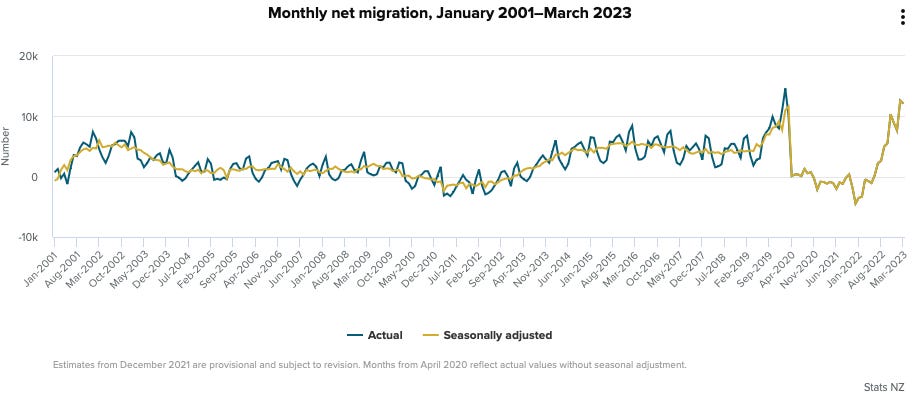

TL;DR: Stronger-than-forecast net migration and population growth looks set to make Labour’s last Budget before the election on October 14 more austere and detract more from inflation than most believed from a first look at last Thursday’s Budget 2023.

The implications for the economy, residential land prices, interest rates and Government borrowing would be profound if net migration keeps pounding along at a rate of over 100,000 per year through 2023 and 2024, or even higher if a National/ACT Government further loosens visa settings and tightens spending after the election.

Other news briefly in our political economy this morning

Auckland’s City Rail Link is unlikely to open until 2026, 18 months later than expected just a few months ago;

MBIE pulled a plan to tighten fire rules for infill housing just a few days before the Loafers Lodge fire;

Demand for food parcels continues to surge in Auckland, Wellington and Christchurch, with insufficient supplies at food banks to cope;

NZ Bus and Go Bus have recruited 559 new drivers from Philippines, India and Fiji since November, halving the shortage and encouraging schedulers to add back routes and services cancelled since Covid;

Big equity losses loom for owners of flood-hit homes in Auckland;

New Zealand advertisers paid Facebook NZ$196 million last year, but Facebook NZ shuffled most of the money through Ireland, meaning it paid just $1 million in tax here last year.

Usually, I put in a paywall for paying subscribers at this point in the email newsletter and lock off the podcast above from free subscribers. But I want to experiment for the next month with publishing everything to everyone immediately to see what happens with subscription rates and email opening rates. I want to thank paying subscribers in advance, who are still the only ones able to comment and get access to our exclusive chat section and webinars. Join our community by subscribing in full to support my journalism in the public interest about housing unaffordability, climate change action and poverty reduction.

Why Budget 2023 is more austere than it first appears

The current view in political and financial circles is Budget 2023 was bit more stimulatory for inflation and interest rates than expected, but is unlikely to be called out tomorrow too brutally by Te Pūtea Matua (Reserve Bank)1 Governor Adrian Orr as the main reason for any further tightening of monetary policy.

There are other forces at work to share the blame with, including stickily-high domestic profit margins, cyclone spending and wage inflation that could see the Reserve Bank hike the OCR as much as 50 basis points to 5.75% at 2pm on Wednesday. Some predict another one or two hikes to a peak of 6.0% later this year.

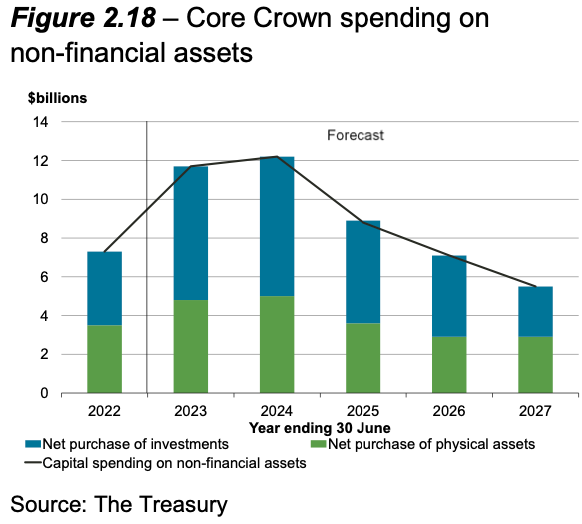

But a closer look at the per capita measures of Government spending and investment show a much tighter and more austere approach is being adopted, especially now our population is growing again at almost 2.5% per annum. If the Labour Government or a National Government successor carries through with this effective tightening of fiscal policy, that creates an imminent risk of new infrastructure shortages, transport congestion, house price and rent inflation and more waiting lists at schools and hospitals.

This austerity would however be great for driving down wage inflation and interest rates, which would turbo-charge growth in residential land prices, especially if a new National/ACT Government brings back interest deductibility for landlords and slashes the bright-line test for landlords’ capital gains back from 10 years to two years. Faster population growth than Treasury is forecasting would also drive the Budget into surplus faster and reduce borrowing, especially if National/ACT loosen migration settings more than Labour already has.

This is not what financial observers currently think or how the political narrative is being shaped right now, but that’s only because either most believe Treasury’s forecasts for a reversion to the mean for net migration of around 40,000 later this year from a current run-rate of over 100,000 per year, or have not thought through the implications of it being too low.

If migration keeps surging or even stays high for the next two years, nominal GDP would grow faster, wage inflation and mortgage rates would be lower and the Budget would return to surplus faster. But I would avoid the Southern motorway and take out some private health insurance if you can.

Stimulus per person is worth watching

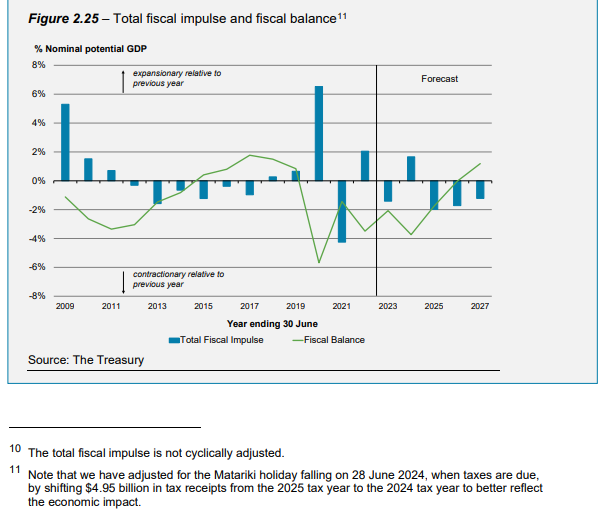

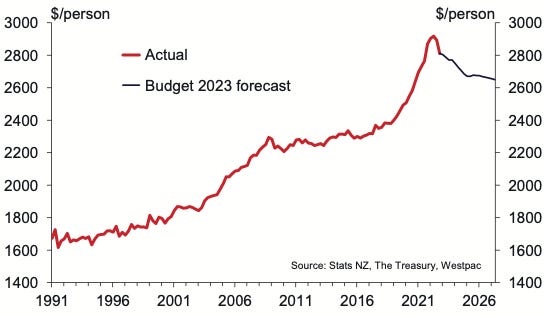

The overall effect of the Budget was slightly inflationary in the next year or so, but detracted from growth over the full four-year forecast period, as this chart shows. It led to economists estimating the Budget might add 25 basis points to the OCR.

But a closer look at the infrastructure spending profile and the effects of strong migration mean there’s a per-capita slowdown coming, as well as new infrastructure and housing pressures as the population keeps growing four times faster than official forecasts, let alone the (non) planning for infrastructure.

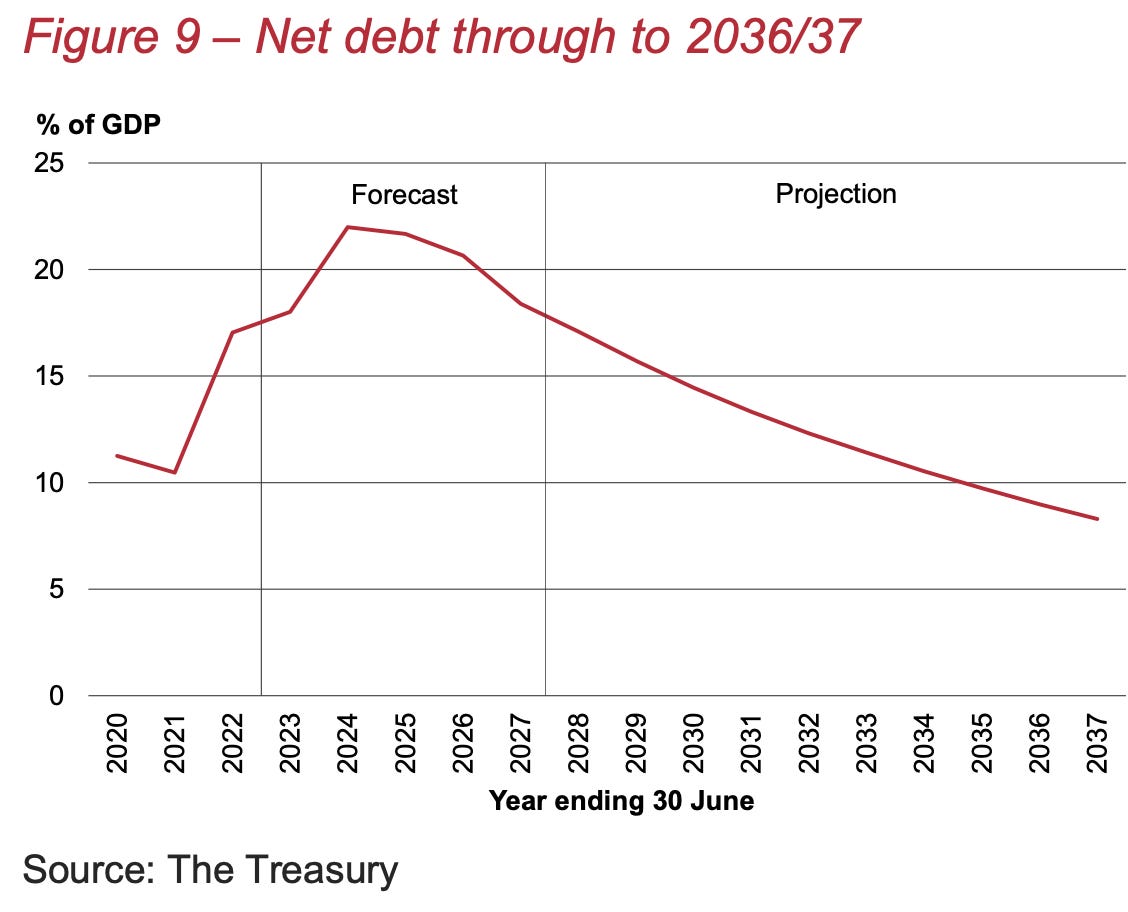

That starvation of spending in the long run, on both capex and operational spending is reflected in the net debt track (astonishingly and criminally) being forecast to fall below 10% of GDP by 2036/37.

Westpac NZ’s economists have done an interesting job this note of pointing out what real government consumption per capita will do when accounting for Treasury’s forecasts. Westpac sees stronger growth, so that would steepen (downwards) the per spending per capita to pre-Covid levels in the wake of the Bill English zero budgets era.

Westpac questioned whether the Government would be able to maintain this stringency, given the pressures that will arise on infrastructure from strong population growth.

While the Budget projected a return to modest surpluses in later years, these forecasts assume a high degree of restraint in spending on government services in the years ahead. The Treasury itself notes that this projection “is a significant departure from previous trends, particularly given population growth will likely add to demand.” Indeed, using the Budget forecasts of net migration (which are substantially lower than our own), we estimate that this implies a 9% fall in government consumption per person, drawn out over five years. Westpac NZ economists.

News elsewhere this morning

Auckland’s City Rail Link is unlikely to open for the public until 2026, which is 18 months later than indicated only a few months ago, Bernard Orsman reports for NZ Herald this morning, citing an interview with CRL’s CEO Sean Sweeney.

MBIE withdrew proposals to double the toughness of fire regulations for new forms of medium density infill housing just days before the Loafers Lodge fire after the construction industry couldn’t agree on how to do without increasing costs, Phil Pennington reported yesterday for RNZ.

Food bank demand continues to surge, with Wellington City Missioner Murray Edridge citing a tripling of demand since Covid, while Dave Letele says his Brown Buttabean food bank in Manukau is unable to cope with demand, and Christchurch’s food bank is now having to limit food parcels to one every five weeks, Newshub’s Rachel Sadler reported last night.

The jump in net migration is beginning to take effect. The national bus driver shortage has almost halved and operators are now looking to restore full timetables. Kinetic, which owns NZ Bus and Go Gus, announced yesterday had recruited 559 new drivers across Aotearoa from Philippines, India and Fiji since November, including 327 for Auckland, 82 for Wellington, 57 for Tauranga, 31 for Hamilton, 50 for Christchurch, and 12 for Dunedin. Auckland Transport (AT) said its driver shortfall had nearly halved to about 295 and it expected to get back to operating reliable services by the end of September.

Big losses loom for the owners of flood-affected properties in Auckland, with those trying to sell as-is where-is bracing for huge reductions in value or their properties being unsaleable, as they wait for confirmation of any buy-backs from the Government, 1News reported last night.

Facebook is doing fantastically well from its New Zealand advertising customers, who paid $196 million for services through Facebook NZ to its lowly-taxed Irish subsidiary last year, but paid just $1 million in taxes to our Government, Daniel Dunkley reported last night for BusinessDesk-$$$.

Quote of the day

‘Get ready for the FOMO’

“There are signs that house prices are bottoming out on average around the country and very soon people are going to start wondering which locations have the greatest potential for price gains.” Independent economist Tony Alexander in his property insights report out this morning.

Ka kite ano

Bernard

FYI on a change of style. Leading with Te Reo name for RBNZ from now on, with English name bracketed, and as many other Government departments as I can.

Share this post