TLDR: There’s now just one living Reserve Bank Governor yet to criticise the one currently at Number 2 The Terrace, and he currently works for the Government, so could not publicly do so, even if he wanted to. This morning previous Governor Graeme Wheeler launched a lengthy attack on the record of central banks broadly in recent years, including that of current Reserve Bank Governor Adrian Orr.

Wheeler joins former Governors Don Brash and Grant Spencer, former Chair Arthur Grimes and former Chief Economist John McDermott in criticising Orr for being too loose with policy and not concentrating enough on keeping inflation down. The only former Governor not to criticise Orr is two-term Governor Alan Bollard, who is currently chair of the Infrastructure Commission, who effectively also reports to Orr’s effective boss, Finance Minister Grant Robertson.

Paid subscribers can see more detail and analysis of Wheeler’s criticism below the paywall and in the podcast above.

Wheeler joins Orr’s critics

The pro-markets think-tank, The New Zealand Initiative, published an 18-page paper this morning titled: ‘How Central Bank Mistakes After 2019 led to Inflation’. It was authored by former Reserve Bank Governor Graeme Wheeler, NZ Initiative Senior Research Fellow Bryce Wilkinson and included a foreword by William White, the former Deputy Governor of the Bank of Canada.

They concluded (bolding mine):

“Central bankers need to reflect deeply on the management of monetary policy over the past two years and review their models and the assumptions and judgments they made. They must ensure that they have first rate financial market expertise on their monetary policy committees and Boards.

“Trite responses about “having no regrets”, “would not do anything differently”, and “there is no alternative” are irresponsible and further damage a central bank’s credibility. Central bankers need to learn from their misjudgements because the social, economic, and political consequences of major mistakes run deep and the trust and confidence that the public have in them can be readily depleted.

“Just as President Bush acknowledged US responsibility for the global financial crisis, central banks could acknowledge what they believe they got wrong and what steps they are taking to rebuild public confidence.” Graeme Wheeler and Bryce Wilkinson in a NZ Initiative paper.

The line bolded above is clearly aimed at Orr’s view that that there was no alternative.

Wheeler was quoted personally in the news release for the paper saying:

“To begin restoring their damaged credibility, central banks must assess and acknowledge why their models and judgements were so inaccurate and inform the public on what steps they are taking to rebuild public confidence.” Graeme Wheeler

White is harsher in his foreword:

Humility rather than hubris should have conditioned monetary policy right from the start. William White

My view - I wrote in more depth with my critique of the Reserve Bank last week after the June quarter inflation figures were higher than expected. I also think there should be a proper independent review, similar to that launched last week for the Reserve Bank of Australia.

Elsewhere in the news here and overseas this morning:

Tap turned - Russia’s state-controlled Gazprom announced overnight it would restrict gas supplies to Europe through its Nordstream 1 pipeline to 20% of their normal levels, further increasing European gas prices by 10% to five times what they were a year ago. Reuters

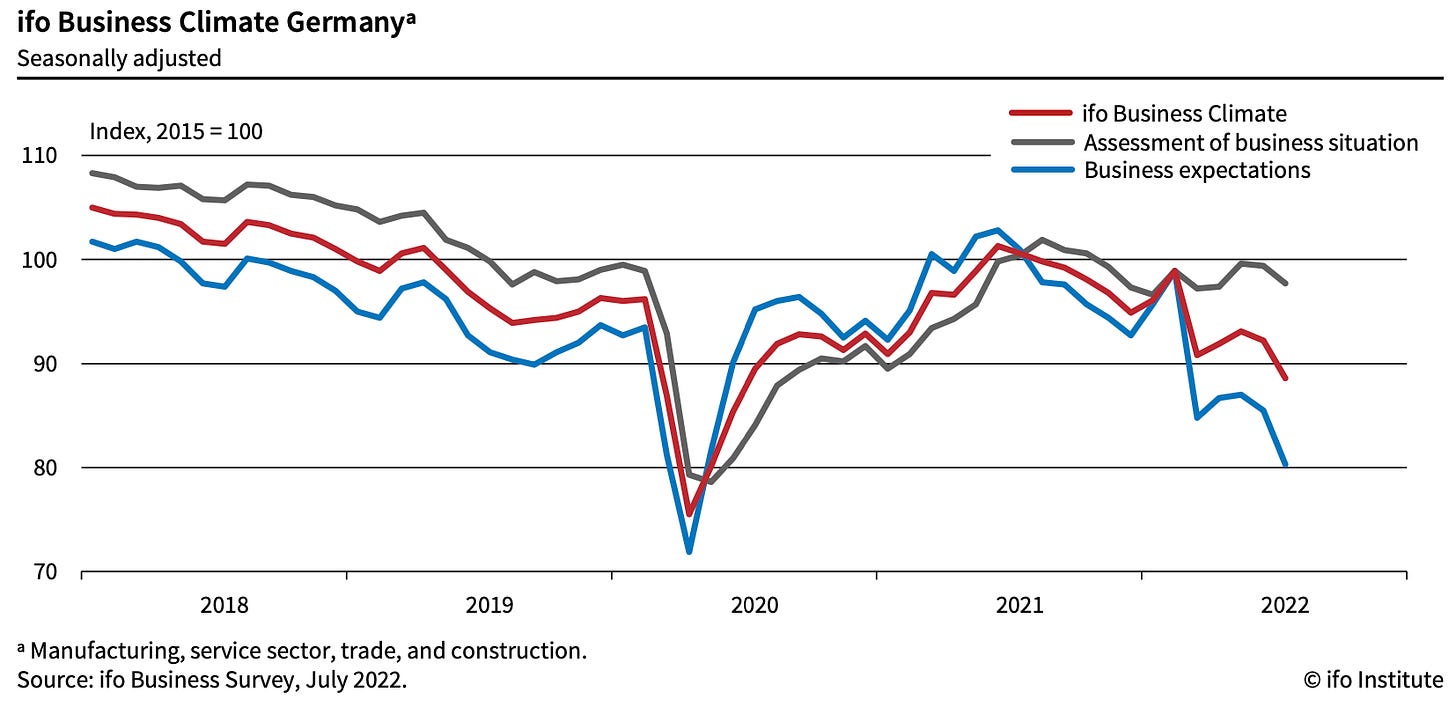

Confidence burned - Germany’s IFO survey of business confidence found a slump in July to its lowest point since June 2020 because of fear about the gas crisis, which is estimated could carve 1-3% off German GDP over the next year. Deutsche Welle

US consumers fleeing - The CEO for BBQ-maker Weber left overnight after reporting weak results that confirmed poor results from discretionary consumer spending bellwethers Bed, Bath and Beyond, Gap and Dollar Tree in recent days. All suggest US consumers, who are responsible for buying the biggest share of output in the world’s largest economy, are retreating from spending after shocks to their real incomes from higher petrol and food prices specifically, and inflation more generally.

So what? - US investors are now betting the US Federal Reserve will tighten too much in response to inflation and have to be cutting rates again within a year. Those people here thinking longer term mortgage rates will keep rising need to know that financial markets are currently betting those longer term rates will be flat or falling because of looming recessions in the United States, Europe and (possibly) China by late this year or early next year. (see Chart of the day below)

Chart of the day

Fed to hike far and fast, then have to cut next year

Quote of the day

‘A mistake in the making’

“Unfortunately, the Fed has seized on aggressive rate hikes—a big dose of the only medicine at its disposal—even though they are largely ineffective against many of the underlying causes of this inflationary spike.” US Democratic Senator Elizabeth Warren in an Op-Ed for the WSJ

Number of the day

$10b - Biosecurity NZ’s estimate of the ‘Doomsday Scenario’ hit to export returns if Foot & Mouth were to become established in Aotearoa-NZ.

Some fun things

Ka kite ano

Bernard

Share this post