TL;DR: These six things stood out to me over the last day in Aotearoa-NZ’s political economy, as of 7:06 am on Thursday, April 11:

The Government has refused a community housing provider’s plea for funding to help build 42 apartments in Hamilton because it said a $100 million fund was used up, the Waikato Times’ Stacey Rangitonga reported. It currently spends 40 times that each year on housing subsidies. (See more analysis and detail below)

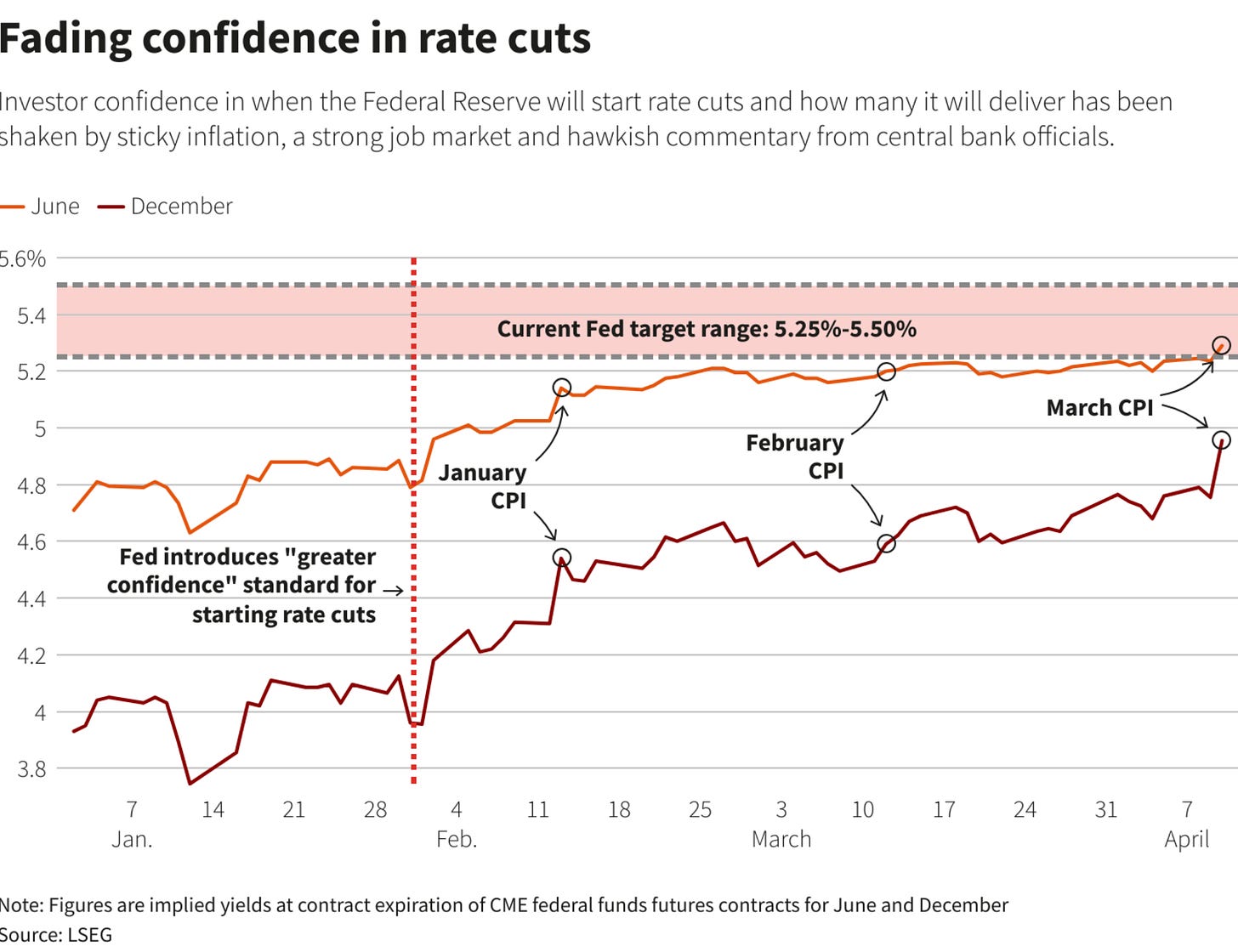

Interest rate cut hopes for 2024 are fading globally after higher-than-expected US inflation figures overnight dragged expectations down to 25 or 50 basis points of cuts this year by the Fed. Early in 2024, 175 points of cuts were expected this year. (See charts of the day below)

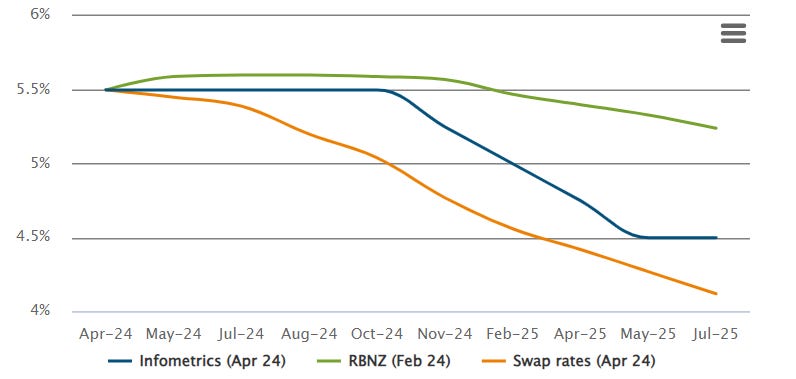

The Reserve Bank reinforced those fears yesterday by sticking to its view that high interest rates were needed to drag inflation down into its 1-3% target band. Economists said mortgage rates may not fall until very late in 2024, if at all. RBNZ

The central bank also pointed to high electricity, insurance and council rates inflation for keeping the OCR at 5.5%. That inflation is partly due to Government freezes and cuts to spending on roads, social homes and water infrastructure, along with high dividends to the Crown from state-owned gentailers. (See quotes of the day below)

Warner Bros Discovery yesterday confirmed the closure of Newshub and TVNZ told staff it would stop producing 1News’ midday and late night news bulletins and stop producing Fair Go and Sunday. (See quotes of the day below)

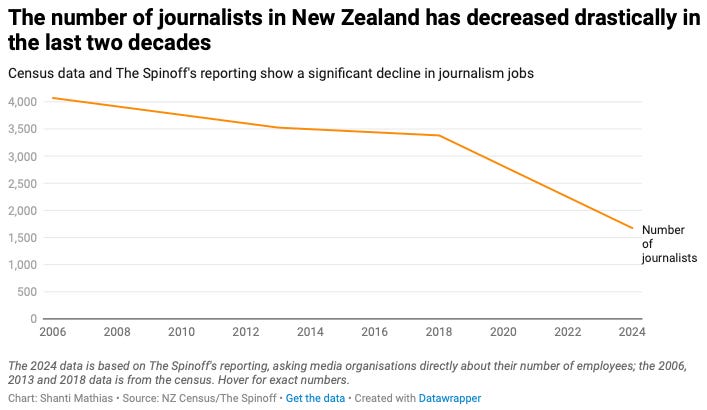

The 380 affected staff amount to 21% of the motu’s entire journalism workforce sacked in one day. It follows a 60% fall in advertising revenues for newspapers, television stations, radio and magazines to less than $1 billion since 2006. (See more in charts of the day below)

(Paying subscribers can see more detail and analysis below the paywall and in the podcast above. We’ll open it up for public reading, listening and sharing if they give permission by getting over 100 likes.)

Going for housing growth?

The Government, which was elected with a ‘Going for Housing Growth’ platform that ‘supercharges’ community housing providers, has refused a community housing provider’s request for funding help to build 42 apartments in Hamilton because it said a $100 million fund was fully allocated, the Waikato Times’ Stacey Rangitonga reported yesterday.

The Government spends over $4 billion a year in rent subsidies, accommodation supplements, first home buyer grants and emergency housing costs.

Bridge Housing Trust’s plans to build a 42 apartment complex on the corner of Tristram and Liverpool Streets in Hamilton central were left under a cloud of funding uncertainty after its application to the Te Tūāpapa Kura Kāinga – Ministry of Housing and Urban Development (MHUD)’s affordable housing scheme was denied.

Under the nationwide initiative, housing providers commit to charging no more than 80% of median rent. In return MHUD pays half the cost of the build. Waikato Times’ Stacey Rangitonga

Housing Minister Chris Bishop made the final decision.

“As we advised the Bridge Trust in February of this year, their proposal was unfortunately not selected to be funded and with the fund itself now fully allocated, we are not able to reconsider that decision.

“The Ministry has considered whether there are other ways we could help progress the Hinemoa Apartments development, but unfortunately there is no suitable alternative funding source currently available.” Chris Bishop quoted by The Waikato Times.

National had campaigned on providing support for Community Housing Providers to build more social housing, rather than continue Labour’s policy of focusing social house building on Kāinga Ora.

Here’s the section in their housing policy titled “Going For Housing Growth”, which is also attached below.

Charts of the day

From 4,000 to 1,300 since 2006

News advertising revenues down 60% since 2006

Mortgage relief drifting away

Fed cuts pared back

Quotes of the day

Will you help, Minister?

"I don't think I can save anything. I'm the Minister for Media and Communications. What I can do is provide a level playing field so that media can be more sustainable, modernise and innovate.” Melissa Lee in Parliament yesterday when a reporter asked whether she thought she could save the media industry. Stuff

Government-driven inflation

“The Committee discussed upside risks to the inflation outlook. Members agreed that persistence of services inflation remains a risk and goods price inflation remains elevated. Anticipated near-term increases to local government rates, insurance, and utility costs, could also further slow the decline in headline inflation.” RBNZ MPC statement.

Comment of the day on The Kākā

“Re Simeon Brown's wish for greater speeds and the impact on emissions. Changing the top speed limit does not impact heavy vehicle speed limits. A pet peeve of mine is the fact heavy trucks on the Waikato Expressway are not being policed for speed. On a 110km/h stretch of road, their speed limit is still 90 km/h but it's being flouted. No wonder the road is falling apart. Dan Adams on yesterday’s Dawn Chorus. More here

Cartoon of the day

More rabbits and holes

Timeline-cleansing nature pic of the day

Painting and weeding required

Ka kite ano

Bernard

Share this post