TL;DR: There are fresh signs this morning the housing market-with-bits-tacked-on economy is brightening up going into winter, and just four months to the day before voting starts.

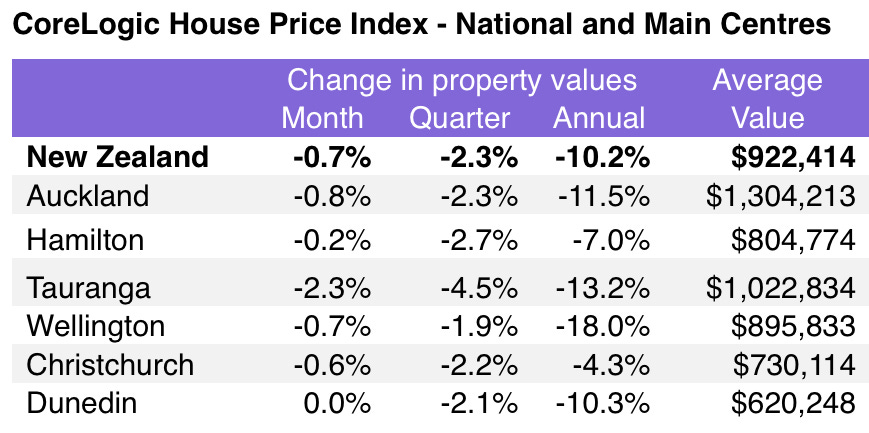

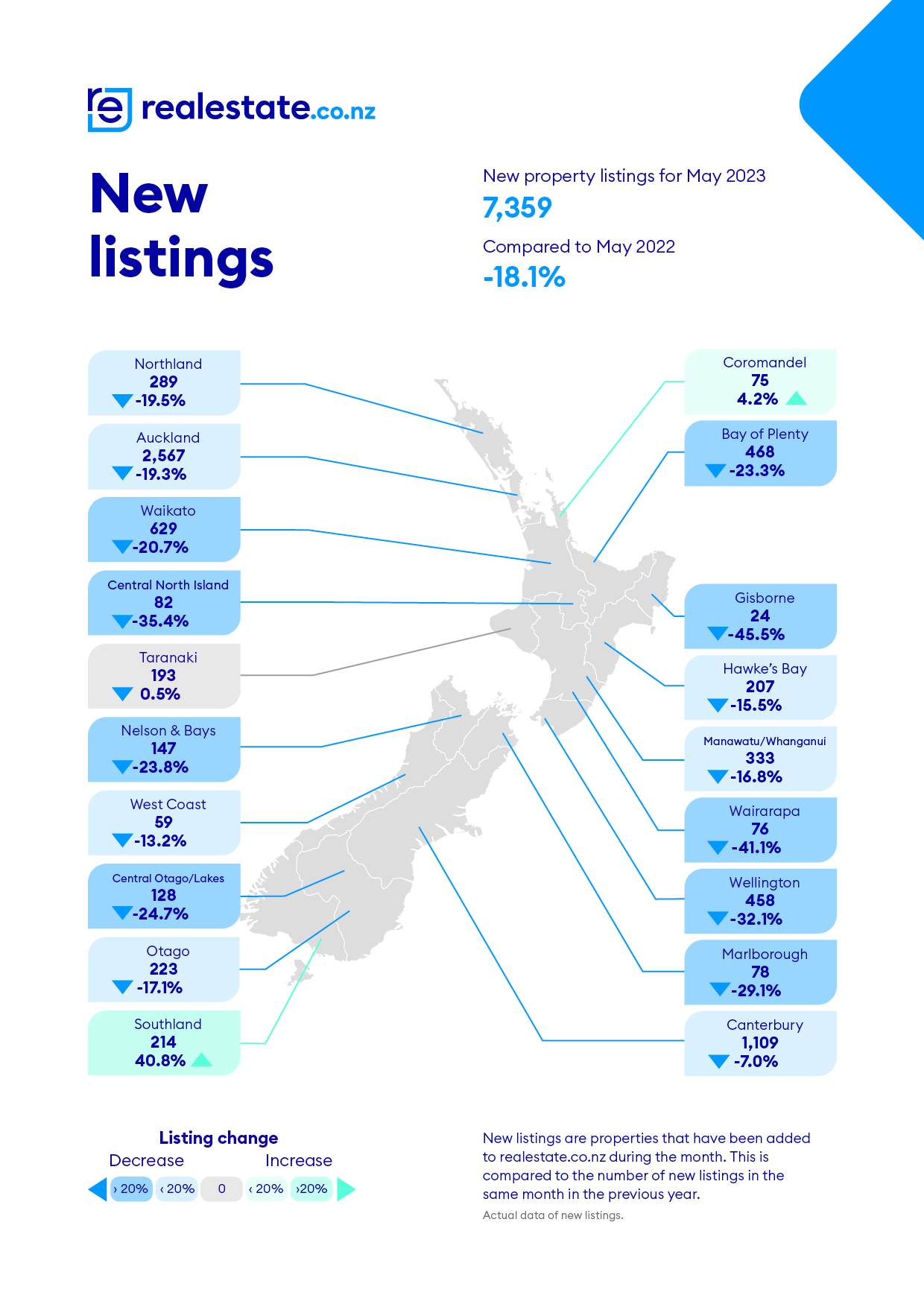

Data this morning from CoreLogic and Realestate.co.nz show a bottoming out of an 18-month slide in house values in a tightening market, with listings at a 16-year low in May. Sellers are happy and able to sit on their hands to wait and see if they can benefit from a 10-20% surge in prices (in my view) after a potential change of Government in the election on October 14. Overseas voting starts on September 27 and advance voting starts on October 2.

News elsewhere from Aotearoa’s political economy on climate, housing and poverty:

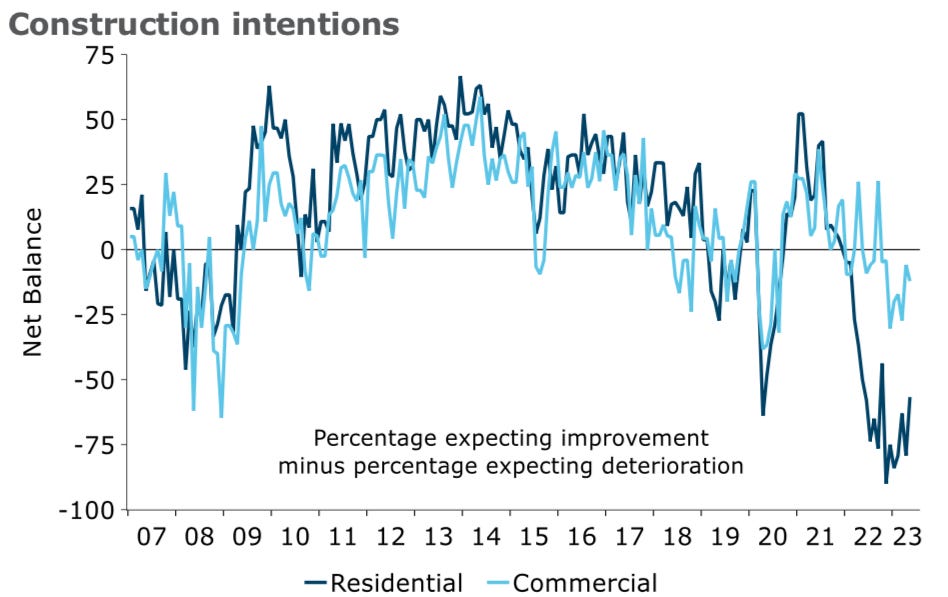

business confidence continued bouncing in May, including in residential construction;

the Government confirmed it had looked at taxing fertiliser, but indicated it probably wouldn’t because farmers opposed it;

MBIE told Wellington City Council last year to do more fire safety checks on dangerous buildings such as Loafers Lodge because it was auditing at less than fifth the expected rate; RNZ

Christopher Luxon stumbled again yesterday with his attempts to appeal to the ‘netball mum’ segment of median voters, saying National would re-impose the $5 prescription fee for contraceptives; and,

stronger-than-expected US jobs figures overnight and hotter-than-forecast inflation data yesterday from Australia again showed how resilient jobs markets have been after the covid lockdowns, including here.

Usually, I put in a paywall for paying subscribers at this point in the email newsletter and lock off the podcast above from free subscribers. But I want to experiment until the end of June with publishing everything to everyone immediately to see what happens with subscription rates, revenues and email opening rates. I want to thank paying subscribers in advance, who are still the only ones able to comment and get access to our very active chat section and webinars. Join our community by subscribing in full to support my journalism in the public interest about housing (un)affordability, climate change (in)action and poverty (not enough) reduction.

Winter’s coming, but the housing economy is brightening

CoreLogic reported overnight that property values fell a further 0.7% in May from April across Aotearoa, but Head of Research Nick Goodall saw evidence in the data “the current downturn is winding up.” However, he saw affordability keeping a lid on demand in any rebound.

“Amid a stabilisation in the cash rate, slightly loosened loan-to-value ratio limits, reduced supply with fewer people listing their property for sale, strong net migration and a positive turn in Australia’s housing market, there’s confidence that the bottom is approaching.

“Affordability, hindered by high prices and contractionary monetary policy will likely keep a lid on demand for the foreseeable future. More than 50% of the average income is required to service an 80% LVR mortgage in Aotearoa compared to 43% in Australia and if property values and interest rates now start to plateau, this is unlikely to improve.” Nick Goodall in CoreLogic report for May.

One feature in Nick’s report this month was a switch by investors to new builds from existing properties because new builds are exempt from interest deductibility rules.

“Indeed, there appears to have been a change in investor behaviour due to the interest deductibility exemption for new builds. During the first quarter of this year, 34% of settled new builds went to mortgaged investors, while only 19% of existing properties went to the same group.

“After years of relative consistency between these two property types, the diversion appeared from Q1 2021, when the share was 28% for both. For properties acquired before 27 March 2021 interest deductibility is being phased out over a four-year period, for properties acquired after 27 March 2021 any interest incurred (from 1 October 2021) will no longer be deductable.” Nick Goodall

‘I’m not selling until I know if we’re getting new tax settings’

Realestate.co.nz released it’s monthly report on asking prices and listings in May this morning, also saying it was seeing the market bottoming out, particularly as new listings fell again to a 16-year low of 7,359, down 18.1% from a year ago.

The number of homes for sale or stock on hand was up with 0.8% from a year ago to 26,685, which equated to 22 weeks worth of inventory at current sales rates. That is below the long-term average of 28 weeks.

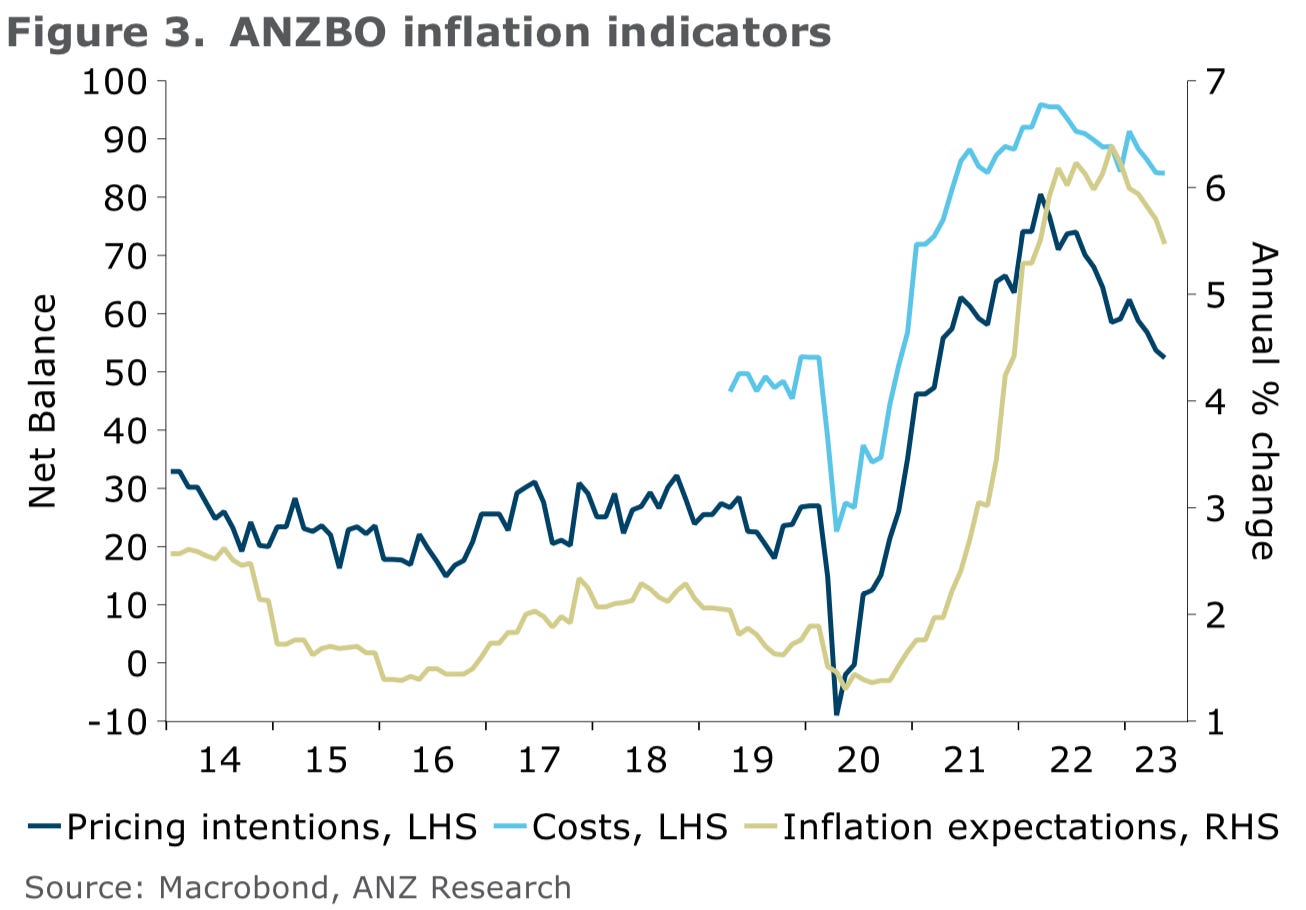

Businesses more confident in May

ANZ’s monthly business confidence survey for May was released yesterday, showing a rebound in both ‘own activity’ and wider business confidence, with easing price and cost pressures, albeit in a slow and sticky way. One feature was a solid bounce in residential construction confidence to a seven-month high. ANZ is sticking with its forecast of one more rate hike at the end of this year

Fertiliser tax? ‘Yeah….but…naah….and probably naaah’

Agriculture Minister Damien O’Connor confirmed yesterday in Parliamentary Question Time he had floated the idea of a nitrogen tax with farming leaders, but they had rejected it and he was “probably” not going to bother to put the idea to his cabinet colleagues. Hansard

Farmers were now considering their carbon sequestration options. So we can expect yet more delay on getting farmers to pay for emissions. Essentially, farmers said no again and the Government accepted that and agreed on another delay.

Here’s the quotes from O’Connor in answer to questions from ACT MP Mark Cameron (bolding mine):

Damien O’Connor: The idea of a levy that would have contributed to money for research and development was my idea of a possible good investment. The industry leaders have come back to me and said they don't like that. We now have to sit down and work on the best way forward of following through with He Waka Eke Noa, but dealing with the dilemma that they don't want to pay anything until they've worked out the full analysis of sequestration options. That will take some time. It will take more research and development. The issue is who will pay for that.

Mark Cameron: Will he now rule out a tax on urea; if not, why not?

O’Connor: There has been no considerate, comprehensive consideration of this by Government or by Ministers at all. I've had brief discussions with sector leaders; they've indicated that they don't want to proceed with that. The question I have is whether I should then bother to put that proposal up to my colleagues. I probably think not, but I'm not going to rule anything in or out here and now.

I wonder if anyone else is bothered about some sort of climate emergency thing. See map of the day too.

Council warned it wasn’t checking lodges enough for fire risk

It turns out Wellington City Council wasn’t doing enough fire safety checks on the city’s most dangerous buildings. Phil Pennington reported for RNZ yesterday that MBIE had found the council was auditing 3% of buildings a year, when it should have been at least 20%.

MBIE told the council in September it needed to do more audits of the riskiest buildings, and explicitly mentioned ‘budget accommodation.’ Loafer’s Lodge was passed as safe by the Council. A fire in the converted office building without sprinklers or two working fire exits killed five people last month.

The radar on National’s median-seeking missile isn’t working

Christopher Luxon continues to stumble in his calibration of National’s appeal to the key ‘netball mum’ segment of median voters. Yesterday he dug in on National’s policy to re-impose the $5 prescription fee, and specifically the fee for getting contraceptives.

Luxon wasn’t helped by comments in Parliament by his religiously conservative fellow Auckland National MP Simon O’Connor that families needed both a father and a mother, which Labour MPs portrayed as extremist and homophobic.

The jobs markets that just won’t die, and some sticky inflation

US jobless claims data overnight showed a more resilient jobs market in the world’s biggest economy, which nudged expectations up to around 70% that the US Federal Reserve will have to put up the Fed Funds rate one more time in June. Reuters

Australian inflation data yesterday was also stronger than expected, also strengthening market views the Reserve Bank of Australia might hike again next week. Remarkably strong jobs markets has been a feature of the post-Covid lockdown world, at least outside of China, where fresh data yesterday showed a slowing of momentum in factory output. Reuters

Hastings residents block plan for social housing

Anti-intensification protestors in Hastings appear to have stopped a proposal to build 10 homes for Kāinga Ora on two sections on Ada Street. Click through to the story from Marty Sharpe to see the pictures of the protest sign for a public meeting last month that attracted hundreds of residents, and three of the men opposed to the social housing development.

This is New Zealand today. MSD reported this month there were 696 families homeless in the Hastings district in the March quarter of this year, up from 198 five years ago, including 161 families requiring homes with three or more bedrooms, such as the ones planned for Ada Street. Stuff

What happens when it rains a lot near Rotorua

News briefly elsewhere

Critics of Government water and welfare policies, Mike Joy and Michael Fletcher, have both been made redundant from Victoria University of Wellington’s Institute for Governance and Policy Studies in moves to save money. NZ Herald

Former National MP Parmjeet Parmar is switching to being a candidate ACT for Election 2023. RNZ

Quote of the day

An insight into the Auckland Mayor’s priorities

“There are a lot of people out there with mortgages in a spot of bother, and I feel sorry for them. I don’t want to make it any worse.” Auckland Mayor Wayne Brown talking in an interview with Bernard Orsman for The NZ Herald about his budget plan, which will be presented today, a day later than originally planned. Brown wants to minimise rates hikes to help homeowners with mortgages.

Map of the day

Temperatures hit record highs in 111 Chinese cities yesterday

Ka kite ano

Bernard

Share this post