TLDR: Cabinet appears set to decide next Monday to let the current ‘traffic lights’ system of Covid controls expire completely by the end of next week, effectively ending Government mask mandates.

The NZ Herald reported this morning Cabinet will decide to scrap the current system enabled by the Epidemic Preparedness (COVID-19) Notice 2020 Renewal Notice (No 2) 2022, the last of which was signed on June 12 and is due to expire within three months, which would be next Monday. The notice itself came into force on June 16 and states it will not expire until Sept 16, next Friday, but can be ended earlier.

Elsewhere in the news this morning, the pound, the euro and the yen fell to multi-decade lows against the surging US dollar and export figures from China were weaker than expected. The NZ$ briefly fell below 60 USc, which is still above its March 2020 lows.

Paying subscribers can see more detail and analysis below the paywall fold and hear more in the podcast above.

In geo-politics, the global economy, business and markets

King (US) Dollar reigns supreme - The pound, euro and yen fell sharply again this morning to multi-decade lows as investors and traders eyed up the prospects of higher US interest rates at the same time as:

Britain’s new tax-cutting-and-spending Government is increasing its budget deficits and debt in a way that is unnerving foreign investors; and,

the Bank of Japan is continuing on its own path of pressing down on interest rates to boost (yes boost) inflationary pressures.

The yen fell to 144 to the US dollar, which was its lowest level since 1998. It is down a fifth in 2022, which is doing the job of boosting inflationary pressure on import costs, but is beginning to unnerve the Japanese Government. It has suggested it might intervene to stop it falling soon. The euro fell to a 20-year low, although is being held up somewhat by growing expectations the European Central Bank will decide tonight to increase its key interest rate by a ‘jumbo’ 75 basis points to (wait for it) 0.75%. CNBC

A looming independence showdown - The pound fell to its lowest level against the US dollar since 1985 as the Bank of England’s Chief Economist Huw Pill told a Parliamentary select committee the Government’s plans to spend (after borrowing) £150b to freeze winter energy bills was likely to force the central bank to raise interest rates. That would pit one arm of the British Government trying to lower costs for consumers against another arm trying to increase borrowing costs. New British PM Liz Truss has previously challenged whether the Bank should remain independent.

“We have to take the actions we have to take to hit the inflation target, hard as though those may be in terms of the consequences.” BoE Chief Economist Huw Pill overnight via FT-$$$1

China slowing fast - China reported exports rose 7.1% in August from a year ago, which was less than half economists’ expectations and points to slowing factory activity. Imports were up just 0.3%, which was less than a third expectations and tallies with signs the ‘factory to the world’ is importing fewer components for assembly and re-export. Meanwhile, more Chinese cities warned residents against holiday travel due to Covid. Reuters

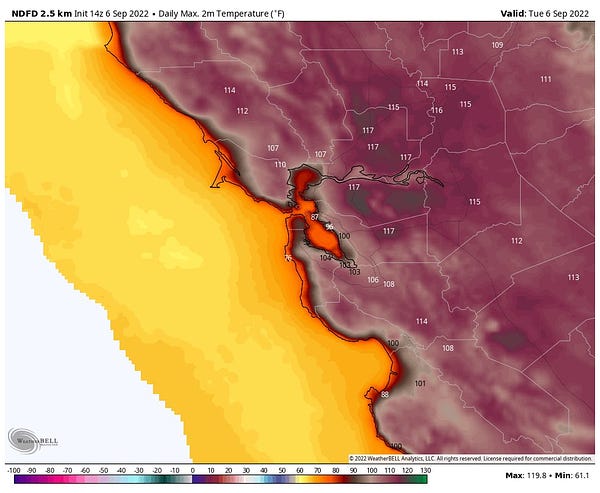

California sweating - California’s governor Gavin Newsom has warned residents of the world’s fifth biggest economy to prepare for power blackouts for the first time in two years because of a record-setting heatwave.

‘Ferme la fonderie’ - Aluminium Dunkerque, which consumes as much electricity as Marseille, France's second largest city, announced plans overnight to cut output by about 22% in the fourth quarter. No wonder Tiwai Point wants to stay open.

Just briefly

An anti-E.S.G. activist investor wants Chevron to pump more oil. WSJ2

In Aotearoa-NZ’s political economy

Gone by Wednesday? - The Government is set to decide on Monday whether to completely drop the entire Covid traffic light system and other legal restrictions by next Wednesday, the NZ Herald reports this morning.

The Herald understands Cabinet on Monday will be deciding on a recommendation to scrap the traffic-light system altogether rather than tweaking the settings or moving to green.

If it goes ahead, it would come into effect as soon as next Wednesday – when the main legal instrument under which the Covid-19 orders are issued will expire if Cabinet decides not to renew it.

That Epidemic Preparedness (Covid-19) Notice 2020 is one of the over-arching legal instruments under which the Government and health authorities have exercised special powers in the Covid-19 response: including the traffic light system. If not renewed, all orders associated with it will also lapse.

If Cabinet gives it the nod, Covid-19 would be treated similar to the way the flu is managed.

Health officials could still require masks in public health settings, such as hospitals, and advise their use elsewhere such as on public transport. However, the Herald was told it would otherwise be up to businesses and providers to decide whether to adopt their own mask rules.

However, it’s worth knowing the notice does not formally expire until Friday. Covid case numbers are at their lowest levels since February.

Covid-19 Modelling Aotearoa co-lead Michael Plank and University of Otago epidemiologist Nick Wilson were quoted as saying the mandates should be eased more gradually.

"Governments, they want their votes and they will often sacrifice what is the right thing to do from a science and public health perspective because they want to win an election." University of Otago epidemiologist Nick Wilson

Just briefly

Chief Human Rights Commissioner Paul Hunt says he’s “horrified” by what was revealed in a TVNZ Sunday expose about emergency housing in Rotorua. 1News

Lotto has been warned a $25m plan to create an online bingo service will harm vulnerable communities. RNZ

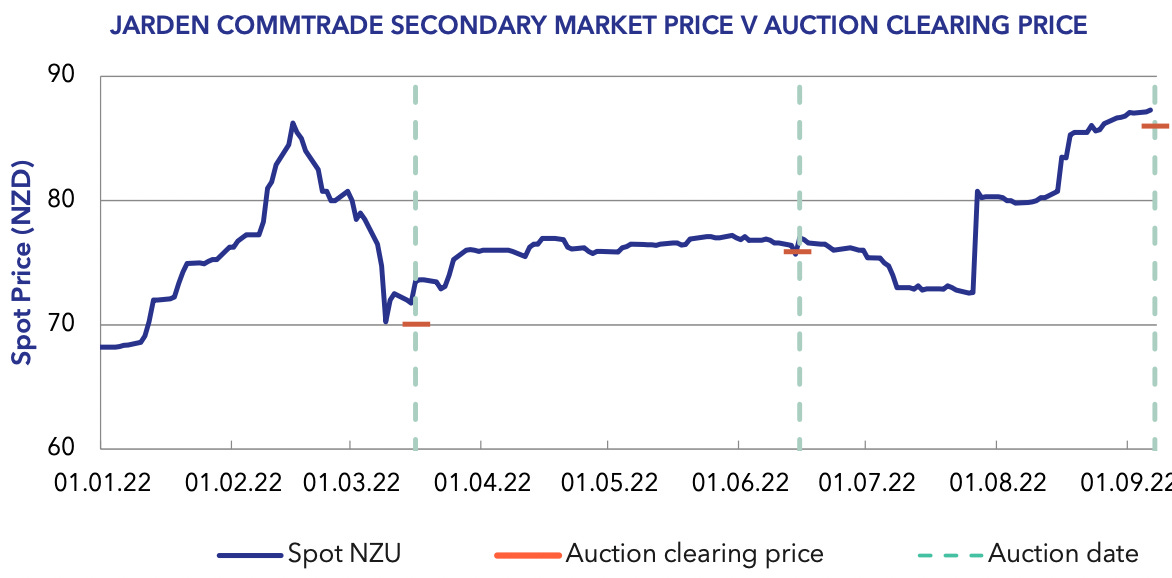

An auction yesterday of Emission Trading System units by the Government saw the price clear at $85.40, which is up from $70 at the last auction in March.

Scoop of the day

David Enrich, the business investigations editor for The New York Times, has an investigation out today into how Abbott Pharmaceuticals kept its poisonous infant formula from becoming a scandal. Fonterra and A2 peeps might find this interesting.

Quote of the day

‘Profit margins need to fall too’

“How long it takes to move inflation back down to 2 percent will depend on a combination of continued easing in supply constraints, slower demand growth, and lower markups, against the backdrop of anchored expectations.” US Federal Reserve Vice Chair Lael Brainard in a speech this morning in New York on ‘Bringing Inflation Down’

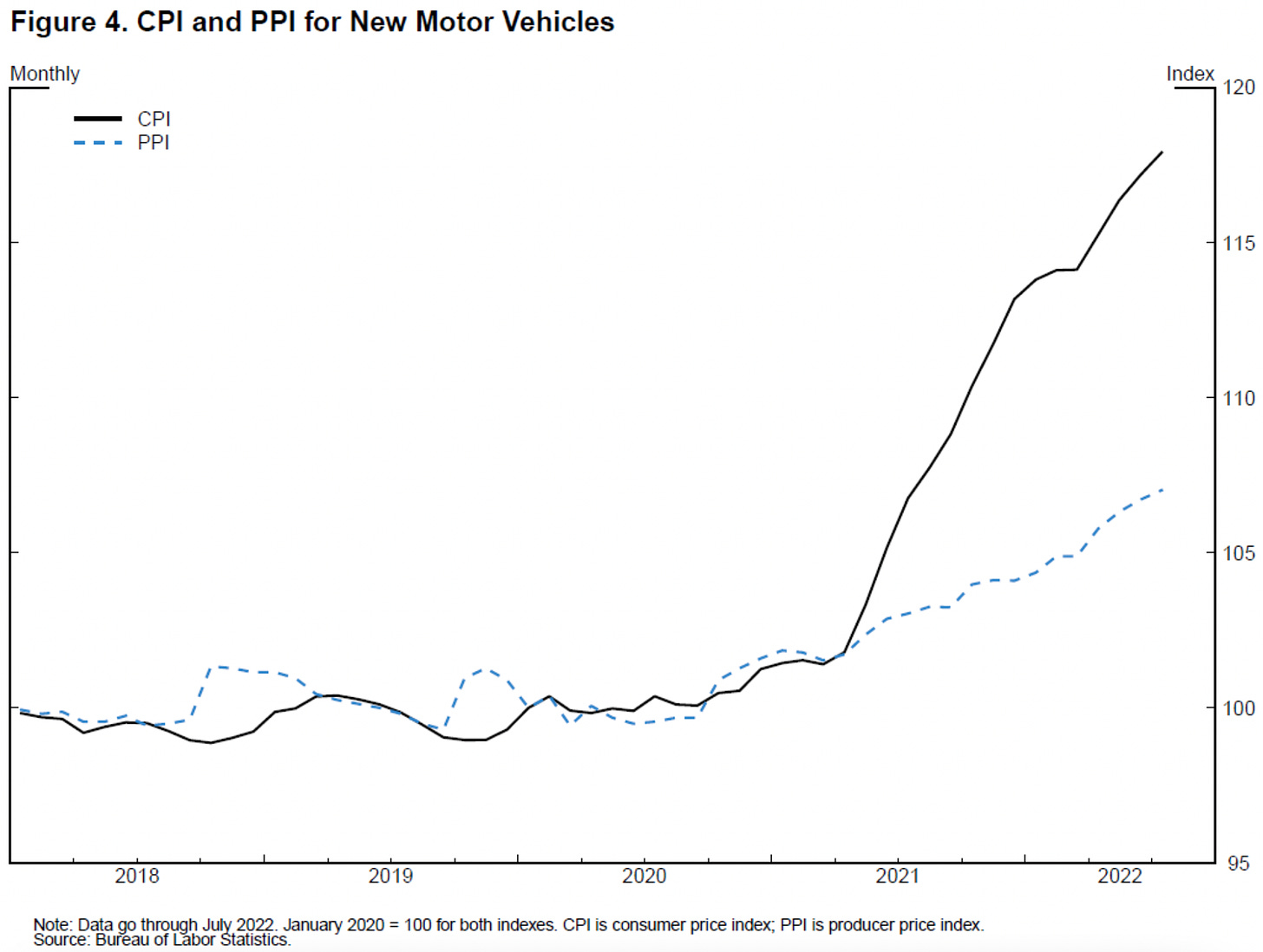

Chart of the day

A good time to be a car dealer in the United States

Brainard also pointed in particular to how car dealerships and retailers had increased their profit margins during Covid and hadn’t put them back down again.

“After moving together closely for several years, starting early last year, the new motor vehicle consumer price index (CPI), which measures the price dealers charge to customers, diverged from the equivalent producer price index (PPI), which measures the price dealers paid to manufacturers. Since then, the CPI has increased three times faster than the PPI. This divergence between retail and wholesale prices suggests an unusually large retail auto margin. With production now increasing, and interest-sensitive demand cooling, there may soon be pressures to reduce vehicle margins and prices in order to move the higher volume of cars being produced off dealer lots.” US Federal Reserve Vice Chair Lael Brainard in a speech this morning in New York on ‘Bringing Inflation Down’ (Bolding mine)

Number of the day

A good time to be a US retailer

30% - Brainard also called out retail profit margins in the United States.

“Similarly, overall retail margins—the difference between the price retailers charge for a good and the price retailers paid for that good—have risen significantly more than the average hourly wage that retailers pay workers to stock shelves and serve customers over the past year, suggesting that there may also be scope for reductions in retail margins. With gross retail margins amounting to about 30 percent of sales, a reduction in currently elevated margins could make an important contribution to reduced inflation pressures in consumer goods.” US Federal Reserve Vice Chair Lael Brainard in a speech this morning in New York on ‘Bringing Inflation Down’

Longer read of the day

Longer watch of the day

Cartoon of the day

Australians are worried the RBA is hiking too much

Profundities, spookies, curiosities and feel-goods

A fun thing

Ka kite ano

Bernard.

This is a gift link from me as an FT subscriber to the first three subscribers that use it. The one link will open three times for three people. Ask for more below if you need it.

This is a gift link from me as an WSJ subscriber that will work once per person.

Dawn Chorus: Covid rules expiring