TLDR: Adrian Orr’s reappointment as Reserve Bank Governor for a second five-year term from the end of next March is now a live political issue after National Leader Christopher Luxon said he wanted an independent review into the ‘tidal wave of cash’ printed by the central bank in 2020 and 2021 before any decision on Orr’s future was made.

Finance Minister Grant Robertson immediately refused yesterday to agree to a review and said he was in discussions with the Reserve Bank’s board about the re-appointment process. He reaffirmed his confidence in Orr.

The problem for Robertson, Orr and the board is that Orr’s current five-year term ends on March 27 and any reappointment is now clearly a contested issue. This is just a few months before what would normally be a ‘caretaker’ period in Government, during which appointments to powerful independent and statutory roles are usually either put on hold or quietly agreed behind the scenes.

Paid subscribers can see more detail and analysis below the paywall fold and in the podcast above, including audio of my questions yesterday to Luxon, Nicola Willis and Robertson.

A reappointment now in doubt

The presumed application for and reappointment of Adrian Orr as Reserve Bank Governor for a second five-year term is now in doubt after the intervention of the Opposition to call for an independent inquiry into the bank’s printing of $55b of money under Orr to buy Government bonds.

Finance Minister Grant Robertson, who has the ultimate say on whether Orr gets the job again when Orr’s term expires on March 27, must decide whether to push through the appointment of this key statutory role in the face of opposition from the party that may be Government within months of Orr’s reappointment.

Usually, any contested situations such as this, is put on hold or a solution is agreed quietly behind the scenes if it is close enough to the caretaker period.

Robertson was certainly combative yesterday when responding to the call for an inquiry.

“I don't think Mr. Luxon has any moral high ground on this. There will inevitably be space for us to look at all manner and aspects of the response. And I'm sure the Reserve Bank will do its bit in there, but the point I'm making here is that I vividly remember calls from National Party to spend more money than we did supporting businesses." Grant Robertson.

Asked if New Zealand should do what Labor Treasurer Jim Chalmers announced last week (an independent review of the Reserve Bank of Australia), Robertson said: "I just did that, and I don't think I'll put the Reserve Bank through that again."

Meanwhile, Orr himself was in a combative mood too, issuing a news release late in the day yesterday in response to critics of the bank, that reaffirmed Reserve Bank was doing its own regular five-yearly review of policy and would learn from what happened in 2020 and 2021.

‘Regrets, he’s had a few, but then again, too few to mention’

The ‘regret’ word was used in such a statement for the first time, although Orr stopped short of admitting mistakes or responsibility for inflation running at 7.3% (bolding mine).

“I regret that the Committee – and society at large – has been confronted with the COVID-19 pandemic, and other recent events that have caused food and energy price spikes. We are a learning institution, and through the open process of the Remit review and the monetary policy review, we will be very clear on our lessons learnt as we forever seek to do a world class job for the people of New Zealand.” Adrian Orr

So what? - Both Orr and Robertson now have tougher decisions to make in the coming months, along with the Reserve Bank board. If Orr and Robertson push ahead with a second term, they are essentially betting Labour will win the next election. If they are worried about the risks to the independence, or even the perceived independence of the Reserve Bank, then they may choose to hold off.

Orr’s predecessor, Graeme Wheeler, decided not to seek a second term in 2017 after it became clear he was not flavour of the month in the Beehive, even though it appointed him in 2012. Wheeler pushed for the introduction of LVR controls in 2013 and a DTI in 2017. They were unpopular with then-PM John Key and he decided not to run again. An interim Governor, Grant Spencer, was appointed for the crossover period that covered the 2017 election.

Ultimately, that may be the fallback position if the heat gets too hot. Orr would have to decide not to reapply and an interim would be appointed for a short period until the election result was clear.

A Rubicon is crossed

Luxon crossed a Rubicon of sorts yesterday, but it was deserved. The Reserve Bank’s decision in early 2020 to unleash money printing, remove LVRs and give billions in cheap loans to banks for them to pump on into higher house prices was itself a political move. By choosing to use the wealth effect to rescue the economy, it was making both a monetary policy decision and a wealth redistribution decision, which was to make one section of society (home owners) much wealthier at the expense of the rest (young renters with renting parents, and their unborn children.) It did so at the risk of an inflationary surge that would hurt renters on precarious and low incomes much harder than asset owners.

Accidentally on purpose, Adrian Orr and Grant Robertson agreed the best way to rescue the economy was to create a new housing boom. None of the new lending unleashed by QE, LVRs and FLP went to businesss or job creation. It went straight into open homes and auction prices.

But also to be fair to the Reserve Bank, it made that decision with the clear and clearly-advised approval of the Government of the day through Robertson. Treasury told Robertson the money printing would boost asset prices. It turned out that approval, came from a Labour Finance Minister, but could just as easily have been a National Government.

What was the alternative?

The Reserve Bank could have chosen not to remove the LVRs, a move other central banks did not do, or introduce cheap loans for banks, which only a few other central banks did. The Reserve Bank could have chosen to distribute stimulus directly as one-off helicopter cash payments to consumers. That may have created inflation, but not the massive asset price inflation we saw due to the unleashing of massive new bank leverage in the form of new mortgages. I opposed QE and the LVR removals, and proposed ‘QE for the people’ (helicopter money) from the start.

I also think the scale of the $20b in cash payments to businesses was too much, and not necessary after the end of the first lockdowns. Ultimately, those payments were put straight into the bank accounts of home owners, and were weaponised by extra mortgage lending through late 2020 and early 2021. The $20b of cash paid to asset owners and the $55b printed to buy Government bonds off banks and pension funds were in effect metastasized into a 45% rise in house prices, which made home owners more than $500b richer.

A supposedly independent central bank that was supposed to be focused solely on keeping inflation low and our financial system stable, ended up working with a Finance Minister to spark a once-off redistribution of wealth from one group in society to another.

Were they hoping no one would notice?

There were always going to be consequences. Now they’re starting to dribble out at the edges through the likes of this call for an inquiry and doubts about the reappointment of the Governor (and the Government) that did it.

Would a National Government have done any differently? I doubt it. The wealth shift benefited the median voters that both major parties need to win elections. National has also not framed this issue as a wealth redistribution issue. It has framed it as a cost of living issue. The subtext is that higher inflation creates the danger of higher interest rates, which in turn risks reversing some of the multi-decade capital gains created by lower-than-expected inflation from 1990 to 2020.

This use of the arms of the state to rescue and benefit asset owners was not unique to Aotearoa-NZ. Every major central bank in the world did it repeatedly during the Global Financial Crisis and through much of the following years, until a major acceleration in 2020 and 2021. They too used their independence to rescue banks and keep asset owners confident and whole.

Few of the bankers for the GFC were prosecuted. Almost all kept their jobs or were soon employed again and earning bonuses. If you can’t remember or weren’t around, have a read or watch The Big Short again (or for the first time). Effectively, central banks and Governments ‘got away with it’ in the 15 years to Covid, although the Tea Party, Trump and Brexit political reactions could be seen partly as the political revolts in response.

The difference for us here in Aotearoa-NZ is that our central bank and Government did it for the first time deliberately in 2020, and at a much greater scale than the rest, once the LVR removal and the Funding For Lending programmes are accounted for. Our house prices rose by much, much more than in other economies where other central banks printed money.

I think we saw an early preview of it here in late 2008 and early 2009 when the Reserve Bank lent $7b to banks so they could roll over their frozen loans on international markets through a little-known Term Auction Facility, and when first Labour and then National Governments created temporary wholesale and retail deposit guarantees for banks and finance companies in late 2008 and 2009.

What an (unlikely) inquiry should examine

The question is whether any independent inquiry in the Reserve Bank’s actions happens (unlikely) and if it did, whether the redistributive aspects and morally hazardous aspects would be examined (even more unlikely).

Ultimately, there will be a political fallout over many generations. Social licenses will be lost, if they haven’t already been. Governments will change and maybe laws will be rewritten. Or maybe nothing will change. Little has changed of substance in the United States and Europe. The same central bankers and finance ministers are in place with the same powers. The only difference is they don’t have the excuse of low inflation any more, although it is a very useful way to inflate away Government debt…

The most interesting question for me right now is whether National launches an independent inquiry if it wins Government late next year, and whether it will ask these sorts of questions about the redistributive consequences. It will depend on who it has to partner with. If TOP and/or Te Pāti Māori are part of any coalition, these would be sorts of questions that could be inserted.

Elsewhere in the news here and overseas this morning:

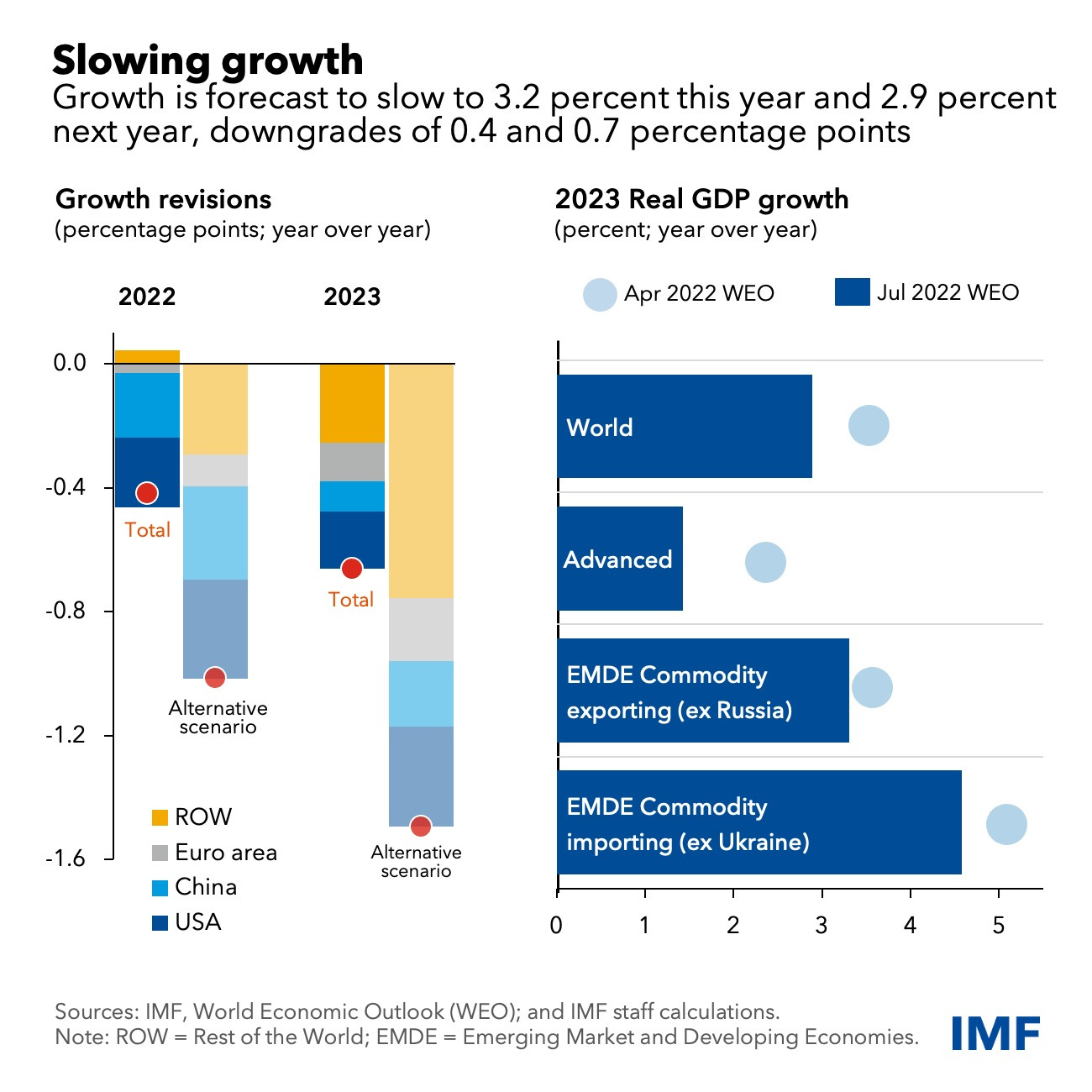

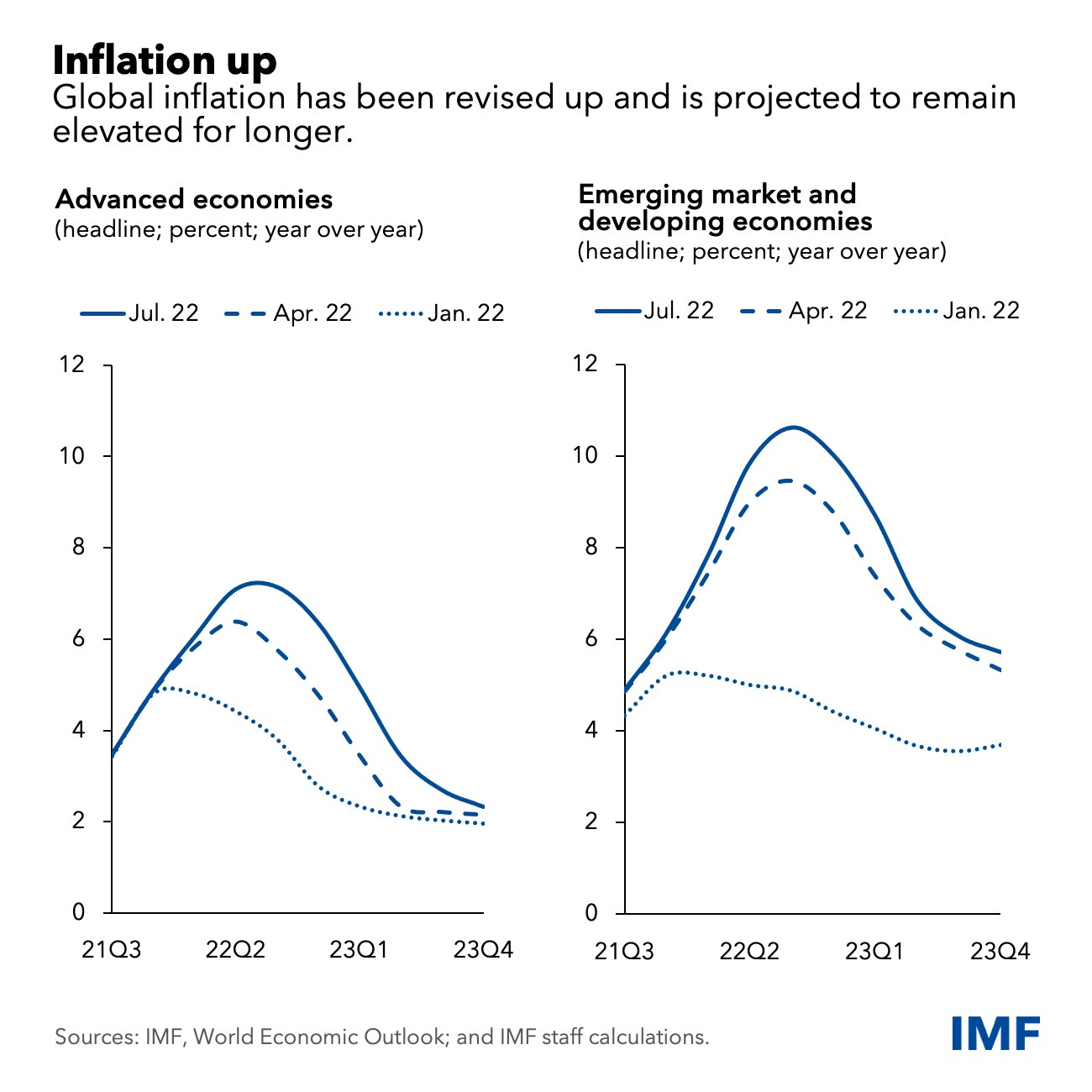

Down and up -The IMF slashed its global GDP growth forecasts for this year and next year overnight in its latest Global Economic Outlook report, but also sharply hiked its forecast for inflation. (See details below in Charts of the Day)

Demand destroyed - The world’s largest retailer in the world’s largest economy, Walmart, warned late yesterday that consumers were pulling back from spending because of the shock of higher prices. Walmart shares dived 8% overnight, dragging shares in a host of retailers such as Macy’s and American Eagle with it. Reuters CNBC

Prices hiked - Amazon increased its delivery fees and streaming prices for Prime in Europe overnight. Its shares are slumping this morning after it reported a US$3.8b loss for the quarter. The S&P 500 and Nasdaq were down 1-2% in late trade. CNBC

Yeah…nah - Pension fund managers published voting records overnight showing they are pulling back from supporting ‘ESG’ resolutions at annual meetings. Under pressure from ‘anti-woke’ political campaigners in the United States and savers worried about their returns, big pension fund managers such as BlackRock and State Street released voting records showing their rate of support for ‘ESG’ proposals on issues such as climate, diversity and other social issues had fallen in the latest round of meetings. FT-$$$

On…off - Russia’s state-controlled Gazprom further squeezed gas supplies to Europe overnight, cutting flows through its Nordstream 1 pipeline to 20% of normal volumes from 40% faster than expected. European natural gas prices surged another 20% to early March levels, while wholesale electricity prices jumped in Germany to a fresh record-high of €370 per MWh, which was six times higher than their prices last year. In response, European ministers agreed to voluntarily cut gas consumption by 15% over the northern winter. Reuters

Consumers say no - US consumer confidence dropped for the third month in a row in July as the food and petrol price shock rippled through spending intentions. The US Conference Board reported its consumer confidence index fell to 95.7 from 98.4 in June. This was lower than economists’ forecasts for around 97.2. Reuters

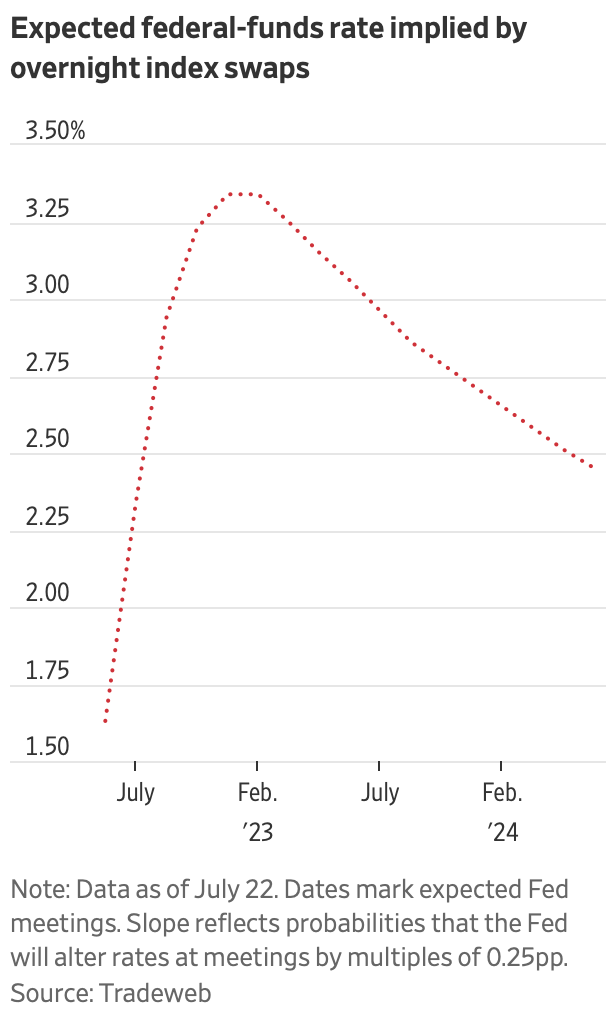

So what? - Demand destruction and the sharp rise in wholesale longer-term interest rates over the last six months is doing the work of slowing demand in the biggest economies towards recessions. That has already dragged down commodity prices and markets are now betting this will slow inflation rates from their peaks in the June and September quarters of this year.

And then? - In turn, financial markets are betting, that means central banks will have to start cutting interest rates again by mid-2023 (See the chart just below). Assuming this pans out, that means mortgage rates here have already peaked and our economy will also head towards a recession caused by a slowing global economy, a 15% fall in house prices and the same demand destruction shock the rest of the world’s consumers are feeling.

Charts of the day

IMF forecasts slower growth and faster inflation

Quote of the day

Robertson says no to an Inquiry

“Captain Hindsight, Mr Luxon, needs to remember what he and his party said in that period of time. Most New Zealanders supported the reasons that we had to intervene both at a fiscal and monetary policy.” Grant Robertson to reporters in the Beehive.

Some fun things

Ka kite ano

Bernard

Share this post