TLDR: Housing Minister Megan Woods has responded to the Human Rights Commission’s call for a new rent freeze and a higher accommodation supplement by relaying on the Labour Government’s regularly-updated list of housing market actions in response.

But it’s missing one crucial ingredient that undermines the power of that list every time it is updated. The Government has repeatedly refused and neglected to put up a target or measure of success in its quest to improve housing affordability for renters and buyers. Without that, the list appears more performative than real.

Paid subscribers can see more analysis and detail below the paywall fold and in the podcast above, which also includes an interview I did yesterday with the Human Rights Commission’s Housing Inquiry Manager Vee Blackwood. There’s also poll below for paid subscribers to say whether they want this one opened up for the public to view and share immediately.

The usual suspects and still no mastermind

Yesterday’s call from the Human Rights Commissioner for a new temporary rent freeze and an increase in the Accommodation Supplement was a significant intervention that demanded a Government response, which dutifully came.

Housing Minister Megan Woods said she had written in response to the Commissioner, Paul Hunt, and also wanted to meet him to explain the Government’s list of actions to improve housing supply and reduce landlord demand.

"Since we came into Government we have taken steps to address some of the worst practices in the rental market, including ending 'no cause' terminations, ensuring our rental homes are warm and dry, limiting rent increases to one per year, and improving the rights of tenants at the Tenancy Tribunal.”

"We also have a significant amount of work underway to increase the supply of new houses and remove incentives for speculators, to deliver a more sustainable housing market.

"All the data we have shows that boosting housing supply is the single biggest thing we can do to keep rents down, and that in markets with strong housing growth, rent growth is consistently lower than markets with less supply." Housing Minister Megan Woods in an emailed statement quoted via Newshub.

Woods also pointed to the Government's $3.8 billion housing acceleration fund, an affordable housing fund, and tax exemptions for build-to-rent landlords.

"As for the families doing it tough right now there's no easy fix, with cost of living increases hitting people all over the world, but we're taking a range of measures to ease the pressure and to make a difference."

"Since the day we came into Government, we've worked hard to lift wages and reduce cost pressures on Kiwis, and we will continue to do so." Megan Woods.

The missing link

The problem here is that the Government has repeatedly refused to say or allow officials to suggest what success would look like, and therefore measure both the progress or the scale of the expected progress of all the actions above.

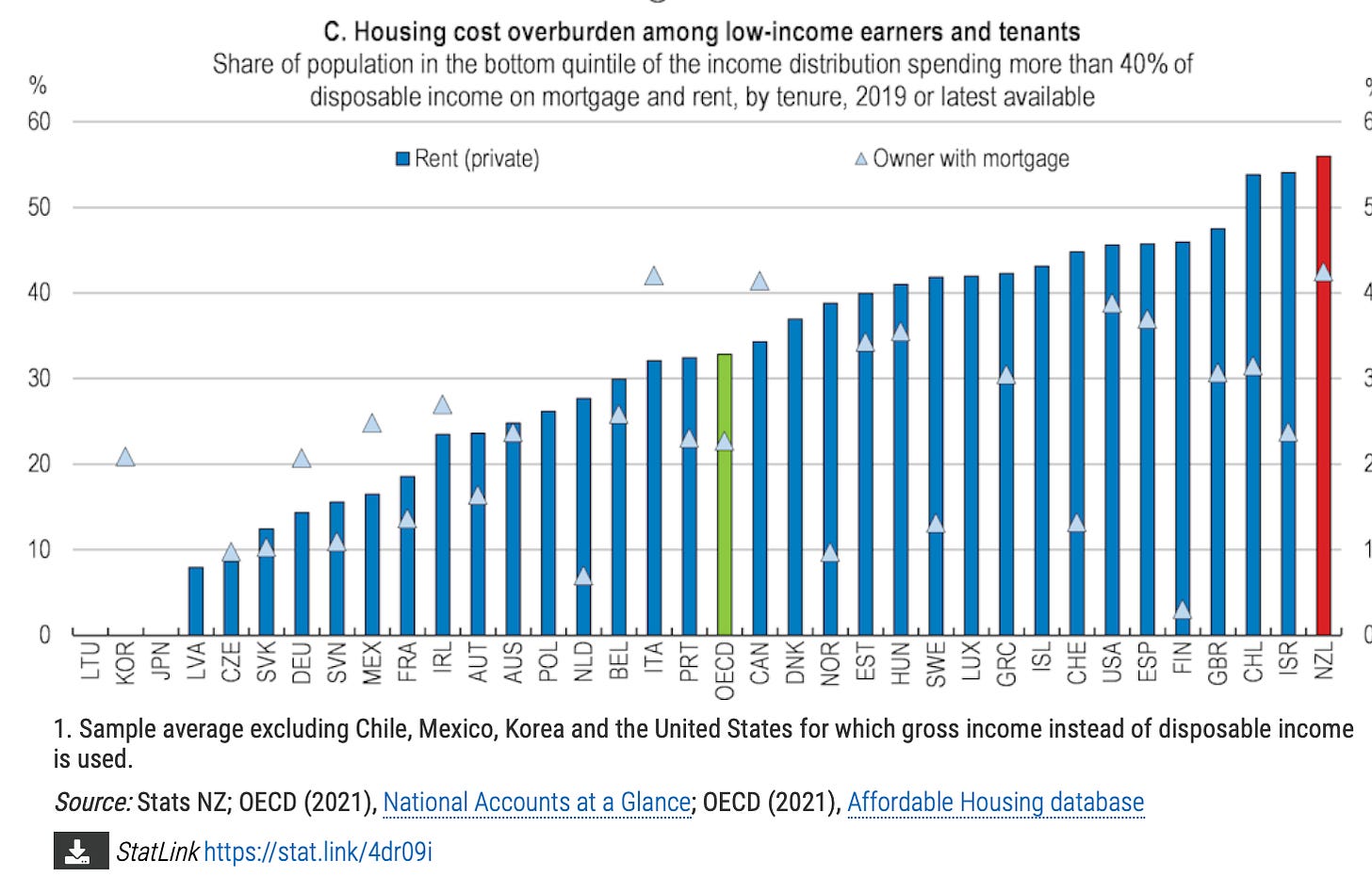

The HRC rightly points to 30% of disposable income as the threshold for rent payments beyond which housing becomes unaffordable. Almost half of renters pay more than 30% of their disposable income on rent and Aotearoa-NZ has the highest proportion in the OECD of low-income renters paying more than 40% of their income on rent.

Previous Governments have variously referred to house price to income ratios of three or four as something to aim for, while 25% of disposable income is currently used as the threshold for social housing income-related rent subsidies, which are currently granted via Kāinga Ora and to Community Housing Providers.

But this Government has refused to set a target for house price-to-income multiples, which by various measures are well over eight and often closer to ten in more expensive markets. Auckland Council once set five as its housing ownership affordability target. The previous National Government once suggested a multiple of four when setting measures of success for councils.

What should success look like?

My view is that 30% of disposable income should be the defined threshold beyond which housing costs are seen as unaffordable. No one should be paying more than that, yet more than half of our lowest-income quintile are currently paying more than 40% of disposable income on rent.

The Government set very clear and defined measures to target child poverty reduction. It should do the same for housing. It has been reluctant to repeat what it sees as the mistake of setting a 100,000 target for KiwiBuild before its election in 2017.

The bottom line - Without a measure of success and progress, the Government’s response lacks heft or credibility.

Elsewhere in the news this morning:

In geo-politics, the global economy, business and markets

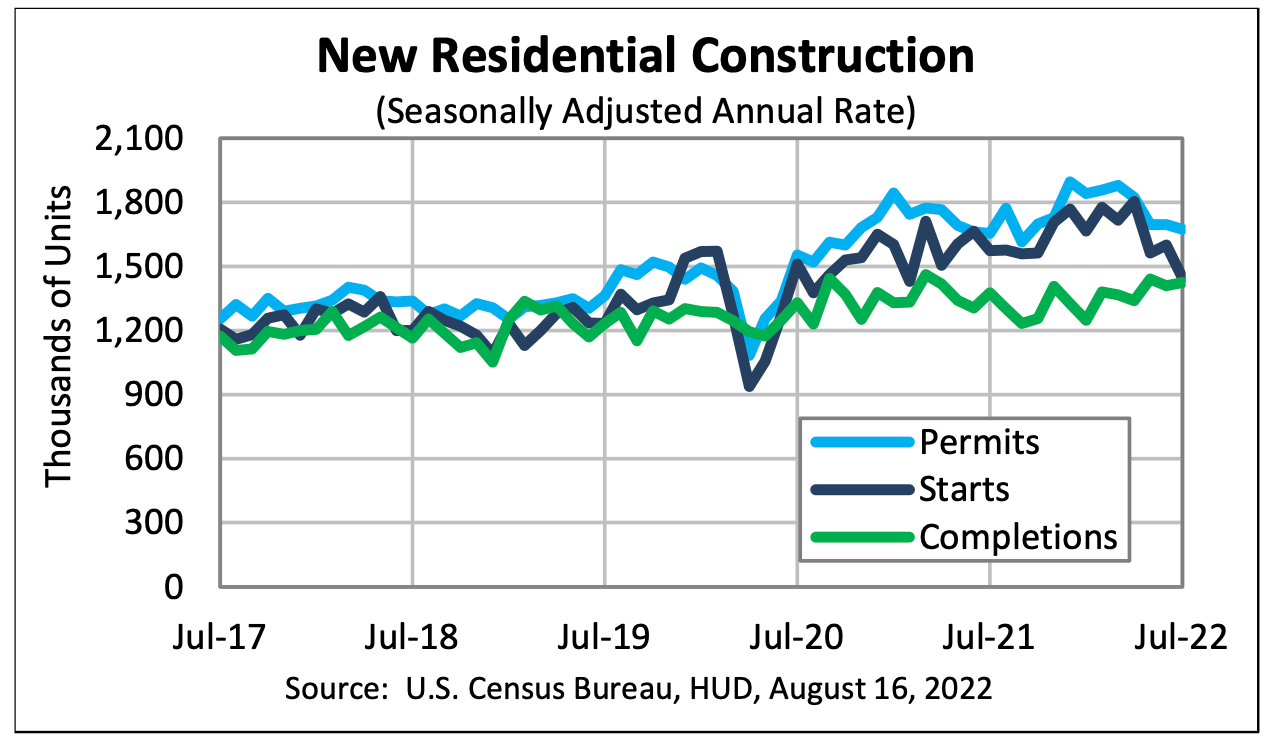

House-building slump - The US Census Bureau reported overnight that housing starts fell 9.6% in July from June to an annualised rate of 1.46m, which was 11.9% below the rate in July 2021 and below the 1.54mn consensus forecast by economists. It was also the lowest rate for housing starts since February 2021

So what? - House-building is at the bleeding edge of activity in the world’s largest economy and is most sensitive to a doubling of 30-year mortgage rates this year and demand destruction from higher construction costs. A weaker than expected result increased expectations that the United States is headed for recession later this year or earlier next year.

The bottom line - That in turn is depressing expectations for inflation and wholesale interest rates, and keeps the pressure down on Aotearoa-NZ’s fixed mortgage rates, despite the well-flagged 50 point hike in the Official Cash Rate by the Reserve Bank that is expected at 2pm today.

Just briefly

US Seventh Fleet commander Vice Admiral Karl Thomas said overnight America should ‘contest’ China’s flying of ballistic missiles over Taiwan. BBC

Production at U.S. factories increased more than expected in July. Reuters

Premier Li Keqiang said overnight China would step up macro-economic policy support for the economy, which pushed up Chinese stocks. He gave no details. Reuters

Germany will keep open three of its nuclear power plants to offset losses of Russian gas-fired electricity, reversing a 20-year policy of planning to close them for safety and environmental reasons, the Wall Street Journal reported.

In Aotearoa-NZ’s political economy, business and markets

The Australian-$$$ reports this morning New Zealand-based brokerage Jarden is investigating complaints of staff harassment, without giving details of whether it was here or in Australia, where Jarden has launched a big expansion over the last couple of years.

The NZ Herald-$$$ reported law firm Morrison Kent had completed an independent review of its culture after complaints about diversity and keeping the wage subsidy despite billing more hours during Covid, but will not release it.

Today’s must-read

A fun thing

Ka kite ano

Bernard Hickey

Share this post