Kia ora. Long stories short, here’s my top things to note in Aotearoa’s political economy around housing, climate and poverty on Thursday, November 21:

The news at 7.30 am: Ukraine fired British-made Storm Shadow missiles into Russia for the first time overnight (Guardian). COP29 is nearly finished without a deal on climate finance (Reuters). LGFA raised its borrowing limit for councils to 350% of revenue from 280% after the Government increased its overdraft limit for LGFA (LGFA, Beehive). NZ’s biggest pulp & paper mill at Kinleith is ending paper production and laying off 230 workers (Oji).

The lead: A group of economists, including former Treasury Chief Economist Girol Karacaoglu and former Productivity Commissioners Ganesh Nana and Bill Rosenberg, published a letter to PM Christopher Luxon this morning calling for an immediate suspension of budget cuts to avoid further worsening a recession they say is hollowing out businesses and conflicts with the Government’s goal of doubling exports.

Scoop du jour: A Southland GP says he’s forced to sedate dementia patients with anti-psychotic drugs because of a shortage of publicly-funded dementia beds in regional areas, The Post’s Rachel Thomas reports this morning.

Deep-dive du jour: An award-winning disability advocate, Jonathan Mosen, told RNZ’s Nine to Noon yesterday he’s leaving New Zealand, saying it is the worst country in the Western world in which to be blind.

Solutions news: A food rescue charity that reduces CO2 emissions, volunteers controlling pests weeds and farmers restore waterways were recognised at the Taranaki Regional Council Environmental Awards. RNZ

Editorial Opinion du jour: Auckland University economics professor and former Reserve Bank economist Robert MacCulloch wrote a scathing Op-Ed in today’s NZ Herald-$$$ about Nicola Willis’ performance as Finance Minister, saying she was missing in action on monopoly-busting, tax, social investment and savings reforms, and was presiding over an ever-lengthening recession that was worsening the Budget deficit.

(There is more detail, analysis and links to documents below the paywall fold and in the podcast above for paying subscribers. Normally, if we get over 100 likes we’ll open it up for public reading, listening and sharing, but in this case I’ve pre-emptively opened it up, given the public interest in the The Lead.)

2. The Lead: Economists call for end to Budget cuts

A group of economists, including former Treasury Chief Economist and former Productivity Commissioners, published a letter to PM Christopher Luxon this morning calling for an immediate suspension of budget cuts to avoid further worsening a recession they say is hollowing out businesses and conflicts with the Government’s goal of doubling exports.

They argued fiscal policy was needlessly worsening the recession, saying there was no clear rationale for projected budget cuts and little consideration about the short-term effects. They wrote:

For example, your Government’s cancellation of key infrastructure projects and sinking-lid cuts to the public service are powerful contributors to the current severe and prolonged recession. This is substantially worsening the contractionary effects on the economy of the Reserve Bank’s use of the Official Cash Rate to contain inflation.

It is important to recognise that even prior to cutting back expenditure, government consumption spending was close to 20% of GDP. This covered spending on health, education, defence, administration, justice, transport, and culture. In addition, deferrals and reductions in projected infrastructure spending has further reduced employment and intensified the economic recession.

There is ample evidence that government spending, including the necessary infrastructure and allied networks, has for many years fallen well short of that required for population growth and demographic changes. The Infrastructure Commission has stated that New Zealand has a $104 billion infrastructure gap at present – and that this picture will significantly worsen given current spending projections.

These accumulating shortfalls put the nation in a poor position to improve its long-run economic resilience and to prepare for future challenges. If nothing is changed now, this under-funding simply passes the burden of adjustments, and investment spending, to future generations.

Failure to correct this course will lead to higher economic scarring, with the costs borne by those with the least ability to pay, as has been demonstrated repeatedly in New Zealand’s history. It will also undermine the resilience of the private sector – particularly exporters – and will continue to constrain the capability of firms to scale up. Economists letter to PM Christopher Luxon

They argued a focus on government debt ignored the impacts on private sector debt and external debt and also lacked a clear rationale.

Irrespective of the debt measure adopted, international comparisons of government debt in comparison to GDP remain in New Zealand’s favour. Credit rating agencies continue to view the government’s debt situation without concern. Bluntly, there is no government (or public) debt crisis in New Zealand.

The New Zealand economy’s ongoing problem is private sector debt. Importantly, private sector debt is being driven upwards by your Government’s fiscal policy in pursuit of surpluses for itself and its aim of rapidly reducing public debt.

Standard economics shows the relationship between public and private sector financial balances. When total domestic saving (both public and private) is insufficient for domestic investment (both private and public), the gap needs to be filled by drawing on foreign funds. The overall current account (or external) deficit is a measure of this gap and requires overseas borrowing or asset sales to foreigners to finance such a deficit. With the banks acting as intermediaries, the resulting increase in liabilities is reflected on both the private and public sectors’ balance sheets.

These connections – in particular, between the Government’s fiscal stance, the size of the current account deficit, and the consequent size of the nation’s external debt – are glaringly missing in documents describing the economic impact of fiscal policy. There is little explanation of how fiscal policy focussed on reducing government spending would reduce New Zealand’s external deficit and total external debt. Consequently, fiscal policy is adding to the vulnerability of economic activity and exposing New Zealand to inevitable global shocks.

They also pointed out the Government’s cuts risked a long-lasting hollowing-out of business.

There appear to be further spending reductions accelerating at this stage of the economic cycle. The negative impact risks undermining retail, hospitality, home improvement sectors, and challenges the heart of rural economies and communities across the nation. Prolonging the current cyclical downturn in this manner means that these costs result from a policy choice, rather than being an economic outcome.

In addition, increasingly worrying is the harm imposed on those households on low or casual wage income or dependent on benefits. The erosion of the already low psychological and financial reserves of the poorest will be hard – and socially and fiscally costly – to repair.

The economists pointed to workers voting against the policy with their feet.

We note that the consequent erosion of the tax base will also impair the government’s balance sheet. This long-lasting harm is further evident in the increasing numbers of trained and skilled New Zealanders migrating abroad in search of hope. This is creating skills shortages across the country, particularly in health and education.

The loss of this capacity and capability – in terms of workforce skills, knowledge and expertise alongside investor/owner appetite for equipment, machinery, technology upgrades and expansions – becomes increasingly permanent the longer the downturn is prolonged.

This form of hollowing-out is currently clearly visible in the construction sector, where once again the boom-bust cycle is seeing harm that will impact on the development of the sector for years to come and further undermine critical efforts to expand the housing stock. This will (again) be likely reflected with future infrastructure and housing developments experiencing difficulties in attracting sub-contractors back to the building and construction sector.

They argued the Government’s fiscal policy of trying to get public debt and the size of Government both under 30% of GDP also conflicted with its aim of doubling the value of exports over the next decade

There is a direct conflict between the current fiscal policy stance and the aspirational export goal. New Zealand’s historical reliance on volume-driven commodity growth and mainly low-value exports requires significant structural shifts for the returns from exports to be doubled. Without investment in key infrastructure, resilience building, business capacity and capability, human capital, and entrepreneurial endeavour, the necessary structural shifts will not occur. The current fiscal policy settings undermine the required investments to facilitate such shifts.

They called for an urgent suspension of spending cuts and further delays in infrastructure funding, along with “a clear economic rationale for fiscal policy” in next year’s Budget. Here’s the full PDF of the letter attached.

My view: I agree with everything in the letter.

Scoop du jour: ‘I have to drug them as there’s no beds’

A Southland GP says he’s being forced to sedate dementia patients with anti-psychotic drugs because of a shortage of publicly-funded dementia beds in regional areas, The Post’s Rachel Thomas reports this morning.

Dr Daniel Allan made the comments to Parliament’s Health Committee on Wednesday. Allan was a psychogeriatrician ‒ a psychiatrist for elderly people ‒ who worked around the South Island but mostly in remote peripheral areas, and spoke to the committee remotely from Southland.

“This happens around New Zealand, but I feel that this is happening more frequently in these places compared to the more well-resourced areas.

“I, as a clinician, have to use sedation, deliberate sedation, using anti-psychotic medication for people with dementia in these rural locations, because I have no other alternative out here.”

Honorable mentions

Justice: Police research adds to evidence against gang patch ban Newsroom’s Laura Walters

Health: Govt rejects Auckland and Otago Unis’ doctor proposal ODT-$$$

Housing: High hopes, no new homes yet: NZ Super Fund, Classic partnership NZ Herald-$$$’s Anne Gibson

4. Deep-dive du jour: Leaving in frustration

An award-winning disability advocate, Jonathan Mosen, told RNZ’s Nine to Noon yesterday he’s leaving New Zealand, saying it is the worst country in the Western world in which to be blind.

Instead of world leading technologies he pointed to new Eftpos machines that had been allowed with flat touchscreens, leaving blind people to have to hand over their card and pin and trust no one round was eavesdropping.

Or audio descriptions for television programmes that weren't available in on demand services, despite that being the increasing way people were accessing television.

"The irony is that it's harder for me to find out what's going on in New Zealand than it is to find out what's going on in other parts of the world because, in particular the New Zealand Herald app has serious accessibility problems, it's really hard to read articles in the Herald, I'm quite willing for them to take my money but the iOS app is in an appalling state. Stuff is a little bit better but not by much." Jonathan Mosen, told RNZ’s Nine to Noon

5. Solutions news:

A food rescue charity that reduces CO2 emissions, volunteers controlling pests weeds and farmers restore waterways were recognised at the Taranaki Regional Council Environmental Awards yesterday. RNZ

6. Editorial, Op-Ed or column du jour:

Auckland University economics professor and former Reserve Bank economist Robert MacCulloch wrote a scathing Op-Ed in today’s NZ Herald-$$$ about Nicola Willis’ performance in her first year as Finance Minister, saying she was:

missing in action on monopoly-busting;

doing little real tax, social investment and savings reforms; and,

was presiding over an ever-lengthening recession that was worsening the Budget deficit.

Here’s a sample:

The fiscal deficit will worsen under the current Government, unless the economy starts to rapidly pick up. The trimming of civil servants, whilst necessary, is not on a scale that will greatly shift the dial.

Willis has done little to address the ageing population trend, which is starting to blow out the deficits. I once handed National MPs a fully-costed plan showing how to avert that problem many years ago, written with a former Finance Minister. They ignored it.

On housing, once the propaganda is stripped away, National’s reforms offer less of an increase in supply than was going to happen under the bi-partisan accord that the party signed up to with Labour years ago. Under that agreement, up to three homes of three storeys could be built on most urban sites, without need for resource consent.

National’s new plans do less. They offer fewer agglomeration benefits, since the emphasis is more on building out into green fields, rather than up. Building out will be more expensive, requiring more infrastructure. Robert MacCulloch in an Op-Ed in the NZ Herald-$$$

Honorable mentions

Op-Ed: Wellington intervention looks like a first resort, not the last Lianne Dalziel in Newsroom.

Analysis: Four key questions following Te Hīkoi mō Te Tiriti Stuff’s Glenn McConnell

Op-Ed Open your wallet for the Foodstuffs merger appeal fund Ernie Newman in The Press

The Kākā’s Journal of Record for Thursday, November 21

Infrastructure & councils: The Treasury and the Local Government Funding Agency agreed to increase the LGFA's borrowing capacity in order to ensure funding for critical water infrastructure.

Infrastructure: The Government’s second Quarterly Investment Report found 83% of Government investments are delivering to budget, and 54% are delivering to original timeframes. A Cabinet paper on the report, commenting on the predominance of transport spending, said “tradeoffs” between transport and "needed investment in other areas" may be required. BusinessDesk

Electricity & living costs: Commerce Commissioner Vhari McWha said the Commission's decision to increase revenue limits for Transpower and local lines companies will increase the average household's monthly electricity bill by roughly $10 from 1 April 2025.

Migration: A Member's Bill by Green MP Teanau Tuiono to reverse a Muldoon Government Act denying certain Samoan people pathways to NZ citizenship passed its third reading and will become law. Muldoon's 1982 law nullified the right of Samoans born between 1924 and 1948 to gain NZ citizenship as British subjects. the new law allows these Samoans to apply for citizenship. RNZ

Oji Fibre Solutions announced its decision to permanently shut down paper production at Tokoroa’s Kinleith Mill in June 2025, estimating roughly 230 jobs will be lost. E tū union negotiator Joe Gallagher said OFS cited high power and log prices for the decision, and asked the company to engage economists on creating a business case for the mill. RNZ

Economy & regions: Infometrics' Quarterly Economic Monitor for September showed a 0.3% and 0.4% year-on-year fall in provincial and rural economic activity respectively, and an almost 17% annual fall in residential consent numbers.

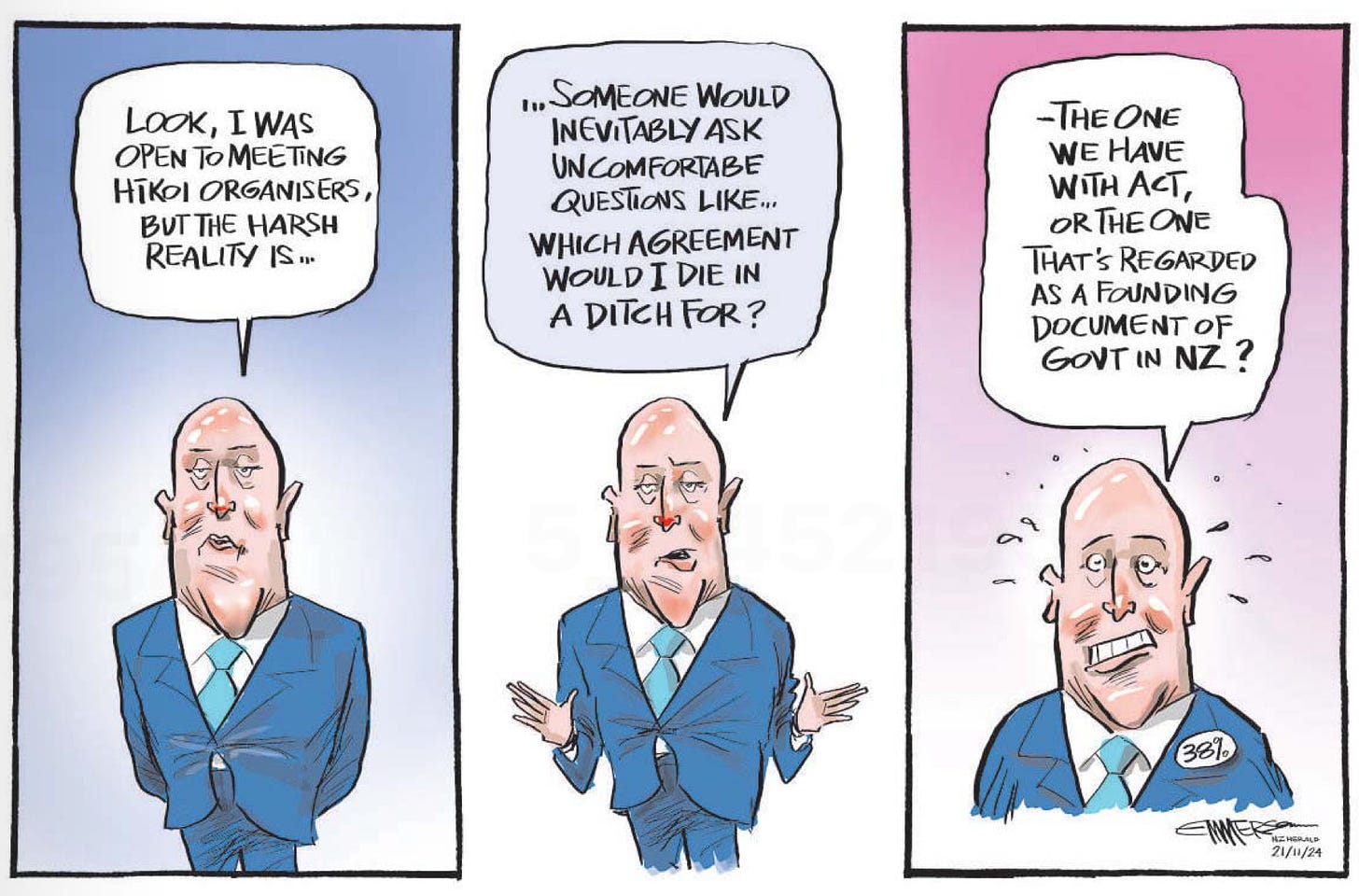

Cartoon du jour: Politics = priorities + choices

Timeline-cleansing nature pic of the day: Big breakfast

Ka kite ano

Bernard

Share this post