TLDR: Three Waters finally got its comeuppance yesterday when the Auditor General called out its underpinning lack of accountability to taxpayers and ratepayers.

The Government should have been up front about its strategy of trying to engineer a tax increase and higher debt onto the nation’s public water infrastructure from the start. Now the reform is mired, unfortunately, in a backlash over co-governance, which is not the real reason for the reforms.

The Labour Government’s way-too-clever-for-its-own-good idea of trying to quietly solve Aotearoa-NZ’s fundamental infrastructure financing problem has now backfired, largely because not being crystal clear about the need for those higher taxes and debts has allowed others to insert co-governance into the vacuum left by that vagueness.

In my view, a massive backlash in this October’s council elections and the ongoing political toll on the Government is likely to see it scuppered before the General Election late next year. Or it will be reversed by a new National-ACT Government by the end of 2023.

Paid subscribers can see my full analysis of Three Waters below the paywall fold and in the podcast above. They can also comment below. I have since opened this up with the permission of paid subscribers.

The real problem with Three Waters

It took the driest of reports from the unlikeliest of places to expose the fundamental problem with Three Waters. The Auditor General lobbed his submission on the Water Services Entities Bill into the Parliamentary Select Committee process yesterday.

It skewered the lack of accountability that Three Waters is creating in its attempt to solve Aotearoa-NZ’s existential infrastructure funding blockage. The too-clever-for-its-own-good nature of Three Waters finally caught up with it and sank its teeth into its own rear.

The Government, in essence, is pushing ahead with plans to create a brand new set of indirectly controlled public assets with their own debt structures and ability to charge the public fees without asking for (or receiving) permission from those who will ultimately pay higher those higher water charges and bear its debts.

It was an understandable strategy. Voting taxpayers and ratepayers almost always reject tax increases and higher debts whenever they’re asked upfront for permission from politicians before it is done.

A way around the 30/30 rule

Three Waters was a clever way for central Government to essentially circumvent the bi-partisan ‘30/30’ consensus that has dominated our political and economic settings for thirty years. That is that:

taxes won’t be raised or new taxes introduced in a way that means Government revenues are more than 30% of GDP; and,

central and local Government won’t raise long term net debt levels beyond 30% of GDP.

That 30/30 consensus meant Aotearoa-NZ’s Government and Councils under-invested in water, transport, health, education and other infrastructure to the tune of about $100b over the last 30 years, and will need to invest another $100b over the next 30 years just to keep up with forecast population growth. That $200b of infrastructure spending over the next 30 years would require breaking one or both of those 30/30 rules. The alternative is much heavier ‘demand management’ tools such as congestion charges, water charges and other forms of user pays that effectively become tax increases.

Given voting taxpayers and ratepayers don’t want to agree to those tax increases or higher public debts (because it means higher interest rates and lower house prices), but also want working infrastructure, there is a massive ‘magical thinking’ problem in both the body politic, Parliament and the Beehive.

Squaring the circle of not asking for permission for higher taxes and debt but still doing it is Three Waters’ major driving force. Unfortunately, Nanaia Mahuta and the Government did want to (or coudn’t) spell that out and have a proper debate. By being vague about that motivation, local authority politicians and ratepayers inserted what they think is the motivation into the vacuum crated by that vagueness.

In my view, co-governance is an inconsequential sideshow. Standard and Poor’s would never approve the debt issuance required if actual revenues and assets were to be actually controlled by Iwi groups.

So where are we now?

The Auditor General’s intervention has cast a harsh spotlight on Three Waters. Sadly, the Government persisted with Three Waters over the last year as the backlash built, and it is now in an awful mess. It is dragging on Labour’s poll rating and will be exposed for all to see in a massive electoral backlash in council in October.

My bet is Labour will quietly drop it before the end of this year, or it will be loudly repealed by the end of next year by a new National-ACT Government.

Elsewhere in the news here in Aotearoa-NZ this morning:

National/ACT could form Govt with 1News/Kantar poll results;

Sam Uffindell’s future in doubt after assault revelation in Stuff, but he says Luxon didn’t know before selection RNZ Checkpoint;

Almost all Cabinet ministers fail to meet OIA deadlines, Stuff’s Andrea Vance reports;

Consumer pessimism is easing a bit in spending survey, Stuff reports;

National ‘begged’ Jami-Lee Ross to stay after Bridges wouldn’t give him top job, Ross tells court, as Stuff’’s Catrin Owen reports; and,

QV’s average house price below $1m for first time since Sept Newshub, RNZ

While overseas overnight and this morning:

China is extending its military drills around Taiwan, Reuters reports;

The US Senate finally passes Biden’s US$3.5t ‘Build Back Better’ climate and tax bill as US$430b ‘Inflation Reduction Act’, Reuters reports;

SoftBank will slash costs after reporting a record US$23b loss, Reuters reports;

Cox Comms is buying Axios for US$525m or 6.1 times annual revenues, CNN reports;

Copper miner Oz Minerals has rejected an A$8.4b takeover bid by BHP, Reuters reports;

Asian crypto lender Hodlnaut halts withdrawals, Reuters reports

Chart of the day

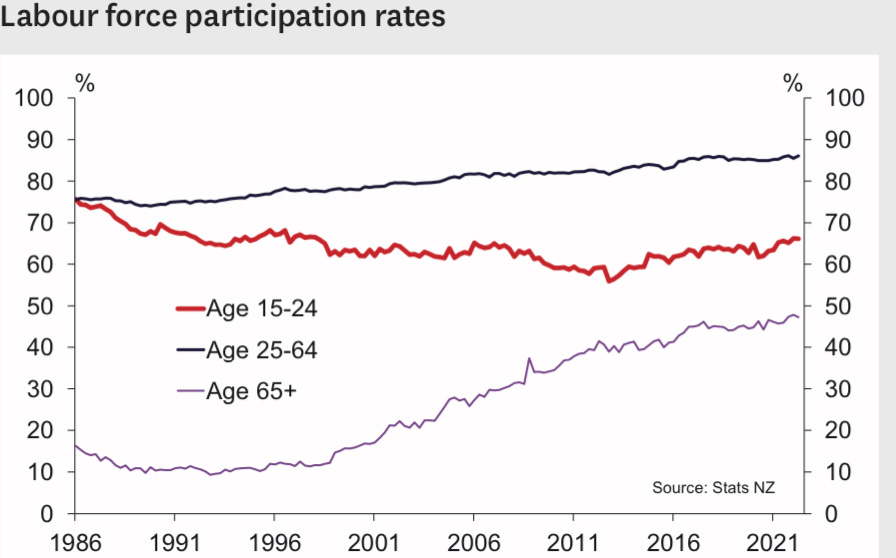

Youth workforce participation has been rising for a decade

Some fun things

Ka kite ano

Bernard

Share this post