TLDR: Just quietly, the Government just chose to reduce Budget deficits by $225m per year in the next few years in order to keep public debt and interest rates just that little bit lower, in order to keep house prices that little bit higher for today’s owners.

Even more quietly, that decision shifts $186b in wealth from future generations’ nest eggs of investments in non-housing assets to today’s home owners leveraged and mostly untaxed equity in homes. It is an extension of an inter-generational wealth transfer that made those buying and owning homes in the last 30 years more than $1t wealthier at the expense of future generations. It is those generations working from 2040 to 2070 who will have to pay for those current home owners’ pensions and health costs through income taxes on their work and GST on their spending. These future generations will also have to pay for the emissions liabilities being accumulated and unaccounted for.

Yesterday’s decision to extend GST to KiwiSaver and other funds management fees was another one of the stealthy decisions by both Labour and National Governments over the last 30 years to prioritise the interests of today’s older median-voting home owners at the expense of younger renters, their children and the unborn.

These decisions are the most damaging to the 50% of children who now live in private rentals with their parents. They and their parents are both now locked out of healthy and secure futures in Aotearoa-NZ, but are sentenced to keep paying income tax and GST for decades to come to ensure those wealthy home owners are paid unconditional basic income after the age of 65 and get free health care from the state.

Paid subscribers can see and hear more detail and analysis below the paywall fold and in the podcast above. They can also vote below to open this up for public sharing early. (I have now opened this up for the public to be shared and read by all.)

How another $186b was just nicked from the future

Yesterday, the Labour Government quietly introduced an extension to the GST net to include funds management fees, Airbnb rooms and Uber fares. Combined, the change is expected to drag in an extra $272m a year in tax revenues from 2026. That, in turn, will reduce future Budget deficits and therefore Crown debt by same amount per year, all other things being equal.

But it is also expected to reduce the amount of KiwiSaver funds under management by $103b by 2070 to $2.1969t and cut non-KiwiSaver managed funds by $83b to $1.75705t by 2070.

It was done in a body of an omnibus of tax changes and without mention by a minister. Tax advisors and fund managers were given a heads up. The kids growing up in private rentals today who will be that much poorer in future were not.

So what actually just happened?

You gotta love the smell of a fresh Taxation (Annual Rates for 2022–23, Platform Economy, and Remedial Matters) Bill introduced into Parliament on a quiet Tuesday afternoon. Almost as good as freshly cut grass…or napalm, depending on your point of view.

Just in case you couldn’t find the detail in the ministerial press release (because it’s not there) and you didn’t have time to read the 223 page official announcement and commentary, or the 133 pages over eight Regulatory Impact Statements (RIS), here’s what you need to know before lunchtime:

the bill extends GST to funds management fees, which is expected to increase tax revenues by $225m from April 1, 2026 onwards;

the extension is estimated by the Financial Markets Authority (FMA) to reduce KiwiSaver funds under management by $103b by 2070 to $2.1969t and cut non-KiwiSaver managed funds by $83b to $1.75705t by 2070;

the extension of GST to online accommodation and transportation services such as Uber and Airbnb, which is expected to raise $47m a year in extra tax revenue; and,

the exemption of public transport from fringe benefit tax, although the exemption for car parks provided by an employer also remains.

The news release focused on the Airbnb and Uber changes, along with the public transport exemption, which has been called for by the Greens for years.

So why KiwiSaver fees and why now? (And why not bank fees too?)

The GST extension to KiwiSaver and other managed funds has snuck up on a few people because the 2018/19 Tax Working Group recommended not extending GST to financial services, in part because it risks opening up a very nasty can of worms that would lead to questions about why mortgage services and bank fees are not charged GST.

This Labour Government’s Tax Working Group recommended no change to GST on financial services in this 2019 paper on the grounds it would be too difficult to disentangle the tax on the service provided by the bank or the fund manager, from the return on the investment.

Here’s the argument from the Tax Working Group:

“Financial services are exempt from GST because of the practical difficulty in trying to isolate the service provided by financial institutions. In principle, GST should apply to the service that financial institutions supply in intermediating borrowing and lending between borrowers and savers.

“However, GST is not intended to apply to savings as they represent deferred consumption, which GST will apply to when eventually spent and consumed.

“However, in reality this sort of matching exercise is not possible as there is no tracing between the source of funds and whom they are lent to. This makes it very difficult to isolate the value of the service provided by financial institutions. In the absence of financial institutions charging explicit fees instead of profiting from interest rate margins, it is generally considered not possible to apply GST to these services under a credit-invoice mechanism.

“Alternative approaches for applying GST to financial services have been considered previously. These include applying GST to the difference between all cash inflows and outflows, charging GST on interest above a certain defined margin, or charging GST on consumer loans on the sum of profits and wages for financial institutions.” The Tax Working Group recommending no change to GST on financial services in this 2019 paper

It’s not about filling in a gaping hole

So what’s going on here?

Parker and the IRD argue in the commentary on the bill that an anomaly has developed where some boutique fund managers taking a cautious approach on the ‘service provided’ aspect of their fees are charging GST, while others taking the ‘financial services are exempt’ approach are not.

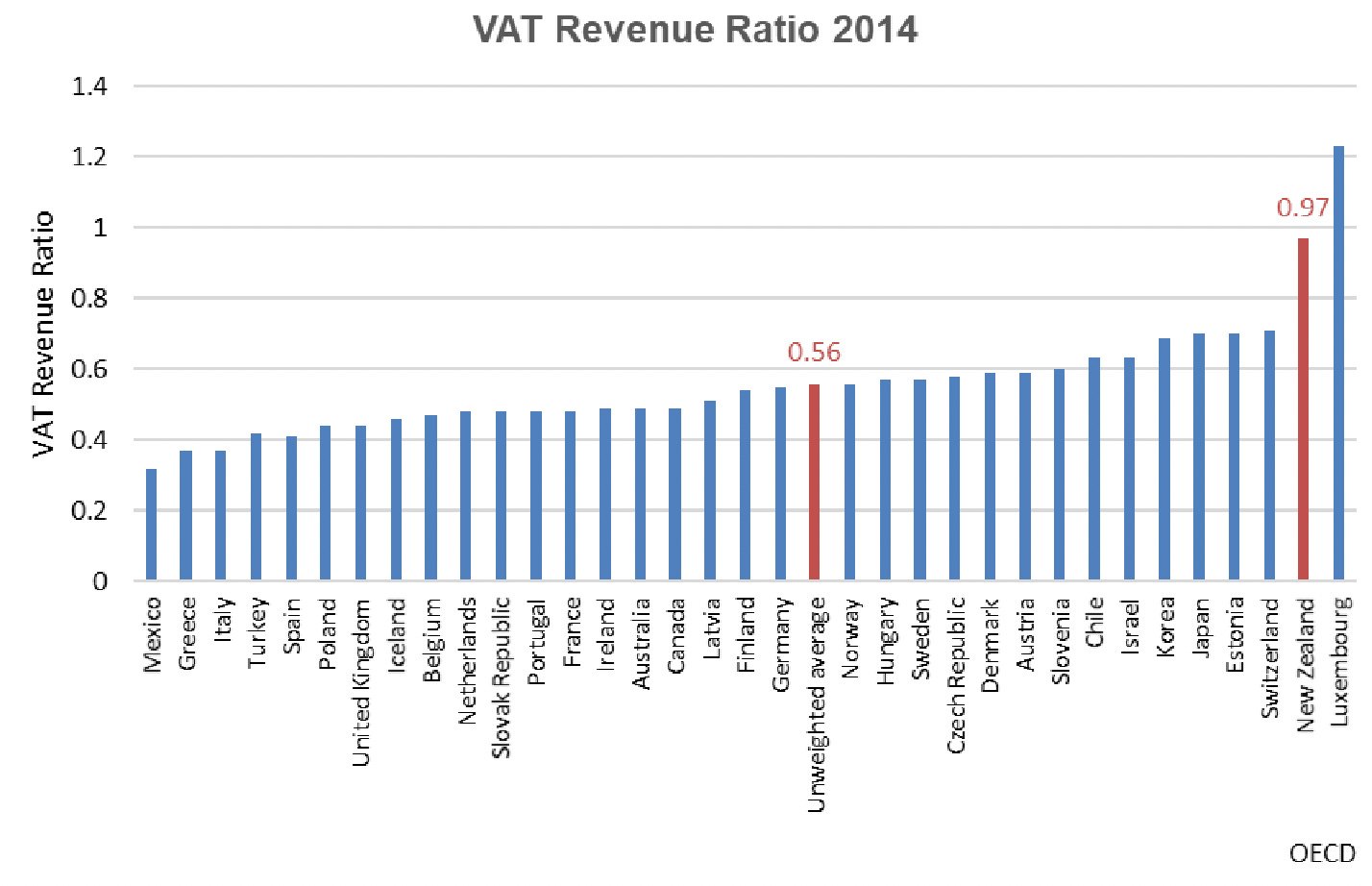

This removes any doubt, but it’s not filling a hole in the GST net that is significant. New Zealand has the second most comprehensive GST net in the world. Only Luxembourg’s is wider, and that’s specifically because it does charge GST (Value Added Tax) on financial services provided to non-residents. This Tax Working Group chart from OECD data tells the story.

It appears an opportunistic move to simply raise some extra revenue to ensure the Budget gets back into surplus faster, and therefore keeps a little more downward pressure on interest rates. That in turn keeps upward pressure on house prices.

This is all consistent with the ‘30/30’ bi-partisan agreement to keep tax and public debt below 30% of GDP in the long run and not to tax unearned and leveraged wealth from gains in residential land prices. The quintupling of section values in the last 20 years is due largely to that 30/30 rule, which has starved cities of the infrastructure spending they need to enable much more brown fields and green fields land for housing.

Careful. You might open up a can of worms.

This move also begs the question: why isn’t GST charged on bank fees, charges and interest on mortgages?

The answer? Because it would massively disrupt bank business models that bury their services and profits in net interest margins. It has effectively become a GST-free subsidy for home owners able to borrow that little more cheaply and therefore push up house prices that little bit more.

The addition of leverage and New Zealand’s exception as the only country in the developed world without a capital gains tax makes the exception an even more profitable lark.

But only for those who own homes.

Ka kite ano

Bernard

Share this post