My pick of the six newsey things to know from Aotearoa’s political economy and beyond from the last 24 hours to 9:46 am on Thursday, April 18 are:

The Lead: Ongoing double-digit inflation in council rates and insurance linked to climate change is pumping up domestic inflation and is helping to delay mortgage rate cuts until late this year or even early 2025. So should the Reserve Bank look through climate change inflation? It says no, but there’s a risk climate shocks drive up inflation and interest rates, delaying de-carbonisation investment. (See more detail and analysis below, and in the podcast above)

Chris Penk announced a four-year delay in the remediation deadlines for quake-prone buildings this morning, giving a repreive to building owners in many provincial towns and in Wellington.

The Ministry of Education and Oranga Tamariki announced more than 1,000 job cuts yesterday. Unions described the cuts as brutal and likely to hit services for disabled people and kids’ lunches. Nicola Willis denied the cuts were to pay for tax cuts and said the Budget would include more spending on Education and OT.

Te Whatu Ora-Health NZ released an initial report from Sapere for its Aged Care Funding and Service Model Review yesterday. It described the sector as under “extreme pressure” and unprepared for an expected surge in demand. It said an extra 12,000 beds were needed by 2032. There are currently only 32,000.

The Office of the Inspectorate of prisons released a damning report yesterday into the treatment of prisoners at Paremoremo, saying staff shortages meant over 100 prisoners were not allowed out of their cells for days at a time over nine months last year. Corrections denied its new staff cuts in the current Budget round would affect conditions.

President Joe Biden has just announced the United States will triple tariffs on imports of steel from China. Reuters

(Thanks for the feedback on yesterday’s experiment. The response was positive, but people are also keen for my selection and analysis of the key items, along with less repetition. So I’ve included a link to the ‘Pick ‘n’ Mix’ in this Dawn Chorus, which has the podcast. My apologies for not getting the podcast out yesterday. A bit too much on. Paying subscribers can see more detail and analysis below the paywall and in the podcast above. We’ll open it up for public reading, listening and sharing if we get over 100 likes)

The Lead: Climate inflation a factor delaying rate cuts

Paid content below this line

Inflation data out yesterday from Stats NZ showed domestic services inflation was higher than the Reserve Bank’s forecasts, which led to financial markets shifting their expectations for the first OCR cut further out into the second half of this year. Some economists (ANZ & Westpac) see a rate cut unlikely until early 2025.

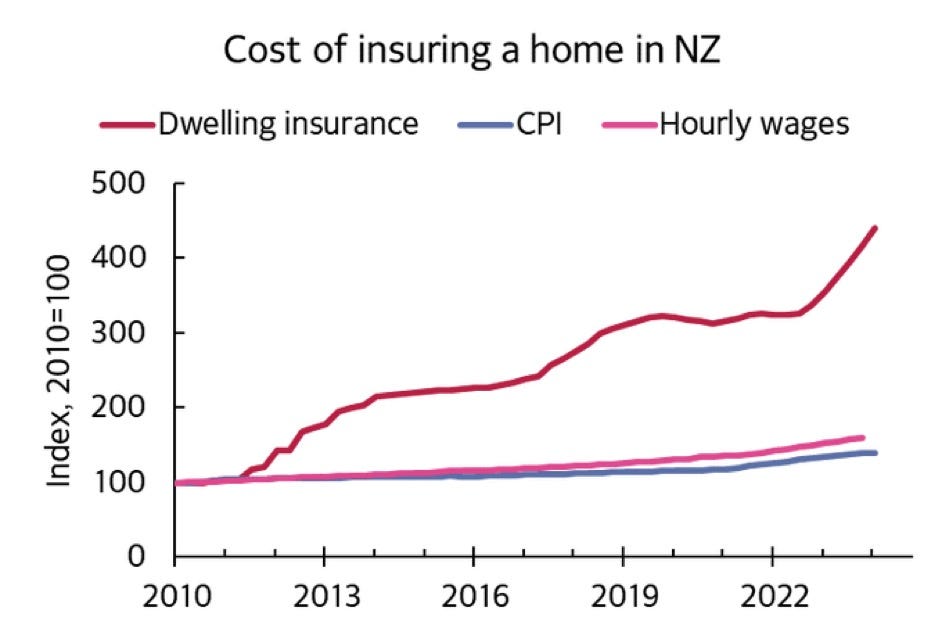

Much of that domestic services inflation came from insurance and council rates costs, which was partly prompted by Cyclone Gabrielle and the need to catch up on under-investment and under-maintenance in roads and pipes and rail. Climate change is expected to generate more of these extreme events, delivering a sort of structural shock to inflation that central banks will have to react to as if they were short-term cyclical issues. That risks creating feedback loops that worsen the situation as higher interest rates slow investment in de-carbonisation.

Some central banks are openly talking about having a dual system for interest rates1, or even widening and raising their inflation target bands to given them flexibility that allows them to ‘look through’ such climate inflation shocks.

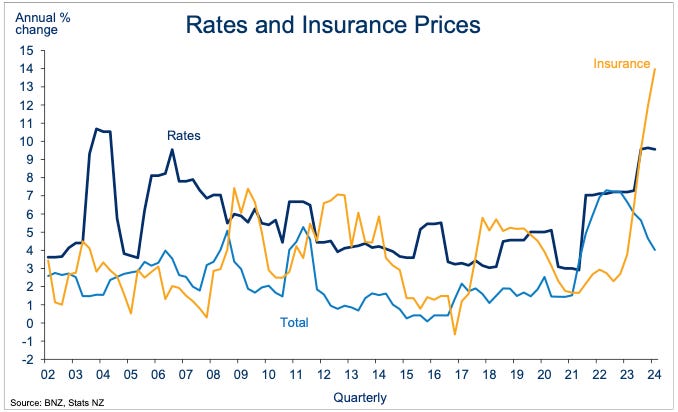

Here’s a chart showing the effects on insurance and rates in Aotearoa-NZ in yesterday’s figures.

I spoke to Kiwibank Chief Economist Jarrod Kerr yesterday for tomorrow’s When The Facts Change podcast. He pointed to the climate effect in a discussion a rise in neutral interest rates. Our discussion is included in the podcast above and in the transcript below (bolding mine):

Jarrod: What will be interesting from not this year, maybe not next year, but future years will be how do we handle the structural increases in inflation that we are going to see from climate change and other forces. I think climate change is an interesting one because we're still trying to figure it out and the cost of substituting away from fossil fuels is inflationary. The cost of rebuilding houses that are in prone areas for cyclones or sea level rise, that's inflationary. The insurance costs are obviously inflationary.

Jarrod: And then there's council rates with the lack of infrastructure and needing to build better infrastructure for the future, not just trying to keep up with what the current population demands. That's inflationary as well, and a lot of this is structural. So I think that the discussion we will have after central banks have got inflation back to 2% to prove their credibility is, actually, there's going to be much higher inflation over the medium term. What do we do? Do we relax our targets? Probably. Do we play around with the CPI basket and extract the climate related stuff out of it? Probably. That's the discussion I think we're going to have in coming years.

Bernard: Some are talking about having two different types of interest rates, a green interest rate, one that essentially is lower than the rest because it strips out the effect of climate change and tries to encourage investment and electrification, and then a normal (or brown) interest rate. Because when you look at some of the fast growing components of insurance here, certainly post-Gabriel, we've got house and car insurance inflation of 12-13%, you've got council rates inflation of 8-9%, in part because there's a bunch of councils, including our biggest one (Auckland), that have had to spend a lot of money on buying land that can't be lived on anymore, or repairing roads. And that is really starting to turn into a bit of a price shock that normally the Reserve Bank or central banks like to look through as temporary price shocks.

At the end of February I spoke to RBNZ Governor Adrian Orr for When The Facts Change and I asked him about whether climate shocks were a factor raising the neutral rate, and whether a different type of ‘green’ interest rate was needed.

I’ve included the exchange in the podcast above and in the transcript below (bolding mine):

Adrian Orr: A lot of the things you talked about is the price of a particular good or service. And they will always change depending on demand, supply, quality, needs etc. And they will get knocked around by different shocks — the demographic aging, climate change. So relative prices are moving. Our role is to make sure that a relative price shift that reflects supply or demand doesn't turn into aggregate inflation. That is everyone hiding behind a cost increase and doing cost plus pricing, and then getting into that inflation spiral. So that's the role of monetary policy, to control the price of money, to make sure it restores and retains its value through time.

But you are correct. The demographics, the climate change, these are all things that can impact on the productivity of an economy. And the productivity is the underlying driver of the potential supply capacity of an economy. In New Zealand, just using our local example, productivity is very low. It's our number one bane. We can increase output by having more inputs, but to do it on a sustainable basis, you have to also do things more productively or do better things. A low productivity economy means that its potential growth rate is very low before inflation starts raising its head. And so that's in large part what's happening globally.

Bernard: Just looking now at that climate issue, one of the concerns people who'd like to see an awful lot of investment in electrification and decarbonification say is if we keep putting up interest rates to control inflation all the time, we're not going to be able to invest what we need in all of these new renewable electricity plants and systems. What's your view on whether monetary policy should take into account the need to get to carbon zero fast.

Adrian: I think that's, without disrespect, that's silly thinking. The number one enemy of investing is inflation. You think of the cost of construction, cost of investing over the last three to five years. If you're doing a project that's going to last longer than 12 months, then what confidence do you have of the eventual bill you will pay if inflation is high and variable? So the interest rate is a tool around managing overall inflation.

The investment you're talking about is critical long term and can be managed through smart balance sheet management. You don't lock in today's interest rate forever, you lock in today and roll it as you need and think about the long term gains through that. So I would say the biggest constraint on investing in alternative energies is the current low cost of fossil fuels. You know that they are always being priced where it makes the alternative just not quite worth the effort. That's the nature of markets operating.

Chart of the day

The EQNZ and Gabrielle effects

Climate graphic of the day

Running hot

Just in case you missed it

Cartoon of the day

Dubai and Oman drown

Timeline-cleansing pic of the day

Jellied beach(ed)

Ka kite ano

Bernard

See more here on dual rates via GreenCentralBanking.

View draft history

Share this post