners.

Today’s must read

Does the Fed really have the market’s back?

‘Don’t worry. There’s always a bailout’ - This Akane Otani article in WSJ overnight captures the current disconnect in global markets perfectly. The world’s most important central bank wants the markets to think it’s serious about getting inflation back down again by hiking short term interest rates until the pips squeak.

A lot of investors think the Fed will rescue them eventually with lower interest rates and money printing because that’s what it’s done for a couple of decades. Stocks have bounced 17% from their lows in June, even though inflation is still painfully high and the Fed hasn’t actually given to too many hints it will go easy on investors this time around.

The Federal Reserve says it is going to keep raising interest rates. Wall Street thinks it’s bluffing. This could spell trouble for both of them. Akane Otani article in WSJ

So what? - If the Fed is not ‘bluffing’ or inflation doesn’t cooperate with the view it will solve itself then financial markets are headed for some almighty disruptions. Ironically, that sort of cataclysmic event might just force the Fed’s hand. It has its own lizard brain problem when a financial market disruption risks turning into a financial stability issue.

My view - There’s always a bailout. There was never a true political reckoning for what happened in the GFC in the United States, the UK and Europe, when central banks and Governments bailed out banks and asset owners to keep them whole. There is a moral hazard problem woven into the DNA of global capitalism now.

Chart of the day

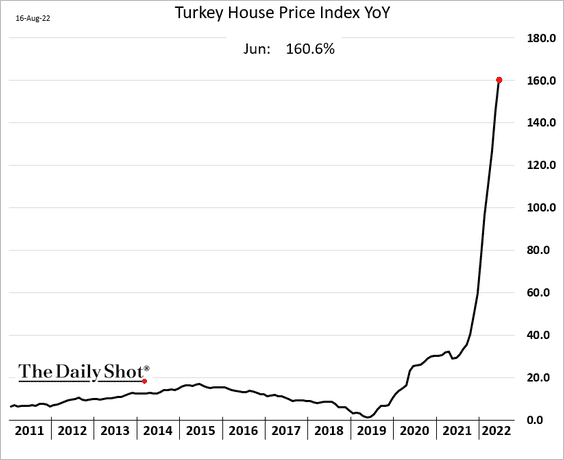

Bizarrely, Turkey cut its OCR last night to fight inflation…

Some fun things

Ka kite ano

Bernard

PS: Here’s the link for paying subscribers to jump onto the weekly hoon webinar with myself and Peter Bale at 5pm for an hour. Also watch out for my invite to the weekly Ask Me Anything session from midday to 1pm today.

China’s water seems to have migrated to Nelson and Westport.

Our climate lizard brains