TLDR & TLDL: The rest of New Zealand outside Auckland is breathing a qualified sigh of relief this morning as Covid-19 restrictions dropped from Level 3 to ‘Delta Two’ rules just before midnight. The mask-wearing rules indoors and the 50-person cap for inside venues remain a major constraint for hospitality and events business, for ‘business-as-usual’ office life.

Auckland is expected to stay at level four for another week at least, with its future dependent on the number of new ‘mystery cases’ dropping to zero per day. There were four un-connected cases found yesterday and there are still 24 cases under investigation where it’s not clear how they caught the virus. It could be a couple more weeks before Auckland can go down a level after a few ‘zero’ days of mystery cases.

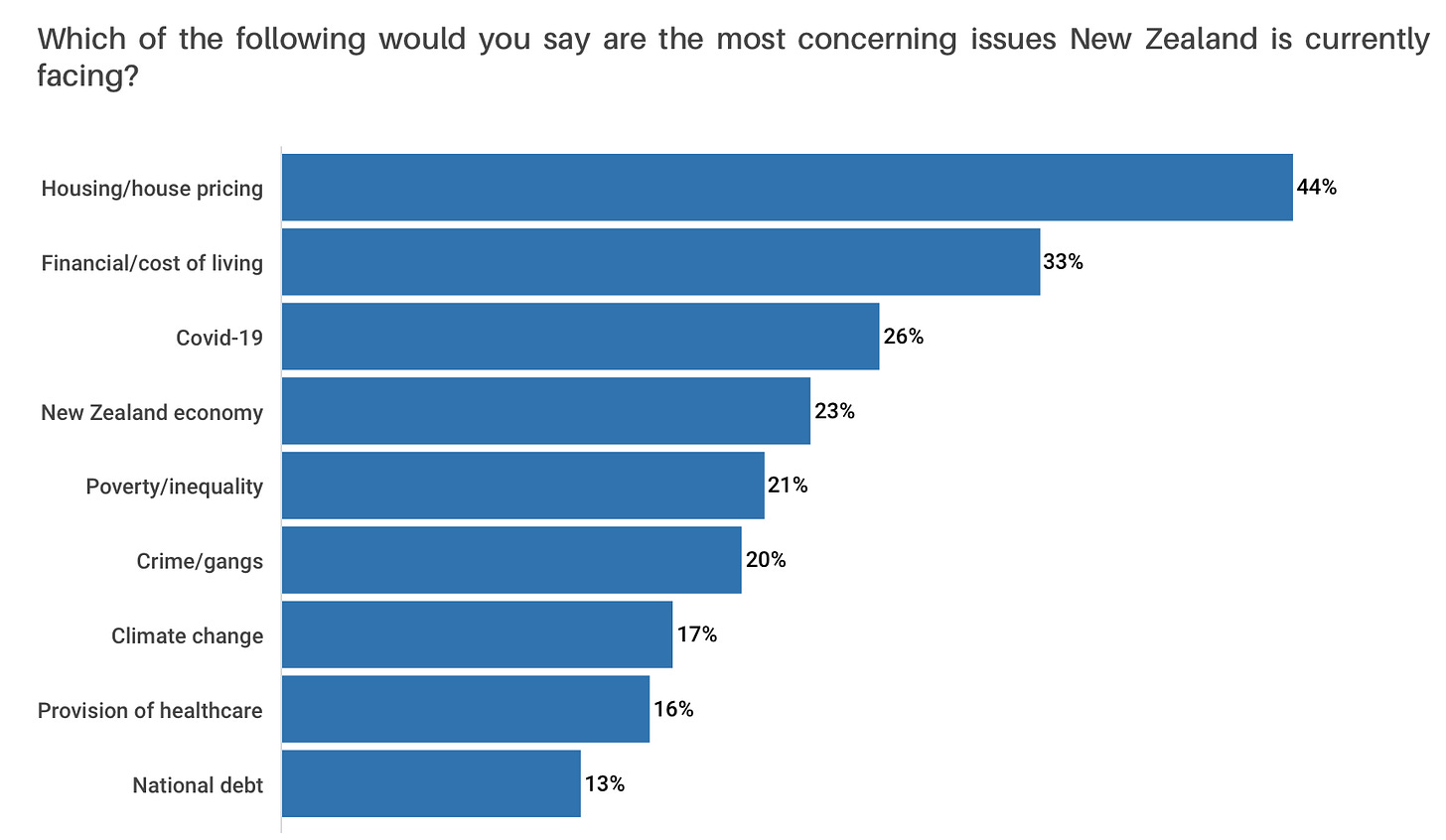

However, despite the drama and fear around Covid-19, it’s not our biggest concern: that would be housing unaffordability.

A Consumer NZ survey of sentiment has found 81% of New Zealanders believe the housing market is over-inflated or out of control, 62% of renters feel locked out of the market and 58% of home owners say they couldn’t afford to buy their house now if they had to pay current CV.

The survey of 1,000 people online is done quarterly and is a nationally representative sample of the population. It also found 44% believed housing was the nation’s main concern, while 33% cited the cost of living and just 26% saw Covid-19 as the main concern.

Scoops and news overnight

In our political economy:

Aotearoa-NZ is set to offer Novovax as a booster shot early next year (Stuff),

Hopes the live events business sector could arrange a Covid insurance scheme with the Government are fading (Stuff),

Auckland’s Eastern Busway project remains in doubt in the Government’s $24.3b transport spending plan detailed yesterday (NZ Herald)

“The Government is yet to receive advice on the efficacy of mixing vaccines and booster shots, but we’re really encouraged by the progress Novavax is making in further developing its vaccine to combat emerging variants of Covid-19.” Covid 19 Minister Chris Hipkins.

In Covid news globally:

Israel’s caseload reported overnight was the world’s highest on a per capita basis ever reported, despite it being the first country to be more than 60% vaccinated (Fortune)

Singapore’s case numbers are now doubling every week, forcing it to consider fresh lockdown measures. It had cautiously opened up last month after hitting 80% vaccination (BusinessTimes)

In the global and local economy, markets and business:

Australia’s Ampol, which is bidding for Z Energy, has employed investment bankers to do due diligence to buy Meridian Energy’s A$1b worth of electricity generation and retailing assets in Australia, (AFR-$$$)

The Reserve Bank of Australia decided late yesterday to proceed with a slight tapering of its money-printing programme from A$5b/week to A$4b/week, saying it expected the economy to rebound after the latest lockdowns. Markets mostly expected it to keep going at A$5b and the Australian dollar rose as a result (BusinessInsider)

China reported last night its export growth was a higher-than-forecast 25.6% in August from a year ago, and up from the annual growth rate of 19.3% in July. Import growth was 33%, indicating China did better than expected in August despite Covid lockdowns (Reuters)

UK PM Boris Johnson broke an election manifesto pledge not to raise main tax rates, announcing overnight a 1.25% tax on share dividends and a 1.25% hike in National Insurance taxes to pay for a £36b increase in health spending over three years (Guardian)

Overnight, El Salvador became the first country in the world to start using bitcoin as its official currency , but had a few hiccups with e-wallets (Reuters)

Yields for european corporate bonds rated as ‘junk’ (below the BBB minus threshold for investment grade) fell below 0% this morning for the first time (YahooFinance)

Apple is expected to launch a new evolution of the iPhone at a launch event next Wednesday morning (NZ Time) night (CNET)

Signs ‘o the times news yesterday

In Covid news;

PM Jacinda Ardern said she was confident of an imminent deal to get more Pfizer doses to keep up the current vaccination rate of 80-90k a day beyond the end of next week, although she didn’t detail where they were coming from, how many and when.

Deputy PM Grant Robertson announced a relaxation of the Level 4 rules in Auckland to allow building materials companies to start manufacturing supplies again before the rest of New Zealand runs out (even more than they already have.

Here’s my take on yesterday’s big Transport plan announcement.

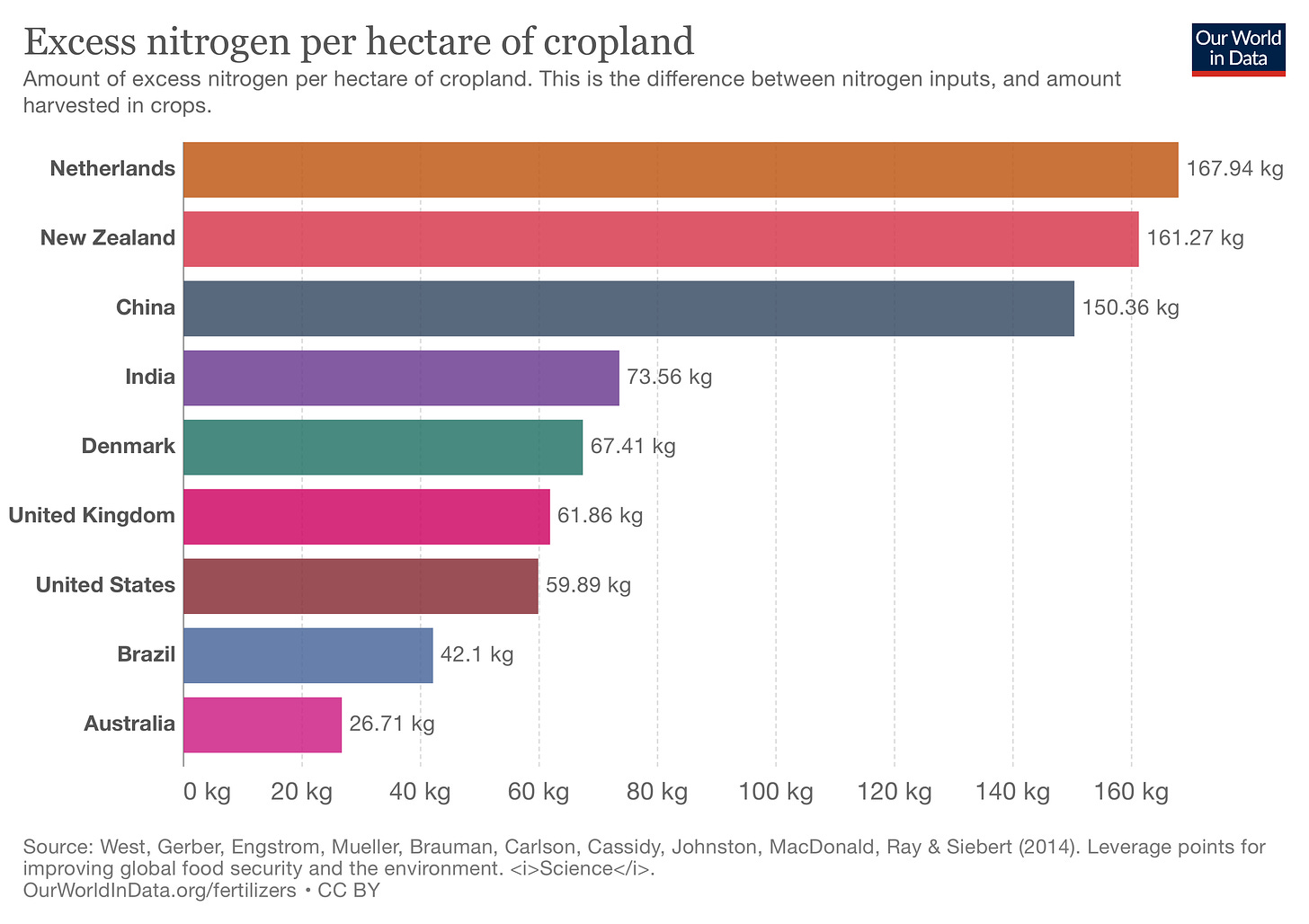

Chart of the day

A useful longer read

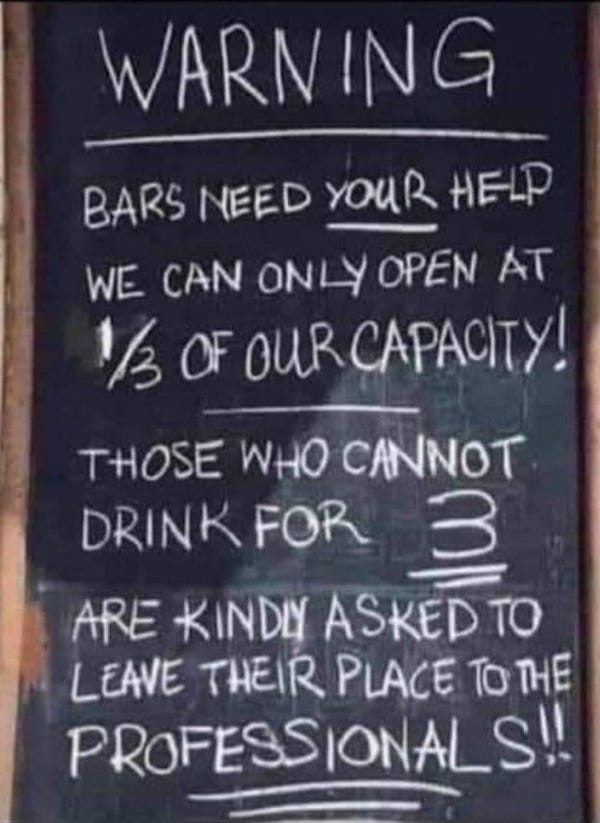

Some fun things

Ka Kite ano

Bernard

Share this post