Long story short: the Government’s austerity policy has driven the economy into a deeper and longer recession that means it will have to borrow $20 billion more over the next four years than it expected just six months ago.

Treasury’s latest forecasts show the National-ACT-NZ First Government’s fiscal strategy of trying to reduce the size of Government to reduce public debt is clearly counter-productive, increasing public indebtedness and unemployment at the same time as crunching economic growth and public services spending lower.

(I spoke with CTU Chief Economist about the HYEFU this afternoon in the video above. I tried to make it a ‘pop-up’ Hoon for paying subscribers to watch as a live event, but failed because I am often a technical doofus. My apologies. Here’s the recorded version for all now above.)

Just briefly, the Top Six things from the Treasury’s HYEFU are:

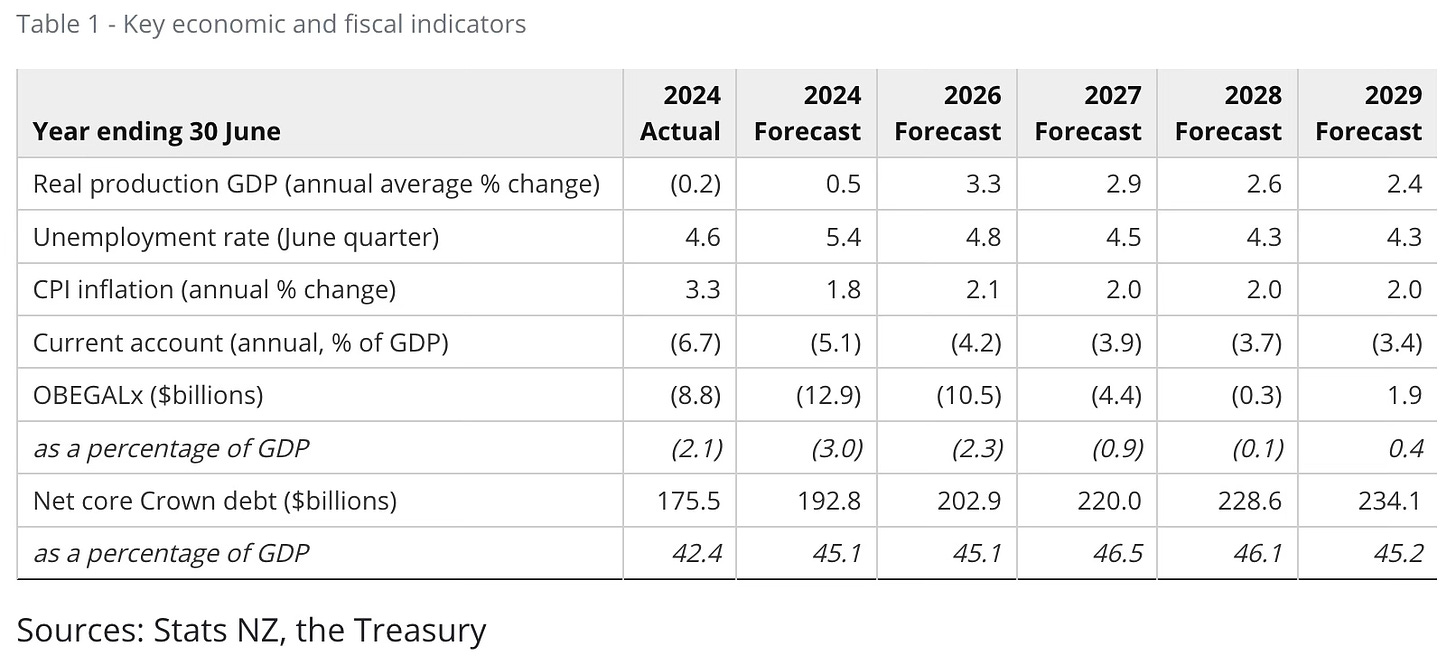

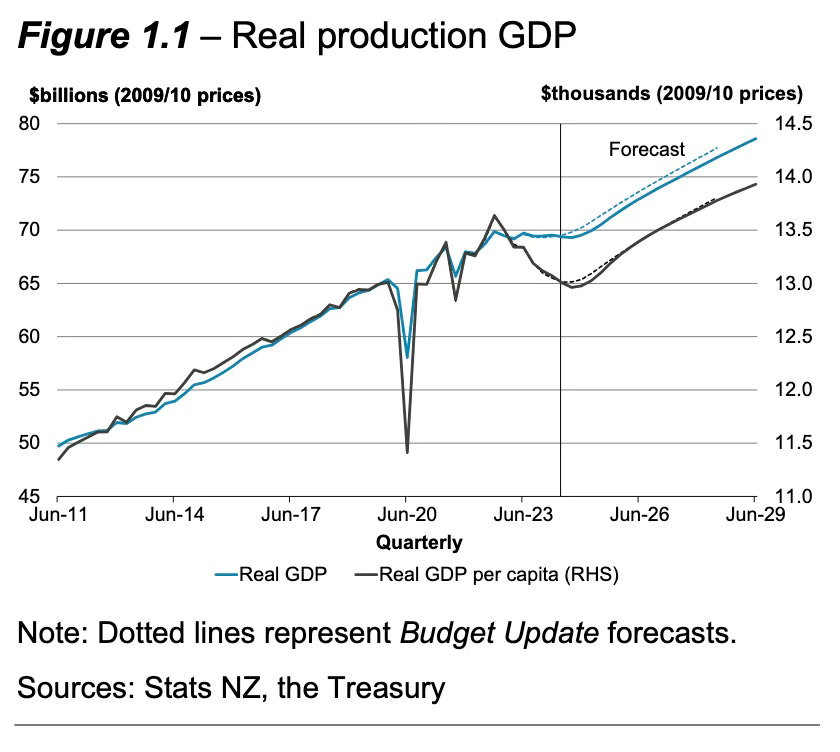

Treasury has downgraded its forecasts for economic growth and tax receipts, as expected. Treasury believes the economy will barely grow overall next year, extending the already-two-years-long recession in per-capita terms well into 2025 (see Charts ju Jour, Quotes du Jour and Tables du Jour below for more);

Treasury does not expect GDP-per-capita to recover to its 2022 peak until 2027 (See Charts du Jour);

Treasury has raised its unemployment forecast next year to 5.4% from 4.8% currently and expects real wage growth to fall from 1.7% per annum currently to an average of just under 1% over the next four years (See Tables du Jour);

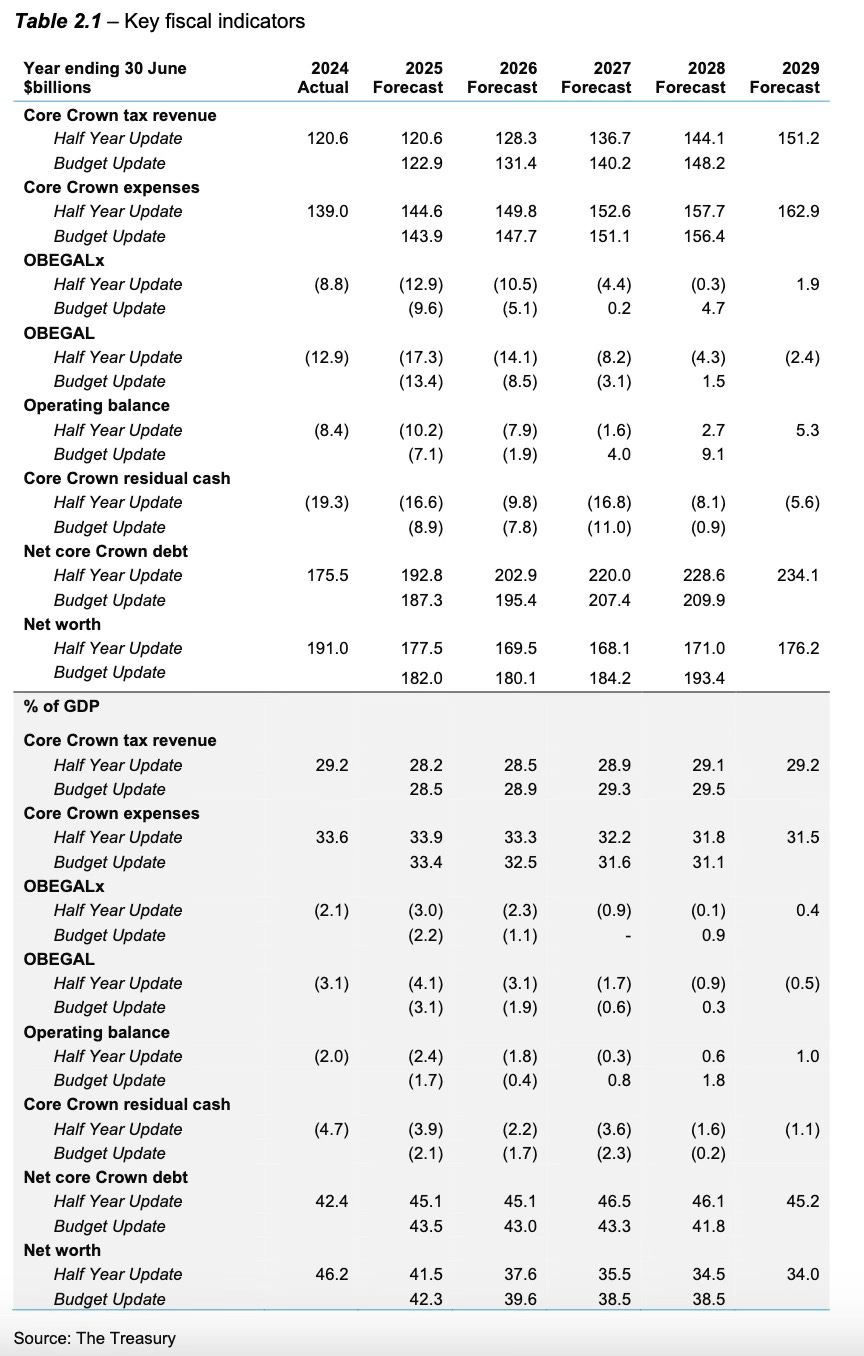

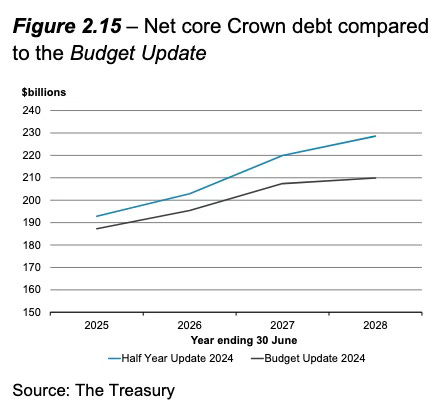

Treasury forecasts the Government will take two years longer to get back into surplus and will have to borrow another $57 billion over the next four years, which means the gross debt-to-GDP ratio peaks at 46.1% in 2027/28, up from 42.4% at June 30, this year and 41.8% in the May 2024 Budget forecasts;

Government debt is now expected to rise to $234.1 billion by 2029, up $24.3 billion from the May Budget forecast for the peak in 2028 of $209.9 billion; and,

The Government has changed its main measure of the Budget balance from the OBEGAL (Operating Balance Excluding Gains and Losses) to the OBEGALx, which excludes the changes in assets and liabilities of ACC.

(Normally at this point we would have a paywall for free subscribers and only paying subscribers could both listen to the Dawn Chorus podcast above and read the analysis and detail below in the Pick ‘n’ Mix. But during our ‘Gravy Day Fortnight’ until this Sunday, December 22, we have opened everything up for all immediately to give everyone a full taste of the public interest journalism your subscription supports. And here’s our ‘Gravy Day Fortnight’ deal that ends on Sunday, December 22.)

Quotes du jour

Here’s the guts of the Treasury’s forecasts and view (bolding mine):

“Compared with the Budget Update, core Crown expenses are $1.4 billion higher per year on average. The weaker economic outlook initially increases benefit expenses, particularly jobseeker support. Upward revisions to school roll projections drive higher education spending while higher core Crown debt adds to finance costs. In addition, Crown entity (excluding ACC) deficits are higher in 2024/25, largely owing to higher expenses in Health New Zealand.

“These changes delay the return to OBEGALx surplus by two years compared to the Budget Update. Adding in the revenue and expenses of ACC, OBEGAL is now forecast to remain in deficit throughout the forecast period. The larger deficits flow through to net core Crown debt of 46.1% of GDP in 2027/28, up from 41.8% previously.

“The change in the fiscal outlook is largely driven by the weaker economic outlook described in the Economic Outlook chapter. Overall, core Crown tax revenue forecasts are now cumulatively $13.0 billion lower compared to the Budget Update, which represents just over 70% of the overall change in OBEGALx. Around half of this change reflects the weaker economic outlook, which has reduced forecast GST and source deduction revenue the most. In addition, the results from recent tax outturns, which show a deterioration in income tax revenue from businesses, have contributed to the downward revisions.

“As a result of the revisions in core Crown tax revenue and to a lesser extent upward revisions to the forecasts of core Crown expenses, net finance costs have been revised up to reflect additional funding requirements now expected over the forecast period. Core Crown expenses are expected to be higher in each year compared to the Budget Update. The updated economic conditions are expected to lead to higher benefit payments in the near term with more recipients anticipated, particular for the jobseeker support benefit.” Treasury’s HYEFU executive summary.

Reactions du jour elsewhere (bolding & headlines mine)

‘It was Treasury wot did it’

“The Half Year Economic and Fiscal Update released today shows the Crown’s financial position has deteriorated over the past six years, but the economy has reached a turning point.

“Inflation is back under control, the Reserve Bank has begun reducing interest rates, and household spending and business activity is expected to lift. After bottoming out in the September quarter, the economy is forecast to grow 0.5 per cent this financial year and 3.3 per cent in the following year.“Relative to the Budget, however, there has been a further deterioration in the Crown’s financial position. The deterioration in the Crown’s financial position is not a consequence of decisions made by this Government. It has been driven largely by Treasury unwinding overly optimistic assumptions about the state of the economy.” Finance Minister Nicola Willis in a statement.

‘Talking about growth does not create it’

“The Half Year Economic and Fiscal Update is the rotten cherry on top of Nicola Willis’ first year as Finance Minister. The damage she has done to the economy means the recession will be longer and the recovery harder.

“A series of poor decisions on her part mean that unemployment is on the rise, there are fewer jobs and a Kiwi leaves every six and a half minutes for greener pastures.

“She is also attempting to manipulate the narrative by magicking up a new way to measure the deficit, but New Zealanders will see through her spin.

“Struggling to balance the books after choosing tax cuts – on top of outrageous tax breaks for landlords and tobacco companies – she’s now looking to pick the pockets of Kiwis through sneaky new taxes to pay for them.

“The Government has no plan to grow the economy other than talking about it. That’s not how the real world works.” Labour finance spokesperson Barbara Edmonds in a statement.

‘Governing for the wealthy’

“Christopher Luxon is choosing to prolong the recession and kneecap productivity through merciless cuts. Today’s HYEFU shows the Government’s trickle-down decisions come at the cost of the very ‘economic growth’ they crow so much about. It doesn’t add up and it doesn’t make sense, and they clearly don’t care.” Green Party Co-Leader and Finance spokesperson, Chlöe Swarbrick in a statement.

‘Back to the bad old days’

“Based on these new forecasts New Zealand will have been in deficit for a whole decade. The last time we experienced something like this was the awful period in New Zealand’s economic history between 1979 and 1993.

“The path back to surplus will remain very challenging. To start with the Government has not increased its operating allowance at all from the Budget. This means it is going to have to achieve expenditure restraint that has rarely been seen before not to mention requiring that restraint in the run up to the next election.

Realistically the only way that this can be achieved is for ongoing spending reductions that will become increasingly unpalatable for the electorate.” BNZ Head of Research Stephen Toplis in this note.

‘A whoppingly bad surprise’

“The Treasury has downgraded its economic and fiscal forecasts to the point where the forecast return to the OBEGAL surplus and residual cash surplus is not achieved over the forecast horizon. That’s much weaker than we anticipated.

“New Zealand Debt Management has lifted their bond issuance guidance by a whopping $20bn to June 2028, much more than we had pencilled in. Short-term issuance has had a bump too. The increased issuance guidance is primarily due to the downgrade to the economic and tax outlook, with just a little more capital spending added.” ANZ Senior Economist Miles Workman

‘The whippings will continue until morale improves’

“The Government is continuing to plan on very skinny allowances for new operational spending of just $2.4bn per year in subsequent years. After pre-commitments (including in the health sector) and assumed other non-discretionary spending (given current policy settings), the Government only has on average $0.7bn per year available to fund all new initiatives and other cost pressures at Budget 2025.

“Given that a share of the Budget 2025 allowance will be needed to fund cost pressures, the Treasury notes that:

“The Government will need to consider expenditure savings, expenditure reprioritisation and revenue-raising policy changes to stay within the signalled Budget allowance.”

“Needless to say, the risks around this profile are heavily skewed towards higher spending.

Westpac NZ Senior Economist Darren Gibbs

Tables du jour: Debt to rise by $59 billion

Charts du Jour: Longer recession and higher debt

Ka kite ano

Bernard

Share this post